AC3103/AA301

ACCOUNTING ANALYSIS & EQUITY VALUATION

_________________________________________________________________________

Course Description and Scope

This course provides students with the conceptual background and analytical skills that are

necessary to identify, assess and apply information for the purposes of analysing and valuing

business activities and entities. The course employs the agency framework within a capital market

context to help students develop the necessary analysis and valuation skills.

Emphasis is placed on integrating the use of financial and non-financial information in business

valuation and analysis, involving strategy analysis, accounting analysis, financial analysis, prospective

analysis and valuation. The course allows students to understand the critical issue of determining the

specific types of information that are relevant in ex ante valuation and ex post analysis of business

entities and their activities. Students are also expected to be aware of the benefits and costs of

acquiring and using such information.

Cases and projects are used to develop and integrate the business analysis and valuation concepts.

Healthy scepticism is emphasized, as students are encouraged to challenge the assumptions and

facts related to each issue.

Course Learning Objectives

After the completion of this course, students should understand and appreciate some of the

rationales and characteristics that underlie business practices and financial reporting. Students

should also appreciate the myriad interactions among the process of business analysis and valuation,

the use of information sets (accounting and non-accounting), and the workings of the capital

markets.

Students are expected to develop important knowledge, skills and attitudes in AA301. The main

objectives are to develop students’ (1) social and interpersonal skills, (2) technical knowledge of

specific accounting standards, (3) technical knowledge of business valuation, (4) creative and critical

thinking, (5) tolerance for ambiguity in a dynamic environment, and (6) strategic thinking and

leadership capabilities in a vibrant environment.

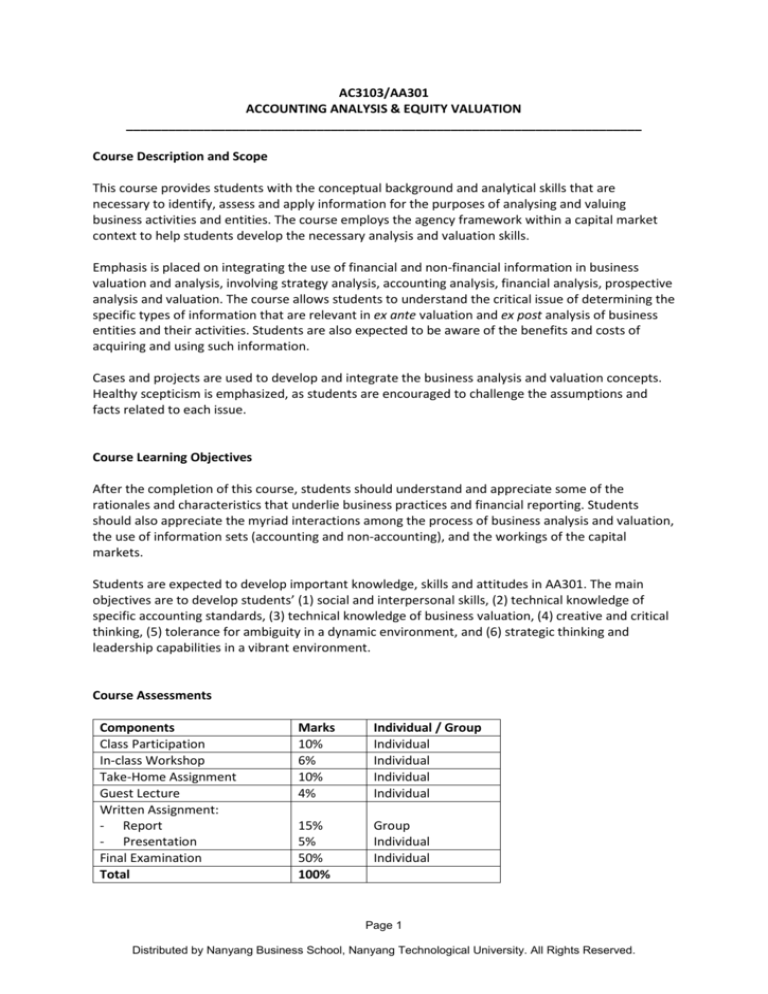

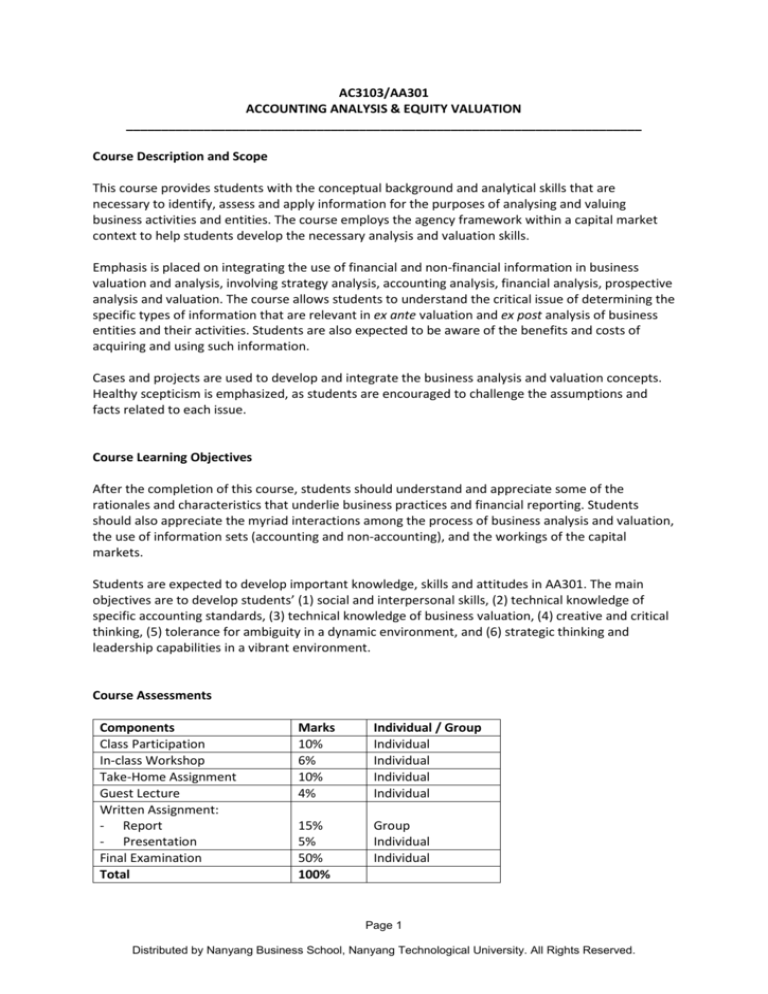

Course Assessments

Components

Class Participation

In-class Workshop

Take-Home Assignment

Guest Lecture

Written Assignment:

- Report

- Presentation

Final Examination

Total

Marks

10%

6%

10%

4%

Individual / Group

Individual

Individual

Individual

Individual

15%

5%

50%

100%

Group

Individual

Individual

Page 1

Distributed by Nanyang Business School, Nanyang Technological University. All Rights Reserved.

Textbook

PHP Palepu, Healy & Peek, Business Analysis and Valuation: IFRS Edition, Text and Cases.

2nd Edition. Cengage Learning, 2010 (Call No: HF5636.B979 2010).

Companion Website: http://www.cengage.co.uk/palepu_peek2/

Scott Financial Accounting Theory: Readings for Business Valuation and Analysis (customized

Pearson Prentice Hall text)

This customized Pearson Prentice Hall text is adapted from: Scott, Financial Accounting Theory. 6th

Edition Pearson Prentice Hall, 2011 (Call No: HF5636.S36 2011)

Proposed Weekly Schedule

Week

1

2

3

4

5

6

7

8

9

10

11

12

13

Topic

Course Introduction

Information Perspective on Accounting Information

Information Perspective on Accounting Information

Measurement Perspective on Accounting Information

The Business Analysis and Valuation Process

Accounting Analysis

Accounting Analysis

Accounting Analysis

Accounting Analysis

Recess Week

Financial Analysis

Prospective Analysis: Valuation Theory and Models

Prospective Analysis: Forecasting

Business Analysis and Valuation

Corporate Communication and Corporate Governance

Corporate Social Responsibility

Corporate Communication and Corporate Governance

Written Assignment

Presentations

Written Assignment

Presentations

Page 2

Distributed by Nanyang Business School, Nanyang Technological University. All Rights Reserved.