Unified Credit-Equity Modeling

advertisement

Unified Credit-Equity Modeling

Rafael Mendoza-Arriaga

Based on joint research with: Vadim Linetsky and Peter Carr

The University of Texas at Austin

McCombs School of Business (IROM)

Recent Advancements in the Theory and Practice of Credit

Derivatives

Nice, France

September 28-30, 2009

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

1/1

Single – Firm

Multi – Firm

Research Projects

Calendar Time

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Time Changes

Credit Risk 2009

2/1

Multi – Firm

Research Projects

Single – Firm

The Constant

Elasticity of Variance

Model

Calendar Time

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Time Changes

Credit Risk 2009

2/1

Multi – Firm

Research Projects

Single – Firm

The Constant

Elasticity of Variance

Model

Equity Default Swaps

under the JDCEV

process

Calendar Time

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Time Changes

Credit Risk 2009

2/1

Multi – Firm

Research Projects

Single – Firm

The Constant

Elasticity of Variance

Model

Equity Default Swaps

under the JDCEV

process

Calendar Time

Rafael Mendoza (McCombs)

Time Changed Markov

Processes in Unified

Credit-Equity Modeling

Unified Credit-Equity Modeling

Time Changes

Credit Risk 2009

2/1

Research Projects

Multi – Firm

Modeling Correlated

Defaults by Multiple

Firms

(Future Research)

Single – Firm

The Constant

Elasticity of Variance

Model

Equity Default Swaps

under the JDCEV

process

Calendar Time

Rafael Mendoza (McCombs)

Time Changed Markov

Processes in Unified

Credit-Equity Modeling

Unified Credit-Equity Modeling

Time Changes

Credit Risk 2009

2/1

Literature Review

Stock Option Pricing Literature

Black-Scholes

(geometric Brownian motion)

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

3/1

Literature Review

Stock Option Pricing Literature

Black-Scholes

(geometric Brownian motion)

Infinite lifetime process

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

3/1

Literature Review

Stock Option Pricing Literature

Black-Scholes

(geometric Brownian motion)

Infinite lifetime process

No possibility

of Bankruptcy!

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

3/1

Literature Review

Stock Option Pricing Literature

Black-Scholes

(geometric Brownian motion)

Infinite lifetime process

No possibility

of Bankruptcy!

Constant volatility

and no jumps

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

3/1

Literature Review

Stock Option Pricing Literature

Black-Scholes

(geometric Brownian motion)

Infinite lifetime process

No possibility

of Bankruptcy!

Constant volatility

and no jumps

No volatility smiles!

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

3/1

Literature Review

Stock Option Pricing Literature

Black-Scholes

Subsequent

Generations of Models

(geometric Brownian motion)

(modeling the

volatility smile)

Infinite lifetime process

No possibility

of Bankruptcy!

Constant volatility

and no jumps

No volatility smiles!

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

3/1

Literature Review

Stock Option Pricing Literature

Black-Scholes

Subsequent

Generations of Models

(geometric Brownian motion)

(modeling the

volatility smile)

Infinite lifetime process

Local Volatility

(CEV, Dupier, etc.)

No possibility

of Bankruptcy!

Constant volatility

and no jumps

No volatility smiles!

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

3/1

Literature Review

Stock Option Pricing Literature

Black-Scholes

Subsequent

Generations of Models

(geometric Brownian motion)

(modeling the

volatility smile)

Infinite lifetime process

Local Volatility

No possibility

of Bankruptcy!

Stochastic Volatility

(CEV, Dupier, etc.)

(Heston, SABR, etc.)

Constant volatility

and no jumps

No volatility smiles!

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

3/1

Literature Review

Stock Option Pricing Literature

Black-Scholes

Subsequent

Generations of Models

(geometric Brownian motion)

(modeling the

volatility smile)

Infinite lifetime process

Local Volatility

No possibility

of Bankruptcy!

Stochastic Volatility

(CEV, Dupier, etc.)

(Heston, SABR, etc.)

Jump Diffusion

Constant volatility

and no jumps

(Merton, Kou, etc.)

No volatility smiles!

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

3/1

Literature Review

Stock Option Pricing Literature

Black-Scholes

Subsequent

Generations of Models

(geometric Brownian motion)

(modeling the

volatility smile)

Infinite lifetime process

Local Volatility

No possibility

of Bankruptcy!

Stochastic Volatility

(CEV, Dupier, etc.)

(Heston, SABR, etc.)

Jump Diffusion

Constant volatility

and no jumps

No volatility smiles!

(Merton, Kou, etc.)

Pure Jump Models

Based on

Levy processes

(VG, NIG, CGMY, etc.)

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

3/1

Literature Review

Stock Option Pricing Literature

Black-Scholes

Subsequent

Generations of Models

tcy

(geometric Brownian motion)

(modelingpthe

rusmile)

k

volatility

an

fb

yo

t

:

i

l

Infinite lifetime processem ibi Local Volatility

l

ob ss firm(CEV, Dupier, etc.)

e.

Pr he po ying

tim

e a inite

t

rl

No possibility e

v

e

a

f

or und

Stochastic

s h lt in Volatility

of Bankruptcy!

ign e

firm(Heston,

ls of th

au SABR, etc.)

,

f

e

d

e

od

orl of d

lw

em

ea ility

es

r

h

Jump Diffusion

b

n

T

I oba

(Merton, Kou, etc.)

r

p

Constant volatility

ive

t

i

s

and noojumps

Pure Jump Models

p

No volatility smiles!

Based on

Levy processes

(VG, NIG, CGMY, etc.)

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

3/1

Literature Review

Stock Option Pricing Literature

Black-Scholes

Subsequent

Generations of Models

(geometric Brownian motion)

(modeling the

volatility smile)

Infinite lifetime process

Local Volatility

No possibility

of Bankruptcy!

Stochastic Volatility

Credit Risk Literature

Reduced Form

Framework

(CEV, Dupier, etc.)

(Heston, SABR, etc.)

Jump Diffusion

Constant volatility

and no jumps

No volatility smiles!

(Merton, Kou, etc.)

Pure Jump Models

Based on

Levy processes

(VG, NIG, CGMY, etc.)

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

3/1

Literature Review

Stock Option Pricing Literature

Black-Scholes

Subsequent

Generations of Models

(geometric Brownian motion)

(modeling the

volatility smile)

Infinite lifetime process

Local Volatility

No possibility

of Bankruptcy!

Stochastic Volatility

Credit Risk Literature

Reduced Form

Framework

Default Intensity Models

(CEV, Dupier, etc.)

(Heston, SABR, etc.)

Jump Diffusion

Constant volatility

and no jumps

No volatility smiles!

Since Duffie & Singleton,

Jarrow, Lando &

Turnbull:

A vast amount

of research has been

developed

(Merton, Kou, etc.)

Pure Jump Models

Based on

Levy processes

(VG, NIG, CGMY, etc.)

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

3/1

Literature Review

Stock Option Pricing Literature

Black-Scholes

Subsequent

Generations of Models

(geometric Brownian motion)

(modeling the

volatility smile)

Infinite lifetime process

Local Volatility

No possibility

of Bankruptcy!

Stochastic Volatility

Credit Risk Literature

Reduced Form

Framework

Default Intensity Models

(CEV, Dupier, etc.)

(Heston, SABR, etc.)

Jump Diffusion

Constant volatility

and no jumps

No volatility smiles!

A vast amount

of research has been

developed

(Merton, Kou, etc.)

Pure Jump Models

Based on

Levy processes

(VG, NIG, CGMY, etc.)

Rafael Mendoza (McCombs)

Since Duffie & Singleton,

Jarrow, Lando &

Turnbull:

Unified Credit-Equity Modeling

Modeling Focus:

Credit Default Events,

Credit Spreads,

Credit Derivatives, etc

Credit Risk 2009

3/1

Literature Review

Stock Option Pricing Literature

Black-Scholes

Subsequent

Generations of Models

(geometric Brownian motion)

(modeling the

volatility smile)

Infinite lifetime process

Local Volatility

No possibility

of Bankruptcy!

Stochastic Volatility

Credit Risk Literature

Reduced Form

Framework

Default Intensity Models

(CEV, Dupier, etc.)

: els f

od n&oSingleton,

lem mDuffie

Since

b

o s

t

o

ati Lando

t

&

Pr credi Jarrow,

rm ke

ar

fo Turnbull:

se

he e in n m

T e th ptio

n

els

tio

or k o A vast

ec amount Mod

ign toc of research

n

t

ibeen

s

on en has

red

Jump Diffusion

isc developed

we

D bet and C

(Merton, Kou, etc.)

ls

de

MoModeling Focus:

y

Pure Jump Models

t

ui

Based on

Eq

(Heston, SABR, etc.)

Constant volatility

and no jumps

No volatility smiles!

Levy processes

(VG, NIG, CGMY, etc.)

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Default Events,

Credit Spreads,

Credit Derivatives, etc

Credit Risk 2009

3/1

Literature Review

Stock Option Pricing Literature

Credit Risk Literature

Black-Scholes

Subsequent

Generations of Models

(geometric Brownian motion)

(modeling the

volatility smile)

Infinite lifetime process

Local Volatility

No possibility

of Bankruptcy!

Stochastic Volatility

Reduced Form

Framework

Default Intensity Models

(CEV, Dupier, etc.)

(Heston, SABR, etc.)

Jump Diffusion

Constant volatility

and no jumps

No volatility smiles!

Since Duffie & Singleton,

Jarrow, Lando &

Turnbull:

A vast amount

of research has been

developed

(Merton, Kou, etc.)

Pure Jump Models

Based on

Levy processes

Modeling Focus:

Credit Default Events,

Credit Spreads,

Unified

Credit Derivatives, etc

Credit-Equity

Modeling

(VG, NIG, CGMY, etc.)

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

3/1

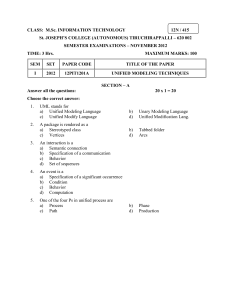

Motivating Example

2 weeks before bankruptcy (9/02/2008) Lehman Brothers (LEH)

stock price price was $16.13

18 days (9/20/2008)

46 days (10/18/2008)

137 days (1/17/2009)

228 days (4/18/2009)

501 days (1/16/2010)

200%

Implied Volatility

180%

160%

140%

120%

100%

80%

60%

0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1 1.1 1.2 1.3 1.4 1.5 1.6

Moneyness (K/S)

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

4/1

Motivating Example

2 weeks before bankruptcy (9/02/2008) Lehman Brothers (LEH)

stock price price was $16.13

18 days (9/20/2008)

46 days (10/18/2008)

137 days (1/17/2009)

228 days (4/18/2009)

501 days (1/16/2010)

200%

Implied Volatility

180%

160%

140%

120%

100%

80%

60%

0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1 1.1 1.2 1.3 1.4 1.5 1.6

Moneyness (K/S)

The stock price drop of 72% from the high $62.19 to $16.13!

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

4/1

Motivating Example

2 weeks before bankruptcy (9/02/2008) Lehman Brothers (LEH)

stock price price was $16.13

18 days (9/20/2008)

46 days (10/18/2008)

137 days (1/17/2009)

228 days (4/18/2009)

501 days (1/16/2010)

200%

Implied Volatility

180%

160%

140%

120%

100%

80%

60%

0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1 1.1 1.2 1.3 1.4 1.5 1.6

Moneyness (K/S)

The stock price drop of 72% from the high $62.19 to $16.13!

Open Interest on Put contracts with strike prices K = 2.5 USD

Maturing on 4/18/2009 (228 days) were 1529 contracts

Maturing on 1/16/2010 (501 days) were 2791 contracts

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

4/1

The Case for the Next Generation of Unified

Credit-Equity Models

Put options provide default protection. Deep out-of-the-money puts

are essentially credit derivatives which close the link between equity

and credit products.

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

5/1

The Case for the Next Generation of Unified

Credit-Equity Models

Put options provide default protection. Deep out-of-the-money puts

are essentially credit derivatives which close the link between equity

and credit products.

Pricing of equity derivatives should take into account the possibility of

bankruptcy of the underlying firm.

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

5/1

The Case for the Next Generation of Unified

Credit-Equity Models

Put options provide default protection. Deep out-of-the-money puts

are essentially credit derivatives which close the link between equity

and credit products.

Pricing of equity derivatives should take into account the possibility of

bankruptcy of the underlying firm.

Possibility of default contributes to the implied volatility skew in stock

options.

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

5/1

Research Goals

Unified Credit –Equity Framework

Credit and equity derivatives on the same firm

should be modeled within a unified framework

Consistent pricing across Credit and Equity assets

Consistent risk management and hedging

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

6/1

Research Goals

Unified Credit –Equity Framework

Credit and equity derivatives on the same firm

should be modeled within a unified framework

Consistent pricing across Credit and Equity assets

Consistent risk management and hedging

Our Goal is to develop

analytically tractable unified credit-equity models

to improve pricing, calibration, and hedging

Analytical tractability is desirable for fast computation of prices

and Greeks, and calibration.

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

6/1

Our Contributions

We introduce a new analytically tractable class of credit-equity

models.

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

7/1

Our Contributions

We introduce a new analytically tractable class of credit-equity

models.

Our model architecture is based on applying random time changes to

Markov diffusion processes to create new processes with desired

properties.

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

7/1

Our Contributions

We introduce a new analytically tractable class of credit-equity

models.

Our model architecture is based on applying random time changes to

Markov diffusion processes to create new processes with desired

properties.

We model the stock price as a time changed Markov process with

state-dependent jumps, stochastic volatility, and default intensity

(stock drops to zero in default).

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

7/1

Our Contributions

We introduce a new analytically tractable class of credit-equity

models.

Our model architecture is based on applying random time changes to

Markov diffusion processes to create new processes with desired

properties.

We model the stock price as a time changed Markov process with

state-dependent jumps, stochastic volatility, and default intensity

(stock drops to zero in default).

For the first time in the literature, we present state-dependent jumps

that exhibit the leverage effect:

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

7/1

Our Contributions

We introduce a new analytically tractable class of credit-equity

models.

Our model architecture is based on applying random time changes to

Markov diffusion processes to create new processes with desired

properties.

We model the stock price as a time changed Markov process with

state-dependent jumps, stochastic volatility, and default intensity

(stock drops to zero in default).

For the first time in the literature, we present state-dependent jumps

that exhibit the leverage effect:

As stock price falls V arrival rates of large jumps increase

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

7/1

Our Contributions

We introduce a new analytically tractable class of credit-equity

models.

Our model architecture is based on applying random time changes to

Markov diffusion processes to create new processes with desired

properties.

We model the stock price as a time changed Markov process with

state-dependent jumps, stochastic volatility, and default intensity

(stock drops to zero in default).

For the first time in the literature, we present state-dependent jumps

that exhibit the leverage effect:

As stock price falls V arrival rates of large jumps increase

As stock price rises V arrival rate of large jumps decrease

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

7/1

Our Contributions (cont.)

In our model architecture, time changes of diffusions have the following

effects:

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

8/1

Our Contributions (cont.)

In our model architecture, time changes of diffusions have the following

effects:

Lévy subordinator time change induces jumps with state-dependent

Levy measure, including the possibility of a jump-to-default (stock

drops to zero).

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

8/1

Our Contributions (cont.)

In our model architecture, time changes of diffusions have the following

effects:

Lévy subordinator time change induces jumps with state-dependent

Levy measure, including the possibility of a jump-to-default (stock

drops to zero).

Time integral of an activity rate process induces stochastic volatility

in the diffusion dynamics, the Levy measure, and default intensity.

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

8/1

Unifying Credit-Equity Models

The Jump to Default Extended Diffusions (JDED)

Before moving on to use time changes to construct models with jumps and

stochastic volatility, we review the Jump-to-Default Extended Diffusion

framework (JDED)

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

9/1

Jump to Default Extended Diffusions (JDED)

.

Defaultable Stock Price

..

{

S̃t , ζ > t

St =

0, ζ ≤ t

We assume absolute priority: the

stock holders do not receive any

recovery in the event of default

(ζ default time)

Rafael Mendoza (McCombs)

.

.

.

..

.

Unified Credit-Equity Modeling

Credit Risk 2009

10 / 1

Jump to Default Extended Diffusions (JDED)

.

Stock Price

..

.

Defaultable Stock Price

..

{

S̃t , ζ > t

St =

0, ζ ≤ t

.

.

100

S(t)

80

60

40

20

(ζ default time)

0

0.0

0.5

1.0

Time (yrs)

1.5

.

..

Model the pre-default stock dynamics under an EMM Q as:

d S̃t = [ µ + h(S̃t ) ]S̃t dt + σ(S̃t ) S̃t dBt

|{z}

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

2.0

.

.

.

.

.

..

10 / 1

Jump to Default Extended Diffusions (JDED)

.

Stock Price

..

.

Defaultable Stock Price

..

{

S̃t , ζ > t

St =

0, ζ ≤ t

.

.

100

S(t)

80

60

40

20

(ζ default time)

0

0.0

0.5

1.0

Time (yrs)

1.5

.

..

Model the pre-default stock dynamics under an EMM Q as:

d S̃t = [ µ + h(S̃t ) ]S̃t dt + σ(S̃t ) S̃t dBt

|{z}

2.0

.

.

.

.

.

..

⇒ µ = r − q. Drift: short rate r minus the dividend yield q

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

10 / 1

Jump to Default Extended Diffusions (JDED)

.

Stock Price

..

.

Defaultable Stock Price

..

{

S̃t , ζ > t

St =

0, ζ ≤ t

.

.

100

S(t)

80

60

40

20

(ζ default time)

0

0.0

0.5

1.0

Time (yrs)

1.5

.

..

Model the pre-default stock dynamics under an EMM Q as:

d S̃t = [ µ + h(S̃t ) ]S̃t dt + σ(S̃t ) S̃t dBt

|{z}

| {z }

2.0

.

.

.

.

.

..

⇒ σ(S). State dependent volatility

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

10 / 1

Jump to Default Extended Diffusions (JDED)

.

Stock Price

..

.

Defaultable Stock Price

..

{

S̃t , ζ > t

St =

0, ζ ≤ t

.

.

100

S(t)

80

60

40

20

(ζ default time)

0

0.0

0.5

1.0

Time (yrs)

1.5

.

..

Model the pre-default stock dynamics under an EMM Q as:

d S̃t = [ µ + h(S̃t ) ]S̃t dt + σ(S̃t ) S̃t dBt

|{z}

| {z }

2.0

.

.

.

.

.

..

⇒ h(S). State dependent default intensity

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

10 / 1

Jump to Default Extended Diffusions (JDED)

.

Stock Price

..

.

Defaultable Stock Price

..

{

S̃t , ζ > t

St =

0, ζ ≤ t

.

.

100

S(t)

80

60

40

20

(ζ default time)

0

0.0

0.5

1.0

Time (yrs)

1.5

.

..

Model the pre-default stock dynamics under an EMM Q as:

d S̃t = [ µ + h(S̃t ) ]S̃t dt + σ(S̃t ) S̃t dBt

|{z}

| {z }

2.0

.

.

.

.

.

..

⇒ h(S). State dependent default intensity

Compensates for the jump-to-default and ensures the discounted

martingale property

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

10 / 1

Jump to Default Extended Diffusions (JDED)

.

Stock Price

..

.

Defaultable Stock Price

..

{

S̃t , ζ > t

St =

0, ζ ≤ t

.

.

100

S(t)

80

60

40

20

(ζ default time)

0

0.0

.

..

0.5

1.0

Time (yrs)

1.5

2.0

.

.

.

.

.

..

If the diffusion S̃t can hit zero:

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

11 / 1

Jump to Default Extended Diffusions (JDED)

.

Stock Price

..

.

Defaultable Stock Price

..

{

S̃t , ζ > t

St =

0, ζ ≤ t

.

.

100

S(t)

80

60

40

20

τ0

.

0

0.0

0.5

.

..

1.0

Time (yrs)

1.5

2.0

.

.

(ζ default time)

.

.

..

If the diffusion S̃t can hit zero:

V Bankruptcy at the first hitting time of zero,

{

}

τ0 = inf t : S̃t = 0

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

11 / 1

Jump to Default Extended Diffusions (JDED)

.

Stock Price

..

.

Defaultable Stock Price

..

{

S̃t , ζ > t

St =

0, ζ ≤ t

.

100

S(t)

80

60

40

.

.

(ζ default time)

0

0.0

0.5

1.0

Time (yrs)

τ0

1.5

2.0

.

..

.

Prior to τ0 default could also arrive by a jump-to-default ζ̃ with

default intensity h(S̃),

{

}

∫t

ζ̃ = inf t ∈ [0, τ0 ] : 0 h(S̃u ) ≥ e , e ≈ Exp(1)

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

.

ζ̃

20

.

..

.

12 / 1

Jump to Default Extended Diffusions (JDED)

.

Stock Price

..

.

Defaultable Stock Price

..

{

S̃t , ζ > t

St =

0, ζ ≤ t

.

100

S(t)

80

60

40

ζ̃

20

(ζ default time)

.

.

.

..

.

0

0.0

0.5

1.0

Time (yrs)

τ0

1.5

2.0

.

.

..

.

Prior to τ0 default could also arrive by a jump-to-default ζ̃ with

default intensity h(S̃),

{

}

∫t

ζ̃ = inf t ∈ [0, τ0 ] : 0 h(S̃u ) ≥ e , e ≈ Exp(1)

V At time ζ̃ the stock price St jumps to zero and the firm defaults

on its debt

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

12 / 1

Jump to Default Extended Diffusions (JDED)

.

Stock Price

..

.

Defaultable Stock Price

..

{

S̃t , ζ > t

St =

0, ζ ≤ t

.

100

S(t)

80

60

40

.

.

(ζ default time)

0

0.0

.

..

The default time ζ is the earliest of:

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

0.5

1.0

Time (yrs)

τ0

1.5

2.0

.

Credit Risk 2009

.

ζ̃

20

.

..

.

13 / 1

Jump to Default Extended Diffusions (JDED)

.

Stock Price

..

.

Defaultable Stock Price

..

{

S̃t , ζ > t

St =

0, ζ ≤ t

.

100

S(t)

80

60

40

.

.

0

0.0

.

..

The default time ζ is the earliest of:

1

0.5

1.0

Time (yrs)

τ0

1.5

2.0

.

.

ζ̃

20

(ζ default time)

.

..

.

The stock hits level zero by diffusion: τ0

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

13 / 1

Jump to Default Extended Diffusions (JDED)

.

Stock Price

..

.

Defaultable Stock Price

..

{

S̃t , ζ > t

St =

0, ζ ≤ t

.

100

S(t)

80

60

40

.

.

0

0.0

.

..

The default time ζ is the earliest of:

1

2

0.5

1.0

Time (yrs)

τ0

1.5

2.0

.

.

ζ̃

20

(ζ default time)

.

..

.

The stock hits level zero by diffusion: τ0

The stock jumps to zero from a positive value: ζ̃

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

13 / 1

Jump to Default Extended Diffusions (JDED)

.

Stock Price

..

.

Defaultable Stock Price

..

{

S̃t , ζ > t

St =

0, ζ ≤ t

.

100

Default Time

ζ:

ζ = min ζ̃ , τ0

S(t)

80

60

40

.

.

0

0.0

.

..

The default time ζ is the earliest of:

1

2

0.5

1.0

Time (yrs)

τ0

1.5

2.0

.

.

ζ̃

20

(ζ default time)

.

..

.

The stock hits level zero by diffusion: τ0

The stock jumps to zero from a positive value: ζ̃

)

(

ζ = min ζ̃, τ0

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

13 / 1

Contingent Claims

.

Risk Neutral Survival Probability (no default by time T)

[

Q (S, t; T ) = E 1{ζ>T }

[ R

]

T

h(Su )du

= E e| − t {z

1

0 >T }

} | {τ{z

}

(

)

Recall: Default time ζ = min ζ̃, τ0 .

.

..

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

.

]

.

Credit Risk 2009

.

..

14 / 1

Contingent Claims

.

Risk Neutral Survival Probability (no default by time T)

[

Q (S, t; T ) = E 1{ζ>T }

[ R

]

T

h(Su )du

= E e| − t {z

1

0 >T }

} | {τ{z

}

(

)

Recall: Default time ζ = min ζ̃, τ0 .

.

..

1

.

]

.

.

..

No jump-to-default before maturity T,

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

14 / 1

Contingent Claims

.

Risk Neutral Survival Probability (no default by time T)

[

Q (S, t; T ) = E 1{ζ>T }

[ R

]

T

h(Su )du

= E e| − t {z

1

0 >T }

} | {τ{z

}

(

)

Recall: Default time ζ = min ζ̃, τ0 .

.

..

1

No jump-to-default before maturity T,

2

Diffusion does not hit zero before maturity T.

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

.

]

.

Credit Risk 2009

.

..

14 / 1

Contingent Claims

.

Defaultable Zero Coupon Bond (at time t)

.

B (S, t; T ) = e −r (T −t) Q (S, t; T ) + e −r (T −t) R [1 − Q (S, t; T )]

|

{z

}

|

{z

}

Disc. Dollar if

No Default occurs

prior to maturity

Disc. recovery R ∈ [0, 1]

if Default occurs

before maturity T

Recall:Q (S, t; T ) is the risk neutral survival probability

.R is a fraction of a dollar paid at maturity.

..

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

.

Credit Risk 2009

.

..

15 / 1

Contingent Claims

.

Defaultable Zero Coupon Bond (at time t)

.

B (S, t; T ) = e −r (T −t) Q (S, t; T ) + e −r (T −t) R [1 − Q (S, t; T )]

|

{z

}

|

{z

}

Disc. Dollar if

No Default occurs

prior to maturity

Disc. recovery R ∈ [0, 1]

if Default occurs

before maturity

Recall:Q (S, t; T ) is the risk neutral survival probability

.R is a fraction of a dollar paid at maturity.

..

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

.

Credit Risk 2009

.

..

15 / 1

Contingent Claims

.

Defaultable Zero Coupon Bond (at time t)

.

B (S, t; T ) = e −r (T −t) Q (S, t; T ) + e −r (T −t) R [1 − Q (S, t; T )]

|

{z

}

|

{z

}

Disc. Dollar if

No Default occurs

prior to maturity

Disc. recovery R ∈ [0, 1]

if Default occurs

before maturity

Recall:Q (S, t; T ) is the risk neutral survival probability

.R is a fraction of a dollar paid at maturity.

..

.

.

..

Defaultable bonds with coupons are valued as portfolios of

zero-coupon bonds

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

15 / 1

Contingent Claims

.

Defaultable Zero Coupon Bond (at time t)

.

B (S, t; T ) = e −r (T −t) Q (S, t; T ) + e −r (T −t) R [1 − Q (S, t; T )]

|

{z

}

|

{z

}

Disc. Dollar if

No Default occurs

prior to maturity

Disc. recovery R ∈ [0, 1]

if Default occurs

before maturity

Recall:Q (S, t; T ) is the risk neutral survival probability

.R is a fraction of a dollar paid at maturity.

..

.

.

..

Defaultable bonds with coupons are valued as portfolios of

zero-coupon bonds

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

.

.

.

.

Call Option

..

[ RT

]

C (S, t; K , T ) = e −r (T −t) E e − t h(Su )du (ST − K )+ 1{τ0 >T }

.

..

15 / 1

Contingent Claims

.

Put Payoff (Strike Price K > 0)

.

..

(K − ST )+ 1{ζ>T } +

|

{z

}

Put Payoff

given no default

by time T

.

K 1{ζ≤T }

| {z }

Recovery amount K

if default occurs

before maturity T

.

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

.

..

16 / 1

Contingent Claims

.

Put Payoff (Strike Price K > 0)

.

..

(K − ST )+ 1{ζ>T } +

|

{z

}

Put Payoff

given no default

by time T

.

K 1{ζ≤T }

| {z }

Recovery amount K

if default occurs

before maturity T

.

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

.

..

16 / 1

Contingent Claims

.

Put Payoff (Strike Price K > 0)

Put Payoff

given no default

by time T

K 1{ζ≤T }

| {z }

Recovery amount K

if default occurs

before maturity T

.

.

Put Option Price

..

[ RT

]

P (S, t; K , T ) = e −r (T −t) E e − t h(Su )du (K − ST )+ 1{τ0 >T }

+ Ke −r (T −t) [1 − Q (S, t; T )]

.

..

.

.

..

(K − ST )+ 1{ζ>T } +

|

{z

}

.

.

.

.

..

NOTE. A default claim is embedded in the Put Option

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

16 / 1

Jump-to-Default Extended Constant Elasticity of

Variance (JDCEV) Model

.

The JDCEV process (Carr and Linetsky (2006))

.

..

.

..

σ(S) = aS β

h(S) = b + c σ 2 (S)

CEV Volatility

(Power function of S)

Default Intensity

(Affine function of Variance)

.

a>0

β<0

b≥0

c≥0

.

dSt = [µ + h(St )]St dt + σ(St )St dBt , S0 = S > 0

⇒ volatility scale parameter (fixing ATM volatility)

⇒ volatility elasticity parameter

⇒ constant default intensity

⇒ sensitivity of the default intensity to variance

For c = 0 and b = 0 the JDCEV reduces to the standard CEV process

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

17 / 1

Jump-to-Default Extended Constant Elasticity of

Variance (JDCEV) Model

.

The JDCEV process (Carr and Linetsky (2006))

.

..

.

..

σ(S) = aS β

h(S) = b + c σ 2 (S)

CEV Volatility

(Power function of S)

Default Intensity

(Affine function of Variance)

.

.

dSt = [µ + h(St )]St dt + σ(St )St dBt , S0 = S > 0

The model is consistent with:

leverage effect V S ⇓→ σ(S) ⇑

stock volatility–credit spreads linkage V σ(S) ⇑↔ h(S) ⇑

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

17 / 1

An Application of Jump to Default Extended

Diffusions (JDED)

Equity Default Swaps under the JDCEV Model

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

18 / 1

Equity Default Swaps (EDS)

Credit-Type Instrument to bring protection in case of a Credit Event

Credit Events:

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

19 / 1

Equity Default Swaps (EDS)

Credit-Type Instrument to bring protection in case of a Credit Event

Credit Events:

1

Reference Entity Defaults

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

19 / 1

Equity Default Swaps (EDS)

Credit-Type Instrument to bring protection in case of a Credit Event

Credit Events:

1

2

Reference Entity Defaults

Reference Stock Price drops significantly (L = 30%S0 )

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

19 / 1

Equity Default Swaps (EDS)

Credit-Type Instrument to bring protection in case of a Credit Event

Credit Events:

1

2

Reference Entity Defaults

Reference Stock Price drops significantly (L = 30%S0 )

Similar to CDS

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

19 / 1

Equity Default Swaps (EDS)

Credit-Type Instrument to bring protection in case of a Credit Event

Credit Events:

1

2

Reference Entity Defaults

Reference Stock Price drops significantly (L = 30%S0 )

Similar to CDS

Protection Buyer makes periodic Premium Payments on exchange of

protection in case of a Credit Event.

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

19 / 1

Equity Default Swaps (EDS)

Credit-Type Instrument to bring protection in case of a Credit Event

Credit Events:

1

2

Reference Entity Defaults

Reference Stock Price drops significantly (L = 30%S0 )

Similar to CDS

Protection Buyer makes periodic Premium Payments on exchange of

protection in case of a Credit Event.

Protection Seller pays a recovery amount (1 − r) for each dollar of

principal at credit event time, if the event occurs prior to Maturity.

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

19 / 1

Equity Default Swaps (EDS)

Equity Default Swap

(EDS)

Protection

Payment

Protection Seller

t

T

Hitting Level

Hits Level (L)

(L)

100

80

S(t)

60

40

20

L

Protection Buyer

0

0.0

0.2

0.4

0.6

0.8

1.0

1.2

1.4

1.6

1.8

2.0

Time (yrs)

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

20 / 1

Equity Default Swaps (EDS)

Equity Default Swap

(EDS)

Protection

Payment

Default Event

(or)

Hitting Level

(L)

100

80

60

S(t)

Hits Level (L)

Or

Default Occurs

Protection Seller

t

T

40

20

L

Protection Buyer

0

0.0

0.2

0.4

0.6

0.8

1.0

1.2

1.4

1.6

1.8

2.0

Time (yrs)

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

20 / 1

Equity Default Swaps (EDS)

t

Protection

Payment

T

Default Event

(or)

Hitting Level

(L)

100

80

60

S(t)

Premium Payments

+

Accrued Interest

Protection Seller

Hits Level (L)

Or

Default Occurs

∆t

Premium

Payment

Equity Default Swap

(EDS)

40

20

L

Protection Buyer

0

0.0

0.2

0.4

0.6

0.8

1.0

1.2

1.4

1.6

1.8

2.0

Time (yrs)

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

20 / 1

Equity Default Swaps (EDS)

t

Protection

Payment

T

Default Event

(or)

Hitting Level

(L)

100

80

60

S(t)

Premium Payments

+

Accrued Interest

Hits Level (L)

Or

Default Occurs

Protection Seller

Acc.

Interest

∆t

Premium

Payment

Equity Default Swap

(EDS)

40

20

L

Protection Buyer

0

0.0

0.2

0.4

0.6

0.8

1.0

1.2

1.4

1.6

1.8

2.0

Time (yrs)

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

20 / 1

Equity Default Swaps (EDS): Balance Equation

We want to obtain the EDS rate ϱ∗ that balances out:

ϱ∗ = {ϱ |PV(Protection Payment)=PV(Premium Payments + Accrued Interest) }

Define: Credit Event Time V TL∆ = min{first hitting time to L, Default Time}

PV(Protection Payment)

PV(Premium Payments)

PV(Accrued Interests)

[

]

∆

(1 − r) · E e −r · TL 1{TL∆ ≤ T }

[

]

∑N

ϱ · ∆t · i=1 e −r · ti E 1{TL∆ ≥ ti }

(

]

[

[ ∆ ])

TL

−r · TL∆

∆

ϱ·E e

TL − ∆t · ∆t

1{TL∆ ≤ T }

∆t

r

T

TL∆

ϱ

r

Time Interval

Recovery

Maturity

Credit Event Time

EDS rate

Risk Free Rate

.. Details

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

21 / 1

Equity Default Swaps (EDS)

Advantages of EDS over CDS

Transparency on which an EDS payoff is triggered. It is easy to know

whether a firm stock price has crossed a lower threshold (L)

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

22 / 1

Equity Default Swaps (EDS)

Advantages of EDS over CDS

Transparency on which an EDS payoff is triggered. It is easy to know

whether a firm stock price has crossed a lower threshold (L)

Using the Stock Price as the state variable to determine a credit

event allows investors to have a Exposure to Firms for which CDS are

not usually traded.

(as in the case of firms with high yield debt)

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

22 / 1

Equity Default Swaps (EDS)

Advantages of EDS over CDS

Transparency on which an EDS payoff is triggered. It is easy to know

whether a firm stock price has crossed a lower threshold (L)

Using the Stock Price as the state variable to determine a credit

event allows investors to have a Exposure to Firms for which CDS are

not usually traded.

(as in the case of firms with high yield debt)

EDS closes the gap between equity and credit instruments since it is

structurally similar to the credit default swap.

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

22 / 1

Time-Changing the Jump to Default Extended

Diffusions (JDED)

Under the jump-to-default extended diffusion framework (including

JDCEV), the pre-default stock process evolves continuously and may

experience a single jump to default.

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

23 / 1

Time-Changing the Jump to Default Extended

Diffusions (JDED)

Under the jump-to-default extended diffusion framework (including

JDCEV), the pre-default stock process evolves continuously and may

experience a single jump to default.

Our contribution is to construct far-reaching extensions by

introducing jumps and stochastic volatility by means of time-changes

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

23 / 1

Time-Changing the Jump to Default Extended

Diffusions (JDED)

“Time Changes of Markov Processes in Credit-Equity Modeling”

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

24 / 1

General Panorama

Continuous

Markov Process

w/ Default Intensity

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

25 / 1

General Panorama

Time Changes

Continuous

Markov Process

w/ Default Intensity

Bochner

Levy Subordination

Absolute Continuous

Time Changes

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

25 / 1

General Panorama

Time Changes

Continuous

Markov Process

w/ Default Intensity

Bochner

Levy Subordination

Levy

Subordination

&

Absolute Continuous

Time Changes

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Absolute

Continuous

Time Changes

Credit Risk 2009

25 / 1

General Panorama

Time Changes

Continuous

Markov Process

w/ Default Intensity

Bochner

Levy Subordination

Levy

Subordination

&

Jump-Diffusion

Process w/

Stochastic Volatility

Default Intensity

Rafael Mendoza (McCombs)

Absolute Continuous

Time Changes

Unified Credit-Equity Modeling

Absolute

Continuous

Time Changes

Credit Risk 2009

25 / 1

General Panorama

Time Changes

Continuous

Markov Process

w/ Default Intensity

Bochner

Levy Subordination

Levy

Subordination

&

Jump-Diffusion

Process w/

Stochastic Volatility

Default Intensity

Absolute Continuous

Time Changes

Absolute

Continuous

Time Changes

Analytical Unified Credit and Equity Option Pricing Formulas

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

25 / 1

General Panorama

Time Changes

Continuous

Markov Process

w/ Default Intensity

Bochner

Levy Subordination

Levy

Subordination

&

Jump-Diffusion

Process w/

Stochastic Volatility

Default Intensity

Absolute Continuous

Time Changes

Absolute

Continuous

Time Changes

Analytical Unified Credit and Equity Option Pricing Formulas

f (x) ∈

/ L2

Laplace Transform

Approach

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

25 / 1

General Panorama

Time Changes

Continuous

Markov Process

w/ Default Intensity

Bochner

Levy Subordination

Levy

Subordination

&

Jump-Diffusion

Process w/

Stochastic Volatility

Default Intensity

Absolute

Continuous

Time Changes

Absolute Continuous

Time Changes

Analytical Unified Credit and Equity Option Pricing Formulas

f (x) ∈

/ L2

Laplace Transform

Approach

Rafael Mendoza (McCombs)

f (x) ∈ L2

Spectral Expansion

Approach

Unified Credit-Equity Modeling

Credit Risk 2009

25 / 1

Time-Changed Process Yt = XTt

.

Time Changed Process Construction

..

Yt = XTt

.

.

..

Tt is a random clock process independent of Xt

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

.

Credit Risk 2009

.

Xt is a background process (e.g. JDCEV)

26 / 1

Time-Changed Process Yt = XTt

.

Time Changed Process Construction

..

Yt = XTt

.

Tt is a random clock process independent of Xt

.

Random Clock {Tt , t ≥ 0}

.

..

Non-decreasing RCLL process starting at T0 = 0 and E [Tt ] < ∞.

.

..

We are interested in T.C. with analytically

[ −λT ]tractable Laplace Transform (LT):

L(t, λ) = E e

Rafael Mendoza (McCombs)

t

<∞

Unified Credit-Equity Modeling

.

Credit Risk 2009

.

.

..

.

.

Xt is a background process (e.g. JDCEV)

26 / 1

Time-Changed Process Yt = XTt

.

Time Changed Process Construction

..

Yt = XTt

.

Tt is a random clock process independent of Xt

.

..

.

.

Random Clock {Tt , t ≥ 0}

.

Xt is a background process (e.g. JDCEV)

.

..

Non-decreasing RCLL process starting at T0 = 0 and E [Tt ] < ∞.

L(t, λ) = E e

.

..

1

t

<∞

Lévy Subordinators with L.T. L(t, λ) = e −ϕ(λ)t V induce jumps

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

.

.

We are interested in T.C. with analytically

[ −λT ]tractable Laplace Transform (LT):

26 / 1

Time-Changed Process Yt = XTt

.

Time Changed Process Construction

..

Yt = XTt

.

Tt is a random clock process independent of Xt

.

..

.

.

Random Clock {Tt , t ≥ 0}

.

Xt is a background process (e.g. JDCEV)

.

..

Non-decreasing RCLL process starting at T0 = 0 and E [Tt ] < ∞.

L(t, λ) = E e

.

..

1

2

t

<∞

Lévy Subordinators with L.T. L(t, λ) = e −ϕ(λ)t V induce jumps

.

.

We are interested in T.C. with analytically

[ −λT ]tractable Laplace Transform (LT):

Absolutely Continuous (A.C.) time changes V induce stochastic

volatility

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

26 / 1

Time-Changed Process Yt = XTt

.

Time Changed Process Construction

..

Yt = XTt

.

Tt is a random clock process independent of Xt

.

..

.

.

Random Clock {Tt , t ≥ 0}

.

Xt is a background process (e.g. JDCEV)

.

..

Non-decreasing RCLL process starting at T0 = 0 and E [Tt ] < ∞.

L(t, λ) = E e

.

..

1

2

3

t

<∞

Lévy Subordinators with L.T. L(t, λ) = e −ϕ(λ)t V induce jumps

.

.

We are interested in T.C. with analytically

[ −λT ]tractable Laplace Transform (LT):

Absolutely Continuous (A.C.) time changes V induce stochastic

volatility

Composite Time Changes V induce jumps & stochastic volatility

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

26 / 1

Illustration of Lévy Subordinators

.

..

Y = XTt where Xt = Bt and Tt = t+ Compound Poisson Process .

with Exponential Jumps

Background Process X(t)

0.6

0.5

Time Process

0.4

1.8

0.3

X(t)

2

1.6

0.2

Time T(t)

1.4

0.1

1.2

0

0

1

0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9

1

1.1 1.2 1.3 1.4 1.5 1.6 1.7

-0.1

Time T(t)

0.8

Time Changed Process Y(t)=X(T(t))

0.6

0.6

0.4

0.5

0.2

0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1

Time t

Y(t)=X (T(t))

0.4

0

0.3

0.2

0.1

0

0

0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9

1

1.1 1.2 1.3 1.4 1.5 1.6 1.7

-0.1

Time (t)

.

.

.

..

When jump in T (t) arrives, the clock skips ahead, and time-changed process is

generated by cutting out the corresponding piece of the diffusion sample path in

which T (t) skips ahead. Jumps arriving at (expected) time intervals 1/α = 1/4 yrs. of (expected) jump size

1/ηRafael

= 0.1 Mendoza

yrs.

(McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

27 / 1

Illustration of Lévy Subordinators

.

..

Y = XTt where Xt = Bt and Tt = t+ Compound Poisson Process .

with Exponential Jumps

Background Process X(t)

0.6

0.5

Time Process

0.4

1.8

0.3

X(t)

2

1.6

0.2

Time T(t)

1.4

0.1

1.2

0

0

1

0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9

1

1.1 1.2 1.3 1.4 1.5 1.6 1.7

-0.1

Time T(t)

0.8

Time Changed Process Y(t)=X(T(t))

0.6

0.6

0.4

0.5

0.2

0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1

Time t

Y(t)=X (T(t))

0.4

0

0.3

0.2

0.1

0

0

0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9

1

1.1 1.2 1.3 1.4 1.5 1.6 1.7

-0.1

Time (t)

.

.

.

..

When jump in T (t) arrives, the clock skips ahead, and time-changed process is

generated by cutting out the corresponding piece of the diffusion sample path in

which T (t) skips ahead. Jumps arriving at (expected) time intervals 1/α = 1/4 yrs. of (expected) jump size

1/ηRafael

= 0.1 Mendoza

yrs.

(McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

27 / 1

Illustration of Lévy Subordinators

.

..

Y = XTt where Xt = Bt and Tt = t+ Compound Poisson Process .

with Exponential Jumps

Background Process X(t)

0.6

0.5

Time Process

0.4

1.8

0.3

X(t)

2

1.6

0.2

Time T(t)

1.4

0.1

1.2

0

0

1

0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9

1

1.1 1.2 1.3 1.4 1.5 1.6 1.7

-0.1

Time T(t)

0.8

Time Changed Process Y(t)=X(T(t))

0.6

0.6

0.4

0.5

0.2

0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1

Time t

Y(t)=X (T(t))

0.4

0

0.3

0.2

0.1

0

0

0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9

1

1.1 1.2 1.3 1.4 1.5 1.6 1.7

-0.1

Time (t)

.

.

.

..

When jump in T (t) arrives, the clock skips ahead, and time-changed process is

generated by cutting out the corresponding piece of the diffusion sample path in

which T (t) skips ahead. Jumps arriving at (expected) time intervals 1/α = 1/4 yrs. of (expected) jump size

1/ηRafael

= 0.1 Mendoza

yrs.

(McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

27 / 1

Illustration of Lévy Subordinators

.

..

Y = XTt where Xt = Bt and Tt = t+ Compound Poisson Process .

with Exponential Jumps

Background Process X(t)

0.6

0.5

Time Process

0.4

1.8

0.3

X(t)

2

1.6

0.2

Time T(t)

1.4

0.1

1.2

0

0

1

0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9

1

1.1 1.2 1.3 1.4 1.5 1.6 1.7

-0.1

Time T(t)

0.8

Time Changed Process Y(t)=X(T(t))

0.6

0.6

0.4

0.5

0.2

0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1

Time t

Y(t)=X (T(t))

0.4

0

0.3

0.2

0.1

0

0

0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9

1

1.1 1.2 1.3 1.4 1.5 1.6 1.7

-0.1

Time (t)

.

.

.

..

When jump in T (t) arrives, the clock skips ahead, and time-changed process is

generated by cutting out the corresponding piece of the diffusion sample path in

which T (t) skips ahead. Jumps arriving at (expected) time intervals 1/α = 1/4 yrs. of (expected) jump size

1/ηRafael

= 0.1 Mendoza

yrs.

(McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

27 / 1

Illustration of Lévy Subordinators

.

..

Y = XTt where Xt = Bt and Tt = t+ Compound Poisson Process .

with Exponential Jumps

Background Process X(t)

0.6

0.5

Time Process

0.4

1.8

0.3

X(t)

2

1.6

0.2

Time T(t)

1.4

0.1

1.2

0

0

1

0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9

1

1.1 1.2 1.3 1.4 1.5 1.6 1.7

-0.1

Time T(t)

Time Changed Process Y(t)=X(T(t))

0.8

0.6

0.6

0.4

0.5

0.2

0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1

Time t

Y(t)=X (T(t))

0.4

0

0.3

0.2

0.1

0

0

0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9

1

1.1 1.2 1.3 1.4 1.5 1.6 1.7

-0.1

Time (t)

.

.

.

..

When jump in T (t) arrives, the clock skips ahead, and time-changed process is

generated by cutting out the corresponding piece of the diffusion sample path in

which T (t) skips ahead. Jumps arriving at (expected) time intervals 1/α = 1/4 yrs. of (expected) jump size

1/ηRafael

= 0.1 Mendoza

yrs.

(McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

27 / 1

Illustration of Lévy Subordinators

.

..

Y = XTt where Xt = Bt and Tt = t+ Compound Poisson Process .

with Exponential Jumps

Background Process X(t)

0.6

0.5

Time Process

0.4

1.8

0.3

X(t)

2

1.6

0.2

Time T(t)

1.4

0.1

1.2

0

0

1

0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9

1

1.1 1.2 1.3 1.4 1.5 1.6 1.7

-0.1

Time T(t)

Time Changed Process Y(t)=X(T(t))

0.8

0.6

0.6

0.4

0.5

0.2

0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1

Time t

Y(t)=X (T(t))

0.4

0

0.3

0.2

0.1

0

0

0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9

1

1.1 1.2 1.3 1.4 1.5 1.6 1.7

-0.1

Time (t)

.

.

.

..

When jump in T (t) arrives, the clock skips ahead, and time-changed process is

generated by cutting out the corresponding piece of the diffusion sample path in

which T (t) skips ahead. Jumps arriving at (expected) time intervals 1/α = 1/4 yrs. of (expected) jump size

1/ηRafael

= 0.1 Mendoza

yrs.

(McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

27 / 1

Illustration of Lévy Subordinators

.

..

Y = XTt where Xt = Bt and Tt = t+ Compound Poisson Process .

with Exponential Jumps

Background Process X(t)

0.6

0.5

Time Process

0.4

1.8

0.3

X(t)

2

1.6

0.2

Time T(t)

1.4

0.1

1.2

0

0

1

0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9

1

1.1 1.2 1.3 1.4 1.5 1.6 1.7

-0.1

Time T(t)

Time Changed Process Y(t)=X(T(t))

0.8

0.6

0.6

0.4

0.5

0.2

0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1

Time t

Y(t)=X (T(t))

0.4

0

0.3

0.2

0.1

0

0

0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9

1

1.1 1.2 1.3 1.4 1.5 1.6 1.7

-0.1

Time (t)

.

.

.

..

When jump in T (t) arrives, the clock skips ahead, and time-changed process is

generated by cutting out the corresponding piece of the diffusion sample path in

which T (t) skips ahead. Jumps arriving at (expected) time intervals 1/α = 1/4 yrs. of (expected) jump size

1/ηRafael

= 0.1 Mendoza

yrs.

(McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

27 / 1

Examples of Lévy Subordinators

.

Three Parameter Lévy measure:

..

ν(ds) = Cs −Y −1 e −ηs ds

where

C > 0, η > 0, Y < 1

.. Details

.

C changes the time scale of the process (simultaneously modifies the

intensity of jumps of all sizes)

Y controls the small size jumps

η defines the decay rate of big jumps

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

.

.

..

.

28 / 1

Examples of Lévy Subordinators

.

Three Parameter Lévy measure:

..

ν(ds) = Cs −Y −1 e −ηs ds

where

C > 0, η > 0, Y < 1

.. Details

.

C changes the time scale of the process (simultaneously modifies the

intensity of jumps of all sizes)

Y controls the small size jumps

η defines the decay rate of big jumps

.

Lévy-Khintchine formula

..

.

.

..

.

.

L(t, λ) = e −ϕ(λ)t

γλ − C Γ(−Y )[(λ + η)Y − η Y ], Y ̸= 0

ϕ(λ) =

.

..

γλ + C ln(1 + λ/η),

Y =0

.

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

.

where

28 / 1

Absolutely Continuous Time Changes

.

Absolutely Continuous Time Changes (A.C)

..

An A.C. Time change is the time integral of some positive function V (z)

of a Markov process {Zt , t ≥ 0},

Tt =

0

V (Zu )du

We are interested in cases with Laplace Transform in closed form:

[

]

Rt

Lz (t, λ) = Ez e −λ 0 V (Zu )du

.

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

.

.

..

∫t

.

29 / 1

Absolutely Continuous Time Changes

.

Absolutely Continuous Time Changes (A.C)

..

An A.C. Time change is the time integral of some positive function V (z)

of a Markov process {Zt , t ≥ 0},

Tt =

0

V (Zu )du

We are interested in cases with Laplace Transform in closed form:

[

]

Rt

Lz (t, λ) = Ez e −λ 0 V (Zu )du

.

.

.

..

∫t

.

Example: The Cox-Ingersoll-Ross (CIR) process:

√

dVt = κ(θ − Vt )dt + σV Vt dWt

with V0 = v > 0, rate of mean reversion κ > 0, long-run level θ > 0,

and volatility σV > 0.

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

29 / 1

Absolutely Continuous Time Changes

The Laplace Transform of the Integrated CIR process:

[

]

Rt

Lv (t, λ) = Ev e −λ 0 Vu du = A(t, λ)e −B(t,λ)v

A=

2ϖe (ϖ+κ)t/2

(ϖ + κ)(e ϖt − 1) + 2ϖ

Rafael Mendoza (McCombs)

! 2κθ

σ2

V

, B=

q

2λ(e ϖt − 1)

,

ϖ

=

2σV2 λ + κ2

(ϖ + κ)(e ϖt − 1) + 2ϖ

Unified Credit-Equity Modeling

Credit Risk 2009

30 / 1

Absolutely Continuous Time Changes

The Laplace Transform of the Integrated CIR process:

[

]

Rt

Lv (t, λ) = Ev e −λ 0 Vu du = A(t, λ)e −B(t,λ)v

A=

2ϖe (ϖ+κ)t/2

(ϖ + κ)(e ϖt − 1) + 2ϖ

! 2κθ

σ2

V

, B=

q

2λ(e ϖt − 1)

,

ϖ

=

2σV2 λ + κ2

(ϖ + κ)(e ϖt − 1) + 2ϖ

This is the Zero Coupon Bond formula under the CIR interest rate

rt = λVt .

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

30 / 1

Illustration of Absolutely Continuous Time Changes

.

CIR parameters κ = 7, θ = 2, V0 = 0.5 and σv =

√

..

.

2

Time Process

CIR Process

3

1

V(t)

0.9

0.8

2.5

0.7

Time T(t)

2

1.5

1

0.6

0.5

0.4

0.3

0.2

0.5

0.1

0

0

0

0.1

0.2

0.3

0.4

0.5

0.6

Time (t)

0.7

0.8

0.9

0

1

0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9

Time t

P ro c e s s e s X (t) v s Y (t)= X (T (t))

1

X (t)

0 .5

0 .4

0 .3

0 .2

0 .1

0

0

0 .1

0 .2

0 .3

0 .4

0 .5

0 .6

0 .7

0 .8

0 .9

1

1 .1

T im e ( t)

.

.

.

..

-0 .1

Time speeds up or slows down based on the amount of new information

arriving and the amount trading (trading time)

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

31 / 1

Illustration of Absolutely Continuous Time Changes

.

CIR parameters κ = 7, θ = 2, V0 = 0.5 and σv =

√

..

.

2

Time Process

CIR Process

3

1

V(t)

0.9

2.5

0.8

0.7

Time T(t)

2

1.5

1

0.6

0.5

0.4

0.3

0.2

0.5

0.1

0

0

0

0.1

0.2

0.3

0.4

0.5

0.6

Time (t)

0.7

0.8

0.9

0

1

0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9

Time t

1

X (t)

X (T (t))

P ro c e s s e s X (t) v s Y (t)= X (T (t))

0 .5

0 .4

0 .3

0 .2

0 .1

0

0

0 .1

0 .2

0 .3

0 .4

0 .5

0 .6

0 .7

0 .8

0 .9

1

1 .1

T im e ( t )

.

.

.

..

-0 .1

Time speeds up or slows down based on the amount of new information

arriving and the amount trading (trading time)

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

31 / 1

Illustration of Absolutely Continuous Time Changes

.

CIR parameters κ = 7, θ = 2, V0 = 0.5 and σv =

√

..

.

2

Time Process

CIR Process

3

1

V(t)

0.9

2.5

0.8

0.7

Time T(t)

2

1.5

1

0.6

Slow

0.5

Fast

0.4

0.3

0.2

0.5

0.1

0

0

0

0.1

0.2

0.3

0.4

0.5

0.6

Time (t)

0.7

0.8

0.9

0

1

0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9

Time t

1

X (t)

X (T (t))

P ro c e s s e s X (t) v s Y (t)= X (T (t))

0 .5

0 .4

0 .3

Slow

Fast

0 .1

0 .2

0 .2

0 .1

0

0

0 .3

0 .4

0 .5

0 .6

0 .7

0 .8

0 .9

1

1 .1

T im e ( t )

.

.

.

..

-0 .1

Time speeds up or slows down based on the amount of new information

arriving and the amount trading (trading time)

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

31 / 1

Composite Time Changes

.

Composite Time Changes

..

A Composite Time Change induces both jumps and stochastic volatility

.

Tt = TT1 2

t

.

..

T22 is and A.C time change

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

.

Credit Risk 2009

.

Tt1 is a Lévy Subordinator

32 / 1

Composite Time Changes

.

Composite Time Changes

..

A Composite Time Change induces both jumps and stochastic volatility

.

Tt = TT1 2

t

T22 is and A.C time change

.

.

Laplace Transform of the Composite Time Change

..

It is obtained by first conditioning w.r.t. the A.C. time change

E[e −λTt ] = E[e −Tt

2

.

..

Rafael Mendoza (McCombs)

ϕ(λ) ]

= Lz (t, ϕ(λ))

Unified Credit-Equity Modeling

.

.

Credit Risk 2009

.

.

..

.

Tt1 is a Lévy Subordinator

32 / 1

Quick Summary

We have:

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

33 / 1

Quick Summary

We have:

1

A Jump-to-Default Extended Diffusion process:

[ Rt

]

[

]

E f (Xt ) 1{ζ>t} = E e − 0 h(Xu )du f (Xt ) 1{τ0 >t}

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

33 / 1

Quick Summary

We have:

1

A Jump-to-Default Extended Diffusion process:

[ Rt

]

[

]

E f (Xt ) 1{ζ>t} = E e − 0 h(Xu )du f (Xt ) 1{τ0 >t}

2

A time-changed process Yt = XTt with the Laplace transform for the

time change Tt given in closed form,

[

]

E e −λTt = L (t, λ)

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

33 / 1

Quick Summary

We have:

1

A Jump-to-Default Extended Diffusion process:

[ Rt

]

[

]

E f (Xt ) 1{ζ>t} = E e − 0 h(Xu )du f (Xt ) 1{τ0 >t}

2

A time-changed process Yt = XTt with the Laplace transform for the

time change Tt given in closed form,

[

]

E e −λTt = L (t, λ)

How do we evaluate contingent claims written on the time-changed

process Yt ?

[

]

E f (Yt ) 1{ζ>Tt }

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

33 / 1

Contingent Claims for the Time-Changed Process

.

Valuing contingent claims written on Yt = XTt

..

]]

[

]

[ [

E 1{ζ>Tt } f (Yt ) = E Ex 1{ζ>Tt } f (XTt ) Tt

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

.

Credit Risk 2009

.

Conditioning

since Xt and Tt are independent

.

..

.

34 / 1

Contingent Claims for the Time-Changed Process

.

Valuing contingent claims written on Yt = XTt

..

]]

[

]

[ [

E 1{ζ>Tt } f (Yt ) = E Ex 1{ζ>Tt } f (XTt ) Tt

.

Unified Credit-Equity Modeling

Credit Risk 2009

.

.

It is equivalent to pricing a contingent claim written on the process Xt

maturing

at time Tt

.

..

.

Rafael Mendoza (McCombs)

.

Conditioning

since Xt and Tt are independent

.

..

.

Conditional Expectation

..

]

[

E 1{ζ>Tt } f (XTt ) Tt

.

34 / 1

Contingent Claims for the Time-Changed Process

.

Valuing contingent claims written on Yt = XTt

..

]]

[

]

[ [

E 1{ζ>Tt } f (Yt ) = E Ex 1{ζ>Tt } f (XTt ) Tt

.

Unified Credit-Equity Modeling

Credit Risk 2009

.

.

It is equivalent to pricing a contingent claim written on the process Xt

maturing

at time Tt

.

..

.

We employ two methodologies to evaluate the expectations and do

the pricing in closed form:

Rafael Mendoza (McCombs)

.

Conditioning

since Xt and Tt are independent

.

..

.

Conditional Expectation

..

]

[

E 1{ζ>Tt } f (XTt ) Tt

.

34 / 1

Contingent Claims for the Time-Changed Process

.

Valuing contingent claims written on Yt = XTt

..

]]

[

]

[ [

E 1{ζ>Tt } f (Yt ) = E Ex 1{ζ>Tt } f (XTt ) Tt

.

.

.

It is equivalent to pricing a contingent claim written on the process Xt

maturing

at time Tt

.

..

.

We employ two methodologies to evaluate the expectations and do

the pricing in closed form:

1

.

Conditioning

since Xt and Tt are independent

.

..

.

Conditional Expectation

..

]

[

E 1{ζ>Tt } f (XTt ) Tt

.

Resolvent Operator: general methodology.

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

34 / 1

Contingent Claims for the Time-Changed Process

.

Valuing contingent claims written on Yt = XTt

..

]]

[

]

[ [

E 1{ζ>Tt } f (Yt ) = E Ex 1{ζ>Tt } f (XTt ) Tt

.

2

.

.

It is equivalent to pricing a contingent claim written on the process Xt

maturing

at time Tt

.

..

.

We employ two methodologies to evaluate the expectations and do

the pricing in closed form:

1

.

Conditioning

since Xt and Tt are independent

.

..

.

Conditional Expectation

..

]

[

E 1{ζ>Tt } f (XTt ) Tt

.

Resolvent Operator: general methodology.

Spectral Representation: for square-integrable payoffs.

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

34 / 1

Resolvent Operator

.

Resolvent Operator:

..

The Laplace Transform of the Expectation Operator:

(Rλ f )(x) :=

Rafael Mendoza (McCombs)

∫∞

0

[

]

e −λt Ex 1{ζ>t} f (Xt ) dt

Unified Credit-Equity Modeling

.

Credit Risk 2009

.

.

..

.

35 / 1

Resolvent Operator

.

Resolvent Operator:

..

The Laplace Transform of the Expectation Operator:

(Rλ f )(x) :=

∫∞

0

[

]

e −λt Ex 1{ζ>t} f (Xt ) dt

.

.

.

..

.

We recover the Expectation via the Bromwich Laplace Inversion

formula:

Rafael Mendoza (McCombs)

Unified Credit-Equity Modeling

Credit Risk 2009

35 / 1

Resolvent Operator

.

Resolvent Operator:

..

The Laplace Transform of the Expectation Operator:

(Rλ f )(x) :=

∫∞

0

[

]

e −λt Ex 1{ζ>t} f (Xt ) dt

.

.

.

..

.

We recover the Expectation via the Bromwich Laplace Inversion

formula:

Rafael Mendoza (McCombs)

1

2πi

∫ ϵ+i∞

ϵ−i∞

.

e λ t (Rλ f )(x)dλ

Unified Credit-Equity Modeling

.

Credit Risk 2009