Section 127 Employer-Provided Educational Assistance Benefits

Employer-Provided Educational

Assistance Benefits

Internal Revenue Code Section 127

An association of 62 leading

public and private research universities

Boston University

Brandeis University

Brown University

California Institute of Technology

Carnegie Mellon University

Case Western Reserve University

Columbia University

Cornell University

Duke University

Emory University

Georgia Institute of Technology

Harvard University

Indiana University

Iowa State University

The Johns Hopkins University

Massachusetts Institute of Technology

McGill University

Michigan State University

New York University

Northwestern University

The Ohio State University

The Pennsylvania State University

Princeton University

Purdue University

Rice University

Rutgers, The State University of New Jersey

Stanford University

Stony Brook University - State University of New York

Texas A&M University

Tulane University

The University of Arizona

University at Buffalo, The State University

of New York

University of California, Berkeley

University of California, Davis

University of California, Irvine

University of California, Los Angeles

University of California, San Diego

University of California, Santa Barbara

The University of Chicago

University of Colorado at Boulder

University of Florida

University of Illinois at Urbana-Champaign

The University of Iowa

The University of Kansas

University of Maryland, College Park

University of Michigan

University of Minnesota, Twin Cities

University of Missouri-Columbia

The University of North Carolina at Chapel Hill

University of Oregon

University of Pennsylvania

University of Pittsburgh

University of Rochester

University of Southern California

The University of Texas at Austin

University of Toronto

University of Virginia

University of Washington

The University of Wisconsin-Madison

Vanderbilt University

Washington University in St. Louis

Yale University

What is It?

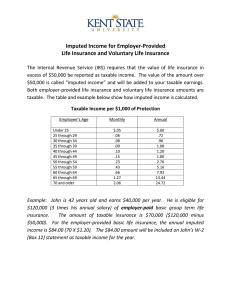

Section 127 of the Internal Revenue Code (IRC) allows employers to exclude from employees’ wages up to $5,250 per year for payment or reimbursement of tuition, fees, books, certain supplies, and equipment for job or non-job related undergraduate and graduate level education as part of a “qualified educational assistance program.” Hence, employees who receive this benefit can exclude up to $5,250 of those benefits from their taxable income.

Section 127 also applies to employer-provided job and non-job related courses of instruction for employees, including the cost of books, certain supplies, and equipment.

Employers that provide their employees with Section 127 educational assistance benefits can deduct these costs as a business expense in determining their income tax liability.

Employers that provide this benefit must have a written qualified educational assistance program that applies exclusively to their employees (including retired, disabled or laid off employees). Also, the program must be offered on a nondiscriminatory basis that does not favor highly-compensated employees, and meet other IRS requirements.

Employees cannot use the same educational expenses paid for or reimbursed through an employer-provided Section 127 educational assistance program as the basis for claiming other federal tax benefits. However, employees may be able to claim other federal tax benefits, such as the Lifetime Learning Credit, for tuition and fees in excess of the $5,250

Section 127 limit.

Background

Section 127 was created as part of the Revenue Act of 1978 and established employerprovided educational assistance as excludable for any type of educational course, apart from those related to games, hobbies or sports, unless these activities are the business of the employer or are required as part of a degree program. Prior to 1978, only specific

“job-related” education assistance was excluded from gross taxable income.

Since its creation in 1978, the provision has expired and been extended several times.

Section 127 was made permanent in the American Taxpayer Relief Tax Act of 2012.

Who Benefits?

In academic year 2007-8, Section 127 enabled 913,000 U.S. workers to pursue higher education courses and degrees that develop and expand critical skills needed to compete in our growing global economy. For example, the top four majors among

Section 127 recipients were business (28%), STEM – sciences, technology, engineering, and mathematics (17%), education (15%), and health (13%). Section 127 is an efficient, cost-effective vehicle for training and improving the U.S. workforce.

Employers provide Section 127 educational assistance benefits because they recognize the value and re ap the return on their investment in their employees’ continued education and training. The average Section 127 benefits received in 2009 was $2,700, with graduate students receiving on average $3,701 and undergraduate students receiving

$1,849.

The average annual employment earnings of Section 127 recipients were $42,711 for the

2007-8 academic year.

Additional information

Coalition to Preserve Employer Provided Education Assistance website: http://www.cpepea.com/

“Who Benefits from Section 127? – A Study of Employee Education Assistance Provided Under Section 127 of the Internal Revenue Code,” 2010, http://www.cpepea.com/research-surveys .

Joint Committee on Taxation Report, JCX-62-12, "Present Law and Background Relating to Tax Exemptions and Incentives for Higher Education" – https://www.jct.gov/publications.html?func=startdown&id=4474 .

Congressional Research Service Report, “Tax Treatment of Employer Educational Assistance for the Benefit of

Employees,” Order Code RS22911, July 3, 2008.

– March 2014