Who Needs Another Consortium? - Association for Manufacturing

advertisement

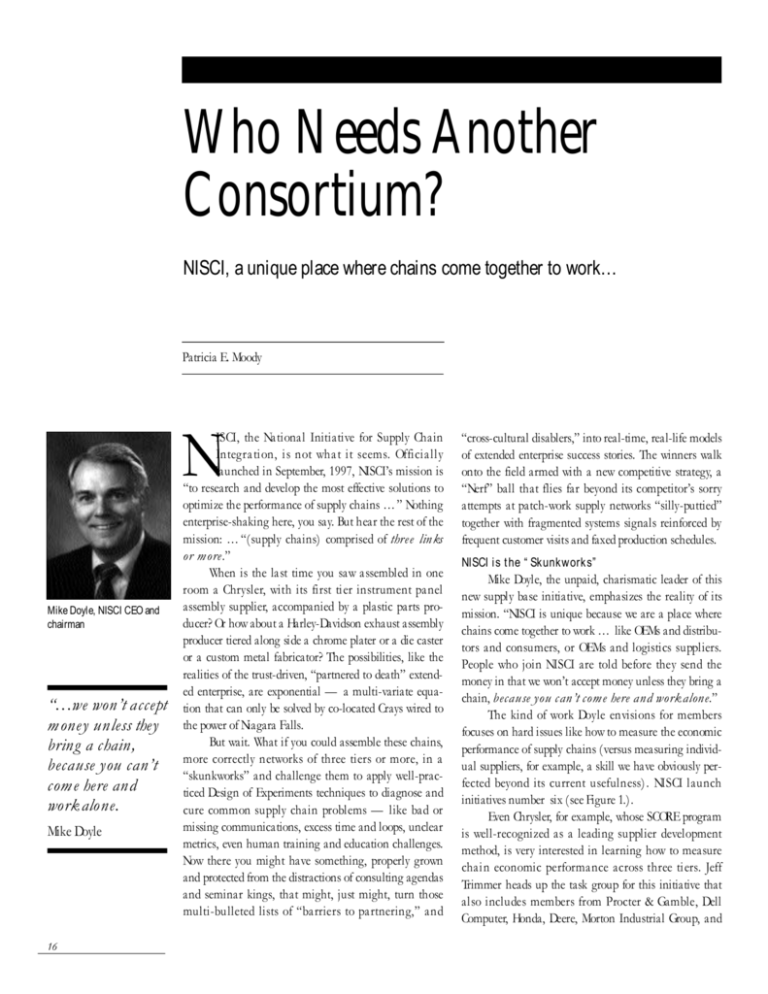

Who Needs Another Consortium? NISCI, a unique place where chains come together to work… Patricia E. Moody N Mike Doyle, NISCI CEO and chairman “…we won’t accept money unless they bring a chain, because you can’t come here and work alone. Mike Doyle 16 ISCI, the National Initiative for Supply Chain Integration, is not what it seems. Off i c i a l l y launched in September, 1997, NISCI’s mission is “to research and develop the most effective solutions to optimize the performance of supply chains …” Nothing enterprise-shaking here, you say. But hear the rest of the mission: …“(supply chains) comprised of three links or more.” When is the last time you saw assembled in one room a Chry s l e r, with its first tier instrument panel assembly supplier, accompanied by a plastic parts producer? Or how about a Harley-Davidson exhaust assembly producer tiered along side a chrome plater or a die caster or a custom metal fabricator? The possibilities, like the realities of the trust-driven, “partnered to death” extended enterprise, are exponential — a multi-variate equation that can only be solved by co-located Crays wired to the power of Niagara Falls. But wait. What if you could assemble these chains, m o re correctly networks of three tiers or more, in a “skunkworks” and challenge them to apply well-practiced Design of Experiments techniques to diagnose and c u re common supply chain problems — like bad or missing communications, excess time and loops, unclear metrics, even human training and education challenges. Now there you might have something, properly grown and protected from the distractions of consulting agendas and seminar kings, that might, just might, turn those multi-bulleted lists of “barriers to partnering,” and “cross-cultural disablers,” into real-time, real-life models of extended enterprise success stories. The winners walk onto the field armed with a new competitive strategy, a “Nerf” ball that flies far beyond its competitor’s sorry attempts at patch-work supply networks “silly-puttied” together with fragmented systems signals reinforced by frequent customer visits and faxed production schedules. NISCI is the “Skunkworks” Mike Doyle, the unpaid, charismatic leader of this new supply base initiative, emphasizes the reality of its mission. “NISCI is unique because we are a place where chains come together to work … like OEMs and distributors and consumers, or OEMs and logistics suppliers. People who join NISCI are told before they send the money in that we won’t accept money unless they bring a chain, because you can’t come here and work alone.” The kind of work Doyle envisions for members focuses on hard issues like how to measure the economic performance of supply chains (versus measuring individual suppliers, for example, a skill we have obviously perfected beyond its current usefulness). NISCI launch initiatives number six (see Figure 1.). Even Chrysler, for example, whose SCORE program is well-recognized as a leading supplier development method, is very interested in learning how to measure chain economic perf o rmance across three tiers. Jeff Trimmer heads up the task group for this initiative that also includes members from Procter & Gamble, Dell Computer, Honda, Deere, Morton Industrial Group, and the University of Chicago. Together, members will design some experiments to see what works, and they will test their ideas by running them across different chains. Design of Experiments Doyle explains NISCI’s source of strategic direction: “We decided that all the literature about supply chains was confusing to us, and that we needed to define that term: a supply chain has three links or more — if it doesn’t have three links, call it something else.” NISCI members will develop Design of Experiments ideas around its six initiatives, and run them in real chains, cross functional, across industries. “And we will watch the failure mechanisms, re run the experiments, and repeat the process until it works,” Doyle added. “ We think that if we have six diff e rent chains, doing each test in parallel, we will have six diff e re n t experiences, re p resenting 40-60 diff e rent companies, spread over probably six different industries,” he said. “If a supply chain practice works in retail, but not in manufacturing, the ‘laboratory’ observations should lead us to understand why does it want to work here, and not work there. “That’s the reason why we are not just cross-functional, we are cross-industrial,” Doyle continued. “Chrysler, for example, knows pretty much everything about the auto industry, but what they are really curious about is what people are doing in other industries — how does Dell do a six months product life cycle, with half the inventory, and ship off the Internet in three days? What can Wal-mart learn from the Chrysler instrument panel supplier, or the Harley front fork wheel guy.” The differences from repeated runs of the experiments give the process robustness and predictability. Trained as an industrial engineer, Doyle is a strong believer that if you don’t measure it, you are not managing it. “We have not identified or mapped these chains, and so we have not thought about these chains from a point of view of determining how we would architect a chain that would maximize performance,” he said. Think about the architecture. “You must have a technology road map, and a manufacturing road map. When we lay the chain on that, we can develop workable sourcing strategies,” Doyle said. One key issue that should be answered soon is specifically which metrics work best across the entire supply chain to produce competitive behaviors. Doyle cites five — quality, time, technology, waste reduction, and business risk reduction. “If you control those five you will know whether you are moving the system in a positive or negative direction.” Peeling the Onion Words get in the way — words like trust, chain, even speed. The more NISCI members look at the supply chain, for example, the more it resembles an entirely different entity, “a can of worms,” or a dynamic system. Complex problems like this might require a marriage of linear programming and systems engineering, borrowing some concepts from weather forecasting models, or geologists. The complexity of this challenge drives top NISCI members, including Doyle, to stick to their mission of “keeping it pure in the middle,” by bringing on the leading thinkers and implementers in the area, giving members a place to work, and letting new companies self-select into the small community of innovators. NISCI is not a think tank, not a consultants’ haven, but a work place where ideas run to reality. One idea, for example, is in the patent pro c e s s already. Think about the different rates financing institutions charge different members of a supply chain — some suppliers pay three-four points over prime, while an OEM pays prime. To the banking community, the spread …how does Dell do a six months product life cycle, with half the inventory, and ship off the Internet in three days? National Initiative for Supply Chain Integration Chrysler Corporation, Deere & Company, Harley-Davidson, Honda of America, Procter & Gamble Co., the Trane Company, Supply America, Inc., and the National Association of Purchasing Management. Launch Initiatives All begin with “Working together to improve ourselves by”… and finish with… “across three links or more.” 1. 2. 3. 4. 5. 6. … stimulating value creation … … standardizing and certifying education and training to enhance performance … … designing chain architecture which supports real-time, consensus decision-making … … measuring chain economic performance … … creating trust, culture, and people processes which support cooperation … … creating a legal, regulatory, and legislative environment which facilitates collective improvement … Figure 1. Each tier of three links or more in the supply chain is addressing one of the six NISCI launch initiatives. 17 …if complex, hierarchy driven software and organization protocols were the answer, we would be there already. covers risk, but remember, if a small supplier has been chosen by Honda, for example, to supply a component to a new product launch, then Honda clearly is working to minimize and absorb the risk. Would it not follow then, that lenders would value rate the risk of viable supply chain members in competitive extended enterprises as less troublesome than vendors struggling to simply stay in business? The message to banks, obviously, is to look at the chain as an assemblage of pieces. If chains are going to work together, they will need a new communications paradigm, and if complex, hierarchy-driven software and organization protocols were the answer, we would be there already. But we think the answer to increased supply chain complexity — the phe- Garry S. Berryman, Vice President of Purchasing, Harley-Davidson, Discussing The ‘Undiscussables’ There are certain subjects that no suppliers happily feed back to big customers — what suppliers think of scheduling practices and personnel, for example, or new product launch changes — Berryman calls them the “undiscussables.” Harley-Davidson key suppliers number approximately 280 out of 425 in total; Harley’s spend total is about $600 million per year. So it is critical for Harley in its growth market to move in concert with its suppliers. Harley’s Supplier Councils epitomize discussing the ‘undiscussables.’ In March a supplier information session was held in which the customer shared in groups of 16 suppliers at a time leading strategies and issues for the coming year. Dealer Advisory and Supplier Advisory Councils meet to discuss issues across the entire value chain 14 times or more per year. “The passion is,” says Berryman, a veteran of Honda of America’s award-winning purchasing department, “let’s open all the doors, and be competitive. Let’s compete with the keiretsu, even head to head, and beat them at their own game! The only way to forge these competitive enterprises is to get all the ‘undiscussables’ on the table and decide what to do with them. If suppliers are key stakeholders to our success, we cannot do it behind closed doors. “Today we had a five-hour session, a top 70 supplier visit, with the owner/president of a key supplier, his executive vice president, the controller, two engineers, a purchasing engineer, and our top technical team members. We spent four hours talking about the business, the technology of aluminum casting, and at the end, we weren’t done. With our top 70 suppliers, we are trying to eliminate the gap between their strategic planning and ours. “The NISCI Trust Module helps us find where we agree and where the gaps are. The Trust Module is a structured, repeatable process to work on relationship building in the value chain.” 18 nomenon of looking more like a can of worms than a hard-forged chain phenomenon — may be real time online feedback systems, real-time performance feedback, or what systems engineers call dynamical control. Imagine a football stadium at half time filled with fans watching a real-time monster TV mounted over the backfield. Each fan is issued either a yellow or a blue 3x3 card. It will take only a few minutes for the fans — the new intelligent agents within the system — to figure out how to form the words “Go, Michigan” or “ Take ’Em Down,” given the constantly visible realtime feedback of the TV screen. Bring on the Simulators, The Team is Ready! “Where to next” hopefully means more work, and a few more self-selected members. An individual can affect a team, a team can affect a group; a group can affect an organization, but an individual cannot change society. “Right now,” says Doyle, “we are probably a team, but we need to become a group!” An Invitation from Bob Parker, Executive Director of NISCI A place where the best of the best come to work together Bob Parker, NISCI’s sole full-time employee and supply management veteran, feels that what NISCI is trying to do in administration — no big staffs, a virtual organization — mirrors supply chains. Of the six initiatives in process, Parker believes “no question Bob Parker, NISCI Executive which one is going to hit Director the road first — Aallied Die Casting will be the first to complete NISCI’s Trust and Cooperation Module. Harley, the OEM customer, Aallied, and two more suppliers — one in plating and one in tool making — make up the four pioneers. A supply chain is in a boat race and they need to understand that they are in the same boat. They need to stroke together. The consumer is the prize. There is no second place. The consumer by choice feeds either one chain or the other. “Our job at NISCI is to cause people to see who is Edward Kwiatkowski, President of Supply America Corporation, Headquartered in Cleveland, OH in the boat and to understand what we are trying to accomplish together. Everybody must buy into the mutual goal — maybe it’s cost reduction or taking a new market,” Parker said. Cost Savings Potential Tom Stallkamp’s (Chry s l e r’s former purc h a s i n g chief) priorities are quality and cost reduction. In his view, one third of everything that happens, from thinking about designing a car to operating it, is waste. Dave Nelson of John Deere says there was 30 percent waste in the Honda chains — and they are pretty good! That’s the potential NISCI is looking at. It takes at least three points of competence in each line to connect the chain properly. In the Harley-Aallied chain, for example, there is a technical guru within each link who is responsible for what the chain is trying to accomplish — the technical point of competence. It’s important that the representatives chosen‚ whether they come from marketing, or quality, or manufacturing — are the people the chairman would ask. They are the right pool of competence: They know what has to happen, they know when to proceed, when they have support, and when to hold and go get the support. Deming told us to look at the whole system. We are coming around to believe that any time you try to make the chain work better, you run into the trust factor. People won’t open up until they have trust. Any chain that wants to use any of our material probably must go through the Trust Module first. That’s where the software people miss it. NISCI is now taking re s e rvations for chains of three links or more to participate in the NISCI Trust and Cooperation Module. It’s based on three years of experience by Harley-Davidson, which developed the module. A phone call to 1/888-AT-NISCI will get you a catalog of materials including 11 videos taken at the group’s launch. Supply America, a not-for-profit corporation that deals with supply chain management issues, provides cost-effective services to supply chains, particularly small- to medium-sized companies, through its network of 350 field sites staffed by over 200 engineers. Supply America is basically an organization that was the network started by NIST in 1989 — growing from three centers to 80, with 350 field sites — a partnership between industry, government, and the states. “We are actually a deployment network for industry,” said President Ed Kwiatkowski. “There will be road map in terms of wants and needs as to what the market wants, and we will be able to deliver needs for the industry. It’s going to take some time because this is a new paradigm shift for this country — viewing the supply chain as an extended enterprise. Lots of waste has been taken out of the factory floor. The next challenge is how to deal with waste in the supply chain. “Small companies — those having fewer than 500 employees — represent significant growth for the economy and significant challenges within the supply chain. One of the reasons Supply America belongs to NISCI is that we think we understand their issues.” Enlightened Self-Interest “We want to be a place where people self-select to join,” Bob Parker said. “Our posture is not to sell. Peter Drucker said that selling is not so much convincing the horse to drink your water as it is the search for the thirsty horse. We are prepared to talk with any horse thirsty for the above.” Patricia E. Moody is Target editor and a member of AME’s Northeast board of directors. She is a certified management consultant and has published Leading Manufacturing Excellence (John Wiley & Sons), Breakthrough Partnering, a guide to how leaders form customer/supplier partnerships, and Powered by Honda, BP for the Extended Enterprise, co-authored with Dave Nelson, Deere vice president of worldwide supply management, and Rick Mayo, a BP pioneer and Honda purchasing manager. She is a founder and former treasurer of the Marblehead Community Charter Public School. For inquiries about NISCI events and membership, contact: BobParker1@compuserve.com © 1998 AME® For information on reprints, contact: Association for Manufacturing Excellence 380 West Palatine Road, Wheeling, IL 60090-5863 847/520-3282 19