Managing currency exposure in

Australian superannuation funds

with Pete Gunning

Chief Executive Officer Asia-Pacific , Russell Investments

This Q&A summarises

the key areas of currency

management, including:

»» How volatile is the

Australian dollar?

»» Does currency add

uncertainty to portfolio

outcomes?

»» How have approaches

to currency

management changed

over time?

»» Is there an optimal

hedge ratio for all

investors?

»» What makes the

Australia dollar different

to other currencies?

»» Does hedging mean less

risk?

»» Why care

about currency

implementation?

»» What are the risks in

implementing currency

exposures?

We also share a case

study based on our

experience in managing

currency exposure

actively in Russell’s multiasset funds in Australia.

Australian superannuation funds are investing

more and more assets globally in the wake of

the Global Financial Crisis, introducing greater

potential currency exposure to portfolios.

ASFA recently invited Pete to share Russell’s insights and

experience in managing currency exposures, particularly from

the perspective of an Australian superannuation fund.

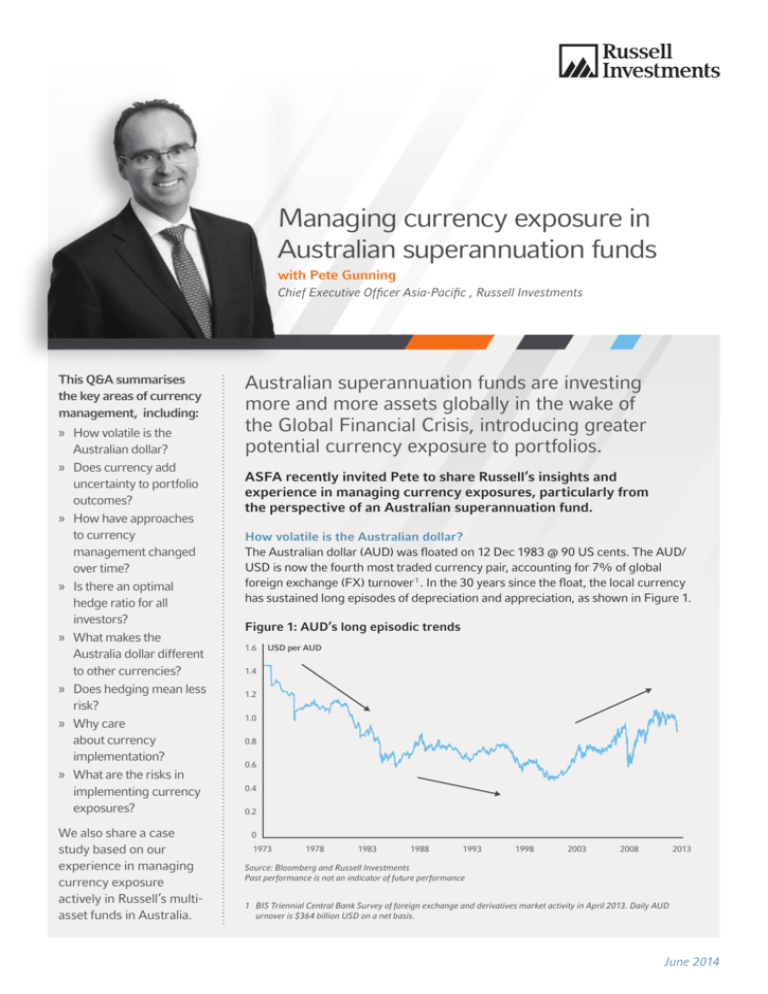

How volatile is the Australian dollar?

The Australian dollar (AUD) was floated on 12 Dec 1983 @ 90 US cents. The AUD/

USD is now the fourth most traded currency pair, accounting for 7% of global

foreign exchange (FX) turnover 1 . In the 30 years since the float, the local currency

has sustained long episodes of depreciation and appreciation, as shown in Figure 1.

Figure 1: AUD’s long episodic trends

1.6

USD per AUD

1.4

1.2

1.0

0.8

0.6

0.4

0.2

0

1973

1978

1983

1988

1993

1998

2003

2008

2013

Source: Bloomberg and Russell Investments

Past performance is not an indicator of future performance

1 BIS Triennial Central Bank Survey of foreign exchange and derivatives market activity in April 2013. Daily AUD

urnover is $364 billion USD on a net basis.

June 2014

Managing currency exposure in Australian superannuation funds

“Over this period,

the trading range

for the Australian

dollar has been

extremely wide”.

Figure 2: AUD vs Purchasing Power Parity

1.10

Rolling 10-year standard deviations

1.00

0.90

0.80

0.70

0.60

0.50

AUD/USD –

PPP estimate –

1 Std Dev Away --2 Std Dev Away – –

0.40

1986

1990

1994

1998

2002

2006

2010

2014

Source: Datastream, Russell Investments

Over this period, the trading range for the

Australian dollar has been extremely wide.

Based on Russell’s estimate of Purchasing

Power Parity (PPP) 2, the Australian dollar has

traded more than two standard deviations

away from PPP (or fair value), reaching as

low as 47.7 US cents in 2001 and as high

as USD110.8 in 2011, as shown in Figure 2.

The dollar has also experienced short term

volatility, plunging more than 15% in the

months after Paul Keating’s ‘Banana Republic’

comments 3 and falling more than 30% in mid

2008 during the Global Financial Crisis.

Figure 3: Five year rolling standard deviation of different currency pairs (annualised)

18

5 year rolling annualised currency volatility

16

14

12

2 Russell’s PPP estimate

provides a useful medium

to long-term reference point

about the likely direction of

currency going forward. It

is not designed as a short

term timing tool. The PPP

estimate is based on the

monetary theory of exchange

rates and measures how

much the AUD buys relative

to other currencies (in this

example, the USD, by taking

into account relative inflation

differentials).

3 “If this Government cannot

get the adjustment, get

manufacturing going again…

and a sensible economic

policy, then Australia is

basically done for. We

will end up being a third

rate economy... a banana

republic. “

Paul Keating on national

radio 14 May 1986

2

10

8

6

4

2

0

01 Jan 2004 01 Jan 2005 01 Jan 2006 01 Jan 2007 01 Jan 2008 01 Jan 2009 01 Jan 2010 01 Jan 2011 01 Jan 2012 01 Jan 2013 01 Jan 2014

– EUR/JPY – NZD/USD – AUD/USD – GBP/JPY – USD/CHF – EUR/USD – USD/CAD – JPY/USD – GBP/USD – EUR/GBP – EUR/CHF

Source: Reserve Bank of Australia, Datastream

Figure 3 illustrates how much more volatile

the AUD/USD is compared to other major

currency pairs and therefore highlights, from

a pure volatility standpoint, the extra attention

Australian investors need to take when

investing overseas.

June 2014

Managing currency exposure in Australian superannuation funds

“The final portfolio

outcome depends

on the relative

direction and size

of the offshore

asset and currency

movements.”

Does currency add uncertainty to

portfolio outcomes?

Although everyone seems to have an

opinion on whether the Australian dollar

is currently over or under valued, 80% of

super funds recently surveyed believe noone is able to accurately predict the value of

the currency over the next 12 months 4 .

One thing that is agreed on - currency

injects further uncertainty to global

investments 5. The final portfolio outcome

depends on the relative direction and size of

the offshore asset and currency movements

(Refer to Figure 1 which shows that these

moves can be large and prolonged).

There are generally four types of scenarios

from an Australian investor’s perspective

as illustrated in Figure 4. For simplicity,

this illustration focuses on the AUD/USD

currency pair and uses the U.S. stock

market as the offshore asset:

1. If the USD appreciates (AUD

depreciates), and the US equity market

rises, the effect is a ‘double bonus’ as

both the underlying equity investment

and the value of the USD portfolio when

translated back to AUD have increased.

2. If the USD depreciates (AUD

appreciates), and the US equity market

falls, the effect is a ‘double whammy’ as

both the underlying equity investment

and value of portfolio when translated

back to AUD have decreased.

3. If the USD appreciates, but the US

equity market falls, the net effect

depends on the relative size of the

movements. If the currency gains are

larger (smaller) than the equity decline,

the net impact is positive (negative).

4. If the USD depreciates, but the US

equity market rises, the net effect

depends on the relative size of the

movements. If the equity gains are larger

(smaller) than the currency loss, the net

impact is positive (negative).

Value of Foreign Currency

Figure 4: Four scenarios for final portfolio outcomes

UP

DOWN

DOWN

UP

Stock Market Return

Hedging currency exposure can remove the impact of

uncertain currency movements on global investments,

leaving the underlying asset as the source of uncertainty

on portfolio outcomes.

4 NAB FX Superannuation

survey 2013

5 Especially when considering

a volatile home currency.

3

June 2014

Managing currency exposure in Australian superannuation funds

How has currency been managed historically?

Foreign Currency Exposure (%)

High

Figure 5: Evolution in approach to currency management over time

Consider hedging

(Minimise regret)

Even small

exposures result in

uncompensated

risk. Low cost of

hedging suggests

beneficial to

manage currency

risk

Do not hedge

(Unnecessary)

15%

Do not hedge

Low

“Even small

(currency)

exposures result

in uncompensated

risk.”

(Not material)

Short

Evaluation horizon

Long

For illustrative purposes only

Historically, the commonly used decision making framework for hedging or not has

primarily focused on the investor’s time horizon and amount of foreign exposure:

6 We expect the amount of

foreign exposure to continue

to increase in future due

to diversification and

globalisation. The Australian

share market accounts for

only 2.9% of the global

market (based on MSCI All

Country World Index as at

28 February 2014). Further,

we expect there will be an

increasing need to invest

offshore to keep up with the

Australian superannuation

industry’s growth. For

example, the Australian share

market is currently slightly

smaller than the Australian

superannuation industry

($1.5 trillion vs 1.8 trillion as

at 28 February 2014 based

on ASX and ASFA data), but

superannuation assets are

projected to grow at a much

higher rate going forward

relative to the domestic share

market.

4

»» T

ime horizon.

As a general rule, the longer the

investor’s time horizon, the less reason

for hedging as it was argued that

currency movements ‘wash out’ in the

long run. Investors with shorter time

horizons were encouraged to consider

hedging to minimise regret, or the risk of

being ‘wrong’ in hindsight. Based on this

principle, investors commonly hedged

50% of their global equities allocations,

because if the AUD depreciates, the

regret is that investors should have

been 0% hedged, while if the AUD

appreciates, the regret would be that

investors should have been 100%

hedged. Thus a 50% strategic hedge

ratio minimises the deviation from either

extreme without the benefit of hindsight.

»» A

mount of foreign exposure 6.

If the % exposure to foreign assets was

small (e.g. below 15%), many investors

did not hedge as the exposure was

deemed immaterial, as shown In Figure 5.

However, increasingly, even small

exposures are now managed (passively or

actively hedged), as investors recognise

the potentially large impact of volatile

currency movements especially in the

short term; where investors are highly

sensitive to peer risk and regret risk;

and where, in a low return environment,

potential additional return sources are in

demand.

June 2014

Managing currency exposure in Australian superannuation funds

“What is the

end goal of the

investor? Are they

seeking to achieve

an absolute level

of return, a return

above inflation,

or peer relative

measures?”

Is there an optimal recommended hedge ratio for all investors?

Russell believes the appropriate hedge ratio for each investor depends on the

investor’s specific circumstances:

1. Investor objectives.

What is the end goal of the investor?

Are they seeking to achieve an absolute

level of return, a return above inflation,

or peer relative measures? A more active

currency management approach will

help contribute to absolute return and

inflation targets, while peer-sensitive

objectives may be supported by a

passive hedge closely tracking peer

hedging levels. Do they have foreign

currency liabilities (e.g. overseas

holidays or other retirement plans

involving offshore purchases)?

2. Time horizon.

As discussed in the previous section,

all else being equal, the shorter the

investor’s time horizon, the more

investors should consider hedging to

manage the impact of potentially large

and adverse currency movements on

their portfolios.

3. Risk budget and tolerance.

Can the investor tolerate a significant

decrease in the value of their assets if

currencies move adversely? Do they

prefer to spend their risk budget on

other fundamental return sources,

e.g. equity risk premium, term, credit,

illiquidity?

4.Liabilities.

Which currency (or currencies) are the

investor’s liabilities denominated in? If

their liabilities are denominated primarily

in Australian dollars, they may want

to fully hedge all currency exposures

in their asset portfolios to match the

currency exposure for their assets and

liabilities and vice versa (e.g. overseas

travel and imports in retirement).

5. Investor beliefs.

What are the investor’s beliefs about

currency as a source of value-add

and diversification? Do they believe

the Australian dollar persistently

outperforms the interest rate

differential 7 ?

6. Peer risk and regret.

How sensitive is the investor to peer

risk? For example, competitive pressures

on public offer super funds, where

members compare short term results in

league tables, may influence the hedge

ratio decision and limit the deviation

from the peer median. Similarly, what

is the tolerance for regret risk from

decision makers?

7 The Forward Rate Bias

hypothesis expect currencies

of higher yielding countries

(AUD, NZD, MXN, BRL) to

systematically experience

less depreciation than the

interest rate differential

implies. See next section for

details.

5

June 2014

Managing currency exposure in Australian superannuation funds

“The implications

.. is that the

correlation patterns

between currency

and underlying

asset markets

assumed for

other ‘defensive’

base currencies,

e.g. USD do not

necessarily apply

from an Australian

perspective.”

What makes the Australian dollar different from other currencies?

The Australian dollar (AUD) is a “risk on”

play. Due to Australia’s historical reliance

on mining and resources, the domestic

currency has been highly correlated to

commodity prices, emerging markets and

global growth in general. Historically, the

AUD has been susceptible to large shocks

in the terms of trade due to volatility in

global demand and prices of commodities

(Australia’s exports).

30-40 year period to 31/3/2014 as shown in

Figure 6. However, it isn’t clear whether this

is episodic and time varying (due to where

we are in the market cycle) or a permanent

feature.

The implications for portfolio management

is that the correlation patterns between

currency and underlying asset markets

assumed for other ‘defensive’ base

currencies, e.g. USD, do not necessarily

apply from an Australian perspective.

Furthermore, the AUD/USD currency

pair tends to be a popular carry trade due

to historical persistence of interest rate

differentials.

The potential future outperformance of the

AUD due to the FRB may also cloud the

hedging decision for an Australian investor.

The Forward Rate Bias (FRB) hypothesis

expects currencies of high yielding

countries (e.g. AUD, NZD, MXN, BRL) to

systematically experience less depreciation

than interest rate differentials imply, i.e.

outperform. In Australia, there is some

empirical evidence of the FRB over the last

Figure 6: AUD/USD outperformance (annualised forward rate bias)

3%

Annualised Forward Rate Bias, AUD vs. USD

2%

1%

0%

-1%

-2%

-3%

-4%

-5%

-6%

-7%

1983

1985

1987

1989

1991

1993

1995

1997

1999

2001

2003

2005

2007

2009

2011

2013

Source: Datastream, Russell Investments

6

June 2014

Managing currency exposure in Australian superannuation funds

“Russell believes

that currency

exposure should be

considered at the

total portfolio level,

encompassing

all global asset

class exposures,

including

emerging markets,

commodities and

unlisted alternative

investments...”

Does hedging mean less risk?

Figure 7: Five year rolling standard deviation (annualised): hedged vs unhedged

24%

– Unhedged – Hedged

21%

18%

15%

12%

9%

6%

1987

1989

1991

1993

1995

1997

1999

2001

2003

2005

2007

2009

2011

2013

Source: Datastream

From an AUD investor perspective hedging

does not necessarily reduce risk. The

answer is time and environment dependent.

In the 1990s, unhedged global equities

returns exhibited higher standard deviation

than the equivalent hedged series, but this

switched in the last two decades as shown

in Figure 7. The net result is a function of the

changing correlations between the currency

and underlying equity market movement.

For the last two decades, the AUD has

primarily been a ‘risk on’ play. When

global equities markets rallied, the AUD

appreciated, decreasing the value of the

global investment in AUD terms. Conversely,

when global markets fell (‘risk off’), the

AUD depreciated, increasing the value of

the global investment in AUD terms. In

both cases, the opposing direction of the

currency and asset movements serves to

dampen the volatility of unhedged returns

when translated back to AUD, leading to the

somewhat surprising result that the volatility

of hedged returns can, in some cases,

be higher than the volatility of unhedged

returns.

7

The result also depends on what measure of

risk is used. Is risk the simple sum of asset

risk and currency risk? Is risk measured as

portfolio standard deviation, peer relative or

liability relative deviations? Is risk measured

at the asset class level or at the total

portfolio level?

Russell believes that currency exposure

should be considered at the total portfolio

level, encompassing all global asset class

exposures, including emerging markets,

commodities and unlisted alternative

investments, as well as traditional global

equities and global fixed interest. Taking

a holistic view of the currency exposure

for the aggregate portfolio helps identify

the net currency positions that the fund is

exposed to (and allows for potential netting

of currency transactions).

June 2014

Managing currency exposure in Australian superannuation funds

“The choice of

approach depends

on whether

investors are

primarily seeking

to manage the

uncertainty

around currency

exposures, use

currency as a

diversifier and

additional source

of return, or a

combination

of both.”

How can investors manage the impact (and/or take advantage) of currency movements?

There are a number of ways to manage

the currency exposures in investment

portfolios: 8

1. Appoint a currency overlay manager to

implement a passive hedge ratio across

your total overseas exposure

2. Actively adjusting the hedge ratio at

pre defined market levels, e.g. using a

disciplined strategic tilting process or

delegating this to an overlay manager

3. Gain passive exposure to currency

indices 9

4. Employ specialist active currency

managers to add value over passive

currency indices

The choice of approach depends on whether

investors are primarily seeking to manage

the uncertainty around currency exposures

(#1), or use currency as a diversifier and

additional source of return (#3 & #4) or a

combination of both (#2). These approaches

can be implemented by:

»» superannuation funds themselves if

there are sufficient resources available to

implement currency decisions;

»» a third-party agency or manager can

implement the currency exposures; or

»» a provider, as part of a total outsourced

solution.

8 In addition to simply using

a defined split of hedged or

un‑hedged share classes

within a pooled fund

structure.

9 Currency indices attempt

to capture the systematic

risk premiums (currency

beta) potentially available

in currency investing. The

indices also enable investors

to distinguish between the

risk/return produced with and

without active management

insight (i.e. separate ‑alpha

and beta).

8

June 2014

Managing currency exposure in Australian superannuation funds

Case study of active currency management

In Russell’s experience, currency movements can

be rapid, volatile and large; currencies tend to follow

trends for long periods of time, only to change

course without much warning. This is why Russell

follows a disciplined and rigorous process to identify

unsustainable market extremes – determining

candidates for tilting, as well as assessing the

triggers for entering/exiting a position.

We have actively managed the currency exposures

in Russell’s multi-asset funds in Australia since

2008, by dynamically adjusting (or tilting) the

hedge ratio, with 50% being the default strategic

position. Figure 8 shows how the currency

exposure has been actively managed over time

in the last 12 months for the Russell Pooled

Superannuation Trust – Balanced Opportunities

Option, based on Russell’s portfolio manager

insights and strategist views.

Factors contributing to our active currency

management include:

»» speculation and official announcements

surrounding the Fed tapering;

»» the Reserve Bank of Australia’s stance on

interest rates and the state of the local economy;

»» market sentiment;

»» outlook for carry trades.

Actively managing the portfolio’s currency

exposure added 1.4% to excess returns during the

calendar year 2013 (on a gross basis).

Figure 8: Example of active currency exposures over time

Hedge Ratio

AUD/USD Spot

1.06

90%

1.04

80%

1.02

70%

1.00

60%

0.98

50%

0.96

40%

0.94

30%

0.92

20%

0.90

10%

0.88

0%

0.86

5 Apr 13

12 Apr 13

19 Apr 13

26 Apr 13

3 May 13

10 May 13

17 May 13

24 May 13

31 May 13

7 Jun 13

14 Jun 13

21 Jun 13

28 Jun 13

5 Jul 13

12 Jul 13

19 Jul 13

26 Jul 13

2 Aug 13

9 Aug 13

16 Aug 13

23 Aug 13

30 Aug 13

6 Sep 13

13 Sep 13

20 Sep 13

27 Sep 13

4 Oct 13

11 Oct 13

18 Oct 13

25 Oct 13

1 Nov 13

8 Nov 13

15 Nov 13

22 Nov 13

29 Nov 13

6 Dec 13

13 Dec 13

20 Dec 13

27 Dec 13

3 Jan 14

10 Jan 14

17 Jan 14

24 Jan 14

31 Jan 14

6 Feb 14

14 Feb 14

21 Feb 14

28 Feb 14

100%

Unhedged

Hedged

AUD/USD Spot Price

For illustrative purposes only - Russell Pooled Superannuation Trust – Russell Balanced Opportunities Option

9

June 2014

Managing currency exposure in Australian superannuation funds

“In relative

terms, there is a

larger range of

costs incurred

for currency

transactions

than many other

investment

activities...”

Why care about currency implementation?

Once the hedge ratio is defined, and a

tilting governance structure is established

(where applicable), the currency exposure

needs to be actually implemented, e.g. an

agency or third-party manager needs to be

instructed to buy and sell the appropriate

equity futures and manage this exposure

going forward. This can be implemented

through a hedged commingled fund or a

currency hedging overlay program, which

encompasses all overseas exposures in

one portfolio rather than each asset class

individually.

Based on Russell’s experience in

transacting currency, the following data

illustrates further how foreign exchange

costs can vary widely across providers:

»» Inattention to FX transactions can be

costly, with the difference between

providers ranging by over 20 basis points

of the portfolio value.

»» Russell’s FX trading service can reduce

those costs, sometimes by more than

75%, through netting and matching, and

select counterparty trading

Figure 9 compares the relative costs of

different investment activities, as well

as demonstrating the range of different

outcomes from different providers. Foreign

exchange can have a significant impact on

the overall costs for an investment portfolio.

In relative terms, there is a larger range of

costs incurred for currency transactions

than many other investment activities (after

equity trading).

»» The average manager / fund paid 9.7

basis ponits in trading costs from 20092012. Russell’s costs were 90% lower

than the average.

Figure 9: Comparison of different costs for different investment activities

n 25% of funds with lowest charges

n Median of all funds

n 25% of funds with highest charges

122.1

43.9

26.6

10.5

Investment management

32.0

18.5

10.9

36.7

5.7

Administration

4.3

Equity trading

14.4

1.8

Foreign exchange

3.2

1.5

0.5

Custody

Source: John Authers, “The Pension Gap”, Financial Times, page 7, 28 May 2103.

10

June 2014

Managing currency exposure in Australian superannuation funds

“... it is important

to ensure that

the manager

or institution

conducting foreign

exchange trades...

is the best agent to

conduct the role...”

What are the risks in implementing currency exposures?

In addition to costs, there are risks involved

in implementing currency exposures

and transactions which also need to be

managed:

»» Operational risk

Trading processes without transparency

and oversight can incur human

errors, leading to misunderstandings

and miscalculations.

»» Counterparty and settlement risk

Trading counterparties might not be able

to fulfil their obligations after a trade is

made. Furthermore, headline risk means

negative news about a counterparty can

rapidly affect other parties’ willingness to

trade.

»» Avoid fraud and unnecessary expenses

Recent negative publicity has increased

awareness and transparency on

implementation issues such as fixing,

collusion, manipulation and high

charges.

Russell believes industry best practice to

manage these risks is achieved through:

»» Transparency and accountability

in trading and reporting

Every trade is timestamped to track

information on each trade. There is full

disclosure/fully visible commission on

services after netting transactions.

»» Improved governance helps prevent

counterparty and settlement risks

This includes having a strong,

independent credit team to review,

approve and monitor all counterparties;

centralised trading; consideration of

multiple counterparties to ensure bids

are competitive; reducing the operational

workload and risks associated with FX

trade settlement (e.g. using Continuous

Linked Settlement – the industry program

for eliminating settlement risks in FX

transactions).

»» T

he agency model

Acting as agent rather than principal

helps ensure interests are always

aligned with the client’s and the agent is

incentivised to find the best execution/

terms for every FX trade. This helps

achieve lower currency transaction costs

and more holistic risk oversight.

It is important to ensure that the manager

or institution conducting foreign exchange

trades on your behalf is the best agent to

conduct the role, in the same way a “best of

breed” equities manager is selected.

CONCLUSION

Investing globally incurs currency risk. Russell believes currency exposures

need to be managed at the total portfolio level. Russell recommends investors

first determine the most appropriate long-term strategic currency approach,

and then consider active management to take advantage of opportunities and

manage risks as they emerge. Finally, investors should implement currency

exposures carefully to avoid cost leakage.

11

June 2014

Managing currency exposure in Australian superannuation funds

Russell Investments

At Russell Investments,

we believe all investors

require a rate of return –

at a level of risk they can

accept and commit to for

the long term.

We’re a global asset

manager with a unique set

of capabilities essential

to managing your total

portfolio and to meeting

your desired outcome.

We integrate these

capabilities to give all our

clients what we believe is

the highest probability of

reaching their goals.

Capital Markets Insights

Our capital markets insights help determine the exposures

your portfolio needs to best achieve your goals.

Portfolio Construction

We believe you need world-class capabilities in strategic

asset allocation.

Manager Research & Indexes

We achieve those exposures through best-of-breed active

managers and customised smart beta or passive exposures.

CAPITAL MARKETS

INSIGHTS

MANAGER

RESEARCH

INDEXES

PORTFOLIO

IMPLEMENTATION

PORTFOLIO

CONSTRUCTION

Portfolio Implementation

To keep your portfolio on track requires a purpose-built,

trading capability in which the broker’s objectives are

aligned with yours. Russell has traded more $500 billion in

currency transactions in 2013. Russell has been recognized

by aiCIO as a leader in foreign exchange, winning the 2011

Industry innovation award winner – Foreign Exchange.10

Russell helps clients manage foreign exchange trading costs

and risks in international portfolios by:

»» Executing foreign exchange trades as a pure agent, not a

principal, providing transparent execution

»» Developing strategies to hedge currency risk through

passive currency overlays & FX exposure management

For more information, please contact:

Dan Birch

Senior Business Development Manager

Russell Investments

+61 2 9229 5170

dbirch@russell.com

»» Analysing foreign exchange trades to assess costs and

identify effective solutions. Russell’s transactions cost

analysis can recommend more stream-lined, straight

forward solutions to reduce costs and risks.

10 No awards were given out in 2012 or 2013.

Issued by Russell Investment Management Ltd ABN 53 068 338 974, AFS Licence 247185. This document provides general information for wholesale investors only and has not been prepared

having regard to your objectives, financial situation or needs. Before making an investment decision, you need to consider whether this information is appropriate to your objectives, financial

situation and needs. This information has been compiled from sources considered to be reliable, but is not guaranteed. Past performance is not a reliable indicator of future performance.

Returns are gross of fees and expenses. Any potential investor should consider the latest Product Disclosure Statement (PDS) in deciding whether to acquire, or to continue to hold, an

investment in any Russell product. The PDS can be obtained by visiting www.russell.com.au or by phoning (02) 9229 5111. RIM is part of Russell Investments (Russell). Russell or its associates,

officers or employees may have interests in the financial products referred to in this information by acting in various roles including broker or adviser, and may receive fees, brokerage or

commissions for acting in these capacities. In addition, Russell or its associates, officers or employees may buy or sell the financial products as principal or agent. Copyright © 2014 Russell

Investments. All rights reserved. This material is proprietary and may not be reproduced, transferred, or distributed in any form without prior written permission from Russell Investments.

April 2014

R_MKT_QA_Currency_V1FF_1404