198th Annual Report 2015

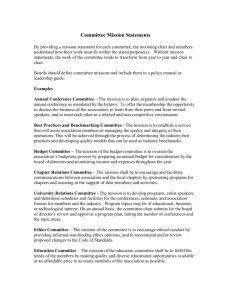

Corporate Governance

When we measure BMO’s performance, shareholder return is an important metric – but only as it reflects a more fundamental commitment to earning the trust of all stakeholders. We have a responsibility not simply to meet regulatory requirements, but to act in accordance with our stated values.

And the cornerstone of our efforts is sound corporate governance.

Our board oversees our business

Our Board of Directors provides stewardship, including direction-setting and general oversight of our management and operations. Its members have sophisticated expertise and a range of perspectives. The board approves the bank’s overall strategy and makes decisions based on

BMO’s values, emphasizing long-term performance over short-term gain.

The board operates independently of management

The Chairman of the Board and our directors, other than the Chief Executive Officer, operate independently of management. Board meetings include time for the independent directors to meet without management or non-independent directors present.

Our focus on diversity reflects our values

The board has adopted a written Board Diversity Policy to facilitate more effective governance. In so doing, the board positions itself to be made up of highly-qualified directors whose diverse backgrounds reflect the changing demographics of the markets in which we operate, the talent available with the expertise required, and the bank’s evolving customer and employee base. The Board Diversity

Policy includes the goal that each gender comprise at least one-third of the independent directors. A diverse board helps us make better decisions.

In addition, the board oversees the development of the next generation of leaders at BMO, ensuring the bank has a solid, diverse team of executives to keep BMO strong and growing in the years to come.

We compensate our directors and executives in ways that encourage good decisions

Our model for compensating directors and executives follows best practices for good governance. We use a pay-for-performance model for executives that includes clawbacks and discourages unreasonable risk-taking.

Directors and executives must own shares, in order to align their interests with those of other shareholders. We do not allow directors and employees to hedge their investments in our shares, securities or related financial instruments.

We maintain a strong focus on ethical conduct

BMO’s Code of Conduct is approved by the board and is rooted in our values of integrity, empathy, diversity and responsibility. Every year, all directors and employees are required to confirm that they have read, understood, complied with and will continue to comply with the code.

The Chief Ethics Officer is responsible for ensuring that awareness and understanding of ethical business principles are embedded in all aspects of our business, and reports on the state of ethical conduct across our organization to the

Audit and Conduct Review Committee of the board.

Our ethical culture is supported by an environment where concerns can be raised without fear of retaliation. We provide various means for raising concerns, including the ability to report them on an anonymous basis. All reports are investigated, and breaches of the code are dealt with swiftly and decisively.

Our board and management stay connected with our shareholders

We engage and inform our shareholders through our annual meeting of shareholders, annual report, management proxy circular, annual information form, sustainability report, corporate responsibility report, quarterly reports, news releases, earnings conference calls, industry conferences and other meetings. Our website provides extensive information about the board, its mandate, the board committees and their charters, and our directors.

20 BMO Financial Group 198th Annual Report 2015

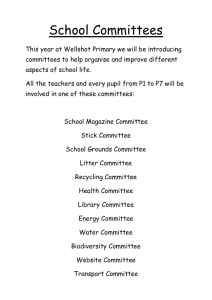

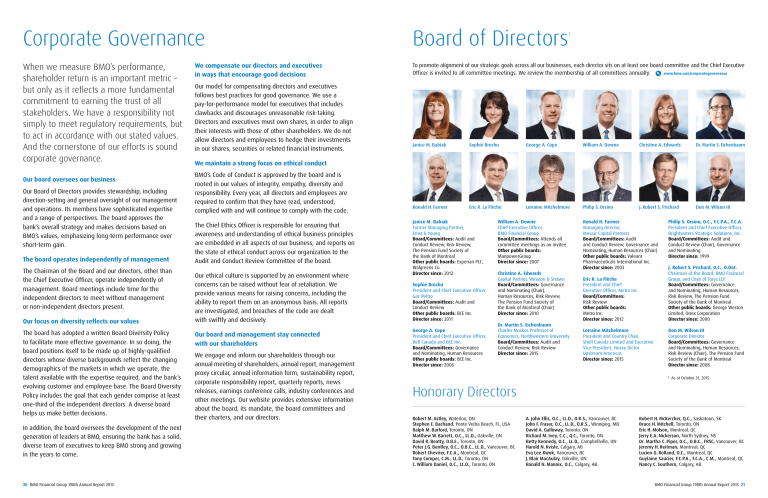

Board of Directors

1

To promote alignment of our strategic goals across all our businesses, each director sits on at least one board committee and the Chief Executive

Officer is invited to all committee meetings. We review the membership of all committees annually. www.bmo.com/corporategovernance

Janice M. Babiak Sophie Brochu George A. Cope William A. Downe Christine A. Edwards Dr. Martin S. Eichenbaum

Ronald H. Farmer Eric R. La Flèche

Janice M. Babiak

Former Managing Partner,

Ernst & Young

Board/Committees: Audit and

Conduct Review, Risk Review,

The Pension Fund Society of the Bank of Montreal

Other public boards: Experian PLC,

Walgreens Co.

Director since: 2012

Sophie Brochu

President and Chief Executive Officer,

Gaz Métro

Board/Committees: Audit and

Conduct Review

Other public boards: BCE Inc.

Director since: 2011

George A. Cope

President and Chief Executive Officer,

Bell Canada and BCE Inc.

Board/Committees: Governance and Nominating, Human Resources

Other public boards: BCE Inc.

Director since: 2006

Lorraine Mitchelmore

William A. Downe

Chief Executive Officer,

BMO Financial Group

Board/Committees: Attends all committee meetings as an invitee

Other public boards:

ManpowerGroup

Director since: 2007

Christine A. Edwards

Capital Partner, Winston & Strawn

Board/Committees: Governance and Nominating (Chair),

Human Resources, Risk Review,

The Pension Fund Society of the Bank of Montreal (Chair)

Director since: 2010

Dr. Martin S. Eichenbaum

Charles Moskos Professor of

Economics, Northwestern University

Board/Committees: Audit and

Conduct Review, Risk Review

Director since: 2015

Philip S. Orsino J. Robert S. Prichard Don M. Wilson III

Ronald H. Farmer

Managing Director,

Mosaic Capital Partners

Board/Committees: Audit and Conduct Review, Governance and

Nominating, Human Resources (Chair)

Other public boards: Valeant

Pharmaceuticals International Inc.

Director since: 2003

Eric R. La Flèche

President and Chief

Executive Officer, Metro Inc.

Board/Committees:

Risk Review

Other public boards:

Metro Inc.

Director since: 2012

Lorraine Mitchelmore

President and Country Chair,

Shell Canada Limited and Executive

Vice President, Heavy Oil for

Upstream Americas

Director since: 2015

Philip S. Orsino, O.C., F.C.P.A., F.C.A.

President and Chief Executive Officer,

Brightwaters Strategic Solutions, Inc.

Board/Committees: Audit and

Conduct Review (Chair), Governance and Nominating

Director since: 1999

J. Robert S. Prichard, O.C., O.Ont.

Chairman of the Board, BMO Financial

Group, and Chair of Torys LLP

Board/Committees: Governance and Nominating, Human Resources,

Risk Review, The Pension Fund

Society of the Bank of Montreal

Other public boards: George Weston

Limited, Onex Corporation

Director since: 2000

Don M. Wilson III

Corporate Director

Board/Committees: Governance and Nominating, Human Resources,

Risk Review (Chair), The Pension Fund

Society of the Bank of Montreal

Director since: 2008

1 As at October 31, 2015.

Honorary Directors

Robert M. Astley, Waterloo, ON

Stephen E. Bachand, Ponte Vedra Beach, FL, USA

Ralph M. Barford, Toronto, ON

Matthew W. Barrett, O.C., LL.D., Oakville, ON

David R. Beatty, O.B.E., Toronto, ON

Peter J.G. Bentley, O.C., O.B.C., LL.D., Vancouver, BC

Robert Chevrier, F.C.A., Montreal, QC

Tony Comper, C.M., LL.D., Toronto, ON

C. William Daniel, O.C., LL.D., Toronto, ON

A. John Ellis, O.C., LL.D., O.R.S., Vancouver, BC

John F. Fraser, O.C., LL.D., O.R.S., Winnipeg, MB

David A. Galloway, Toronto, ON

Richard M. Ivey, C.C., Q.C., Toronto, ON

Betty Kennedy, O.C., LL.D., Campbellville, ON

Harold N. Kvisle, Calgary, AB

Eva Lee Kwok, Vancouver, BC

J. Blair MacAulay, Oakville, ON

Ronald N. Mannix, O.C., Calgary, AB

Robert H. McKercher, Q.C., Saskatoon, SK

Bruce H. Mitchell, Toronto, ON

Eric H. Molson, Montreal, QC

Jerry E.A. Nickerson, North Sydney, NS

Dr. Martha C. Piper, O.C., O.B.C., FRSC, Vancouver, BC

Jeremy H. Reitman, Montreal, QC

Lucien G. Rolland, O.C., Montreal, QC

Guylaine Saucier, F.C.P.A., F.C.A., C.M., Montreal, QC

Nancy C. Southern, Calgary, AB

BMO Financial Group 198th Annual Report 2015 21