BizReturns Manual: Section 3 (1065 Returns)

advertisement

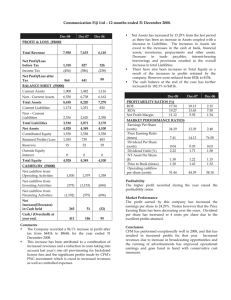

Say “Yes” to good loans. 3 SECTION Beyond the 1040: Corporation Partnership & LLC Returns Partnerships PC/V1 3-2 Section 3: Partnerships BEYOND THE 1040 General information Form 1065 Used by general partnerships, limited partnerships, limited liability companies and limited liability partnerships. Section 1 of this manual has detailed descriptions along with advantages and disadvantages of each of these types of entities. Schedule K-1 The K-1 is a schedule within the Form 1065. ( There is a K-1 in an 1120S as well so do not get confused between the two.) Pass-through Entity The 1065 (like the 1120S) is a pass-through entity. Income, deductions and credits retain their character as they pass through to the owner’s return. The diagram at right assumes the partner is an individual. The partner can also be another partnership or other entity. Self Study Students: 1) Read the sections on general and limited partnerships and limited liability companies (Section 1). 2) Refer to the completed Bailey 1040 analysis and Bailey Drug Store 1065 analysis on the following pages. Follow along on the completed worksheet as you review each page of the tax return. 3) A practice case on Able Baker Book Store 1065 is in Section 6 for your use. Linda Keith CPA, Inc. February 2012 PC/V1 Section 3: Partnerships LINDA KEITH, CPA What Does It Look Like? General Partnership Limited Partnership Limited Liability Company Information only! 1040 1065 K-1 A u C o n t r ib le b a it r a t io n s Ch Interest/Dividends BCu a p i t a l G sin ains/ ess Lo s s e Actual Cashflow to Partner: s Inc Use K-1. om e/L os Cashflow Available to Partner: s Use partner’s share of Form 1065 cashflow plus his/her guaranteed payments. K-1 Pass-throughs or allocations B D E Analysis of Bailey Drug Store 1065 On the next pages you will find blank forms to use in this section. On the following two pages is a completed analysis of Bailey Drug Store’s 1065, along with the 1040 analysis of the Baileys. Personal lenders are likely to start with the 1040 analysis. Once it is determined that the Bailey’s own a significant interest in the partnership, the personal lender will likely get the business return to consider cashflow available from the business. After all, a high percentage owner can take what he or she wants to take. Commercial lenders lending to Bailey Drug Store are likely to start with the 1065. Once you determine the business loan is a good possibility, you are likely to need a personal guarantee. Thus you’ll get the 1040 of the owner and analyze their personal situation. So, we’ll all look at the return of the business and of the high % owner at some point. PC/V1 Linda Keith CPA, Inc. February 2012 3-3 <Total Net Cas 3-4 Entity Name Section 3: Partnerships Tax BEYOND THEForm 1040Type PLUS PLUS PLUS (MINUS) K-1 EQUALS Summary worksheet OTHER 1065 K-1 Scorp/ Actual Net 1065 K-1 1120S K-1 Guaranteed 1065 K-1 LLC/ cash flow Contributions Distributions Withdrawals Payments 1065 GP/ Ltd from/(to) L or 19 Ln 4 L entity 1120S P % Own Ln 16 'D' Use for 1040 Analysis: Yes or No Type of Loan For Business Cashflow: Consumer and mortgage lenders will use the K-1 Summary or the full Partnership worksheet, depending on your borrower’s percentage ownership and whether you want to use actual cashflow or cashflow available. Your guidelines will give you the % cutoff. Mortgage lending typically uses a 25% threshold. I’ve seen from 15% up to 50%. Business lenders may also use the K-1 summary when looking at the personal analysis of a guarantor. Start with Sections A, B and C. Determine if cashflow and debt coverage ratio meet your guidelines. If not, don’t give up. It may be the owner/guarantor’s are taking excess funds out of the company but have excess liquidity in their personal balance sheet. If you are getting their signature, the fact that extra cashflow is not left in the company may not be a barrier. To check cashflow of the owner/ guarantor, continue with Section D. K-1 Worksheet: For Personal Cashflow Available: This will calculate the actual cashflow from the pass-through entity to the owner. Some lenders only add ‘cash’ withdrawals. See my note on page 3-23. If you are digging for dollars, consider whether capital contributions are recurring by asking questions or looking at previous year’s tax returns. If not, do not subtract them. You start the same way as the commercial analysis. If you are working on a personal loan, B:14 will be blank. It is for a proposed business loan. Most personal lenders do not use Section C, Debt Coverage Ratio, in their analysis. Excel tm will calculate it anyway. In Section D, the worksheet subtracts debt from business cashflow to arrive at cashflow available to distribute. Skip D:18 unless your company guidelines require this step. Once you have cashflow available to distribute, you calculate the owner/ guarantor’s share. Since guaranteed payments are subtracted in deriving taxable income, and your owner/guarantor received some of those guaranteed payments, you’ll add that to the owner/guarantor’s share of cashflow available to distribute to get ‘Available Personal Cashflow’. Be sure to make a choice, this figure (D:23) or actual K-1 distributions from the K-1 summary sheet...not both! Partnership Worksheet: The full partnership worksheet is necessary to calculate business cashflow and to determine an owner’s share of that cashflow. Work the tax return, not the worksheet! Look for the 6 Ns as you go: N onrecurring I ncome and E xpenses N oncash I ncome and D eductions N ontaxed I ncome & N ondeductible E xpenses N ew I ncome & E xpenses N ondocumented I ncome Linda Keith CPA, Inc. February 2012 PC/V1 Note other cas entity such as for building or to/from shareh manage/super a related entity Section 3: Partnerships LINDA KEITH, CPA Partnership Case Study worksheet Form 1065 Partnerships CAUTION: Use either Actual Cashflow to the owner (K-1 Summary) OR Cashflow Available to the Owner (from this worksheet) for the 1040Pg1 Cashflow Worksheet. Company name and type of business>>> 1 2 3 4 5 6 7 8 9 10 11 Business Cashflow Available to Pay Debt Enter ordinary income (Ln 22) Add back interest expense (Ln 15) Add back depreciation (Ln 16a) … +/- from Front Page, see comments: … +/- from Line 20, see comments: … +/- from Sch K, see comments: …from Sch M-1, see comments below: [Add 1-7] Cashflow Before debt & distributions Subtract Cash distributions (M-2, Ln 6) Add Capital contributions (M-2, Ln 2) [8-9+10] Cashflow Available to Pay Debt Front Page Adjustments: Consider nonrecurring income/expenses or unusual bad degts if projecting cashflow. Add'l A: Add'l from Line 20: Trace to supporting schedule. Add back nonrecurring items if projecting cashflow. Add back noncash amortization. Borrower Annual Debt B: Enter term debt annual payments 12 Enter LOC/ interest-only payments 13 Enter proposed loan payments 14 15 [Add 12 thru 14] Total debt C: Debt Coverage Ratio 16 [11/(12+13)] DCR Before Proposed Loan 17 [11/15] DCR After Proposed Loan D: 18 19 20 21 22 23 Personal Cashflow to Owner/Guarantor: Optional: Change to required DCR [8-(15*18)] [8-(15 18)] Cashflow Available to Distribute Enter partner's % profit/loss from K-1 [19*20] Owner's share before gntd pmnts Add this owner's guaranteed pmnts (K-1, Ln 4) [21+22] Available Personal Cashflow Use Available Cashflow in Personal Analysis? Personal Cashflow to 1040 Pg 1 1.00 Yes or No OR Actual Personal Cashflow: Use K-1 Summary sheet instead of this worksheet. COMMENTS PC/V1 Add'l from Schedule K: Consider including income or expenses from Lines 1-13 of the Schedule K. These are not yet in your figures. If projecting and they are nonrecurring, leave them out. Most commonly used are Line 2 for rentals (calculate cashflow from From 8825) and Line 5 for interest income. Line 12 Section 179 is depreciation not in your figures so ignore here here. Line 13a charitable contributions are not yet in your figures. Subtract if you are doing actual/historical. If you are doing recurring, consider if business related and recurring before subtracting. Schedule M-1 Adjustments: These figures are not yet in your cashflow calculations. Line 4: Actual Cashflow subtract cash outlays. Recurring Cashflow only subtract if recurring cash outlays. Line 6: Actual Cashflow add cash received. Recurring Cashflow only add if recurring cash received. Linda Keith CPA, Inc. February 2012 3-5 3-6 Section 3: Partnerships Bailey Completed 1040 Analysis BEYOND THE 1040 On the next two pages, I have completed a personal 1040 and a partnership analysis for the Baileys. Use them to follow along with the 1040 that satrts on page 3-8 and the 1065 that starts on page 3-12. See Sectgion 3 for the S Corporation that also feeds into the Bailey’s personal analysis. Borrower>>> Bill and Barnum Ann Bailey AGI W/ 1.2 DCR Actual K-1 Year>>>> Amount Amount Amount Adjusted Gross Income 164,896 164,895 164,895 Adjustments to: Wages C-Corp Owner from W/S (1,031) (1,031) (1,031) Interest Full Note Payments Received Tax-exempt Dividends State Tax Alimony Received Sch C Business from W/S Capital Gains Other Gains IRA Distributions Pension Distributions Rents, Pships,etc (122,733) (122,733) (122,733) AGI: ALWAYS - gains/+ losses 0 125,108 3,659 0 121,143 (5,061) 97,475 0 0 Partnership C/F from W/S Rental C/F from W/S K-1 Summary S Corp C/F from W/S Estates/Trusts Sch F Farm from W/S Unemp Comp Social Security Other Income/NOL's Adjustments or Other: ie: AGI Add back All Adj. ie: minus 1/2 SE Tax ie: minus Fed/State Tax ie: minus Family Living ie: minus personal debt 169,900 14,158 157,214 13,101 138,606 11,551 Annual Cashflow Monthly Cashflow Prepared by>>> Linda Keith Line S/A W/ 1.2 DCR Actual K-1 Amount Amount Amount 37 7 48,600 48,600 48,600 830 830 830 0 125,108 3,659 0 121,143 (5,061) 97,475 0 0 Frm 1120 8a/Sch B From client 8b 9/Sch B 10 11 12/ Sch C 13/Sch D 14 15 16 17 E, Pg 1 E, Pg 2 E, Pg 2 E, Pg 2 E, Pg 2 18/Sch F 19 20 21 23-35 (8,298) 169,900 14,158 (8,298) 157,215 13,101 (8,298) 138,607 11,551 COMMENTS: Column 1: With Available Cashflow from Partnership and SCorporation after business debt paid. Column 2: With Available Cashflow from Partnership and SCorporation after adequate debt covereage of 1.2 DCR. Column 3: Actual Cash to owner/guarantor from the Partnership and SCorporation. Linda Keith CPA, Inc. February 2012 PC/V1 K-1 Summary Sheet Year: 2009 Bill and Barnum Ann Bailey Bailey Drug Store 1065 Completed Partnersip Analysis Tax Form Entity Name Bailey Drug Store Bailey Fisheries Type 0 PLUS 11,075 86,400 Section 3: Partnerships 3-7 97,475 LINDA KEITH, CPA PLUS PLUS MINUS 1065 K-1 Scorp/ 1065 K-1 1120S K-1 Guaranteed 1065 K-1 LLC/ Contributions Distributions Withdrawals Payments 1065 GP/ Ltd Ln 4 '07 L (Prior N) 1120S P % Own Ln 16 'D' '07 L (Prior N) 1065 GP 60% 11,075 86,400 0 1120S Scorp 80% 0 EQUALS Actual Net cash flow from/(to) entity 97,475 0 Use for 1040 Analysis: Yes or No CAUTION: If you complete the K-1 Summary sheet for a partnership, LLC or S Corporation and also complete the Partnership or S Corpor worksheet, you run the risk of including on 1040 Pg 1 both the actual cashflow to the owner/guarantor (this form) and the cashflow available from the other worksheets. Notice you can calculate the actual cashflow here, and then in the second to the last column, indicate 'no'. That Company name and type of business>>> Bailey Drug Store actual distributions for that entity will not flow to the 1040 Pg 1 and you are free to use cashflow available instead. A: Business Cashflow Available to Pay Debt DEBT * 1.2 I have 1completed the Bailey's 1040 on this K-1 Worksheet. 64,709 yes or no 64,709 Enter ordinary income (Ln Pg1 22) both ways, thus did not indicate Add back interest expense (Ln 15) Add back depreciation (Ln 16a) … +/- from Front Page, see comments: … +/- from Line 20, see comments: … +/- from Sch K, see comments: …from Sch M-1, see comments below: [Add 1-7] Cashflow Before debt & distributions Subtract Cash distributions (M-2, Ln 6) Add Capital contributions (M-2, Ln 2) [8-9+10] Cashflow Available to Pay Debt 15,802 15,859 15,802 15,859 1,187 1,187 97,557 (18,458) 97,557 (18,458) 79,099 79,099 33,043 33,043 33,043 33,043 Add'l 2 3 4 5 6 7 8 9 10 11 Annual Debt Enter term debt annual payments Enter LOC/ interest-only payments Enter proposed loan payments [Add 12 thru 14] Total debt C: 16 17 Debt Coverage Ratio [11/(12+13)] DCR Before Proposed Loan [11/15] DCR After Proposed Loan D: 18 19 20 21 22 23 Personal Cashflow to Owner/Guarantor: Optional: Change to required DCR [8-(15*18)] Cashflow Available to Distribute Enter partner's % profit/loss from K-1 [19*20] [19 20] Owner Owner's s share before gntd pmnts Add this owner's guaranteed pmnts (K-1, Ln 4) [21+22] Available Personal Cashflow Use Available Cashflow in Personal Analysis? Personal Cashflow to 1040 Pg 1 Borrower B: 12 13 14 15 2.39 2.39 2.39 2.39 1.00 64,514 60 38 708 38,708 86,400 125,108 Yes 125,108 1.20 57,905 60 34 743 34,743 86,400 121,143 Yes 121,143 OR OR Actual Personal Cashflow: Use K-1 Summary sheet instead of this worksheet. COMMENTS Debt ESTIMATED by adding pg one interest $15,802 to Sch L year-end principal $17,241 = $33,043. Sch K: Line 5: $1,187 interest income. Line 13a: Did not subtract charitable contributions…optional. Sch M-1 Ln 6: Did not add insurance proceeds $7,800…nonrecurring. COLUMN TWO: Entered Optional DCR (required debt coverage) of 1.2. Result will show amount really available personally after adequate debt coverage for the business. Your company's guidelines decide whether or not this step is taken. PC/V1 Linda Keith CPA, Inc. February 2012 3-8 Section 3: Partnerships BEYOND THE 1040 Linda Keith CPA, Inc. February 2012 Bailey 1040 Page one PC/V1 Section 3: Partnerships Bailey W-2 The partner’s 1040 I have included the owner’s 1040 first, to show you how they information from a partnership flows into the 1040 of the owner. The Baileys have an active interest in both a partnership and an S corporation. Their 1040 starts at left. I have included just a few of the relevant forms from that return. The worksheet packet has AGI method and Schedule Analysis method (SAM) worksheets completed for this return. If you are not ‘in class’, use the worksheets on pages 6 & 7. Follow along. Wages...see W-2 Line 5 above. It is also $48,600. AGI: No adjustment. SAM: Use the $48,600. PC/V1 LINDA KEITH, CPA Interest...circle and trace to Schedule B. Rentals, Partnerships, etc...DO NOT use the number on the front page, Line 17. It is just a placemarker. AGI: Subtract $122,733 (you would add it back if it were a loss). SAM: Enter zero. Both: Circle the number and trace it to Schedule E on page 3-11. SE tax...guidelines vary. AGI: I made no adjustment. SAM: I subtracted it. Your financial institution may do the opposite or subtract total federal taxes and even debt or family living expenses. Check your guidelines! Linda Keith CPA, Inc. February 2012 3-9 3-10 Section 3: Partnerships BEYOND THE 1040 Bailey 1040 Schedule B <<<Might Say ‘K-1 Interest’ or ‘Interest from a K-1’. Note: This software listed the name of the Partnership and S Corporation passing through the K-1 interest. Often, it will simply say ‘K-1 Interest’ or even “Interest from a K-1’. In either case, it is noncash in this 1040 and should not be included in recurring personal cashflow. If you cannot tell if it is K-1 pass-through or actual payments from a company, ask. This Schedule B lists the partnership and S Corporation but does not make it clear that the interest is pass-through from a K‑1. Often the listing will say ‘Interest from a K‑1’ or ‘K‑1 interest expense’. While it is not obvious that it is passthrough, we can confirm that on the K-1. Low % Owner: Exclude pass-through interest and dividends from cashflow. The individual partner or S corporation shareholder did not receive this cash. You will determine their actual cashflow by using withdrawals and guaranteed payments from their K-1. High % Owner: Choice one...exclude pass-through interest/dividends from personal cashflow AND be sure to include it in the cashflow of the partnership or S corporation when you analyze the source entity. Choice two... Include it in personal cashflow. After all, the owner does have access to it if a high enough %. If you do, though, then you cannot add it again Linda Keith CPA, Inc. February 2012 when you do the 1065 or 1120S analysis. You’ll find it there on Schedule K. With this choice, you cannot also use actual distributions from a K-1. Case study: We’ll use choice one. AGI method: Subtract the $1,031 interest ($712 Drug Store and $319 Fishery) from cashflow. Schedule Analysis method: Include the $830 interest from the bank. Tax-exempt interest May be listed here but will always be listed on Page 1, Line 8b of the 1040. Use 1040, Line 8b as your source for tax-exempt interest. The Bailey’s had none. The tax-exempt interest on Line 8b may include K-1 pass-through interest as well. We will be able to confirm that on the K-1 when we review it. It will be important not to add taxexempt interest at the partnership or S corporation level if you have already included the pass-through in the personal analysis. PC/V1 Section 3: Partnerships Bailey 1040 Schedule E, Page two LINDA KEITH, CPA Nonpassive = Business income of active general partner or active S-Corporation shareholder or active LLC Member (Member-Manager) While your guidelines are likely to require that you review all K‑1 information, my guess is that in general the greater likelihood of income or risk of loss is on the nonpassive side. Passive = Business/investment income if owner isn’t active Includes Limited Partners and can include LLC Members/SCorp shareholders. Generally not guarantors of debt (although they could be) and therefore losses limited to investment in the activity. Passive losses can be misleading, since the real loss may be greater than the deductible loss due to passive loss limitations. The K-1s least likely to be significant are small passive gains from RE and Oil & Gas investments. One of my clients has a guideline that allows ignoring income from any K-1 representing less than 10% of cashflow. ( They still subtract the paper loss, though.) PC/V1 Linda Keith CPA, Inc. February 2012 3-11 3-12 Section 3: Partnerships BEYOND THE 1040 Form U.S. Return of Partnership Income 1065 For calendar year 2011, or tax year beginning ending , 20 Overview G See separate instructions. Department of the Treasury Internal Revenue Service A Bailey Drug Store Principal business activity OMB No. 1545-0099 , 2011, 2011 . Name of partnership D Bailey Drug Store 93-0000000 Employer identification number Overview Retail B Principal product or service Drugs C Print or type. Number, street, and room or suite number. If a P.O. box, see the instructions. E 1 Stop Place 06/03/76 City or town Business code number 591200 State Bailey G Check applicable boxes: Overview (1) (6) F ZIP code WA 98000 Initial return (2) Final return (3) Technical termination ' also check (1) or (2) Name change (4) Date business started Total assets (see instrs) 487,592. $ (5) Address change Overview Amended return H Check accounting method: (1) Cash Overview (2) X Accrual (3) Other (specify) I Number of Schedules K-1. Attach one for each person who was a partner at any time during the tax year J Check if Schedules C and M-3 are attached Overview 2 Caution. Include only trade or business income and expenses on lines 1a through 22 below. See the instructions for more information. 1 a Merchant card and third-party payments (including amounts reported on Form(s) 1099-K). For 2011, enter -0b Gross receipts or sales not reported on line 1a (see instructions) c Total. Add lines 1a and 1b d Returns and allowances plus any other adjustments to line 1a (see inst) e Subtract line 1d from line 1c 2 Cost of goods sold (attach Form 1125-A) 3 Gross profit. Subtract line 2 from line 1e I N C O M E I N S T R S F O R L I M I T A T I O N S 7 Other income (loss) * STMT (attach statement) 8 Total income (loss). Combine lines 3 through 7 9 Salaries and wages (other than to partners) (less employment credits) 10 Guaranteed payments to partners 11 Repairs and maintenance 12 Bad debts 13 Rent 14 Taxes and licenses 15 Interest Overview 16 a Depreciation (if required, attach Form 4562) Equipment List b Less depreciation reported on Form 1125-A and elsewhere on return 17 Depletion (Do not deduct oil and gas depletion.) 18 Retirement plans, etc 19 Employee benefit programs Overview 4 5 6 Overview Overview Overview 16 a 16 b Debt List 15,859. 83,497. 705,751. 249,360. 123,878. 17,228. 1,648. 36,541. 36,773. 15,802. 7 8 9 10 11 12 13 14 15 15,859. 16c 17 18 19 9,065. * STMT 20 134,888. 21 22 641,042. 64,709. 21 Total deductions. Add the amounts shown in the far right column for lines 9 through 20 22 Ordinary business income (loss). Subtract line 21 from line 8 Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than general partner or limited liability company member manager) is based on all information of which preparer has any knowledge. A Signature of general partner or limited liability company member manager Print/Type preparer’s name Paid Preparer Use Only 622,254. 3 20 Other deductions (attach statement) Sign Here Overview 2,360,509. 1,738,255. 4 Ordinary income (loss) from other partnerships, estates, and trusts (attach statement) See OtherSchedule Income Statement 5 Net farm profit (loss) (attach F (Form 1040)) 6 Net gain (loss) from Form 4797, Part II, line 17 (attach Form 4797) S E E D E D U C T I O N S 0. 2,360,509. 2,360,509. 1a 1b 1c 1d 1e 2 Preparer’s signature A May the IRS discuss this return with the preparer shown below (see instrs)? Yes Date Date Check if No PTIN self-employed Firm’s name Firm’s address G G InoSelf-Prepared N. Umbers Firm’s EIN G 123 Accountancy Way SeaTax, WA 98584 BAA For Paperwork Reduction Act Notice, see separate instructions. Linda Keith CPA, Inc. February 2012 Phone no. PTPA0112 10/27/11 Form 1065 (2011) PC/V1 Overview Section 3: Partnerships LINDA KEITH, CPA 1065, Page One How significant is the risk or the income? In-depth or cursory review needed? For personal Loans Option I: Borrower is higher % owner. If sufficient % ownership (see Schedule K­‑1) per your guidelines, many lenders include his/her share of partnership cashflow in personal cashflow. The figure in AGI is a % of the taxable income of the partnership...the bottomline of the 1065. AGI Method: Subtract gain or add back loss from the partnership on the 1040. Schedule Analysis Method: Do not use the figures on the 1040. Both: Add owner’s share of business cashflow plus guaranteed payments paid directly to borrower (See K-1). Option II: Borrower is lower % owner. If your borrower’s % is low (based on guidelines) then cash actually taken may be used. See the notes opposite Schedule K-1 (page 2-21) for instructions. Overview Pg 2 Sch B Lines 1 and 4 (See Pg 3-15) Pg 3 Sch B Lines 6 and 8 (See Pg 3-17) Pg1 Top Calendar or fiscal year Pg 1 Box A&B Type of business Pg 1 Box E Date started Pg 1 Ln G Initial or final return...they may have simply changed entity type. If so, you may be looking at a partial year. Pg 1 Ln H If cash basis, be careful drawing conclusions from comparison. Pg 1 Ln I # of K-1s (generally # of owners) Pg 1 Ln 1c Gross receipts Pg 1 Ln 4 Partner in another partnership? Pg 1 Ln 9 Salaries other than to partners Pg 1 Ln 10 ‘Compensation’ to partners... see also partner withdrawals on M-2 ‘10 Pg 2 Sch A Ln 3 or ‘11 1125-A Ln 3 Cost of labor Pg 1 Ln 13 Rents Pg 1 Ln 15 Interest (see shortcut at right.) Pg 1 Ln 16 Depreciation... Review equipment list if available for size/ scope of business and whether they are replacing as a healthy business would. PC/V1 Source of Adjustments to Line 22: 1st) 2nd) 3rd) 4th) 5th) Page One Other Deductions Schedule [Ln 20] Schedule K [Lns 2-13] Schedule M-1 [Lns 4 & 6] Schedule M-2 [Commercial only] General Cashflow Formula: Start Line 22 Add Line 15 Minus Borrower Plus Line 16a Commercial Lenders Minus M-2, Line 6 Plus M-2, Line 2 Ordinary Income Interest^ Loan Payments*^ Depreciation only: Withdrawals Capital contributions ^ Shortcut for debt... Two choices: 1) To estimate debt after adding back interest: Page 1, Line 15 Interest _________ Sch L, Line 16, Col (d) +________ ESTIMATED DEBT PMTS =________ 2) OR Do not add back interest and subtract principal (Schedule L, Line 16, Column d). * Debt Coverage: Do not subtract debt. Additional Line-by-Line Instructions: 1a. Up, down, sideways? 2. Compare COGS% to prior year. 4. What % do they own? Get K-1 or 1065. Replace Ln 4 with cashflow. 6. G/L on disposal of assets...need to replace? If casualty loss. Impact on future cashflow? Adequate insurance? 7.Recurring? 10. G uaranteed payments: (See page 3-23) 11. Compare to prior years. 12. Bad Debts: Accrual only. Cash basis shows less revenue if not paid. If large or nonrecurring, consider if a write-off of old receivables. May be noncash. 14. Enough? (At least 10%-40% of Line 9) 15. Add back interest and subtract debt. ( We’ll use the shortcut.)^ 16a.Add back depreciation. 18. Add back if optional. 20. Trace to supporting schedule. Adequate insurance? Add back amortization or nonrecurring items. Linda Keith CPA, Inc. February 2012 3-13 3-14 Section 3: Partnerships BEYOND THE 1040 Form 1065 (2011) Schedule B 1 a Bailey Drug Store Other Information 93-0000000 What type of entity is filing this return? Check the applicable box: b Domestic limited partnership X Domestic general partnership c e Overview Bailey Drug Store Domestic limited liability company Foreign partnership d f Domestic limited liability partnership Other Page 2 Yes No Overview 2 At any time during the tax year, was any partner in the partnership a disregarded entity, a partnership (including an entity treated as a partnership), a trust, an S corporation, an estate (other than an estate of a deceased partner), or a nominee or similar person? X 3 At the end of the tax year: a Did any foreign or domestic corporation, partnership (including any entity treated as a partnership), trust, or tax-exempt organization, or any foreign government own, directly or indirectly, an interest of 50% or more in the profit, loss, or capital of the partnership? For rules of constructive ownership, see instructions. If ’Yes,’ attach Schedule B-1, Information on Partners Owning 50% or More of the Partnership X b Did any individual or estate own, directly or indirectly, an interest of 50% or more in the profit, loss, or capital of the partnership? For rules of constructive ownership, see instructions. If ’Yes,’ attach Schedule B-1, Information on Partners Overview Owning 50% or More of the Partnership 4 At the end of the tax year, did the partnership: a Own directly 20% or more, or own, directly or indirectly, 50% or more of the total voting power of all classes of stock entitled to vote of any foreign or domestic corporation? For rules of constructive ownership, see instructions. If ’Yes,’ complete (i) through (iv) below (i) Name of Corporation (ii) Employer Identification Number (if any) 1125-A Cost of Goods Sold X (v) Maximum Percentage Owned in Profit, Loss, or Capital OMB No. 1545-2225 (December 2011) Department of the Treasury Internal Revenue Service X (iv) Percentage Owned in Voting Stock (iii) Country of Incorporation b Own directly an interest of 20% or more, or own, directly or indirectly, an interest of 50% or more in the profit, loss, or capital in any foreign or domestic partnership (including an entity treated as a partnership) or in the beneficial interest of a trust? For rules of constructive ownership, see instructions. If ’Yes,’ complete (i) through (v) below (i) Name of Entity (ii) Employer (iii) Type of (iv) Country of Identification Entity Organization Number (if any) Form X Form 1065 (2011) PTPA0112 10/27/111120-S, 1065, and 1065-B. G Attach to Form 1120, 1120-C, 1120-F, Employer identification number Name Bailey Drug Store 1 2 Inventory at beginning of year Purchases 3 4 5 Cost of labor Additional section 263A costs (attach schedule) Other costs (attach schedule) 6 7 Total. Add lines 1 through 5 Inventory at end of year 93-0000000 Overview 8 Cost of goods sold. Subtract line 7 from line 6. Enter here and on Form 1120, page 1, line 2 or the appropriate line of your tax return (see instructions) 9 a Check all methods used for valuing closing inventory: (i) (ii) (iii) X 1 2 312,067. 1,771,294. 3 4 5 6 7 2,083,361. 345,106. 8 1,738,255. Cost Lower of cost or market Other (Specify method used and att. expl.) b Check if there was a writedown of subnormal goods c Check if the LIFO inventory method was adopted this tax year for any goods (if checked, attach Form 970) d If the LIFO inventory method was used for this tax year, enter amount of closing inventory computed under LIFO e If property is produced or acquired for resale, do the rules of section 263A apply to the corporation? f Was there any change in determining quantities, cost, or valuations between opening and closing inventory? If ’Yes,’ attach explanation BAA For Paperwork Reduction Act Notice, see separate instructions. Linda Keith CPA, Inc. February 2012 9d Yes X No Yes X No Form 1125-A (12-2011) PC/V1 1065, Page Two and Form 1125-A ‘11 Form 1125-A or ‘10 Schedule A Cost of Goods Sold Lines 1 & 7: Watch for a dramatic change in inventory. Generally, the trend in inventory should mirror the trend in sales. A jump in inventory should usually be accompanied by an increase in sales. If not, they may be building up inventory for expansion. Inventory buildup uses part of the cashflow generated by the business because the money is tied up in inventory until the goods are sold and the receivables collected. If this trend continues, not all cashflow generated by operations is available to the owners in the form of compensation or to the business to service debt unless they are financing the buildup through borrowing or capital contributed. On the other hand, a severe drop in inventory could signal cashflow problems. Is it a permanent drop? Did they have a year-end sale that has been made up in beginning of the year purchases? If not, will it be? Is the supplier now closer? Did the company adopt ‘just-in-time’ inventory methods that allow it to run on lower inventory levels? Section 3: Partnerships LINDA KEITH, CPA of a limited partner or limited liability company member is less than of a general partner. Question 3b: If yes, decide if you need the owner’s return for guarantor analysis. Generally, % ownership over a certain amount will be the determining factor. 20% or 25% is common. The attached Schedule B-1 will list all owners meeting this criteria. For the owner you are lending to (or who is guaranteeing your business loan) you will also find their % ownership on their Schedule K-1. Question 4(a&b): If yes, decide if you need the corporate return, the partnership return or the partnership Schedule K-1. Generally, % ownership over a certain amount will be the determining factor. 20% or 25% is common. If you use either actual cashflow from the Schedule K-1 or available cashflow from an analysis of the Form 1065 Partnership return, be sure to subtract any gain or add back any loss on this 1065, Page One Line 4. Line 3: Will include wages/ payroll taxes/ benefits for people working directly on manufacture of product as well as subcontractors. Line 5: May include insurance. Look here if the insurance on the supporting schedule to the Others Deductions (Line 20) on Page One does not seem adequate. Schedule B: Other Information This section has been changing since the 2008 returns although it has about the same information, just in slightly different places. It also does not change what we do with the information. Question 1: If not a general partnership, see entity explanation earlier in the workbook. Note that the overall risk PC/V1 Linda Keith CPA, Inc. February 2012 3-15 3-16 Section 3: Partnerships BEYOND THE 1040 Form 1065 (2011) 5 6 Overview Bailey Drug Store Bailey Drug Store 93-0000000 Page 3 Yes No Did the partnership file Form 8893, Election of Partnership Level Tax Treatment, or an election statement under section 6231(a)(1)(B)(ii) for partnership-level tax treatment, that is in effect for this tax year? See Form 8893 for more details X Does this partnership satisfy all four of the following conditions? a The partnership’s total receipts for the tax year were less than $250,000. b The partnership’s total assets at the end of the tax year were less than $1 million. c Schedules K-1 are filed with the return and furnished to the partners on or before the due date (including extensions) for the partnership return. X d The partnership is not filing and is not required to file Schedule M-3 If ’Yes,’ the partnership is not required to complete Schedules L, M-1, and M-2; Item F on page 1 of Form 1065; or Item L on Schedule K-1. Is this partnership a publicly traded partnership as defined in section 469(k)(2)? X 8 During the tax year, did the partnership have any debt that was cancelled, was forgiven, or had the terms modified so as to reduce the principal amount of the debt? X 9 Has this partnership filed, or is it required to file, Form 8918, Material Advisor Disclosure Statement, to provide information on any reportable transaction? X At any time during calendar year 2011, did the partnership have an interest in or a signature or other authority over a financial account in a foreign country (such as a bank account, securities account, or other financial account)? See the instructions for exceptions and filing requirements for Form TD F 90-22.1, Report of Foreign Bank and Financial Accounts. If ’Yes,’ enter the name of the foreign country. G X 7 Overview 10 11 At any time during the tax year, did the partnership receive a distribution from, or was it the grantor of, or transferor to, a foreign trust? If ’Yes,’ the partnership may have to file Form 3520, Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts. See instructions 12 a Is the partnership making, or had it previously made (and not revoked), a section 754 election? See instructions for details regarding section 754 election. b Did the partnership make for this tax year an optional basis adjustment under section 743(b) or 734(b)? If ’Yes,’ attach a statement showing the computation and allocation of the basis adjustment. See instructions X c Is the partnership required to adjust the basis of partnership assets under section 743(b) or 734(b) because of a substantial built-in loss (as defined under section 743(d)) or substantial basis reduction (as defined under section 734(d))? If ’Yes,’ attach a statement showing the computation and allocation of the basis adjustment. See instructions X 13 Check this box if, during the current or prior tax year, the partnership distributed any property received in a like-kind exchange or contributed such property to another entity (other than disregarded entities wholly-owned by the partnership throughout the tax year) 14 At any time during the tax year, did the partnership distribute to any partner a tenancy-in-common or other undivided interest in a partnership property? 15 If the partnership is required to file Form 8858, Information Return of U.S. Persons With Respect To Foreign Disregarded Entities, enter the number of Forms 8858 attached. 16 X X X See instructions G Does the partnership have any foreign partners? If ’Yes,’ enter the number of Forms 8805, Foreign Partner’s Information Statement of Section 1446 Withholding Tax, filed for this partnership. G 17 Enter the number of Forms 8865, Return of U.S. Persons With Respect to Certain Foreign Partnerships, attached to this return 18 a Did you make any payments in 2011 that would require you to file Form(s) 1099? See instructions b If ’Yes,’ did you or will you file all required Form(s) 1099? 19 Enter the number of Form(s) 5471, Information Return of U.S. Persons With Respect To Certain Foreign Corporations, attached to this return X G X X Designation of Tax Matters Partner (see the instructions) Enter below the general partner designated as the tax matters partner (TMP) for the tax year of this return: Name of designated TMP If the TMP is an entity, name of TMP representative Address of designated TMP Identifying number of TMP A A A Phone number of TMP A A Form 1065 (2011) PTPA0112 10/27/11 Linda Keith CPA, Inc. February 2012 PC/V1 Section 3: Partnerships 1065, Page Three LINDA KEITH, CPA Question 6: If yes, they are not required to complete Schedule L: Balance Sheet, Schedule M-1, Schedule M-2, Item F on Page 1 and Item J on the K-1. If you are lucky, they’ll complete them anyway. Question 8: The answer to this question might be of interest. If yes, find out why. Other Questions: If the answer is yes… take a look. Designation of Tax Matters Partner: Often the partner designated is the ‘managing’ partner and has more day-today control than others. PC/V1 Linda Keith CPA, Inc. February 2012 3-17 3-18 Section 3: Partnerships BEYOND THE 1040 Bailey Drug Store Parent to the K-1s KEY to Notes Below: A Do not use...already on Page One. B Cashflow rentals and add to worksheet. C Add if recurring...generally assumed. Form 1065 (2011) Schedule K 1 2 D E F G Add gain/subtract loss if recurring. Depreciation = Do not subtract Optional? Check your guidelines Subtract if recurring Bailey Drug Store Partners’ Distributive Share Items 93-0000000 1 2 Ordinary business income (loss) (page 1, line 22) Net rental real estate income (loss) (attach Form 8825) 3 a Other gross rental income (loss) 3c Guaranteed payments 4 5 6 Interest income Dividends: a Ordinary dividends 5 6a b Qualified dividends c Unrecaptured section 1250 gain (attach statement) 10 Net section 1231 gain (loss) (attach Form 4797) 11 Other income (loss) (see instructions) Type Credits C 7 8 9a D 9b 9c D 10 11 Cash contributions (50%) c Section 59(e)(2) expenditures: (1) Type G d Other deductions (see instructions) Type G 14 a Net earnings (loss) from self-employment b Gross farming or fishing income (2) Amount c Gross nonfarm income 15 a Low-income housing credit (section 42(j)(5)) b Low-income housing credit (other) c Qualified rehabilitation expenditures (rental real estate) (attach Form 3468) d Other rental real estate credits (see instructions) Type G e Other rental credits (see instructions) Type G f Other credits (see instructions) Type G 16 a Name of country or U.S. possession b Gross income from all sources c Gross income sourced at partner level Foreign gross income sourced at partnership level d Passive category G e General category G Foreign Deductions allocated and apportioned at partner level Transactions g Interest expense G h Other Deductions allocated and apportioned at partnership level to foreign source income i Passive category G j General category G l Total foreign taxes (check one): G Paid Accrued m Reduction in taxes available for credit (attach statement) n Other foreign tax information (attach statement) 17 a Post-1986 depreciation adjustment b Adjusted gain or loss Alternative Minimum c Depletion (other than oil and gas) Tax d Oil, gas, and geothermal properties ' gross income (AMT) Items e Oil, gas, and geothermal properties ' deductions f Other AMT items (attach stmt) 18 a Tax-exempt interest income b Other tax-exempt income Other c Nondeductible expenses Information 19 a Distributions of cash and marketable securities b Distributions of other property 20 a Investment income b Investment expenses c Other items and amounts (attach stmt) BAA Linda Keith CPA, Inc. February 2012 C PTPA0134 09/06/11 12 13 a 13 b 13 c (2) 13 d 14 a 14 b 14 c 15 a 15 b 15 c 15 d 15 e 15 f 16 b 16 c f Other 16 f 16 h k Other 16 k 16 l 16 m 17 a 17 b 17 c 17 d 17 e 17 f 18 a 18 b 18 c 19 a 19 b 20 a 20 b E 5,000. 188,587. D D G G F G These lines are used by the preparer to complete the 1040’s or are items elsewhere on the return. I recommend you ignore them. SelfEmployment 123,878. A 1,187. C 6b 7 Royalties 8 Net short-term capital gain (loss) (attach Schedule D (Form 1065)) 9 a Net long-term capital gain (loss) (attach Schedule D (Form 1065)) b Collectibles (28%) gain (loss) Deductions B 3b 4 12 Section 179 deduction (attach Form 4562) 13 a Contributions b Investment interest expense 64,709. A 3a b Expenses from other rental activities (attach stmt) c Other net rental income (loss). Subtract line 3b from line 3a Income (Loss) Page 4 Total amount 705,751. 7,800. 18,458. 1,187. Form 1065 (2011) PC/V1 Section 3: Partnerships LINDA KEITH, CPA 1065, Page Four SCHEDULE K: Partners’ Shares Line 4 Guaranteed payments Shows the allocations for income and other items for all partners combined. This is the parent to the K-1’s. Notice all the lines! Partnerships (like S corps) are ‘pass-through’ entities. Income, credit and deduction items retain their character as they move from the partnership into the partners’ returns. Many of these lines are completely irrelevant to the lender and are used to instruct the tax preparer. Refer to the suggestions directly on the form to the left. Since guidelines vary among financial institutions, here is some additional information. These guaranteed payments have already been deducted on Page One, Line 10 of the 1065. They are shown as income here only so the tax preparer can allocate them to the income section of the K-1 of each partner. If you are doing a personal analysis, you will use the K-1, Line 5 for the individual partner you are analyzing. By definition, the guaranteed payments are distributed on a basis other than the profit and loss percentage. (See page 3-23 for an explanation of guaranteed payments.) Line 1 Ordinary Business Income Lines 5-11 Income (Loss) Same explanation as Lines 2-3 above. Since we start with Page One of the tax return for our cashflow calculations you started with this figure on Page One. Do not pick it up again here. Line 12 Section 179 expense deduction Lines 2 Net Rental Real Estate Lines 13 Deductions If the partnership is formed solely to hold real estate, the front page of the 1065 will be blank and there will be a Form 8825 attached. (See page 3-26.) Another option is for the partners to report only their share of the rental on Schedule E of their personal return. Use the rental schedule of the 1040 cashflow worksheet to determine rental cashflow. Add back depreciation on the 8825 even if you have added depreciation back on Page 1 of the 1065. Rental depreciation is not included on Page 1. Bring the rental cashflow onto the partnership instead of the 1040 worksheet so the partner only gets credit for his/her share. Line 3 Income (Loss) Lines 3 and 5-11 are not in your cashflow calculations yet as they do not flow to the front page of the Form 1065. For historical cashflow, add if income or subtract if loss. For projections, only do so if you think it is recurring. PC/V1 Ignore. This is depreciation which was not subtracted on Page 1 of the 1065 partnership return. No need to add back. These items are not in your cashflow calculations yet as they do not flow to the front page of the Form 1065. For historical cashflow, subtract them. For projections subtract only if recurring. Line 13a is charitable contributions and many lenders either do not subtract them or make note of them in written commentary since they can be discontinued if needed. Line 13b Investment Interest may already be taken into consideration on the debt list from your borrower. However, it is interest expense over and above that reported on Page One of the 1065 partnership return. If it is similar to margin interest on a stock broker account and it is recurring, subtract it. Ignore the Rest! The remaining lines provide information to the tax preparer or are duplicates of information you’ll find elsewhere. Linda Keith CPA, Inc. February 2012 3-19 3-20 Section 3: Partnerships BEYOND THE 1040 Bailey Drug Store Bailey Drug Store Analysis of Net Income (Loss) 93-0000000 Form 1065 (2011) 1 Net income (loss). Combine Schedule K, lines 1 through 11. From the result, subtract the sum of Schedule K, lines 12 through 13d, and 16l (i) Corporate (ii) Individual (iii) Individual (iv) Partnership Analysis by (active) (passive) partner type: 2 a General partners Balance Sheets per Books (a) Assets 1 Cash 2 a Trade notes and accounts receivable b Less allowance for bad debts 3 Inventories 4 U.S. government obligations 5 Tax-exempt securities 6 Other current assets (attach stmt) Ln 6 Stmt 7 a Loans to partners (or persons related to partners) b Mortgage and real estate loans 8 Other investments (attach stmt) 9 a Buildings and other depreciable assets b Less accumulated depreciation 10 a Depletable assets b Less accumulated depletion 11 Land (net of any amortization) 12 a Intangible assets (amortizable only) b Less accumulated amortization Ln 13 Stmt 13 Other assets (attach stmt) 14 Total assets Liabilities and Capital 15 Accounts payable 16 Mortgages, notes, bonds payable in less than 1 year Ln 17 Stmt 17 Other current liabilities (attach stmt) 18 All nonrecourse loans 19 a Loans from partners (or persons related to partners) b Mortgages, notes, bonds payable in 1 year or more Ln 20 Stmt 20 Other liabilities (attach stmt) 21 Partners’ capital accounts 22 Total liabilities and capital Beginning of tax year (b) End of tax year (c) 58,472. 2 Income included on Schedule K, lines 1, 2, 3c, 5, 6a, 7, 8, 9a, 10, and 11, not recorded on books this year (itemize): 3 4 Guaranteed pmts (other than health insurance) Expenses recorded on books this year not included on Schedule K, lines 1 through 13d, and 16l (itemize): a Depreciation $ b Travel and entertainment $ 61,815. 141,389. 105,085. 54,755. 312,067. 61,815. 345,106. 24,567. 22,017. 151,369. 120,944. 36,304. 1,100. 487,265. 68,811. 16,891. 17,562. 123,878. 192,574. 5 Add lines 1 through 4 Schedule M-2 Analysis of Partners’ Capital Accounts 215,129. 1 Balance at beginning of year Busn Cashflow: Add 3 4 a Cash b Property Net income (loss) per books Other increases (itemize): 5 Add lines 1 through 4 7 Principal > due in next twelve months Deductions included on Schedule K, lines 1 through 13d, and 16l, not charged against book income this year (itemize): a Depreciation $ 8 Add lines 6 and 7 9 Income (loss) (Analysis of Net Income (Loss), line 1). Subtract line 8 from line 5 6 Distributions: 7 a Cash b Property Other decreases (itemize): 8 9 Add lines 6 and 7 Balance at end of year. Subtract line 8 from line 5 Capital contributed: 62,862. 17,241. 16,695. 125,310. 117. 265,367. 487,592. < Add (recurring) cash rec’d, 7,800. otherwise ignore. 7,800. 184,774. Busn Cashflow: Subtract 18,458. 68,696. 283,825. PTPA0134 09/06/11 Linda Keith CPA, Inc. February 2012 30,425. 2,137. 487,592. included on Schedule K, lines 1 through 11 (itemize): $ a Tax-exempt interest Ln 6 Stmt 7,800. * STMT < Subtract (recurring) cash spent, otherwise ignore. (d) 26,092. 54,755. 167,809. 1,063. 215,129. 487,265. Schedule M-1 Reconciliation of Income (Loss) per Books With Income (Loss) per Return Note. Schedule M-3 may be required instead of Schedule M-1 (see instructions). 68,696. 6 Income recorded on books this year not 1 Net income (loss) per books 2 184,774. (vi) Nominee/Other 184,774. b Limited partners Schedule L 1 (v) Exempt organization Page 5 18,458. 265,367. Form 1065 (2011) PC/V1 Section 3: Partnerships LINDA KEITH, CPA 1065, Page Five Schedule L: Balance Sheets Line 6 Nontaxed Income Increases in assets use up cashflow generated from operations, as do decreases in liability and capital balances. Purchase of equipment, for example, uses cashflow. On the other hand, a decrease in assets is a source of cash. Examples: selling equipment or investments. Reducing inventory levels will free up cash as well. Increasing liabilities ...borrowing money... is a source of cash as is increased capital contributions by the owners. Tax returns show you history. Cashflow generated from operations used last year to build up cash balances or inventory, or pay down debts, may be used differently next year. If the inventory levels are now stable the cashflow used to build them up last year may be available to your borrower this year for other uses. Historical: Add cash received, otherwise ignore. Projecting: Add recurring cash received, otherwise ignore. BOTH: See exception for tax-exempt interest below. If present, the partner’s share of taxexempt interest has already been included in Form 1040, Line 8b. If you are doing a personal analysis and have added the tax-exempt interest from Line 8b to the personal cashflow, do not also add tax-exempt interest from M-1 Line 6 to partnership cashflow. When doing a business analysis, DO add tax-exempt interest to cashflow. Bailey Drug Store is showing $7,800 on Line 6. When you trace it to the supporting schedule you will find that it is insurance proceeds (see page 3-28). ‘Insurance proceeds’ does not sound like recurring cashflow so I will not add it. Shortcut for debt: Schedule L, Line 16, column (d) principal due in the next 12 months can be used in debt estimates. This will not be a good estimate when: 1) Debt levels are changing; 2) Line 16 includes a balance on a commercial line of credit; or 3) Line 16 does not include current portion of long-term debt. Alternate method: Some financial institutions start the cashflow analysis with M-1, Line 1 instead of the bottom line of Page One. In that case, you will need to make adjustments for all noncash and nonrecurring items on all lines of the M-1. Schedule M-1: Reconciliation This schedule is a source of nontaxed income and nondeductible expenses. Any items reported on the M-1 have not been reported on Page One or the Other Deductions (Line 20) Schedule. Schedule M-2: Analysis Line 2a: Capital contributed during the year represents cash put into the business by all partners. Capital contributed may be recurring. Commercial lenders will add this to historical cashflow, and may add it to recurring cashflow. Line 6a: Commercial lenders may wish to subtract this from partnership cashflow if it represents typical compensation to the partners. This reduces cashflow available to pay debts or grow the business. If you subtract Line 6a also add Line 2a, capital contributed, back in. This way you only count net withdrawals against business cashflow. In my solution, I subtracted the $18,458. Line 4 Nondeducted Expenses Historical: Subtract cash spent, otherwise ignore. Projecting: Subtract recurring cash spent, otherwise ignore. PC/V1 Linda Keith CPA, Inc. February 2012 3-21 3-22 Section 3: Partnerships BEYOND THE 1040 Bailey Drug Store 651111 2011 Schedule K-1 (Form 1065) For calendar year 2011, or tax Department of the Treasury Internal Revenue Service year beginning , 2011 ending Information About the Partnership 1 Ordinary business income (loss) Partnership’s employer identification number B Partnership’s name, address, city, state, and ZIP code 93-0000000 OMB No. 1545-0099 15 Credits 16 Foreign transactions 38,825. 2 Net rental real estate income (loss) 3 Other net rental income (loss) 4 Guaranteed payments Add for Partner Cashflow 86,400. A C Amended K-1 Part III Partner’s Share of Current Year Income, Deductions, Credits, and Other Items , Partner’s Share of Income, Deductions, G See separate instructions. Credits, etc. Part I Final K-1 5 Interest income 712. Bailey Drug Store 1 Stop Place Bailey, WA 98000 6 a Ordinary dividends IRS Center where partnership filed return 7 Royalties 8 Net short-term capital gain (loss) 6 b Qualified dividends Ogden, UT D Check if this is a publicly traded partnership (PTP) Part II E 9 a Net long-term capital gain (loss) Information About the Partner Partner’s identifying number Partner’s name, address, city, state, and ZIP code G X General partner or LLC Limited partner or other LLC member H X Domestic partner Foreign partner J member-manager What type of entity is this partner? K L Net section 1231 gain (loss) 18 11 Other income (loss) B Partner’s share of liabilities at year end: Nonrecourse Qualified nonrecourse financing Recourse $ $ $ Partner’s capital account analysis: Beginning capital account Capital contributed during the year Current year increase (decrease) Withdrawals and distributions Ending capital account $ $ $ $ $ 19 12 85,531. 14 47,804. A Distributions A Section 179 deduction 11,075. Other deductions 3,000. 20 Other information A 712. Self-employment earnings (loss) 125,225. C 423,451. 129,077. *See attached statement for additional information. 41,217. 11,075. 159,219. GAAP Section 704(b) book Other (explain) Did the partner contribute property with a built-in gain or loss? X No Yes If ’Yes’, attach statement (see instructions) 4,680. Code of ‘A’ means Cash Distributions 60.00000 % 13 60.00000 % A 60.00000 % 60.00000 % 60.00000 % 60.00000 % X Tax basis M 10 Individual Partner’s share of profit, loss, and capital (see instructions): Beginning Ending Profit Loss Capital Tax-exempt income and nondeductible expenses 9 c Unrecaptured section 1250 gain Barnum Ann Bailey 747 Stone Ave Bailey, WA 98000 I Alternative minimum tax (AMT) items 9 b Collectibles (28%) gain (loss) 666-77-8888 F 17 F O R I R S < Subtract for Partner Cashflow < Add for Partner Cashflow U S E O N L Y BAA For Paperwork Reduction Act Notice, see Instructions for Form 1065. Schedule K-1 (Form 1065) 2011 PTPA0312 Linda Keith CPA, Inc. February 2012 08/18/11 PC/V1 Section 3: Partnerships LINDA KEITH, CPA 1065: Schedule K-1 Partner’s Share of Income, Etc. withdrawals: This is part of the Form 1065, not the Form 1040. You may request the Schedule K-1 only or the full Form 1065 with the K-1. As discussed earlier, you need both if the borrower has a high % ownership. Actual cashflow to the partner as evidenced by the K-1 may not be as enlightening as cashflow available to the partner from business operations as evidenced by the full return. Item G: If a limited partner, they are more like an investor than self-employed or a business owner. See limited partnerships discussion in Section 1. Item J: This gives an indication of the partner’s percentage of profit or loss in the business. You also can determine the % ownership of capital. Use it to decide if the partner could access additional cashflow generated by the business. Your guidelines should indicate at what % ownership you use the full 1065 if you are working on a partner’s personal cashflow. Top of the right column: Notice if this is the final K-1. Add the withdrawals figure even if the K-1 shows it as a negative (minus sign or brackets). It is negative from the perspective of the partnership. It is always positive to the partner. If the withdrawals are not cash (see code for Line 19 on Page 2 of the K-1) you may not wish to count them. Consider whether the withdrawal of property other than cash was in lieu of cash and therefore could be counted. The figure on Schedule E, Form 1040 is a combination of Line 1, Ordinary Income and Line 4, Guaranteed Payments. Formula for Actual Cashflow (Generally low % partners): 1) Add Section L: Withdrawals (Section N: 2006 returns. Cash only? See Code Line 19) 2) Plus Line 4: Guaranteed Payments 3) Less Section L: Capital Contributed (Section N: 2006 returns. Consider if recurring) Withdrawals + Guaranteed Payments - Capital Contributed = Actual Cash PC/V1 Guaranteed Payments: Line 4 Payments made on a basis other than the agreed income/loss split: frequently payment for time spent in the business. Thus, two people may be 50/50 partners, but one works full time and the other only half time. They could agree to be paid $20/ hour worked as guaranteed payments. Excess profits are split 50/50. When to use the formula: The formula is generally used for low % (noncontrolling) owners only. Check your guidelines to find out when you must get the full 1065 instead. A 25%+ ownership guideline is common. If the partner % ownership is higher: Consider giving the partner credit for: 1) Share of cashflow generated from operations left over after guaranteed payments paid to all borrowers. (If negative, count against personal cashflow.) 2) Also add his/her guaranteed payments. Their share of guaranteed payments is not based on profit/loss % so you must use the actual amount from Line 4 of the K-1. Residential Secondary Market lenders: I have seen secondary market residential lending worksheets that use Line 1 Ordinary income plus Line 4 Guaranteed Payments for low % owners. This does not make sense to me but if that is what your guidelines call for, use it. Linda Keith CPA, Inc. February 2012 3-23 3-24 Section 3: Partnerships BEYOND THE 1040 Bailey Drug Store Schedule K-1 (Form 1065) 2011 Barnum Ann Bailey 93-0000000 Page 2 This list identifies the codes used on Schedule K-1 for all partners and provides summarized reporting information for partners who file Form 1040. For detailed reporting and filing information, see the separate Partner’s Instructions for Schedule K-1 and the instructions for your income tax return. Code Report on 1 Ordinary business income (loss). Determine whether the income (loss) is passive or nonpassive and enter on your return as follows. J Work opportunity credit Report on K Disabled access credit Passive loss See the Partner’s Instructions L Empowerment zone and renewal community Passive income Schedule E, line 28, column (g) 2 3 Nonpassive loss Nonpassive income Net rental real estate income (loss) Other net rental income (loss) Schedule E, line 28, column (h) Schedule E, line 28, column (j) See the Partner’s Instructions M N Net income Schedule E, line 28, column (g) Net loss See the Partner’s Instructions O P 4 Guaranteed payments 5 Interest income 6 a Ordinary dividends 6 b Qualified dividends 7 Royalties 8 Net short-term capital gain (loss) 9 a Net long-term capital gain (loss) 9 b Collectibles (28%) gain (loss) 9c 10 11 12 13 Unrecaptured section 1250 gain Net section 1231 gain (loss) Schedule E, line 28, column (j) Form 1040, line 8a Form 1040, line 9a Form 1040, line 9b Schedule E, line 3b Schedule D, line 5 Schedule D, line 12 28% Rate Gain Worksheet, line 4 (Schedule D Instructions) See the Partner’s Instructions See the Partner’s Instructions Other income (loss) Code A Other portfolio income (loss) B Involuntary conversions C Section 1256 contracts and straddles D Mining exploration costs recapture E Cancellation of debt F Other income (loss) Section 179 deduction Other deductions A B C D E F G H I J K L M N O P Q R S T U V W Cash contributions (50%) Cash contributions (30%) Noncash contributions (50%) Noncash contributions (30%) Capital gain property to a 50% organization (30%) Capital gain property (20%) Contributions (100%) Investment interest expense Deductions ' royalty income Section 59(e)(2) expenditures See the Partner’s Instructions See the Partner’s Instructions Form 6781, line 1 See Pub 535 Form 1040, line 21 or Form 982 See the Partner’s Instructions See the Partner’s Instructions 17 See the Partner’s Instructions Form 4952, line 1 Schedule E, line 19 See the Partner’s Instructions 19 A Cash distributed Deductions ' portfolio (2% floor) Schedule A, line 23 19 B or(other) C Other property Deductions ' portfolio Schedule A,distributed line 28 Amounts paid for medical insurance Schedule A, line 1 or Form 1040, line 29 of cash If property distributed in lieu Educational assistance benefits See the Partner’s Instructions and cash was available, consider Dependent care benefits Form 2441, line 12 Preproductive period expenses See the Partner’s Instructions counting it as cashflow. Commercial revitalization deduction from A B C 19 20 C D E F Form 1040, line 8b See the Partner’s Instructions See the Partner’s Instructions See the Partner’s Instructions C Other property Other information A Investment income Net earnings (loss) from self-employment Schedule SE, Section A or B G H I J K L M N O P Q R S T U V W X Y Form 4952, line 4a Investment expenses Fuel tax credit information Qualified rehabilitation expenditures (other than rental real estate) Form 4952, line 5 Form 4136 Basis of energy property Recapture of low-income housing credit (section 42(j)(5)) Recapture of low-income housing credit (other) Recapture of investment credit See the Partner’s Instructions Recapture of other credits Look-back interest ' completed long-term contracts Look-back interest ' income forecast method Dispositions of property with section 179 deductions Recapture of section 179 deduction See the Partner’s Instructions Form 8611, line 8 Form 8611, line 8 Form 4255 See the Partner’s Instructions See Form 8697 See Form 8866 Interest expense for corporate partners Section 453(l)(3) information Section 453A(c) information Section 1260(b) information Interest allocable to production expenditures CCF nonqualified withdrawals Depletion information ' oil and gas See the Partner’s Instructions Amortization of reforestation costs Unrelated business taxable income Precontribution gain (loss) Section 108(i) information Other information PTPA0312 Linda Keith CPA, Inc. February 2012 See the Partner’s Instructions and the Instructions for Form 6251 Depletion (other than oil & gas) Oil, gas, & geothermal ' gross income Oil, gas, & geothermal ' deductions Tax-exempt interest income Other tax-exempt income Nondeductible expenses Distributions A Cash and marketable securities B Distribution subject to section 737 E F Form 1040, line 71; check box a See the Partner’s Instructions Form 1116, Part I A B C See Form 8903 Instructions Form 8903, line 7b Form 8903, line 17 See the Partner’s Instructions Other rental credits Undistributed capital gains credit Alcohol and cellulosic biofuel fuels credit See the Partner’s Instructions Other AMT items Tax-exempt income and nondeductible expenses Domestic production activities information Qualified production activities income Employer’s Form W-2 wages Other deductions See the Partner’s Instructions Form 1040, line 62 Alternative minimum tax (AMT) items A Post-1986 depreciation adjustment B Adjusted gain or loss B C D See the Partner’s Instructions See the Partner’s Instructions Credit for employer social security and Medicare taxes Backup withholding C Gross income sourced at partner level Foreign gross income sourced at partnership level D Passive category E General category Form 1116, Part I F Other Deductions allocated and apportioned at partner level G Interest expense Form 1116, Part I H Other Form 1116, Part I Deductions allocated and apportioned at partnership level to foreign source income I Passive category J General category Form 1116, Part I K Other Other information L Total foreign taxes paid Form 1116, Part II M Total foreign taxes accrued Form 1116, Part II N Reduction in taxes available for credit Form 1116, line 12 O Foreign trading gross receipts Form 8873 P Extraterritorial income exclusion Form 8873 Q Other foreign transactions See the Partner’s Instructions See Form 8582 Instructions See the Partner’s Instructions See the Partner’s Instructions Gross farming or fishing income Gross non-farm income Credits A Low-income housing credit (section 42(j)(5)) from pre-2008 buildings B Low-income housing credit (other) from pre-2008 buildings C Low-income housing credit (section 42(j)(5)) from post-2007 buildings D Low-income housing credit (other) from post-2007 buildings E Qualified rehabilitation expenditures (rental real estate) F Other rental real estate credits G H I 18 See the Partner’s Instructions Other credits Foreign transactions A Name of country or U.S. possession B Gross income from all sources rental real estate activities Pensions and IRAs Reforestation expense deduction 14 Self-employment earnings (loss) Note. If you have a section 179 deduction or any partner-level deductions, see the Partner’s Instructions before completing Schedule SE. 15 16 employment credit Credit for increasing research activities 08/18/11 Schedule K-1 (Form 1065) 2011 PC/V1 Section 3: Partnerships LINDA KEITH, CPA Form 4562 Depreciation Form 4562 Depreciation and Amortization Department of the Treasury Internal Revenue Service (99) separate instructions. Name(s) shown on return Part I 1 2 3 4 5 OMB No. 1545-0172 ▶ Attach Attachment Sequence No. 179 to your tax return. Identifying number Business or activity to which this form relates Election To Expense Certain Property Under Section 179 Note: If you have any listed property, complete Part V before you complete Part I. Maximum amount (see instructions) . . . . . . . . . . . . . . . . . . Total cost of section 179 property placed in service (see instructions) . . . . . . Threshold cost of section 179 property before reduction in limitation (see instructions) . Reduction in limitation. Subtract line 3 from line 2. If zero or less, enter -0- . . . . . Dollar limitation for tax year. Subtract line 4 from line 1. If zero or less, enter -0-. If separately, see instructions . . . . . . . . . . . . . . . . . . . . 6 2011 (Including Information on Listed Property) ▶ See (a) Description of property (b) Cost (business use only) . . . . . . . . . . . . married . . . . . . . . . . . filing . . 5 8 9 10 11 12 Goes to Sch K Special Depreciation Allowance and Other Depreciation (Do not include listed property.) (See instructions.) 14 Special depreciation allowance for qualified property (other than listed property) placed in service during the tax year (see instructions) . . . . . . . . . . . . . . . . . . . . . . 15 Property subject to section 168(f)(1) election . 16 Other depreciation (including ACRS) . . . Part III 1 2 3 4 (c) Elected cost 7 Listed property. Enter the amount from line 29 . . . . . . . . . 7 8 Total elected cost of section 179 property. Add amounts in column (c), lines 6 and 7 . . . . . . 9 Tentative deduction. Enter the smaller of line 5 or line 8 . . . . . . . . . . . . . . . . 10 Carryover of disallowed deduction from line 13 of your 2010 Form 4562 . . . . . . . . . . . 11 Business income limitation. Enter the smaller of business income (not less than zero) or line 5 (see instructions) 12 Section 179 expense deduction. Add lines 9 and 10, but do not enter more than line 11 . . . . . 13 13 Carryover of disallowed deduction to 2012. Add lines 9 and 10, less line 12 ▶ Note: Do not use Part II or Part III below for listed property. Instead, use Part V. Part II 3-25 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14 15 16 MACRS Depreciation (Do not include listed property.) (See instructions.) Section A 17 17 MACRS deductions for assets placed in service in tax years beginning before 2011 . . . . . . . 18 If you are electing to group any assets placed in service during the tax year into one or more general asset accounts, check here . . . . . . . . . . . . . . . . . . . . ▶ Section B—Assets Placed in Service During 2011 Tax Year Using the General Depreciation System (a) Classification of property 19a b c d e f g h (b) Month and year placed in service (c) Basis for depreciation (business/investment use only—see instructions) (d) Recovery period (e) Convention (g) Depreciation deduction (f) Method 3-year property 5-year property 7-year property 10-year property 15-year property 20-year property 25-year property 25 yrs. S/L Residential rental 27.5 yrs. MM S/L property 27.5 yrs. MM S/L Nonresidential real 39 yrs. MM S/L property MM S/L Section C—Assets Placed in Service During 2011 Tax Year Using the Alternative Depreciation System S/L Class life 12 yrs. S/L 12-year 40 yrs. MM S/L 40-year i 20a b c Part IV Summary (See instructions.) 21 Listed property. Enter amount from line 28 . . . . . . . . . . . . . . . . . . . . 22 Total. Add amounts from line 12, lines 14 through 17, lines 19 and 20 in column (g), and line 21. Enter here and on the appropriate lines of your return. Partnerships and S corporations—see instructions 23 For assets shown above and placed in service during the current year, enter the portion of the basis attributable to section 263A costs . . . . . . . For Paperwork Reduction Act Notice, see separate instructions. PC/V1 . . . . . 21 22 Goes to Pg 1 23 Cat. No. 12906N Form 4562 (2011) Linda Keith CPA, Inc. February 2012 3-26 Section 3: Partnerships BEYOND THE 1040 Form 8825 (Rev. December 2010) Form 8825 Rentals Rental Real Estate Income and Expenses of a Partnership or an S Corporation instructions on back. ▶ Attach to Form 1065, Form 1065-B, or Form 1120S. Employer identification number Name 1 OMB No. 1545-1186 ▶ See Department of the Treasury Internal Revenue Service Show the type and address of each property. For each rental real estate property listed, report the number of days rented at fair rental value and days with personal use. See instructions. See page 2 to list additional properties. Physical address of each property—street, city, Type—Enter code 1-8; Fair Rental Days Personal Use Days state, ZIP code see page 2 for list A B C D Properties Rental Real Estate Income 2 Gross rents . . . . . . 3 4 5 6 7 8 9 10 11 12 13 14 15 A . Rental Real Estate Expenses Advertising . . . . . . . Auto and travel . . . . . Cleaning and maintenance . . Commissions . . . . . . Insurance . . . . . . . Legal and other professional fees Interest . . . . . . . . Repairs . . . . . . . . Taxes . . . . . . . . Utilities . . . . . . . . Wages and salaries . . . . Depreciation (see instructions) Other (list) ▶ B C D 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 Total expenses for each property. Add lines 3 through 15 . . . 17 Income or (Loss) from each property. Subtract line 16 from line 2 16 17 18a Total gross rents. Add gross rents from line 2, columns A through H . . . . . . . . . . b Total expenses. Add total expenses from line 16, columns A through H . . . . . . . . . 19 Net gain (loss) from Form 4797, Part II, line 17, from the disposition of property from rental real estate activities . . . . . . . . . . . . . . . . . . . . . . . . . . . 20a Net income (loss) from rental real estate activities from partnerships, estates, and trusts in which this partnership or S corporation is a partner or beneficiary (from Schedule K-1) . . . . . . 18a 18b ( ) 19 20a b Identify below the partnerships, estates, or trusts from which net income (loss) is shown on line 20a. Attach a schedule if more space is needed: (1) Name 21 (2) Employer identification number Net rental estate income (loss). Combine lines 18a through 20a. Enter the result here and on: • Form 1065 or 1120S: Schedule K, line 2, or • Form 1065-B: Part I, line 4 For Paperwork Reduction Act Notice, see back of form. Linda Keith CPA, Inc. February 2012 Cat. No. 10136Z 21 Form 8825 (12-2010) PC/V1 Section 3: Partnerships Form 8825 Rental Real Estate LINDA KEITH, CPA The Form 8825 feeds into the Schedule K and will be attached to a partnership or S corporation return. Cashflow this form just like you would a Schedule E in a personal 1040. Include the rental cashflow on the ‘Miscellaneous...from Schedule K’ line of the partnership/ S corporation worksheet. Caution: In some cases the preparer might have included rental depreciation on Page 1. Don’t add it back twice. See 1065 Page 1, Line 16b on page 3-12. If it is blank, then it is safe to add back the rental depreciation. PC/V1 Linda Keith CPA, Inc. February 2012 3-27 3-28 Section 3: Partnerships BEYOND THE 1040 Supporting Schedules Bailey Drug Store 93-0000000 1 Form 1065, Line 7 Other income (loss) Video rental income Liquor Miscellaneous 50,742. 17,498. 15,257. Total 83,497. Form 1065, Line 20 Other deductions Advertising Bank Credit Card Fee Utilities Insurance Supplies Legal/Acctg Contracted Services Equip. rental & maintenance Dues/Subscriptions Cleaning/main Postage Cash short Misc Delivery/auto Bank Service charge NSF Checks Bailey Drug Store 93-0000000 Vendor Service Charges Travel Form 1065, Schedule L, Line 13 Other Total Assets 38,308. 21,246. 12,798. 13,300. 7,650. 6,098. 5,888. 5,072. 4,542. 4,238. 3,142. 2,508. 2,350. 2,300. 1,902. 1,411. 1,176. 959. If nondeducted meals, be sure to ‘visit’ Schedule M-1 for other nondeducted items. We are not there yet. 2 134,888. Beginning of tax year Other Assets: Form 1065, Schedule M-1, Line 6 Sch M-1, Line 6 Deposits 1,100. Insurance proceeds 7,800. Total 7,800. Total Always look for noncash and nonrecurring expenses to add back. Also consider if insurance is adequate. End of tax year 2,137. Add if (recurring) 1,100. cash received.2,137. Form 1065, Schedule L, Line 17 Other Current Liabilities Form 1065, Schedule L, Line 6 Other Current Assets Other Current Liabilities: Other Current Assets: Payroll taxes payable Line of Credit Miscellaneous Total Total Linda Keith CPA, Inc. February 2012 Form 1065, Schedule L, Line 20 Other Liabilities Beginning of tax year of Beginning tax year 5,519. 12,043. 24,567. 17,562. 24,567. End of tax year End of tax year 5,519. 11,176. 22,017. 16,695. 22,017. PC/V1 Section 3: Partnerships Supporting Schedules LINDA KEITH, CPA Whenever a line in a tax return simply says (attach schedule) the information you need will be in the back of the tax return after all of the formal IRS schedules. Some software numbers these, some use letters and others, like mine, simply refer back to the Form, Schedule and Line number. They are generally in the same order you run across them in the return itself. Form 1065, Schedule A (2010) or 1125-A (2011) Cost of Goods Sold Other costs, Line 5 Form 1065, Page One, Line 7 Other Income (loss) Form 1065, Schedule M-1 Reconciliation Nontaxed Income, Line 6 This is a great example of a company that uses the other income line, not for unusual items, but just for different categories of income. As long as it is typical for the business, you don’t need to be concerned with it. The $15,257, if it was not also on the second year return, might need some explanation to leave it in. I made no adjustments for this. Form 1065, Page One, Line 20 Other Deductions Review this schedule to be sure they have adequate insurance. If so, make no adjustment. If not, check for insurance on a supporting schedule to Schedule A, Cost of Goods sold, Line 5. A lack of adequate insurance is a red flag. Also check here for nonrecurring expenses or amortization you can add back to ordinary income. How to find nonrecurring items? Sometimes it is obvious by the name, such as disaster repairs. Otherwise, compare to another year’s return. All of these expenses looked like they could be typical for a drug store and there was no amortization listed. They do have insurance. Therefore, I made no additional adjustments because of this. PC/V1 Bailey Drug Store did not have Other Costs on the COGS schedule. When it is there, sometimes it includes insurance. If the insurance coverage elsewhere in the return looks too low, check here. For example, insurance on a warehouse where inventory is stored would be back here. The $7,800 was income on the books and not on the tax return. Therefore, if it is cash received (recurring cash received if projecting cashflow) we need to add it to cashflow. Insurance proceeds does not sound like recurring cashflow to me. If you are digging for dollars and $7,800 will make a difference, reconsider. For example, what if the insurance proceeds are to offset additional expenses they have shown elsewhere in the return due to a claim? Then it would be your clue to add back the nonrecurring, unusual expenditures. I did not add the $7,800 insurance proceeds to cashflow. Form 1065, Schedule L Balance Sheet Other Current Liabilities, Line 17 If any outstanding balance of a Commercial Line of Credit is on this line, you can be more confident in using Schedule L, Line 16 for principal on term debt due in the next twelve months. This is a shortcut when you do not have detailed debt info. See page 3-13 for the shortcut. Linda Keith CPA, Inc. February 2012 3-29 3-30 Section 3: Partnerships BEYOND THE 1040 Linda Keith CPA, Inc. February 2012 PC/V1