Activity-Based Costing and Quality Management

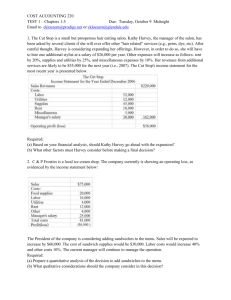

advertisement