Condo Conversion Sales

advertisement

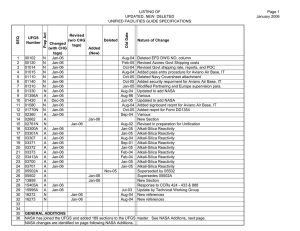

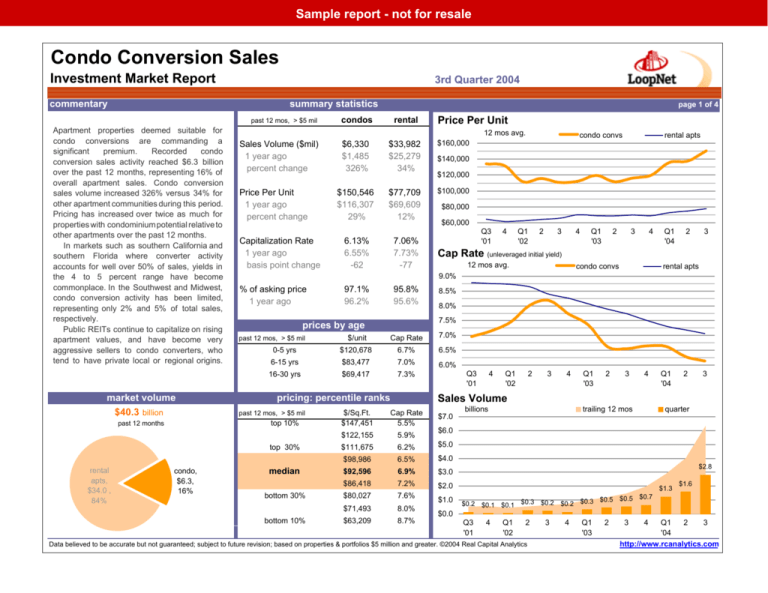

Sample report - not for resale Condo Conversion Sales Investment Market Report commentary 3rd Quarter 2004 summary statistics Apartment properties deemed suitable for condo conversions are commanding a significant premium. Recorded condo conversion sales activity reached $6.3 billion over the past 12 months, representing 16% of overall apartment sales. Condo conversion sales volume increased 326% versus 34% for other apartment communities during this period. Pricing has increased over twice as much for properties with condominium potential relative to other apartments over the past 12 months. In markets such as southern California and southern Florida where converter activity accounts for well over 50% of sales, yields in the 4 to 5 percent range have become commonplace. In the Southwest and Midwest, condo conversion activity has been limited, representing only 2% and 5% of total sales, respectively. Public REITs continue to capitalize on rising apartment values, and have become very aggressive sellers to condo converters, who tend to have private local or regional origins. market volume $40.3 billion past 12 months past 12 mos, > $5 mil condo, $6.3, 16% Price Per Unit condos rental $6,330 $1,485 326% $33,982 $25,279 34% $160,000 $150,546 $116,307 29% $77,709 $69,609 12% $100,000 6.13% 6.55% -62 7.06% 7.73% -77 12 mos avg. Sales Volume ($mil) 1 year ago percent change Price Per Unit 1 year ago percent change Capitalization Rate 1 year ago basis point change condo convs % of asking price 1 year ago 97.1% 96.2% 95.8% 95.6% $120,000 $80,000 $60,000 Q3 '01 4 Q1 '02 2 3 4 Cap Rate (unleveraged initial yield) 12 mos avg. $/unit Cap Rate 7.0% 0-5 yrs $120,678 6.7% $83,477 7.0% 16-30 yrs $69,417 7.3% 6.0% bottom 30% bottom 10% 4 condo convs Q3 '01 4 2 Q1 '02 3 4 Sales Volume pricing: percentile ranks median 3 Q1 '04 2 3 rental apts 8.0% 6-15 yrs top 10% 2 8.5% 6.5% past 12 mos, > $5 mil Q1 '03 7.5% prices by age past 12 mos, > $5 mil rental apts $140,000 9.0% top 30% rental apts, $34.0 , 84% page 1 of 4 $/Sq.Ft. $147,451 Cap Rate 5.5% $122,155 5.9% $111,675 6.2% $5.0 $98,986 6.5% $4.0 $92,596 6.9% $3.0 $86,418 7.2% $80,027 7.6% $2.0 $71,493 8.0% $63,209 8.7% $7.0 billions Q1 '03 2 3 4 Q1 '04 2 3 quarter trailing 12 mos $6.0 $1.0 $0.0 $2.8 $0.5 $0.5 $0.7 $0.2 $0.1 $0.1 $0.3 $0.2 $0.2 $0.3 Q3 '01 4 Q1 '02 2 Data believed to be accurate but not guaranteed; subject to future revision; based on properties & portfolios $5 million and greater. ©2004 Real Capital Analytics 3 4 Q1 '03 2 3 4 $1.3 $1.6 Q1 2 3 '04 http://www.rcanalytics.com Sample report - not for resale Condo Conversion Sales 7 Investment Market Report 3rd Quarter 2004 page 2 of 4 regions and markets past 12 mos condo conversions $ mil $/unit cap buyer composition rental apartments $/unit volume (mil) DC VA burbs $288.2 $194,227 — $1,194.5 $146,315 cap 6.8% Baltimore $81.5 $209,512 — $657.3 $103,171 6.6% DC MD burbs $10.1 $78,516 — $668.6 $99,255 7.7% others $195.4 $185,729 5.2% $1,047.5 $69,438 6.9% Mid-Atlantic $575.2 $188,395 5.2% $3,567.9 $98,137 7.1% Chicago $196.9 $182,146 6.8% $961.7 $85,549 7.8% Detroit $86.5 $91,572 7.5% $192.4 $57,618 9.2% Minneapolis $58.0 $139,423 — $213.2 $69,660 7.8% others $22.5 $53,699 8.6% $1,206.4 $43,860 8.0% Midwest $363.9 $127,206 7.4% $2,573.7 $57,008 8.1% Manhattan $236.1 $296,173 — $1,518.6 $232,385 5.8% No NJ $222.5 $413,569 5.5% $635.4 $155,323 6.3% Boston $305.4 $243,573 — $392.8 $120,344 6.3% others $121.5 $216,139 7.8% $1,926.2 $79,692 7.4% Northeast $885.5 $281,009 6.7% $4,473.0 $117,526 6.4% Miami $1,189.5 $145,538 5.1% $684.5 $90,877 6.5% Atlanta $177.1 $125,244 — $1,520.8 $68,445 7.1% Broward $452.1 $154,564 5.9% $734.4 $95,339 6.9% others $749.9 $100,476 6.1% $4,664.6 $60,692 7.3% Southeast $2,568.5 $128,587 5.9% $7,604.3 $66,523 7.1% Dallas $21.5 $120,112 — $1,669.4 $56,976 7.5% Phoenix $25.5 $95,149 — $1,354.7 $61,300 7.5% Houston $30.4 $152,022 — $1,141.4 $49,696 8.1% others $77.8 $58,277 7.7% $2,370.1 $59,317 7.8% Southwest $155.2 $78,307 7.7% $6,535.6 $57,168 7.7% Los Angeles $379.9 $217,804 7.1% $2,750.3 $146,886 6.1% San Diego $929.2 $195,216 5.3% $960.0 $139,350 5.7% Las Vegas $217.2 $73,850 7.4% $941.1 $63,149 7.8% others $255.4 $161,675 5.8% $4,575.6 $94,196 6.6% West $1,781.7 $161,607 6.0% $9,226.9 $103,568 6.6% condo convs private user/other inst'l/foreign 92% rental apartment 1% 2%5% 64% 53% all core 1 2 3 4 5 6 7 8 9 10 reit/public 2% 4% buyers Crescent Heights Investments MCZ Development Corp Troxler Residential Ventures El Ad Group Chetrit Group SunVest Resort Communities 19% 22% 15% 21% sellers Archstone Communities AIMCO Vornado Realty Trust Essex Property Trust Tennessee Consolidated Altman Development Daniel J Furlan Pacifica Hospitality Bradford Group LaSalle Investment Management Property Markets Group, Inc Watt Commercial Properties Inc JEMB Realty Corp. Pacific Property Company seller composition private condo convs rental apartment all core Data believed to be accurate but not guaranteed; subject to future revision; based on properties & portfolios $5 million and greater. ©2004 Real Capital Analytics user/other 58% reit/public 1% 68% 55% 8% inst'l/foreign 30% 11% 1% 18% 13% 15% 22% http://www.rcanalytics.com Sample report - not for resale Condo Conversion Sales Investment Market Report 3rd Quarter 2004 page 3 of 4 Date Property Address Location Herndon, VA 30 Recent Transactions Yr Blt Units Price $/Unit Cap Buyer Oct-04 Avalon at Fox Mill 13001 Cabin Creek Rd 2000 165 $38,000,000 $230,303 - Wills Co. Oct-04 Tanglewood Terrace 1564 Tanglewood Ln Escondido, CA 1986 24 $5,050,000 $210,417 - Hammer Ventures Oct-04 Villa Marine Apartments 525 Marine St San Diego, CA 1964 12 $6,000,000 $500,000 - CFRA Inc Oct-04 Crossroads Apartments 3605 Ash St San Diego, CA 1986 92 $20,000,000 $217,391 - Davlyn Investments Inc. Oct-04 Summit Sand Lake 8927 Latrec Ave Orlando, FL 1994 416 $38,000,000 $91,346 - American Invsco Corp. Oct-04 Monarch at Carmel Valley 12356 Carmel Country Rd San Diego, CA 2000 225 $83,000,000 $368,889 - Hammer Ventures Oct-04 The Savoy on Palmer Ranch5100 Northridge Road Sarasota, FL 2000 324 $30,175,000 $93,133 7.2% Oct-04 Triana at Corona Ranch 1018 Vista De Los Cerros St 1991 328 $59,000,000 $179,878 - Pacifica Cos. Oct-04 4455-4473 Home Ave 4455-4473 Home Ave San Diego, CA 1985 42 $4,500,000 $107,143 - Maisel Presley Inc Oct-04 Oct-04 Oct-04 Oct-04 Coronado Manor Apartments1560 Coronado Ave Waerstone at Vallejo Apartm 1333 N Camino Alto Madison Avenue Manor 3535 Madison Ave Forest Glen Townhome Apa 20146-20259 Cohasset St 1969 1978 1971 1972 76 180 88 204 $8,750,000 $20,250,000 $14,100,000 $34,000,000 $115,132 $112,500 $160,227 $166,667 4.5% 5.0% 3.9% 5.5% Oct-04 Fletcher Hills Pines 1280 West Main St El Cajon, CA 1974 44 $6,225,000 $141,477 4.4% Sep-04 Brownstones on McCue 2400 McCue 2001 200 $30,404,400 $152,022 - Corona, CA San Diego, CA Vallejo, CA San Diego, CA Winnetka, CA Houston, TX BF Group Coronado Manor Homes LLC Hammer Ventures Skylight Investments 1280 West Main LLC Choice Condominiums Sep-04 Warner Center 5515-5555 Canoga Ave Woodland Hills, CA 1987 1,279 $300,000,000 $234,558 - Troxler Residential Ventures Joint Sep-04 Lincoln at Delaney Square 300 E South St Orlando, FL 2003 364 $42,200,000 $115,934 - Tarragon Realty Investors Inc. Joi Sep-04 Jamestowne Village 1523 N Van Dorn Alexandria, VA 1964 378 $56,532,823 $149,558 - Mid-City Urban LLC Sep-04 River West 401 S 1st St Minneapolis, MN 1989 416 $58,000,000 $139,423 - Turnstone Group LLC Sep-04 Westchester at Briarcliff 1999 Cliff Valley Atlanta, GA 2003 270 $37,500,000 $138,889 - El Ad Group Sep-04 Westchester at Dunwoody 1850 Cotillion Dr Atlanta, GA 2003 398 $48,200,000 $121,106 - El Ad Group Sep-04 Collwood Point 5055 Collwood Blvd San Diego, CA 1974 51 $9,500,000 $186,275 - Maisel Presley Inc Sep-04 Alexan Virginia Center 9480 Virginia Center Blvd Vienna, VA 2003 327 $77,000,000 $235,474 - Crescent Heights Investments Sep-04 Latigo at Silverado Ranch 2300 Siverado Ranch Blvd Las Vegas, NV 1997 400 $35,600,000 $89,000 8.3% Sep-04 Centergate Celebration 745 Centergate Dr Orlando, FL 2001 287 $47,000,100 $163,763 - SunVest Resort Communities Lexin Capital Sep-04 Tuscany Place 4860 Rolando Court San Diego, CA 1975 99 $11,800,000 $119,192 - Matthew Maisel and Robert Presley Sep-04 The Alexan 2665 SW 37th Ave Miami, FL 2002 200 $31,000,000 $155,000 - SunVest Resort Communities Joint V Sep-04 Park Vista Apartments 900 LaCosta Circle Sarasota, FL 1972 108 $6,297,083 $58,306 7.0% White & Associates Sep-04 Bay Club Tower 3300 Ne 191 Street Aventura, FL 1990 702 $137,500,000 $195,869 3.5% Chetrit Group Sep-04 Plaza 440 440 N Wabash Ave Chicago, IL 1992 457 $107,000,000 $234,136 - Data believed to be accurate but not guaranteed; subject to future revision; based on properties & portfolios $5 million and greater. ©2004 Real Capital Analytics http://www.rcanalytics.com Sample report - not for resale Condo Conversion Sales Investment Market Report 3rd Quarter 2004 page 4 of 4 Date Property Address Location Herndon, VA 30 Recent Transactions Yr Blt Units Price $/Unit Cap 1998 435 $145,700,000 $334,943 - Crescent Heights Investments 1989 120 $16,000,000 $133,333 - Pacifica Hospitality Sep-04 Museum Towers 13001 Cabin Creek Rd Sep-04 Mission Grove 1564 Tanglewood Ln Escondido, CA Sep-04 Cottages 525 Marine St San Diego, CA 1965 65 $15,100,000 $232,308 - Sep-04 Savannah Ridge Apartments3605 Ash St San Diego, CA 2001 59 $7,100,000 $120,339 6.5% Buyer Nevis Homes IGL Real Estate Sep-04 Morningside on the Green 8927 Latrec Ave Orlando, FL 1984 174 $17,800,000 $102,299 - local investor Aug-04 2000 Lincoln Park West 12356 Carmel Country Rd San Diego, CA 1931 195 $45,000,000 $230,769 - Nick Gouletas Aug-04 OceanCrest 5100 Northridge Road Sarasota, FL 1968 942 $143,000,000 $151,805 - MCZ Development Corp Joint Venture Aug-04 Signature at Scottsdale Horiz1018 Vista De Los Cerros St Corona, CA 1995 268 $25,500,000 $95,149 - Oculus Development Joint Venture P Aug-04 Carmel Pointe 4455-4473 Home Ave San Diego, CA 2002 200 $63,000,000 $315,000 - Pacifica Hospitality Aug-04 Aug-04 Aug-04 Aug-04 Florida Club Palermo Apartments Whitney on Main Park Hill 1560 Coronado Ave San Diego, CA 1333 N Camino Alto Vallejo, CA 2001 2003 1970 1969 200 230 280 264 $19,000,000 $58,200,000 $56,000,000 $27,800,000 $95,000 $253,043 $200,000 $105,303 - SunVest Resort Communities Joint V Integral Partners Hamilton Company Joint Venture New RBGEM LLC Aug-04 Winery Estates 1280 West Main St El Cajon, CA 1970 106 $6,290,000 $59,340 8.0% Aug-04 Villa Redondo 2400 McCue 1990 125 $26,250,000 $210,000 - 3535 Madison Ave San Diego, CA Winnetka, CA 20146-20259 Cohasset St Houston, TX United Development Group Pacifica Hospitality Aug-04 Lincoln Manor 5515-5555 Canoga Ave Woodland Hills, CA 1978 41 $6,500,000 $158,537 - Hammer Ventures Aug-04 The Grand Venezia 300 E South St Orlando, FL 2002 336 $49,000,000 $145,833 - F & M Hotels Aug-04 Lincoln Pointe Apartments 1523 N Van Dorn Alexandria, VA 1991 285 $41,000,000 $143,860 - Tarragon Realty Investors Inc. Joi Aug-04 Le Club at Saga Bay 401 S 1st St Minneapolis, MN 1992 332 $34,286,900 $103,274 - Professional Management Inc (Miami Aug-04 OceanView Apartments 1999 Cliff Valley Atlanta, GA 1971 400 $51,166,700 $127,917 - Crescent Heights Investments Aug-04 Carmel Mountain 1850 Cotillion Dr Atlanta, GA 1988 338 $69,940,500 $206,925 - Silverstone Communities Also Known Aug-04 Fountains at Countryside 5055 Collwood Blvd San Diego, CA 1987 168 $10,200,000 $60,714 6.5% Atlantic American Realty Group Aug-04 Belleair Pines Apartments 9480 Virginia Center Blvd Vienna, VA 1988 80 $5,700,000 $71,250 6.4% Belleaire Village Condos (Knoxvill Aug-04 Waverly at Surfside 2300 Siverado Ranch Blvd Las Vegas, NV 2003 111 $33,600,000 $302,703 - Margolias Realty Aug-04 St Charles Regency Apartme745 Centergate Dr Orlando, FL 1951 221 $7,500,000 $33,937 - Eli Khoury Aug-04 North Park Towers 4860 Rolando Court San Diego, CA 1974 313 $23,668,551 $75,618 - Aug-04 The Arbors at Park Place 2665 SW 37th Ave Miami, FL 1985 92 $10,900,000 $118,478 4.4% Aug-04 North Park Place 900 LaCosta Circle Sarasota, FL 1974 253 $19,131,449 $75,618 - Global Equities and Loans Aug-04 Essex on Lake Merrit 3300 Ne 191 Street Aventura, FL 2002 270 $88,000,000 $325,926 - Emerald Fund Joint Venture Lennar Aug-04 La Jolla Village 440 N Wabash Ave Chicago, IL 1975 184 $43,000,000 $233,696 - Daniel J Furlan Data believed to be accurate but not guaranteed; subject to future revision; based on properties & portfolios $5 million and greater. ©2004 Real Capital Analytics Global Equities and Loans Mosaic USA Joint Venture Grosvenor http://www.rcanalytics.com