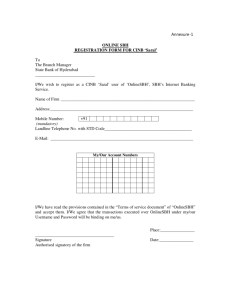

State Bank Of India

advertisement

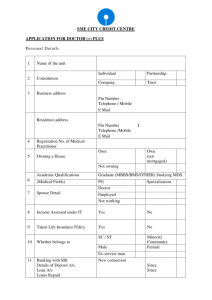

India’s Top Banks 2008 State Bank of Hyderabad Office: Gunfoundry, Hyderabad - 500001, Andhra Pradesh Tel: 91 40 23387713/7261 Fax: 91 40 23387819 Email: sbhgmpnd@sbhyd.co.in Website: www.sbhyd.com About the Bank State Bank of Hyderabad (SBH) was formed as Hyderabad State Bank on Aug 8, 1941. In 1953, the bank took over the assets of Hyderabad Mercantile Bank Ltd. In the year 1956, RBI took over the bank as its first subsidiary and changed its name to SBH. In 1959, SBH became a subsidiary of State Bank of India. SBH offers corporate, retail and agriculture credit to its customers. In FY07, SBH issued a total of 38,350 Laghu Udhyami credit cards, 2,587 units were financed under the Finbowl Trade Scheme and 1,481 units were financed under the SME Smart Score Scheme. In FY07, the bank issued 1,31,003 kisan credit cards taking the number to 6,08,477. Under the retail segment, the bank has extended its housing loan to 65,048 borrowers and provided 7,771 new education loans to students at the end of Mar 2007. The bank has also introduced a few new products designed to meet the credit needs of its customers which includes; Speed Remittance Product, Xpress Money Product, SBI Vishwa Yatra Foreign Travel Card (FTC), SBH 500, SNH 60, Mahila Shakti and Career Planner. D&B D-U-N-S® No - 65-067-5630 BALANCE SHEET (Rs mn) Liabilities Capital Reserves & Surplus Deposits Borrowings Other liabilities & provisions Total Liabilities 172 25236 415027 3934 46154 490523 PROFIT & LOSS (Rs mn) Expenditure Interest expended 21345 Operating Expenses 8085 Provision - NPAs 460 Others 4523 Total Expenses 34413 as on 31st Mar 2007 Assets Cash & Balance with RBI# 28721 Other Bank Balances* 16909 Investments 139192 Advances 281093 Fixed Assets 2422 Other Assets 22186 Total Assets 490523 During the year FY07 Income Interest Earned Other Income Total Income Net Profit / Loss KEY RATIOS KEY RATIOS Efficiency (%) Credit Deposit Ratio Cash Deposit Ratio Investment Deposit Ratio Term Loan/Total Adv Net NPAs/Net Adv Term Dep/Total Dep Strength (%) CAR Tier I CAR Tier II Growth (%) Deposits Advances Business (Deposits+Advances) 67.73 6.92 33.54 59.86 0.22 68.62 21.98 34.73 26.83 34894 4575 39469 5055 8.25 4.26 Profitability (%) Return on Assets Return on Equity Net Interest Margin/ Total Assets 1.14 21.72 3.02 Productivity (Rs mn) Business Per Employee Net Profit Per Employee 47.36 0.39 #Includes cash in hand available with banks and balances with RBI * Includes balances with other banks within India & outside India and money at call & short notices RANKING: All Banks Total Income Net Profit Assets Branches 22 21 22 19 MANAGEMENT DETAILS Chairman O P Bhatt Auditors S Mann & Company Doogar And Associates Kapoor Tandon & Company Dinesh Mehta & Company Sreedhar Suresh & Rajagopalan INFRASTRUCTURE (Mar 07) No of Branches 939 Rural Semi Urban Urban Metro 254 299 219 167 No of ATMs OWNERSHIP(%) Promoter’s Holdings Institutions (Resident & Non Resident) Any Other 400 (Mar 07) 100.00 - State Bank of India Office: Corporate Centre, State Bank Bhavan, M C Road, Mumbai - 400021, Maharashtra Tel: 91 22 22029456/9451 Fax: 91 22 22885369 Email: agm.inv@sbi.co.in Website: www.statebankofindia.com About the Bank State Bank of India (SBI) was established in July 1, 1955 and operates with a group network of seven associate banks namely SBBJ, SBH, SB Indore, SB Mysore, SB Patiala , SBS and SBT. In personal banking domain, SBI offers products such as deposits, recurring deposits, housing loan, car loan, educational loan, loan for pensioners, loan against mortgage of property, loan against shares and debentures, medi-plus scheme and rent plus scheme. Few new products launched in FY07 were Truly Gold SBI Gold master Card, Go Air SBI Credit Card, Low interest offer and The Smart Traveller. The bank also introduced ATM linked KCCs in all circles in FY07. The bank caters to SME customer expectations through products like SBI Power Gain, SBI Power Pack and SBI SME Sahaj. There are few new schemes designed for NRIs like car loan scheme and In Principle scheme for NRI home loans. BALANCE SHEET (Rs mn) Liabilities Capital Reserves & Surplus Deposits Borrowings Other liabilities & provisions Total Liabilities 5263 307722 4355211 397033 600423 5665652 PROFIT & LOSS (Rs mn) Expenditure Interest expended 234368 Operating Expenses 118235 Provision - NPAs 14283 Others 40304 Total Expenses 407190 as on 31st Mar 2007 Assets Cash & Balance with RBI#290764 Other Bank Balances* 228922 Investments 1491489 Advances 3373365 Fixed Assets 28189 Other Assets 252923 Total Assets 5665652 During the year FY07 Income Interest Earned Other Income Total Income Net Profit / Loss KEY RATIOS KEY RATIOS Efficiency (%) Credit Deposit Ratio Cash Deposit Ratio Investment Deposit Ratio Term Loan/Total Adv Net NPAs/Net Adv Term Dep/Total Dep Strength (%) CAR Tier I CAR Tier II Growth (%) Deposits Advances Business (Deposits+Advances) 77.46 6.68 34.25 53.68 1.56 51.52 14.60 28.85 20.41 D&B D-U-N-S® No - 65-005-6914 Profitability (%) Return on Assets Return on Equity Net Interest Margin/ Total Assets Productivity (Rs mn) Business Per Employee Net Profit Per Employee 394910 57693 452603 45413 8.01 4.33 0.84 15.41 3.03 35.70 0.24 #Includes cash in hand available with banks and balances with RBI * Includes balances with other banks within India & outside India and money at call & short notices RANKING: All Banks Total Income Net Profit Assets Branches 1 1 1 1 MANAGEMENT DETAILS Chairman O P Bhatt Auditors D P Sen & Co, K Jain & Co, J Kapila Associates, R G N Price & Co, M M Nissim & Co, S K Mittal & Co, V Kumar & Co, M Choudhury & Co, Laxminiwas & Jain, G M Kapadia & Co, D Singla & Co INFRASTRUCTURE (Mar 07) No of Branches 9270 Rural Semi Urban Urban Metro 3825 2561 1561 1323 No of ATMs OWNERSHIP(%) Promoter’s Holdings Institutions (Resident & Non Resident) Any Other 4407 (Mar 07) 59.7 31.90 8.40 41