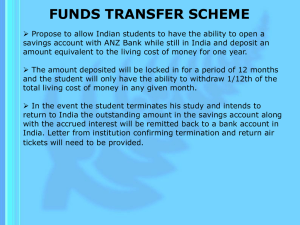

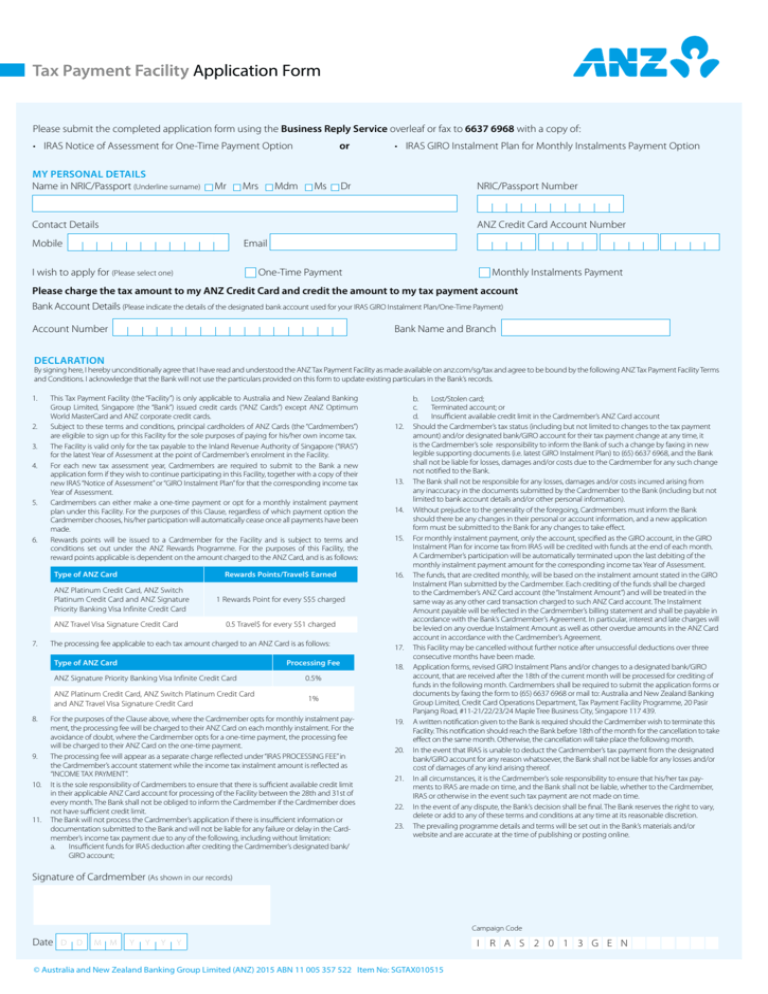

Tax Payment Facility Application Form

advertisement

Tax Payment Facility Application Form Please submit the completed application form using the Business Reply Service overleaf or fax to 6637 6968 with a copy of: or • IRAS Notice of Assessment for One-Time Payment Option MY PERSONAL DETAILS Name in NRIC/Passport (Underline surname) Mr Mrs Mdm Ms • IRAS GIRO Instalment Plan for Monthly Instalments Payment Option Dr NRIC/Passport Number Contact Details ANZ Credit Card Account Number Email Mobile I wish to apply for (Please select one) One-Time Payment Monthly Instalments Payment Please charge the tax amount to my ANZ Credit Card and credit the amount to my tax payment account Bank Account Details (Please indicate the details of the designated bank account used for your IRAS GIRO Instalment Plan/One-Time Payment) Account Number Bank Name and Branch DECLARATION By signing here, I hereby unconditionally agree that I have read and understood the ANZ Tax Payment Facility as made available on anz.com/sg/tax and agree to be bound by the following ANZ Tax Payment Facility Terms and Conditions. I acknowledge that the Bank will not use the particulars provided on this form to update existing particulars in the Bank’s records. 1. 2. 3. 4. 5. 6. This Tax Payment Facility (the “Facility”) is only applicable to Australia and New Zealand Banking Group Limited, Singapore (the “Bank”) issued credit cards (“ANZ Cards”) except ANZ Optimum World MasterCard and ANZ corporate credit cards. Subject to these terms and conditions, principal cardholders of ANZ Cards (the “Cardmembers”) are eligible to sign up for this Facility for the sole purposes of paying for his/her own income tax. The Facility is valid only for the tax payable to the Inland Revenue Authority of Singapore (“IRAS”) for the latest Year of Assessment at the point of Cardmember’s enrolment in the Facility. For each new tax assessment year, Cardmembers are required to submit to the Bank a new application form if they wish to continue participating in this Facility, together with a copy of their new IRAS “Notice of Assessment” or “GIRO Instalment Plan” for that the corresponding income tax Year of Assessment. Cardmembers can either make a one-time payment or opt for a monthly instalment payment plan under this Facility. For the purposes of this Clause, regardless of which payment option the Cardmember chooses, his/her participation will automatically cease once all payments have been made. Rewards points will be issued to a Cardmember for the Facility and is subject to terms and conditions set out under the ANZ Rewards Programme. For the purposes of this Facility, the reward points applicable is dependent on the amount charged to the ANZ Card, and is as follows: Type of ANZ Card Rewards Points/Travel$ Earned ANZ Platinum Credit Card, ANZ Switch Platinum Credit Card and ANZ Signature Priority Banking Visa Infinite Credit Card ANZ Travel Visa Signature Credit Card 7. 12. 13. 14. 15. 16. 1 Rewards Point for every S$5 charged 0.5 Travel$ for every S$1 charged The processing fee applicable to each tax amount charged to an ANZ Card is as follows: Type of ANZ Card Processing Fee ANZ Signature Priority Banking Visa Infinite Credit Card ANZ Platinum Credit Card, ANZ Switch Platinum Credit Card and ANZ Travel Visa Signature Credit Card 8. 17. 18. 0.5% 1% For the purposes of the Clause above, where the Cardmember opts for monthly instalment payment, the processing fee will be charged to their ANZ Card on each monthly instalment. For the avoidance of doubt, where the Cardmember opts for a one-time payment, the processing fee will be charged to their ANZ Card on the one-time payment. 9. The processing fee will appear as a separate charge reflected under “IRAS PROCESSING FEE” in the Cardmember’s account statement while the income tax instalment amount is reflected as “INCOME TAX PAYMENT”. 10. It is the sole responsibility of Cardmembers to ensure that there is sufficient available credit limit in their applicable ANZ Card account for processing of the Facility between the 28th and 31st of every month. The Bank shall not be obliged to inform the Cardmember if the Cardmember does not have sufficient credit limit. 11. The Bank will not process the Cardmember’s application if there is insufficient information or documentation submitted to the Bank and will not be liable for any failure or delay in the Cardmember’s income tax payment due to any of the following, including without limitation: a. Insufficient funds for IRAS deduction after crediting the Cardmember’s designated bank/ GIRO account; 19. 20. 21. 22. 23. b. Lost/Stolen card; c. Terminated account; or d. Insufficient available credit limit in the Cardmember’s ANZ Card account Should the Cardmember’s tax status (including but not limited to changes to the tax payment amount) and/or designated bank/GIRO account for their tax payment change at any time, it is the Cardmember’s sole responsibility to inform the Bank of such a change by faxing in new legible supporting documents (i.e. latest GIRO Instalment Plan) to (65) 6637 6968, and the Bank shall not be liable for losses, damages and/or costs due to the Cardmember for any such change not notified to the Bank. The Bank shall not be responsible for any losses, damages and/or costs incurred arising from any inaccuracy in the documents submitted by the Cardmember to the Bank (including but not limited to bank account details and/or other personal information). Without prejudice to the generality of the foregoing, Cardmembers must inform the Bank should there be any changes in their personal or account information, and a new application form must be submitted to the Bank for any changes to take effect. For monthly instalment payment, only the account, specified as the GIRO account, in the GIRO Instalment Plan for income tax from IRAS will be credited with funds at the end of each month. A Cardmember’s participation will be automatically terminated upon the last debiting of the monthly instalment payment amount for the corresponding income tax Year of Assessment. The funds, that are credited monthly, will be based on the instalment amount stated in the GIRO Instalment Plan submitted by the Cardmember. Each crediting of the funds shall be charged to the Cardmember’s ANZ Card account (the “Instalment Amount”) and will be treated in the same way as any other card transaction charged to such ANZ Card account. The Instalment Amount payable will be reflected in the Cardmember’s billing statement and shall be payable in accordance with the Bank’s Cardmember’s Agreement. In particular, interest and late charges will be levied on any overdue Instalment Amount as well as other overdue amounts in the ANZ Card account in accordance with the Cardmember’s Agreement. This Facility may be cancelled without further notice after unsuccessful deductions over three consecutive months have been made. Application forms, revised GIRO Instalment Plans and/or changes to a designated bank/GIRO account, that are received after the 18th of the current month will be processed for crediting of funds in the following month. Cardmembers shall be required to submit the application forms or documents by faxing the form to (65) 6637 6968 or mail to: Australia and New Zealand Banking Group Limited, Credit Card Operations Department, Tax Payment Facility Programme, 20 Pasir Panjang Road, #11-21/22/23/24 Maple Tree Business City, Singapore 117 439. A written notification given to the Bank is required should the Cardmember wish to terminate this Facility. This notification should reach the Bank before 18th of the month for the cancellation to take effect on the same month. Otherwise, the cancellation will take place the following month. In the event that IRAS is unable to deduct the Cardmember’s tax payment from the designated bank/GIRO account for any reason whatsoever, the Bank shall not be liable for any losses and/or cost of damages of any kind arising thereof. In all circumstances, it is the Cardmember’s sole responsibility to ensure that his/her tax payments to IRAS are made on time, and the Bank shall not be liable, whether to the Cardmember, IRAS or otherwise in the event such tax payment are not made on time. In the event of any dispute, the Bank’s decision shall be final. The Bank reserves the right to vary, delete or add to any of these terms and conditions at any time at its reasonable discretion. The prevailing programme details and terms will be set out in the Bank’s materials and/or website and are accurate at the time of publishing or posting online. Signature of Cardmember (As shown in our records) Campaign Code Date D D M M Y Y Y Y © Australia and New Zealand Banking Group Limited (ANZ) 2015 ABN 11 005 357 522 Item No: SGTAX010515 I R A S 2 0 1 3 G E N Postage will be paid by addressee. For posting in Singapore only. BUSINESS REPLY SERVICE PERMIT No. 06580 Australia and New Zealand Banking Group Limited Credit Card Operations Department Tax Payment Facility Programme 20 Pasir Panjang Road, Maple Tree Business City #11-21 to 24 Singapore 117439