Bencherif Akram

advertisement

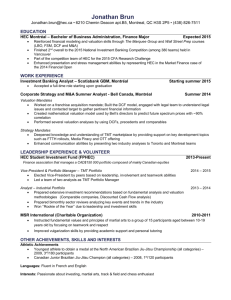

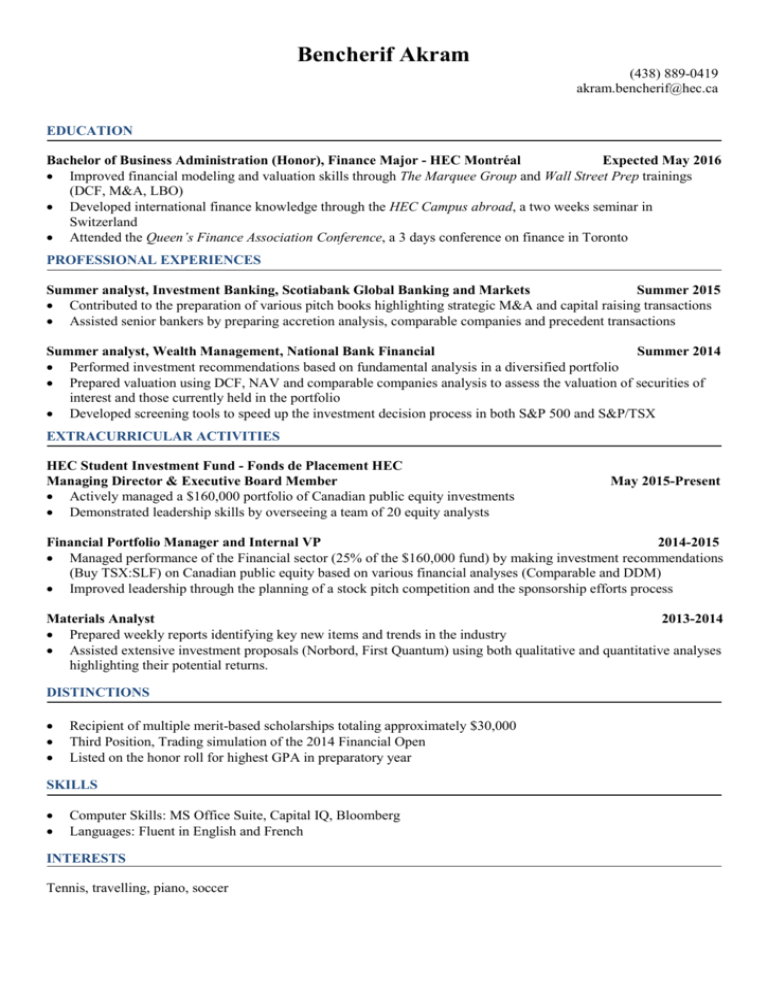

Bencherif Akram (438) 889-0419 akram.bencherif@hec.ca EDUCATION Bachelor of Business Administration (Honor), Finance Major - HEC Montréal Expected May 2016 Improved financial modeling and valuation skills through The Marquee Group and Wall Street Prep trainings (DCF, M&A, LBO) Developed international finance knowledge through the HEC Campus abroad, a two weeks seminar in Switzerland Attended the Queen’s Finance Association Conference, a 3 days conference on finance in Toronto PROFESSIONAL EXPERIENCES Summer analyst, Investment Banking, Scotiabank Global Banking and Markets Summer 2015 Contributed to the preparation of various pitch books highlighting strategic M&A and capital raising transactions Assisted senior bankers by preparing accretion analysis, comparable companies and precedent transactions Summer analyst, Wealth Management, National Bank Financial Summer 2014 Performed investment recommendations based on fundamental analysis in a diversified portfolio Prepared valuation using DCF, NAV and comparable companies analysis to assess the valuation of securities of interest and those currently held in the portfolio Developed screening tools to speed up the investment decision process in both S&P 500 and S&P/TSX EXTRACURRICULAR ACTIVITIES HEC Student Investment Fund - Fonds de Placement HEC Managing Director & Executive Board Member Actively managed a $160,000 portfolio of Canadian public equity investments Demonstrated leadership skills by overseeing a team of 20 equity analysts May 2015-Present Financial Portfolio Manager and Internal VP 2014-2015 Managed performance of the Financial sector (25% of the $160,000 fund) by making investment recommendations (Buy TSX:SLF) on Canadian public equity based on various financial analyses (Comparable and DDM) Improved leadership through the planning of a stock pitch competition and the sponsorship efforts process Materials Analyst 2013-2014 Prepared weekly reports identifying key new items and trends in the industry Assisted extensive investment proposals (Norbord, First Quantum) using both qualitative and quantitative analyses highlighting their potential returns. DISTINCTIONS Recipient of multiple merit-based scholarships totaling approximately $30,000 Third Position, Trading simulation of the 2014 Financial Open Listed on the honor roll for highest GPA in preparatory year SKILLS Computer Skills: MS Office Suite, Capital IQ, Bloomberg Languages: Fluent in English and French INTERESTS Tennis, travelling, piano, soccer