17-24 The FIFO ending inventory is lower than the weighted

advertisement

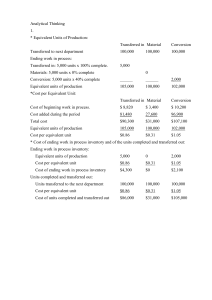

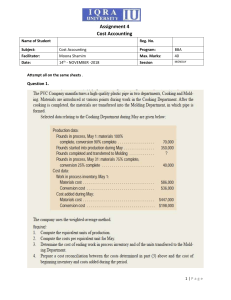

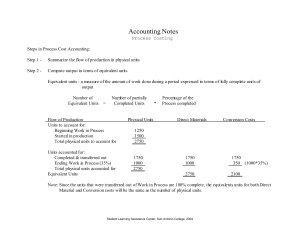

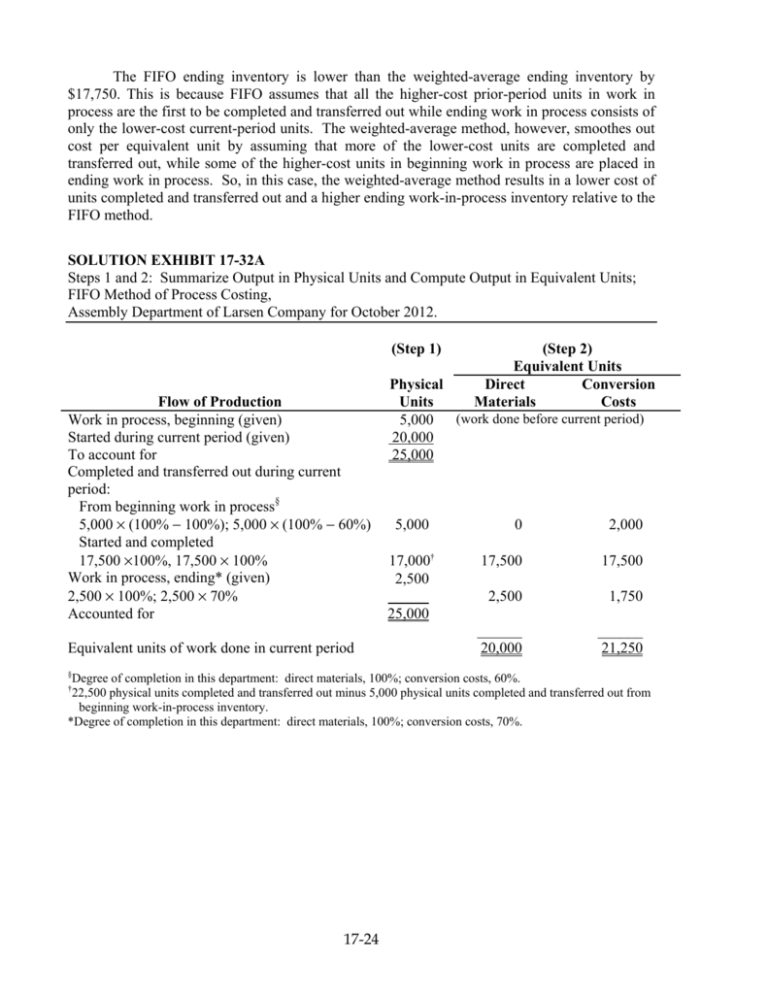

The FIFO ending inventory is lower than the weighted-average ending inventory by $17,750. This is because FIFO assumes that all the higher-cost prior-period units in work in process are the first to be completed and transferred out while ending work in process consists of only the lower-cost current-period units. The weighted-average method, however, smoothes out cost per equivalent unit by assuming that more of the lower-cost units are completed and transferred out, while some of the higher-cost units in beginning work in process are placed in ending work in process. So, in this case, the weighted-average method results in a lower cost of units completed and transferred out and a higher ending work-in-process inventory relative to the FIFO method. SOLUTION EXHIBIT 17-32A Steps 1 and 2: Summarize Output in Physical Units and Compute Output in Equivalent Units; FIFO Method of Process Costing, Assembly Department of Larsen Company for October 2012. (Step 1) Flow of Production Work in process, beginning (given) Started during current period (given) To account for Completed and transferred out during current period: From beginning work in process§ 5,000 × (100% − 100%); 5,000 × (100% − 60%) Started and completed 17,500 ×100%, 17,500 × 100% Work in process, ending* (given) 2,500 × 100%; 2,500 × 70% Accounted for Equivalent units of work done in current period § (Step 2) Equivalent Units Direct Conversion Materials Costs Physical Units (work done before current period) 5,000 20,000 25,000 5,000 17,000† 2,500 0 2,000 17,500 17,500 2,500 1,750 20,000 ______ 21,250 25,000 Degree of completion in this department: direct materials, 100%; conversion costs, 60%. 22,500 physical units completed and transferred out minus 5,000 physical units completed and transferred out from beginning work-in-process inventory. *Degree of completion in this department: direct materials, 100%; conversion costs, 70%. † 17-24