ECO 103

advertisement

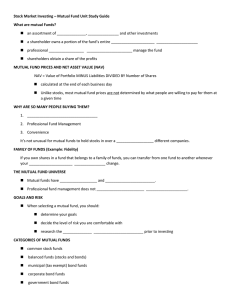

Monroe Community College Business Administration and Economics Department Course Syllabus ECO 103 PERSONAL MONEY MANAGEMENT Course Description: A very practical course which teaches you how to create a financial plan to realize goals, such as home ownership and early retirement. By taking this course, you will learn how to avoid credit trouble, save money on automobile purchases, and buy a desirable home. You will also learn how to protect yourself from financial disaster through the purchase of the lowest cost and safest insurance policies. Finally, you will learn how to make your money grow by investing in stocks, bonds, and mutual funds. Using the techniques you learn in this class will allow you to plan, save, and spend wisely so you and your family will enjoy a better way of life. Credit Hours: 3 Course Prerequisite: None. Course Learning Outcomes: 1. Understand the importance of personal financial planning, develop your financial priorities and understand how your personal decisions affect your financial goals. 2. Construct personal financial statements and budgets and learn how to analyze these tools. 3. Manage your liquidity and analyze the various banking services that are available and how these services can help you manage liquidity. 4. Acquire and use credit wisely to assist you in meeting your financial goals. 5. Understand how taxes affect your success in planning especially in reference to investments and retirement planning. 6. Make effective buying decisions 7. Use insurance to protect your assets and income. 8. Follow the steps of the investment process and understand the tradeoff between risk and return to develop your investment strategy. 9. Learn how to buy and sell securities and other types of securities that are available. 10. Use mutual funds to simplify your investment decisions, decrease costs and time, and achieve your financial goals. 11. Develop your strategy and use the appropriate financial tools to plan for future goals including college education and retirement. Current text/supplemental materials: 1. Personal Finance, 11th Ed., Garman, Forgue, MCC customized version ISBN-13: 978-1-285-10663-3, with Aplia ISBN-13: 978-1-285-10738-7, Full Text: ISBN-13: 978-1-111-53101-0. Publisher: Cengage Learning. 2. ECO 103 workbook. Please be certain to consult with the assigned course instructor or Department to verify current required course textbook(s) and other materials. All syllabi are updated annually and are intended to be a generic representation of the course requirements. Individual instructor requirements may vary. **For SLN courses please visit the SLN website to verify all text. 2 Offered: Please check the catalog for limitations on course offerings. ____x___fall ___x____spring ____x___summer ___x____on-line Course Outline by Order of Coverage Chapter 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Topic(s) Personal Financial Planning - an overview or personal finance Career Planning - identifying career goals, trends, developing a resume Financial Statements, Tools, and Budgetsstrategies, goal setting, budgets, financial statements and ratio analysis Managing Income Taxes – calculating income tax 1040, strategies to reduce taxese.g. homeownership, 401k etc.. Managing Checking and Savings Accounts – types of checking accounts, Certificates of Deposit, Money Market Account, Money Management Building and Maintaining Good Credit advantages/ disadvantages cost of credit, managing debt, bankruptcy laws and consumer loans. Credit Cards and Loans – types of credit cards, consumer installment loans, types of interest and costs Vehicle and Other Major Purchases – comparative shopping, negotiating , buying and leasing a car Buying Your Home – steps to home ownership, costs associated with closing and selling a home. Managing Property and Liability Risk – Understanding homeowner insurance, automobile insurance and liability insurance. Managing Health Expenses – understanding medical costs, medical planned benefits and disability insurance Life Insurance Planning – how much insurance is needed, understanding your policy, methods of buying life insurance. Investment Fundamentals – starting an investment program, understanding risks, and establishing a long term investment strategy. Investing in Stocks and Bonds – review of the major characteristics of common stocks and bonds, using the internet to evaluate. Strong Emphasis Med Skim Optional Approximate time period 1 week X X 1 week X 1 week X 1 week X 1 -2weeks X 1-2 week X 1 week X 1 week X X Cover with chapter 8 &9 1 week X 1 week X 1week X 1 week X 3 15 Investing through Mutual Funds - Why purchase mutual funds, classification of mutual funds, buying and selling mutual funds, mutual fund costs. Tax advantaged ways of investing in mutual funds. 1 week X Business Administration and Economics Dept. Monroe Community College 1000 E. Henrietta Rd. Rochester, NY 14623 585-292-3353 All syllabi are updated annually and are intended to be a generic representation of the course requirements. Individual instructor requirements may vary. May 2013