SET At-A-Glance (Seller)

advertisement

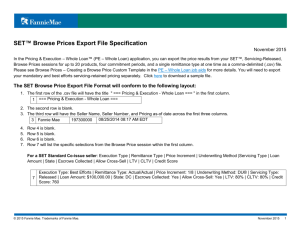

SERVICING EXECUTION TOOL AT A GLANCE Your complete solution for whole loan, concurrent servicing sales to Fannie Mae The Servicing Execution Tool™ (SET™), available via Fannie Mae’s whole loan committing application, offers sellers upfront loan-level pricing and all-in funding for the purchase of the loan and servicing asset at the same time. SET provides an easy and efficient way for servicers to compete for your business through an auction platform. SET utilizes a standardized servicing Purchase and Sale Agreement (PSA) which eliminates the need to manage individual agreements with each participating servicer. WITH FANNIE MAE’S ONE-STOP, SERVICING-RELEASED WHOLE LOAN TRANSACTION, YOU GET… Competitive and comprehensive up-front pricing of your loan and servicing assets o Fannie Mae’s whole loan price* + servicing-released premium (SRP) All-in funding within 48-hours of Fannie Mae good delivery o Includes the whole loan price, SRP, servicer’s fees and escrow transfers Access to multiple servicers competing for your business without separate contracts o Single Purchase and Sale Agreement (PSA) within the Selling Guide Pricing and committing on a loan-by-loan basis o Best efforts and mandatory executions available *If applicable, loan-level price adjustments (LLPAs) and the adverse market delivery charge (AMDC) will be subtracted from the pass-through price payable by Fannie Mae at time of loan purchase. D ID Y OU K NOW ? Committing on a loan-level basis through Pricing & Execution™ - PE Whole Loan provides flexibility and efficiency. You can: Change the product, rates and commitment amount without fees Pull in your loan information directly from Desktop Underwriter® Decide at time of commitment to either retain or sell your servicing G ETTING S TARTED To learn more about SET, visit the Single Family business portal on FannieMae.com or contact your Fannie Mae Account Manager. © 2015 Fannie Mae. Trademarks of Fannie Mae. November 2015 1