FMC in Telefónica

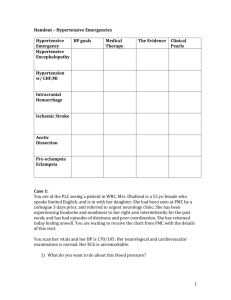

advertisement

FMC in Telefónica Many devices, many networks, one service Daniel Collico Savio Telefónica de Argentina Rio de Janeiro, November 30th, 2005 1 Messages in life “A Hail to the Thief” (Radiohead, 2004) 2 Messages in the life of operators Reinvention Increase sales ! Loyalty indicators Keep broadband churn down 2% Be a tech “first mover” Branding FMC Keep an eye in the competitors Keep ARPU high 3 Facts “70% of customers avoid paying mobile rates by using a landline” “Over 30% of mobile calls are made from the home today” “19% of customers have QoS problems with mobile coverage”. Source: Analysys, PWC, In-Stat 4 Why would you have a single Provider? Importance of Each Factor Influencing the Decision to Use a Single Provider for Fixed Voice, Internet and TV Needs Lower total cost for service Ability to have all service problems resolved with a single phone call Ability to get a faster broadband connection than I currently get Ability to have all services included in a single bill Ability to get broadband Internet access from the same provider A wider selection of options for voice-calling and television service plans Ability to get mobile/wireless telephone service from the same provider Knowing neighbors, relatives or friends who switched to the service and were happy with it Dissatisfaction with your current voice-calling or television service provider 0 10 20 30 40 50 Percent 60 70 80 90 Source: Alcatel 5 Home. Today or in ten years. Broadband IP connectivity 6 Contents FMC development Telefonica context FMC in Telefonica New handsets, new players Conclusions 7 State of the art Fixed mobile integration (FMC) is the integration of wireline and wireless networks and services. - Must include voice and data. - Regardless of underlying access technologies. - Integrating billing systems Competition is increasing everywhere - Cable, VoIP and Wi-Fi providers - Voice services become commoditized Recent advances in technology - Standard emerging and handsets improving. 8 Main drivers of FMC For a Telco Drivers ? For a Wireless operator Overcome the wireless substitution Leverage the broadband deployment Facing competition from cable and VoIP Starting to reach maturation Need new sources of revenue / new apps Some NW difficulties For Customers Quality of service Cost “Don´t bother me with technology” 9 Technology trends Provides seamless handover of calls between mobile and IP worlds UMA Approved by 3GPP (Abr 2005) GPRS, GSM, Wi-Fi, Bluetooth. Over-specified ? Developed by the 3GPP project. Enable a common IP NW between any Trends ? IMS type of carrier. No matter the access, deliver voice and multimedia via any access. CTP / SIP CTP works with Bluetooth SIP is the signaling protocol, handling IP sessions (i.e. IP telephony). 10 Battlefields Content TV- VOD 100x 0 0 Bit Rate 2M SMS x ~0 10x x x 100x ~0 100x 10x Broadband Dialup Voice Fixed Nomadic Mobility Mobile 100 K Size of the market ≈ Zero Awakening Growing Huge ! 11 UMA 1. A mobile subscriber with a UMA-enabled, dual-mode handset moves within range of an unlicensed wireless network to which the handset is allowed to connect. 2. Upon connecting, the handset contacts the UMA Network Controller (UNC) over the broadband IP access network to be authenticated and authorized to access GSM voice and GPRS data services via the unlicensed wireless network. 3. If approved, the subscriber’s current location information stored in the core network is updated, and from that point on all mobile voice and data traffic is routed to the handset via the Unlicensed Mobile Access Network (UMAN) rather than the cellular 12 radio access network (RAN). UMA 4. ROAMING: When a UMA-enabled subscriber moves outside the range of an unlicensed wireless network to which they are connected, the UNC and handset facilitate roaming back to the licensed outdoor network. This roaming process is completely transparent to the subscriber. 5. HANDOVER: If a subscriber is on an active GSM voice call or GPRS data session when they come within range (or out of range) of an unlicensed wireless network, that voice call or data session can automatically handover between access networks with no discernable service interruption. Handovers are completely transparent to 13 the subscriber. Networks Present Future 14 How it works Bluetooth BT Broadband line Wi-Fi Próximos Pasos Today Bluetooth or Broadband Wi-Fi enabled modem Tomorrow Migration to Wi-Fi phones More mobile devices Improve QoS 15 Example 1: BT Fusion BT landline rates when you are at home or office Competitive mobile bundled minutes when you are out and about Free BT Fusion Motorola v560 phone Stylish, compact flip phone design with large, vivid colour display with video and camera Free BT Hub to wireless home network 16 Example 2: France Telecom Launched June 2004 “Business everywhere” Focus in nomadic employees with laptops or PDAs Pricing €68/m including Wi-Fi and unlimited GPRS use. Home ADSL access payed by the company. « un seul contrat, une seule facture, un seul service client pour les gestionnaires et les utilisateurs » Handsets: Nokia, Motorola, Samsung, Sony Ericsson, LG, Sagem, HTC and PalmOne... 17 Contents FMC development Telefonica context FMC in Telefonica New handsets, new players Conclusions 18 Environment Regulation Resources Growth Rentability Leadership Competition Customers 19 Revenues Evolution Base 100 Dic´01 100 100 100 100 % Regulated Revenues 29% 100 2001 IPC 97,6 7171% 71 68 64 58 2002 2003 2004 2005 137,8 Nominal value 142,8 151,3 165,8 IPC-adjusted value 20 Tariff comparison Residential fixed call prices + 300 min. local (US$) Argentina Chile Brasil 7,8 México España 0,009 0,017 17,1 0,024 14,2 Perú Uruguay Fixed call price (US$/min) 19,9 0,020 0,026 13,2 14,6 0,046 25,0 0,030 21 Mobile competition Fixed and mobile evolution (lines, MM) 156% Mobile 14,7 13,3 16,4 Fixed Increase % 9% 8,1 8,4 6,4 6,9 8,1 8,2 6,7 7,6 8,5 8,5 8,6 8,8 2000 2001 2002 2003 2004 1T05 2T05 Penet Fix / Pop. (%) 22,0 22,6 21,6 21,7 22,2 22,5 22,8 Penet Fix s/ Pop. (%) 17,4 18,6 17,9 20,1 34,8 38,5 42,5 0,79 0,82 0,83 0,93 1,57 1,71 1,87 Relative Penet (M/F) 22 Cable competition Country Cable TV / house hold US Europa (avg) Spain France U.K. Argentina Cablemodem / broadband ratio 66,0% 67,6% 33,9% 23,5% 31,2% 42,6% 53,0% 24,8% 27,7% 11,0% 42,2% 39,5% 23 Customers Population Demographics (%) 50 50 Economic crash in Dec 2001 35 20 15% population migrated from “Media” to “Baja” 20 11 10 4 Marginal Baja Argentina 1996 Media 15% population migrated from “Baja” to “Marginal” Alta Argentina 2002 24 Contents FMC development Telefonica context FMC in Telefonica New handsets, new players Conclusions 25 Approach Marketing Telefónica Movistar (TEM) Technology Handsets 26 Fixed - mobile sinergy in Telefonica New business opportunities More complex develoments Quick wins 2005 Product “Speedy + Movistar” Telefonica Wireless 2006 2007-2008 CAPEX Reduction Who knows??? NW sinergy Family Talk Marketing analysis Voice VPN with FMC integration service Increasing Wholesale services to Movistar Fixed SMS service 27 Bundle Speedy + Movistar Idea • Raise broadband Speedy sales • Leverage in the activity of mobile market. • Reduce churn in both services. “More than a bundle” Concept + (w. camera) 11% Impact • 2 Months Free • 25 MB Photo sharing space • 3 months of 550 min. (fixed) 1000 minutes (mobile)l • 1000 SMS Free 10.000 9.000 • 11% growth in monthly Speedy sales. Speedy monthly sales * Aporte estimado de 3.000 altas asumiendo 3% de ventas de Speedy sobre el total de ventas de Movistar con Cámara. 28 Speedy + Movistar 29 Telefonica wireless handset Objetive Concepto • Improve “time to market” for fixed telephony new customers. • Go beyond Telefonica boundaries. • Capex reduction. •Brand-new fixed telephony service •Improve Telefonica branding via new handsets •Increase MOU. Concept + Impact • Additional 2,9 MM $ revenues (year) • Deployment times decrease. 30 FMC evolution Roadmap Full NW and services integration Convergence of applications Examples in Telefonica FMC services launch Transformation in organizational structures CAPEX Reduction / Operational issues Major broadband deployment Billing integration Focus group / Systems coordination Bundling of services 31 Contents FMC development Telefonica context FMC in Telefonica New handsets, new players Conclusions 32 More devices, new players 33 FMC handset vendors and products Manufacturer Model Technology Comments Motorola V560 Bluetooth + Wireless Launched with BT Fusion Motorola A910 Wi-Fi + Wireless LG, Samsung, Avance Phillips Planned Wi-Fi + Wireless UMA, Kineto wireless NEC N900iL Wi-Fi+FOMA Business (private Wi-Fi networks) Manufacturer Model Service Prov Approx Price UTStarcom F-1000 Vonage USD 180 Net-2com VoiceLine XJ100 Net2Phone USD 175 Nokia 9300 Zyxel Prestige 2000 Grado de Próximos Pasos USD 400 Wi-Fi + Wireless Others: Hitachi, Nokia + Avaya, Hop Onetc. USD 220 34 Contents FMC development Telefonica context FMC in Telefonica New handsets, new players Conclusions 35 The new message has strong roots Reinvention Increase sales ! Loyalty indicators Keep broadband churn down 2% Be a tech “first mover” Branding Keep an eye in the competitors Keep ARPU high FMC based on FMC Broadband IP connectivity For us, FMC may be a new message. For the customer, what’s going on is broadband IP connectivity. 36 Everything is changing Accton Technology Corp (Taiwan)+ Skype on Nov 9 announced that the handset WiFi SkyPhone WM1185-T was launched. Enables mobile Skype users all around the world to make free mobile calls to other Skype users. 16 14 12 Millions of Users Skype now: 61 MM registered users 10 8 Skype 6 Kazaa 4 ICQ Hotmail 2 0 1 2 3 4 5 6 7 8 9 10 11 Month Since Launch 12 13 14 15 16 17 18 37 A threat or an opportunity ? Fax did not kill the postal service. Email did not kill the fax IM did not kill email Skype will not kill the Telcos. Fixed-Mobile operators must - adopt these trends - consider a set of services “following” specific clients - integrate billing processes and networks - Take advantage of the consequent NW reductions Key: QoS / Pricing / Handsets HFC operators: possible loosers ? 38 Thank you! Daniel Collico Savio collicod@telefonica.com.ar Rio de Janeiro, November 30th, 2005 39