Which medical expenses are not eligible?

advertisement

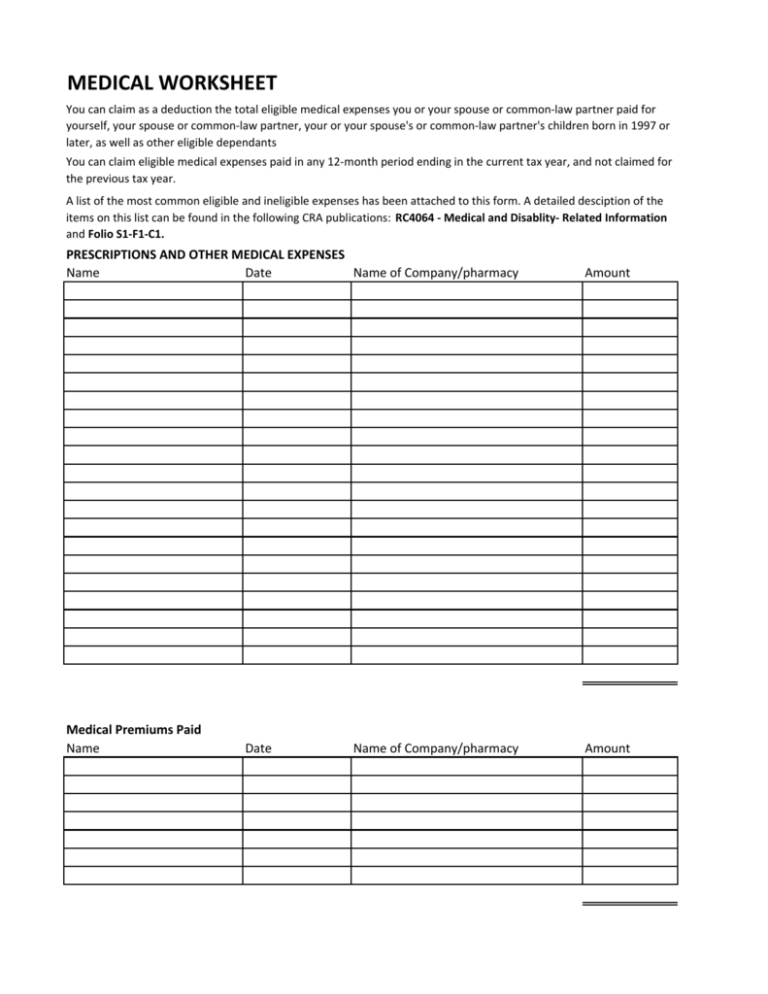

MEDICAL WORKSHEET You can claim as a deduction the total eligible medical expenses you or your spouse or common-law partner paid for yourself, your spouse or common-law partner, your or your spouse's or common-law partner's children born in 1997 or later, as well as other eligible dependants You can claim eligible medical expenses paid in any 12-month period ending in the current tax year, and not claimed for the previous tax year. A list of the most common eligible and ineligible expenses has been attached to this form. A detailed desciption of the items on this list can be found in the following CRA publications: RC4064 - Medical and Disablity- Related Information and Folio S1-F1-C1. PRESCRIPTIONS AND OTHER MEDICAL EXPENSES Name Date Name of Company/pharmacy Amount Medical Premiums Paid Name Amount Date Name of Company/pharmacy MEDICAL WORKSHEET If you had to travel at least 40 kilometres one way from your home to obtain medical services, you may be able to claim the public transportation expenses, or vehicle expense if public transportation is unavailable. To claim these expenses based on the simplified method, please indicate how many kilometers you travelled one way to obtain medical services. If you would like to claim this expense based on the detailed method, please write your totals expenses for each trip below and attach the reciepts to this sheet. KM travelled/ $ paid KILOMETERS TRAVELLED FOR MEDICAL PUPOSES Name Date Name of doctor/Purpose of trip x 0.485 If you had to travel at least 80 kilometres one way from your home to obtain medical services, you may be able to claim accommodation, meal, and parking expenses in addition to your transportation expenses as medical expenses. To claim these expenses based on the simplified method, please indicate how many kilometers you travelled and the number of meals claimed (max 3/day). If you would like to claim this expense based on the detailed method, please indicate how many kilometers you traveled, record your total expenses for each trip, and attach the reciepts to this sheet. MEALS INCUREED FOR MEDICAL PURPOSES Name Date Name of doctor/Purpose of trip To claim transportation and travel expenses, the following conditions must be met: - substantially equivalent medical services were not available near your home - you took a reasonably direct travelling route -it is reasonable, under the circumstances, for you to have travelled to that place for those medical services. $ or Meals & KM MEDICAL WORKSHEET You cannot claim medical expenses for which you were reimbursed. If you were reimbursed for any portion of the expenses listed on the other worksheets you provided please list the reimbursed amounts below. If the medical expenses included on the other worksheets were recorded net of any reimbursements, then the reimbursements do not need to be included here. REIMBURSEMENTS OF MEDICAL EXPENSES Name Date Name of doctor/Purpose of trip Amount Which medical expenses are eligible? 1 of 6 http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/ncm-tx/rtrn/cmpltng/ddctns/lns30... Canada.ca Services Departments Français Canada Revenue Agency Home / Individuals and families / Tax return / Deductions / Medical expenses / Which medical expenses are eligible? Which medical expenses are eligible? The cost of any of the following items can be claimed on line 330 or used in the calculation for a claim on line 331. When you click on any of the medical expenses below, a brief description of the expense is given along with any certification needed. This list is not exhaustive. For a more detailed list and additional information of allowable medical expenses, see Income Tax Folio S1-F1-C1, Medical Expense Tax Credit. To verify if a specific profession is recognized, see Authorized medical practitioners by province or territory for the purposes of claiming medical expenses. Note The person with the impairment in physical or mental functions may be able to claim some of the following expenses as a disability supports deduction on line 215. He or she can claim these expenses on either line 215 or line 330, or split the claim between these two lines as long as the total of the amounts claimed is not more than the total expenses paid. The person may claim whichever is better for him or her. To get a list of topics in alphabetical order, select or type a letter: Select a letter Go A Acoustic coupler Air conditioner Air filter, cleaner, or purifier Altered auditory feedback devices 29-01-15 4:26 PM Which medical expenses are eligible? 2 of 6 http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/ncm-tx/rtrn/cmpltng/ddctns/lns30... Ambulance service Animals Artificial eye or limb Assisted breathing devices Attendant care expenses Audible signal devices B Baby breathing monitor Bathroom aids Bliss symbol boards Blood coagulation monitors Bone conduction receiver Bone marrow transplant Braces for a limb Braille note-taker devices Braille printers, synthetic speech systems, large print-on-screen devices Breast prosthesis C Cancer treatment Catheters, catheter trays, tubing Certificates Chair Cochlear implant Computer peripherals Cosmetic surgery Crutches D Deaf-blind intervening services Dental services Dentures and dental implant Devices or software Diapers or disposable briefs Doctor Driveway access Drugs and medical devices bought under Health Canada's Special Access Program 29-01-15 4:26 PM Which medical expenses are eligible? 3 of 6 http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/ncm-tx/rtrn/cmpltng/ddctns/lns30... E Elastic support hose Electrolysis Electronic bone healing device Electronic speech synthesizers Electrotherapy devices Environmental control system (computerized or electronic) Extremity pump F Furnace G Gluten-free products Group home H Hearing aids Heart monitoring devices Hospital bed Hospitals services I Ileostomy and colostomy pads Infusion pump Insulin or substitutes In vitro fertility program K Kidney machine L Laboratory procedures or services Large print-on-screen devices 29-01-15 4:26 PM Which medical expenses are eligible? 4 of 6 http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/ncm-tx/rtrn/cmpltng/ddctns/lns30... Laryngeal speaking aids Laser eye surgery Lift or transportation equipment Liver extract injections M Medical marijuana or marijuana seeds Medical services provided by qualified medical practitioners Medical services provided outside of Canada Moving expenses N Needles and syringes Note-taking services Nurse Nursing home O Optical scanners Organ transplant Orthodontic work Orthopaedic shoes, boots, and inserts Osteogenesis stimulator (inductive coupling) Oxygen concentrator Oxygen and oxygen tent P Pacemakers Page turner devices Personalized therapy plan Phototherapy equipment Premiums paid to private health services plans Pre-natal and post-natal treatments Prescriptions drugs and medications Pressure pulse therapy devices R 29-01-15 4:26 PM Which medical expenses are eligible? 5 of 6 http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/ncm-tx/rtrn/cmpltng/ddctns/lns30... Reading services Real-time captioning Rehabilitative therapy Renovation or construction expenses Respite care expenses S School for persons with an impairment in physical or mental functions Scooter Sign-language interpretation services Spinal brace Standing devices T Talking textbooks Teletypewriters Televison closed caption decoders Tests Therapy Training Travel expenses Treatment centre Truss for hernia Tutoring services V Vaccines Van Vehicle modification Vision devices Visual or vibratory signalling device Vitamin B12 injections Voice recognition software Volume control feature (additional) W Walking aids Water filter, cleaner, or purifier 29-01-15 4:26 PM Which medical expenses are eligible? 6 of 6 http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/ncm-tx/rtrn/cmpltng/ddctns/lns30... Wheelchairs and wheelchair carriers Whirlpool bath treatments Wigs Forms and publications General Income Tax and Benefit Package for 2014 - Guide, Returns, Schedules Guide RC4064, Medical and Disability-Related Information Income Tax Folio S1-F1-C1, Medical Expense Tax Credit Related topics Which medical expenses are not eligible? Date modified: 2015-01-05 29-01-15 4:26 PM Which medical expenses are not eligible? 1 of 2 http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/ncm-tx/rtrn/cmpltng/ddctns/lns30... Canada.ca Services Departments Français Canada Revenue Agency Home / Individuals and families / Tax return / Deductions / Medical expenses / Which medical expenses are not eligible? Which medical expenses are not eligible? There are a number of expenses that are commonly claimed as medical expenses in error. The expenses you cannot claim include the following: athletic or fitness club fees; birth control devices (non-prescription); blood pressure monitors; cosmetic surgery - expenses for purely cosmetic procedures including any related services and other expenses such as travel, incurred after March 4, 2010, cannot be claimed as medical expenses. Both surgical and non-surgical procedures purely aimed at enhancing one's appearance are not eligible. These non-eligible expenses include the following: liposuction; hair replacement procedures; filler injections (for removing wrinkles); teeth whitening. An expense, including those identified above, may qualify as a medical expense if it is necessary for medical or reconstructive purposes, such as surgery to address a deformity related to a congenital abnormality, a personal injury resulting from an accident or trauma, or a disfiguring disease. diaper services; health plan premiums paid by an employer and not included in your income; health programs; organic food; over-the-counter medications, vitamins, and supplements, even if prescribed by a medical practitioner; personal response systems such as Lifeline and Health Line Services; the following provincial and territorial plans: Alberta Health Care Insurance Plan 29-01-15 4:27 PM Which medical expenses are not eligible? 2 of 2 http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/ncm-tx/rtrn/cmpltng/ddctns/lns30... Manitoba Health Plan Medical Services Plan of British Columbia New Brunswick Medicare Division of Provincial Department of Health Newfoundland Medical Care Plan Northwest Territories Health Insurance Services Agency of Territorial Government Nova Scotia Medical Services Insurance Ontario Health Insurance Plan Prince Edward Island Health Services Payment Plan Quebec Health Insurance Board (including payments made to the Health Services Fund) Saskatchewan Medical Care Insurance Plan Yukon Territorial Insurance Commission; or travel expenses for which you can get reimbursed. Forms and publications General Income Tax and Benefit Package for 2014 - Guide, Returns, Schedules Guide RC4064, Medical and Disability-Related Information Income Tax Folio S1-F1-C1, Medical Expense Tax Credit Related topics Which medical expenses are eligible? Date modified: 2015-01-05 29-01-15 4:27 PM