Excerpt from Clean Edge Business Strategy Case

advertisement

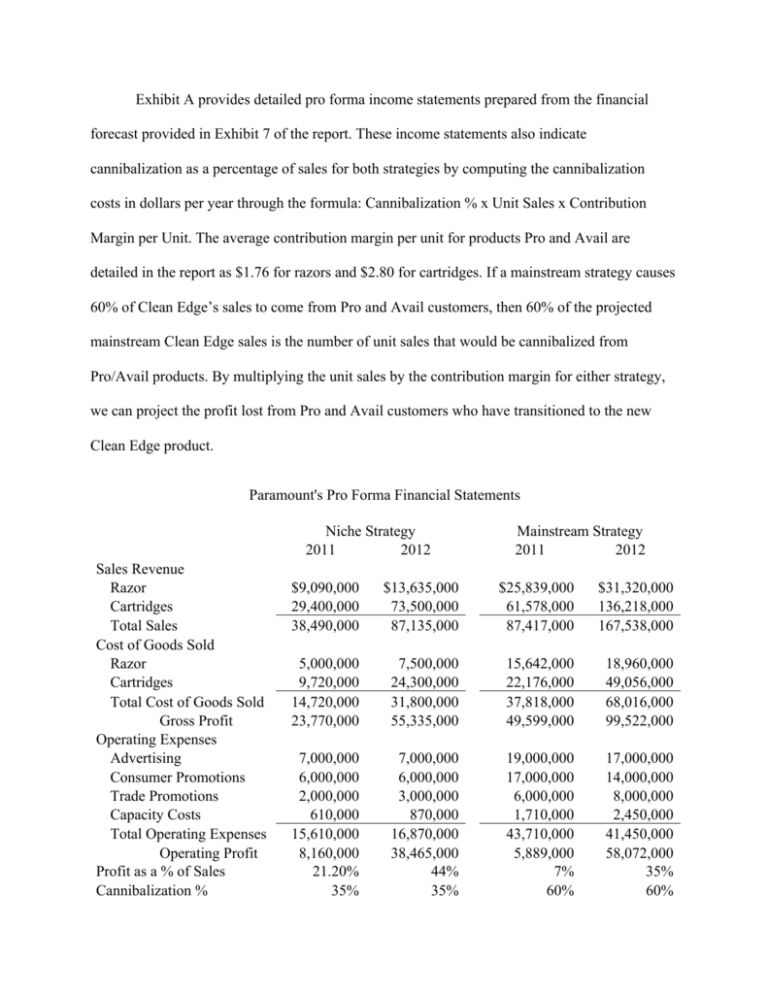

Exhibit A provides detailed pro forma income statements prepared from the financial forecast provided in Exhibit 7 of the report. These income statements also indicate cannibalization as a percentage of sales for both strategies by computing the cannibalization costs in dollars per year through the formula: Cannibalization % x Unit Sales x Contribution Margin per Unit. The average contribution margin per unit for products Pro and Avail are detailed in the report as $1.76 for razors and $2.80 for cartridges. If a mainstream strategy causes 60% of Clean Edge’s sales to come from Pro and Avail customers, then 60% of the projected mainstream Clean Edge sales is the number of unit sales that would be cannibalized from Pro/Avail products. By multiplying the unit sales by the contribution margin for either strategy, we can project the profit lost from Pro and Avail customers who have transitioned to the new Clean Edge product. Paramount's Pro Forma Financial Statements Niche Strategy 2011 2012 Sales Revenue Razor Cartridges Total Sales Cost of Goods Sold Razor Cartridges Total Cost of Goods Sold Gross Profit Operating Expenses Advertising Consumer Promotions Trade Promotions Capacity Costs Total Operating Expenses Operating Profit Profit as a % of Sales Cannibalization % Mainstream Strategy 2011 2012 $9,090,000 29,400,000 38,490,000 $13,635,000 73,500,000 87,135,000 $25,839,000 61,578,000 87,417,000 $31,320,000 136,218,000 167,538,000 5,000,000 9,720,000 14,720,000 23,770,000 7,500,000 24,300,000 31,800,000 55,335,000 15,642,000 22,176,000 37,818,000 49,599,000 18,960,000 49,056,000 68,016,000 99,522,000 7,000,000 6,000,000 2,000,000 610,000 15,610,000 8,160,000 21.20% 35% 7,000,000 6,000,000 3,000,000 870,000 16,870,000 38,465,000 44% 35% 19,000,000 17,000,000 6,000,000 1,710,000 43,710,000 5,889,000 7% 60% 17,000,000 14,000,000 8,000,000 2,450,000 41,450,000 58,072,000 35% 60% Cannibalization Cost ($)** Razors Cartridges Total Cannibalization Profit After Cannibalization $616,000 3,920,000 4,536,000 3,624,000 $924,000 9,800,000 10,724,000 27,741,000 $3,484,800 16,632,000 20,116,800 (14,227,800) $4,224,000 36,792,000 41,016,000 17,056,000 **Cannibalization costs computed by the formula: Cannibalization ($) = Cannibalization % x Unit Sales x Contribution Margin Per Unit The projected loss in sales of Pro and Avail in 2011 of the niche strategy is 350,000 units compared to 1.98 million units for the mainstream product launch. The profit after cannibalization for the niche strategy over 2011 and 2012 produces profits of $31,365,000, while the mainstream strategy produces a large net loss in the first year and total cumulative profits of $2,828,200 following the first two years. After analysis of the effects of Clean Edge’s cannibalization of Pro and Avail’s sales, it is apparent that a niche strategy will lead Paramount to a higher degree of success in the super-premium segment. While a broad mainstream approach leads to higher sales numbers, it also causes higher costs and lower profits. I believe that Paramount should position the Clean Edge razor as a niche product to effectively complement their current product portfolio and boost their dominance in the nondisposable market. Clean Edge’s branding strategy will have a large effect on the product’s perceived quality, the advertising expense required for a successful launch, and the cannibalization of existing products’ sales. The company must select a branding strategy that will effectively promote their niche strategy when advertising the product; these branding considerations are whether Paramount should focus advertisement on the “Clean Edge” name as a new and innovative product line or continue to use their brand name equity by concentrating on the “Paramount” name to allow customers to associate Clean Edge with Paramount’s current Pro and Avail products. “Paramount Clean Edge” would utilize Paramount’s brand strength to promote value across all three lines and would allow Paramount to be directly associated with the innovation Clean Edge offers the market. It would also help Paramount save on marketing expenses, as the Paramount name would require much less advertising than promoting a new brand. However, it could lead to increased cannibalization as customers using Pro become attracted to Clean Edge’s better performance. On the other hand, branding as “Clean Edge by Paramount” would provide product differentiation from less advanced products Pro and Avail, making Clean Edge stand out as a uniquely innovative product. It would also serve to prevent a decrease in sales from Pro, as the product would be more likely to be viewed as a new and innovative super-premium product than a refreshed Paramount product model. However, promoting a new brand like Clean Edge could cause higher marketing expenditures than predicted in order to develop a name in the superpremium segment. In order for consumers to trust Clean Edge’s quality, Paramount would likely have to spend heavily on media advertising and consumer promotions to attract consumers to the product, and pay for trade promotions to push for more shelf space in retail outlets. A mainstream strategy focusing on broadly reaching all three markets by promoting Clean Edge as the best available product in the market would benefit from utilizing the Paramount name for product association. However, the niche strategy concentrating on highly involved users who differentiate between products and are concerned with performance would be better suited to promote Clean Edge separately in order to take sales away from competitors with other new innovative products. Paramount should brand their innovative product under a new “Clean Edge” brand to promote the product apart from the current lines Pro and Avail in attempt to avoid the high percentage of cannibalization of these lines sales by Clean Edge.

![[Lecture 19] studio system 2 for wiki](http://s2.studylib.net/store/data/005217793_1-c296c1b3b7b87d52a223478e417a702f-300x300.png)