A financial system plays an important role as an intermediary for

advertisement

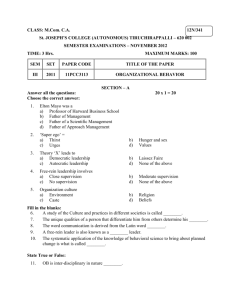

Thai Financial System Structure A financial system plays an important role as an intermediary for capital mobilization and allocation of economic resources and as a provider of payment and settlement services. A well developed, efficient and stable financial system is thus the key to support sustainable economic development. Table 1 Number and Asset Size of In general, a financial system comprises three Financial Institutions as of yearend 2014 key elements namely financial institutions, financial Number % of Total markets and payment systems. Assets of 1. Financial Institution Financial There are 2 types of financial institution in Institutions Depository Corporations 2,020 69.6 Thailand, including: Commercial Banks 30 47.9 1) Depositary Corporations, for example, Specialized Financial Institutions 6 15.0 commercial banks, Special Financial Institutions Saving Cooperatives and Credit Unions 1,943 6.0 (SFIs), Saving Corporative and credit unions, and Money Market Mutual Funds 41 0.7 money market mutual funds; and Non-Depository Corporations 7,074 30.4 2) Non-depository corporations, for example, Mutual Funds 1,495 9.8 mutual funds, insurance companies, provident funds, Insurance Companies 86 7.6 Leasing Companies 661 3.0 asset management companies, and securities Credit Card and Personal Loan Companies 29 2.8 companies. Provident Funds 418 2.3 As of yearend 2014, total assets of financial Government Pension Fund 1 2.0 institutions amounted to 36 trillion baht or 2.7 folds of Asset Management Companies 33 0.9 the country’s GDP. Considering such asset size, Securities Companies 47 0.8 depository corporations played the most important role Agricultural Cooperatives 3,748 0.5 Pawn Shops 556 0.2 with the share of 69.6 percent, while non-depository Source : Bank of Thailand corporations had the share of 30.4. The most important depository corporations were commercial banks and SFIs with the share of 47.9 and 15.0 percent, respectively. Such domination was attributed to their extensive branch networks which allow them to service businesses and consumers more widely than other types of financial institutions. At the end of 2014, commercial banks and SFIs together owned approximately 9,664 branches and 61,839 ATMs nation-wide. Thai Financial System Structure 2. Financial Markets Financial markets comprise (1) money market Comparison of Loan, Bond and Stock which offers short-term liquidity to financial institutions via Ratio to GDP interbank lending and repurchase market; (2) capital market 2.0 which offer medium-term and long-term capital 1.5 mobilization through bond and stock markets; (3) foreign 1.0 exchange market; and (4) derivatives market which offers 0.5 financial instruments whose return based on a designed variable. 0.0 Bond and stock markets have developed and Loan-Commercial Banks Loan-Depository Corporations expanded their roles continuously in supporting the Thai Loan-Non-Depository Corporations Stock(Market Value) economic and financial system. At the end of 2014, bond Bond(Par Value) markets had 9.3 trillion baht total bond outstanding, Source : Bank of Thailand including short-term (< 1 year) and long-term (> 1 year bonds. At the same time, stock market capitalization reached 14.2 trillion baht, with corporate as a major players. For foreign exchange market, monthly value of transactions of authorized entities averaged at 6.8 trillion baht. Money market size reached 2.1 trillion baht with the majority of transactions conducted by financial institutions; whereas derivative market was not yet widely used where most transactions were for hedging among counter parties on the over-the-counter (OTC) market. 3. Payment Systems Achievement of smooth and stable economic transactions depends greatly on having in place suitable payment systems infrastructure to support payment and settlement transactions between business and institutions. The BOT also plays the role in promoting efficient, stable and secured payment services. The payment systems consist of BAHTNET (Bank of Thailand Automated High-value Transfer Network) is a financial infrastructure serving for Real-Time Gross Settlement (RTGS) of large value funds transfer between financial institutions and other organization maintaining deposit account at the BOT. Cheque Clearing System consists of Electronic Cheque Clearing System (ECS), Provincial Cheque Clearing and Bill for Collection (B/C) Bulk Payment System is the convenient means of payment for a customer in making inter-bank preauthorized transactions that are large in volume and have a regular recurring payment period. Funds transfer via ATM In enhancing efficiency of payment system and performance of commercial banks, the BOT has implemented a policy to promote the use of ATM in conducting an interbank Retail Fund Transfer. Financial Institution Regulation and Supervision Policy Definition of various financial institutions Commercial bank business serves as the intermediaries that allocate funds from depositors and loan out to household and business sectors. Commercial bank business can be categorized to many different forms, namely commercial bank (universal banking), retail banks, foreign commercial bank’s subsidiary and foreign commercial bank’s branch. The aforementioned forms of commercial bank business are registered under the Financial Institutions Business Act B.E. 2551 (2008) and supervised by the BOT. Special Financial Institutions established with each specific law, whose objectives are to serve the government policies in promoting economic development and supporting investment. Examples of such institutions are Bank for Agriculture and Agricultural Cooperatives (BAAC), Government Saving Banks (GSB), Government Housing Banks (GHB), and Export-Import Bank of Thailand (EXIM) etc, whereby these institutions are established in accordance with the Bank for Agriculture and Agricultural Cooperatives Act, B.E. 2509 and amended, the Government Saving Banks Act, B.E. 2489 and amended, the Government Housing Banks Act, B.E. 2496 and amended and the Export-Import Bank of Thailand Act, B.E. 2536 and amended, respectively. Furthermore, these institutions are under the supervision of the Ministry of Finance. Finance Company is a business that raises funds from the public in the form of promissory notes (P/N) and employing such funds in several forms of investment including commerce, development, purchases and consumption, and housing. Such business is established in accordance with the Financial Institution Business Act, B.E. 2551 and under the supervision of the BOT. Credit Foncier Business is business of accepting money from public in the form of promissory notes (P/N) and employing such accepted money in one or several ways such as granting credits by mortgaging immovable property, accepting immovable property on consignment etc. The Credit Foncier Business is registered under the Financial Institutions Business Act B.E. 2551 (2008) and supervised by the BOT. Saving Cooperative and Credit Union established on voluntary basis by members that generally consists of people with the common bond (e.g. same occupation or living areas etc.), where the operating funds of the cooperative is contributed periodically by members. The contributed funds will be loaned out to support other members who are in need of money with interest charged. The benefit gained from permitting loans will be contributed to members in the form of interest rate, dividend or other benefits etc. Saving Cooperative and Credit Union is under the supervision of the Board of National Cooperative Development in accordance with The Cooperatives Act, B.E. 2542. Pawn-shop is a business that offers secured loans of maximum 100,000 baht per customer, with items of personal property used as collateral. The collateral can be redeemed within a certain contractual period of Financial Institution Regulation and Supervision Policy time. Such business is established in accordance with Pawn-shop Act, B.E.2505 and amended and under the supervision of the Ministry of interior. Money market mutual fund is a type of mutual fund that mainly invests in bank deposits, short term debt with the repayment period of not exceeding 1 year (i.e. Treasury bills, Bill of exchange, Promissory note) and Government bonds or corporate debentures with the repayment period of not exceeding 1 year. Furthermore, such mutual fund is open-end fund with the portfolio duration of not more than 3 months and under the supervision of the Securities and Exchange Commission in accordance with The Securities and Exchange Act, B.E.2535 and amended. Mutual Fund is a well managed investment tools that seek the highest returns under the certain extent of risk investors can take. The mutual fund is suitable for retail investors who want to invest in money and capital market but; are not well equipped with financial knowledge, are lack of experience and have limited financial resources etc. Furthermore, such fund is under the supervision of the Securities and Exchange Commission in accordance with The Securities and Exchange Act, B.E.2535 and amended. Insurance can be categorized into 2 types of business namely; 1) Life insurance, insured against the loss or damage of individual/group of individual where the insurer promises to pay a designated beneficiary in exchange for a premium, upon the death, disability, or critical illness of the insured person. 2) Non-life insurance is broadly divided into 4 areas, namely Fire insurance, Auto insurance, marine insurance and Miscellaneous Insurance. Insurance businesses are under the supervision of the Office of Insurance Commission in accordance with Life Insurance Act, B.E.2535 and amended, and non-life Insurance Act, B.E. 2535 and amended. Provident Fund is a form of fund set up voluntarily between the employer and employees where the assets of this fund consist of money contributed by both employers and employees. The setting up of a provident fund can be regarded as a kind of benefit for employees where the assets of this fund will be further managed by a professional fund management called "Asset Management Company (AMC)." The benefits derived from management are distributed to members of the fund proportionately. Provident fund is under the supervision of the Securities and Exchange Commission in accordance with Provident Fund Act, B.E. 2530 and amended, and The Securities and Exchange Act, B.E.2535 and amended. Credit card and Personal loan Company is a non-depositary business that provides credits in various forms, for example credit card and personal loans etc. This type of business in under the supervision of the BOT in accordance with Declaration of the Revolutionary Council No. 58 and the Financial Institutions Business Act B.E. 2551. Financial Institution Regulation and Supervision Policy Asset Management Company is established to manage Non-performing asset of financial institutions. Such company is supervised by the Ministry of Finance in accordance with the Emergency Decree on the Asset Management Company B.E.2541. Securities Company conducts various kinds of securities business namely, brokerage, dealer, underwriter, investment advisory and private fund management etc. Securities Company is under the supervision of the Securities and Exchange Commission in accordance with the Securities and Exchange Act, B.E.2535 and amended. Money Changers are granted licenses to provide foreign currency exchange services in accordance with the Exchange Control Act, B.E.2485. Money changers business is under the supervision of the Ministry of Finance and the Bank of Thailand.

![Job Description - Program Director [1]](http://s3.studylib.net/store/data/005857458_1-3791b985859891a770a8c3867ad1e7d5-300x300.png)