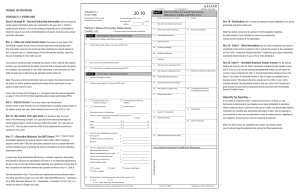

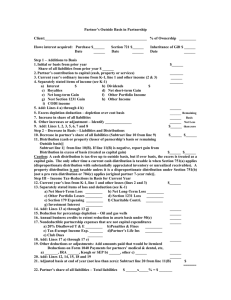

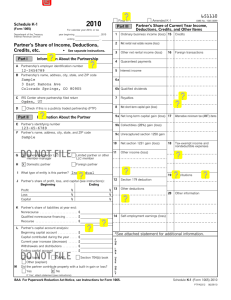

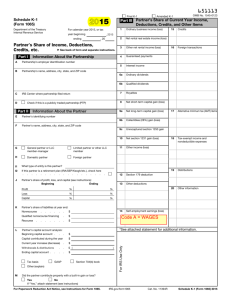

PTPs, MLPs AND THEIR pESKY k-1S

advertisement