CLEAR CHANNEL CAPITAL I, LLC

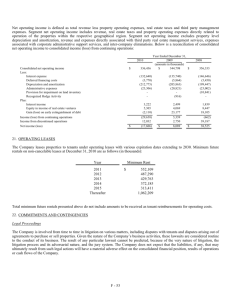

advertisement