North America Equity Research

13 January 2015

Initiation

Overweight

Juno Therapeutics

JUNO, JUNO US

Price: $61.51

A Lot of CARs in the Garage…Initiating at OW

Price Target: $66.00

We are initiating coverage of JUNO with an OW rating based on the potential of its

CAR-T platform, which we believe has broad and disruptive potential across oncology

and is at the forefront of the innovation cycle in biotech. The technology genetically

engineers a patient’s immune cells into “homing devices” that seek out and destroy

tumor cells. Enthusiasm is understandably high given unprecedented response rates in

hard-to-treat cancers, and this has been validated to a certain extent by the lineup of

major players with skin in the game (NVS, CELG, AMGN, PFE, JNJ). JUNO, in our

view, is particularly well positioned given its relationships with multiple leading

medical institutions, thus providing pipeline flexibility/optionality. Bottom line, the

CAR-T space is in its early stages, and while we do not think it’s necessary to pick a

winner just yet, we think JUNO may have a competitive advantage (plus wholly

owned products) that allows it to pull into the lead over time. Shares don’t come

cheap, but further data in 2015 as well as progress towards new targets/indications

should continue to make JUNO a name investors likely will want to own in 2015.

Biotechnology

Cory Kasimov

AC

(1-212) 622-5266

cory.w.kasimov@jpmorgan.com

Bloomberg JPMA KASIMOV <GO>

Whitney G Ijem

(1-212) 622-4668

whitney.g.ijem@jpmorgan.com

Brittany Terner

(1-212) 622-8527

brittany.terner@jpmorgan.com

J.P. Morgan Securities LLC

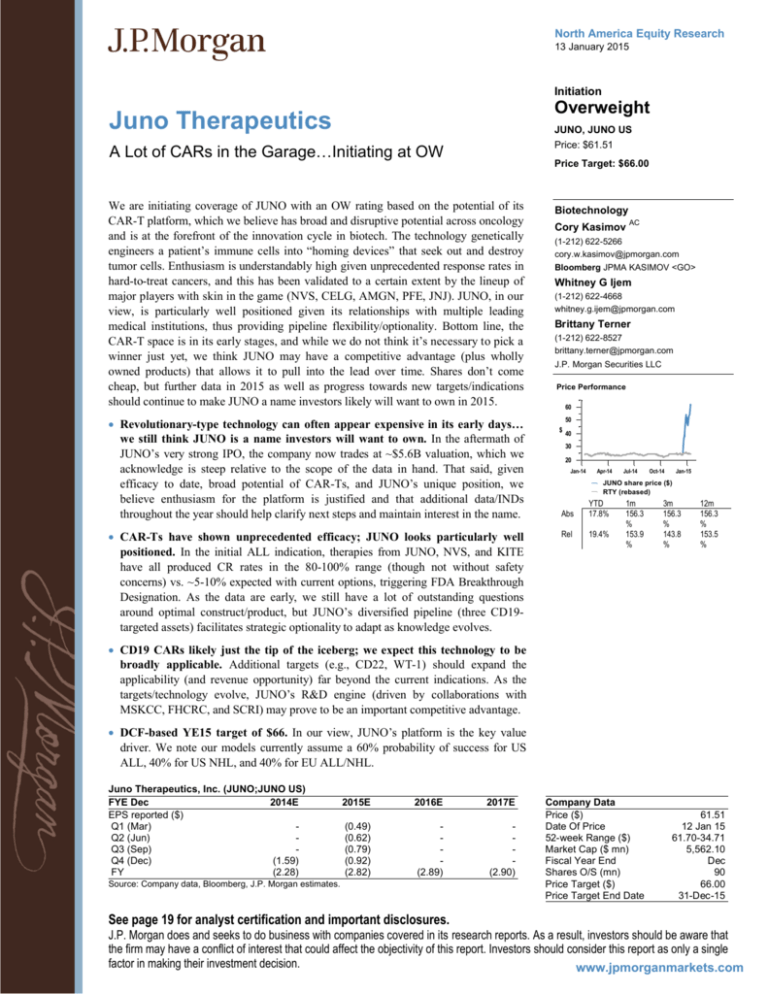

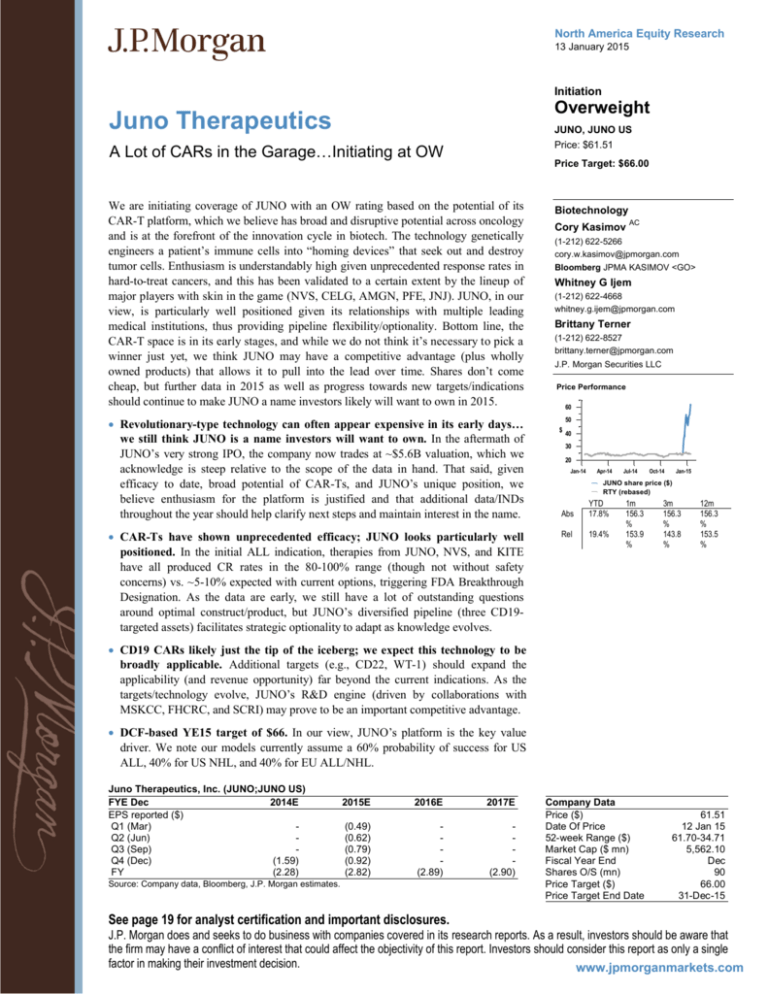

Price Performance

60

Revolutionary-type technology can often appear expensive in its early days…

we still think JUNO is a name investors will want to own. In the aftermath of

JUNO’s very strong IPO, the company now trades at ~$5.6B valuation, which we

acknowledge is steep relative to the scope of the data in hand. That said, given

efficacy to date, broad potential of CAR-Ts, and JUNO’s unique position, we

believe enthusiasm for the platform is justified and that additional data/INDs

throughout the year should help clarify next steps and maintain interest in the name.

50

$ 40

Abs

YTD

17.8%

CAR-Ts have shown unprecedented efficacy; JUNO looks particularly well

positioned. In the initial ALL indication, therapies from JUNO, NVS, and KITE

have all produced CR rates in the 80-100% range (though not without safety

concerns) vs. ~5-10% expected with current options, triggering FDA Breakthrough

Designation. As the data are early, we still have a lot of outstanding questions

around optimal construct/product, but JUNO’s diversified pipeline (three CD19targeted assets) facilitates strategic optionality to adapt as knowledge evolves.

Rel

19.4%

30

20

Jan-14

Apr-14

Jul-14

Oct-14

Jan-15

JUNO share price ($)

RTY (rebased)

1m

156.3

%

153.9

%

3m

156.3

%

143.8

%

12m

156.3

%

153.5

%

CD19 CARs likely just the tip of the iceberg; we expect this technology to be

broadly applicable. Additional targets (e.g., CD22, WT-1) should expand the

applicability (and revenue opportunity) far beyond the current indications. As the

targets/technology evolve, JUNO’s R&D engine (driven by collaborations with

MSKCC, FHCRC, and SCRI) may prove to be an important competitive advantage.

DCF-based YE15 target of $66. In our view, JUNO’s platform is the key value

driver. We note our models currently assume a 60% probability of success for US

ALL, 40% for US NHL, and 40% for EU ALL/NHL.

Juno Therapeutics, Inc. (JUNO;JUNO US)

FYE Dec

2014E

EPS reported ($)

Q1 (Mar)

Q2 (Jun)

Q3 (Sep)

Q4 (Dec)

(1.59)

FY

(2.28)

2015E

2016E

2017E

(0.49)

(0.62)

(0.79)

(0.92)

(2.82)

(2.89)

(2.90)

Source: Company data, Bloomberg, J.P. Morgan estimates.

Company Data

Price ($)

Date Of Price

52-week Range ($)

Market Cap ($ mn)

Fiscal Year End

Shares O/S (mn)

Price Target ($)

Price Target End Date

61.51

12 Jan 15

61.70-34.71

5,562.10

Dec

90

66.00

31-Dec-15

See page 19 for analyst certification and important disclosures.

J.P. Morgan does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that

the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single

factor in making their investment decision.

www.jpmorganmarkets.com

Cory Kasimov

(1-212) 622-5266

cory.w.kasimov@jpmorgan.com

North America Equity Research

13 January 2015

Table of Contents

Investment Thesis ....................................................................3

Risks to Rating and Price Target ............................................5

Company Description ..............................................................6

Upcoming Events .....................................................................6

Pipeline......................................................................................7

Financial Outlook .....................................................................9

Valuation .................................................................................10

Management ...........................................................................12

Models .....................................................................................15

2

Cory Kasimov

(1-212) 622-5266

cory.w.kasimov@jpmorgan.com

North America Equity Research

13 January 2015

Investment Thesis

Juno Therapeutics

(JUNO)

Overweight

T-Cells may represent the future of cancer research

Immuno-oncology has been a very hot topic in cancer drug development for a few

years now, and its evolution continues. CAR-T technology is a type of

immunotherapy that combines the specificity of a monoclonal antibody with the

potent cell-killing activity of the immune system’s T cells. A CAR-T product

describes a cell-based therapy that comprises a patient’s own T cells that have been

genetically modified ex vivo (outside the body) to express chimeric antigen receptors

(artificial receptors that bind certain antigens with downstream effects that

affect/enhance the T cells’ behavior). When the cell product is infused into the body,

the CARs recognize and bind to specific markers expressed by target cells, and that

binding activates the T cells’ cytotoxic effects (which are enhanced via costimulatory domains of the CAR). The first wave of CAR-T products in the clinic

target CD19, a molecule expressed ubiquitously on B cells, though not on

hematopoietic cells. As CD19 expression is retained in many B-cell lymphomas and

leukemias, it represents an attractive target in the treatment of these diseases.

Unprecedented response rates with initial CD19 CAR-Ts are generating

significant enthusiasm among doctors, the industry, the FDA…and investors

The three highest-profile CAR-T programs are JUNO’s JCAR015 (MSKCC), NVS’s

CTL019 (UPENN) and KITE’s KTE-C19 (NCI). Each of these initial products target

CD19 and have shown impressive response rates in a variety of indications. In ALL

(acute lymphoblastic leukemia), CR rates in the 80-100% range have been observed

in highly refractory adult and pediatric patients (in whom CR rates of ~5-10% would

be expected with existing therapies). The FDA is also enthusiastic about the potential

of CAR-T therapies, having granted both NVS’s CTL019 and JUNO’s JCAR015

Breakthrough Therapy Designation (BTD) in 2014.

From “Model-Ts” to “Lamborghinis”…we expect significant evolution in both

the science and manufacturing of CAR-Ts in the coming years

We expect Juno, with its multitude of collaborations, to be at the forefront of this

revolution. As all of these products have looked impressive to date, we think it’s too

early (and likely not necessary) to pick a winner, and note that there is still a lot to

learn about 1) the optimal CAR-T construct (CAR structure/co-stimulatory domain,

cell composition of the therapeutic product, manufacturing procedure, etc.) as well as

2) the actual administration of the product (repeat doses, pre-conditioning, etc.).

JUNO’s pipeline of CD19 CAR-T products and multiple R&D collaborations

provide strategic flexibility that is relatively unique within the CAR-T space

From a competitive standpoint, we believe that JUNO is particularly well positioned

given its relationships with Memorial Sloan Kettering (MSKCC; JCAR015), the Fred

Hutchinson Cancer Research Center (FHCRC; JCAR014), and the Seattle Cancer

Research Institute (SCRI; JCAR017). Importantly, each of the three CD19-targeted

candidates has differences that allow JUNO to adapt to new information in choosing

the best product (not simply a potentially good one). We suspect this optionality

could facilitate a higher level of scientific integrity, and we are already seeing that

play out as JUNO has de-prioritized JCAR014 in favor of JCAR017 as its profile

may be more favorable in NHL. Such flexibility may be even more important longerterm as the technology and targets evolve.

3

Cory Kasimov

(1-212) 622-5266

cory.w.kasimov@jpmorgan.com

North America Equity Research

13 January 2015

CD19 likely just the beginning...the real excitement stems from the potential of

CAR-T therapy in the broader oncology space

While CD19 CAR-Ts in ALL have provided initial evidence of the exceptional

efficacy potential of this approach, this is likely just the tip of the iceberg (as well it

should be given the amount of money that is pouring into the field). JUNO and other

CAR-T players are investigating the potential of CARs (and TCRs, another type of

highly specific T-cell therapy) to target markers other than CD19 and across a range

of cancers. JUNO recently in-licensed a CD22-targeted program, and while this is

still directed towards B-cell malignancies, it represents JUNO’s first non-CD19

program in the clinic (Phase 1 to start imminently). Other targets identified by JUNO

include L1CAM, MUC-16/IL-12, ROR-1, and WT-1, which are all over-expressed in

certain cancer types and all of which are expected to be in Phase 1 in 2015.

We assume JCAR015 and JCAR017 are JUNO’s first commercial products and

model peak US sales of ~$150M in ALL and ~$1B in NHL

It is estimated that ~6,000 patients are diagnosed with ALL each year in the US,

~80% of which are of B-cell origin. We estimate roughly two-thirds of those patients

could ultimately be considered relapsed/refractory (across all lines of therapy), with

about half of patients ultimately being relapsed/refractory 2L+ (driven mostly by

adult patients). We assume an overall penetration of CAR-T into 2L+ rrALL of 90%

at peak (if it works, we think it will eventually overtake SCTs) and assume a price of

$250K. In NHL, we assume there are ~40K cases of aggressive disease diagnosed

each year in the US, with roughly one-third of those patients becoming relapsed/

refractory post 2L and eligible for treatment. We assign a slightly lower overall

CAR-T peak penetration of 75% in rrNHL. In both, we currently estimate JUNO gets

33% of the total CAR-T share (pending further data clarity).

Balance sheet: JUNO appears well positioned financially

JUNO ended 3Q14 with ~$238M in cash and subsequently raised ~$246M in an

initial public offering of common stock in December (J.P. Morgan acted as a co-lead

book-running manager). We estimate that JUNO will end 2014 with ~$430M in cash

and believe the company has sufficient capital through at least 2016.

Initiate at Overweight: JUNO well positioned within the nascent CAR-T space

with its collaborations and diversified platform of wholly owned products

We are initiating coverage of JUNO with an Overweight rating and year-end 2015

price target of $66. We believe in the long-term potential of CAR-Ts in general, and

see JUNO as uniquely well positioned given its relationships with multiple

institutions. Our target is based on a DCF analysis that projects FCF through 2022,

assumes a five-year intermediate growth rate of 15%, a terminal rate of 2.5%, and

utilizes a discount rate of 13%.

4

Cory Kasimov

(1-212) 622-5266

cory.w.kasimov@jpmorgan.com

North America Equity Research

13 January 2015

Risks to Rating and Price Target

Juno is susceptible to the standard risks that apply to the entire biotech industry,

including development, regulatory, commercial, manufacturing, financing, and IP

pitfalls. Risks more specific to Juno are outlined below:

Competitive risk

As highlighted above, there are an increasing number of players involved in the

CAR-T arena. It is possible that competitive programs may prove to be superior to

JUNO’s. On the other hand, it is possible that any safety issues/other problems with

other CAR-T programs may affect perception of JUNO’s programs. It is also

possible that resources available to competitive programs (driven by large Pharma

partners) could help accelerate development or otherwise benefit competitors.

Clinical risk

JCAR015, JCAR014 and JCAR017 have been used in a limited number of patients,

and there are still a lot of unanswered questions around the optimal CAR-T product.

It is possible that additional patients enrolled in JUNO’s trials may respond

differently to the various products, and ongoing trials may not meet the safety and

efficacy thresholds for further development. JUNO intends to initiate several

additional Phase 1 trials with non-CD19-targeted CARs, and it is possible that

efficacy in these new indications may not be as robust, and/or that previously

unknown safety issues could emerge with the new CARs.

Regulatory risk

As there are no currently approved CAR-T-based therapies, the hurdles for

regulatory approval may be higher/different than currently expected. Given CAR-T

products are living cells that respond to in vivo stimuli and grow, there may be

additional regulatory hurdles pre- or post-approval, and regulatory agencies may

want to see additional or longer-term data before approving one of JUNO’s therapies.

If approved, it is possible that the product labels may not be as anticipated,

potentially limiting use. Further, regulatory agencies could remove JCAR015,

JCAR017, or any other potentially approved product from the market if they show

additional/more severe AEs in a real-world setting.

Commercial risk

CAR-Ts are not simple therapies. They are more logistically complex than most

traditional anti-cancer therapeutics, including small molecules and traditional

monoclonal antibodies. Moreover, the striking potency of these products seems to

come at a price (at least in these early days) with potentially lethal cytokine release

syndrome (CRS) the most noteworthy complication. If approved, the complexity and

toxicity of CAR-Ts may relegate them to more niche opportunities than we currently

anticipate.

5

Cory Kasimov

(1-212) 622-5266

cory.w.kasimov@jpmorgan.com

North America Equity Research

13 January 2015

Company Description

Juno Therapeutics is a Seattle-based biopharmaceutical company focused on

developing therapies that re-engage the body’s immune system to fight cancer. The

company is developing cell-based immunotherapies based on its chimeric antigen

receptor (CAR) and T-cell receptor (TCR) technologies. JUNO’s technology

platform revolves around the ability to genetically modify T cells to recognize and

kill cancer cells. The company’s lead clinical programs, JCAR015, JCAR017, and

JCAR014, use CAR technology to target CD19, a protein expressed on the surface of

B cell leukemias and lymphomas. JCAR015 is currently in a Phase 1 trial in rrALL,

and JUNO intends to initiate a Phase 2 trial in 2015 that could support accelerated

approval in the US. The company intends to initiate a Phase 1/2 trial for JCAR017 in

rrNHL in 2015, as well as initiate several Phase 1 trials for new, non-CD19-targeted

products during the year.

Upcoming Events

Figure 1: JUNO News Flow Highlights

Anticipated Newsflow Highlights

Program

JCAR015

Event

Initiate pivotal Phase 2 trial in Adult ALL

Updated Data from Phase 1 trial in Adult rrALL

Expected

mid-2015

mid-2015

Significance

Low

High

JCAR017

Initiate Phase 1/2 trial in rrNHL

Updated Data from Phase 1/2 trial in pediatric rrALL

2015

mid-2015

Low

High

JCAR014

Updated Data from Phase 1/2 trial in B Cell malignancies

mid-2015

High

Source: Company reports and J.P. Morgan estimates.

For Juno in 2015, the key catalysts will be presentation of updated data from the

ongoing Phase 1 trial of JCAR015 in adult ALL, as well data updates from the Phase

1/2 trials of JCAR017 in pediatric ALL and JCAR014 in B-cell malignancies, all of

which we anticipate midyear at ASCO. We also expect additional data updates for

each program in December at ASH. During the year, JUNO also expects to initiate a

pivotal Phase 2 trial for JCAR015 in rrALL, as well as a Phase 1/2 trial of JCAR017

in adult rrNHL. After JUNO recently in-licensed a CD22 CAR from Opus Bio/NCI,

we anticipate initial data from the ongoing trial in rrNHL and rrALL in late 2015/

early 2016 (potentially at ASH). The company also expects to initiate Phase 1 trials

for at least three additional CAR product candidates including products targeting

L1CAM, MUC-16/IL-12, and ROR-1. JUNO intends to initiate a Phase 1 trial with

its WT-1-targeted TCR product in 2015.

6

Cory Kasimov

(1-212) 622-5266

cory.w.kasimov@jpmorgan.com

North America Equity Research

13 January 2015

Pipeline

Figure 2: JUNO Pipeline

Product Pipeline Highlights

Program

P/C

Ph 1

Ph 2

Ph 3

FDA

Mkt.

Partner

Comments

JCAR015

Adult ALL and Adult NHL

MSKCC

JCAR017

Pediatric ALL and Adult NHL

SCRI

JCAR014

Adult B Cell Malignancies

FHCRC

CD22 CAR

rrALL and rrNHL

NCI/Opus Bio

WT-1 TCR

AML, NSCLC

CD19 "Armored" CARs

CLL

CD19 Fully Human scFV CAR

Adult NHL

L1CAM CAR

Neuroblastoma

MUC16 & IL-12 "Armored" CAR

Ovarian Cancer

ROR-1 CAR

CLL, Solid Tumors

Source: Company reports.

Juno’s lead product candidates are CD19-targeted CAR products currently in Phase 1

and Phase 1/2 development.

JCAR015 – JCAR015 was developed at MSKCC; it makes use of a CD28 costimulatory domain, and the cell product is CD3+ enriched PBMCs. The drug is

currently being evaluated in a Phase 1 trial in adult rrALL patients. Data

presented at ASH 2014 (11/14/2017 cut-off), showed treatment with JCAR015

resulted in an 89% CR rate in 27 evaluable patients, with 78% of patients

achieving CRm. As has been the case with virtually all CD19-targeted CARs in

ALL, severe cytokine release syndrome (CRS) was the most notable AE; in 28

patients evaluable for safety, 28% experienced severe CRS (0% in patients with

low disease burden, 33% in patients with high disease burden). There have been

two deaths in patients with severe CRS. Protocol changes allowed for the use of a

lower dose of cells in patients with high-burden disease, and the safety/efficacy

of the lower dose is currently being evaluated, as is the safety/efficacy of a

second scheduled dose of cells roughly three weeks following the initial dose.

JCAR017 – JCAR017 was developed at SCRI and utilizes a 4-1BB costimulatory domain. The cell product is made up of a defined cell composition of

CD4+ and CD8+ T cells. A Phase 1/2 trial is currently ongoing in pediatric ALL

patients and recently updated data (11/26/2014 cut-off) show that 85% of the 13

treated patients achieved CR. Ten of the 11 CR patients remained in CR as of the

data cut-off date. About 39% of patients in the trial experienced CRS, and ~31%

of patients experienced febrile neutropenia. Interestingly, patients treated with

JCAR017 have experienced the highest cell expansion and longest cell

persistence in the body relative to JUNO’s other products. As those two metrics

7

Cory Kasimov

(1-212) 622-5266

cory.w.kasimov@jpmorgan.com

North America Equity Research

13 January 2015

are thought to correlate with clinical benefit, the company plans to take JCAR017

forward into adult rrNHL, as well as continue development in pediatric rrALL.

JCAR014 – JCAR014 was developed at FHCRC, and makes use of the 4-1BB

co-stimulatory domain, with the final product being composed of a defined ratio

of CD8+ and CD4+ T cells. JCAR014 is currently being evaluated in a Phase 1/2

trial in patients with rel/ref B Cell malignancies. The most recently presented data

is as of 11/25/2014. In 13 patients treated with rrALL, 11 received product with a

1:1 ratio of CD8+ to CD4+ cells (due to manufacturing issues). In those patients

who received the proper cell product, the investigator-reported CR rate is 100%,

with an 82% CRm rate. In rrNHL, ten of 12 patients received a cell product with

the proper ratio, and in those ten patients the investigator-reported CR+PR rate

was 60%. Initial data from this trial indicates that duration of response in rrNHL

correlates with cell expansion and cell persistence. As noted above, JCAR017 has

had the highest expansion/longest persistence, which is why JUNO is moving it

forward into rrNHL (and deprioritizing JCAR014). The company intends to

continue to enroll patients in the ongoing Phase 1/2 trial to explore additional

treatment strategies, though at this point does not intend to move JCAR014

forward into pivotal trials.

8

Cory Kasimov

(1-212) 622-5266

cory.w.kasimov@jpmorgan.com

North America Equity Research

13 January 2015

Financial Outlook

Juno Therapeutics is a developmental-stage biotechnology company with upcoming

clinical catalysts (Phase 1 updates for various products anticipated in mid-2015) with

potential for approval and launch of the latest-stage product (JCAR015, expected to

start a pivotal Phase 2 trial in 2015) in 2017. Currently, we do not model profitability

until 2019. Juno has worldwide commercialization rights to all of its CARs; the

company intends to commercialize in the US on its own, and we expect clarity on the

ex-US strategy in 2015. Given the highly targeted physician audience for the initial

indications, we currently assume the company commercializes JCAR015 and

JCAR017 on its own in the EU.

OpEx Expectations: Below we briefly highlight our assumptions for Juno’s key

operating spend line items.

COGS. Given Juno’s products are cell-based therapies, we expect biologic-like

COGS in the 15-30% range, though the company has indicated it is targeting the

lower end of that range. At peak, we model COGS of 25%, inclusive of ~10% in

royalties owed to the various academic collaborators.

R&D trends. We assume R&D will continue to ramp as Juno executes the

various early-stage trials, initiates a pivotal Phase 2 for JCAR015, and brings at

least four new products into the clinic. In the outer years, we assume the company

will continue to aggressively invest in R&D on additional products given its

technology platform and eventual commercial infrastructure.

SG&A trends. We anticipate Juno will begin to build commercial infrastructure

in 2017, ahead of the potential launch of JCAR015 which we assume will occur

during the year. Our model reflects an expected field force of ~20 reps to start.

Juno’s current cash position

should be sufficient through at

least 2016.

JUNO ended 3Q14 with ~$238 million in cash

JUNO ended 3Q14 with ~$238M in cash, and subsequently raised ~$246M in an

initial public offering of common stock in December (J.P. Morgan acted as a co-lead

book-running manager). We estimate that JUNO will end 2014 with ~$430M in cash,

and believe the company has sufficient capital through at least 2016.

Share count

We estimate Juno currently has ~93 million fully diluted shares outstanding,

including ~90 million common shares and ~3 million stock options post-offering.

Figure 3: JUNO Key Financial Metrics

Key Financial Metrics

In $ thousands

December financial year-end

Cash

Debt

2013A

2014E

2015E

2016E

2017E

2018E

2019E

36.1

-

459.0

-

135.0

-

122.9

-

153.6

-

37.9

-

(30.6)

(69.3)

150.0

(324.0)

-

(212.1)

200.0

(219.3)

250.0

(215.7)

100.0

(8.6)

-

Revenue

EPS

-

(3.37)

(2.82)

(2.89)

41.3

(2.90)

161.8

(1.93)

360.6

(0.31)

Average shares outstanding

Fully diluted shares outstanding

-

97.04

90.93

99.92

91.13

CFOp + CapEx (burn)

Expected financing

43.21

59.23

90.83

90.53

93.15

90.73

29.3

-

100.33

90.83

Source: Company reports and J.P. Morgan estimates.

9

Cory Kasimov

(1-212) 622-5266

cory.w.kasimov@jpmorgan.com

North America Equity Research

13 January 2015

Valuation

We are initiating coverage of

JUNO with an Overweight rating

and a December 2015 price

target of $66 per share.

Our year-end 2015 price target of $66 per share is based on a DCF analysis (100%).

Figure 4: JUNO Valuation Summary

Juno Valuation Summary

Discount rate

4Q15 Fully Diluted Shares (m)

13%

93.5

Main value drivers

US ALL

US NHL

Valuation methodology

DCF

P/E 2016

Real options scenario analysis

Risk adjusted NPV analysis

Total

Catal yst/liquidity discount

YE15 Price Target

Prob of approval

60%

40%

Peak WW sales est

(avg. scenario)

$

156

$ 1,250

Value / share

$

65.73

Weighting

100%

$

$

74.23

59.85

Avg peak yr

2021

2022

Adj. value/ share

$

65.73

0%

0%

$

$

$

$

65.73

0%

66

Source: J.P. Morgan estimates.

Discounted cash flow analysis (100% weighting)

We utilize a DCF to value JUNO. We believe this may prove to be more appropriate

longer-term than our NPV analysis given that it assigns some terminal value. With

this model, we project cash flows out to 2022 at which point we assign an

intermediate growth rate of 15% based on the potential for additional product

launches for five years followed by a terminal rate of 2.5% assuming continued

growth in revenues as additional products/indications come on line. Our DCF utilizes

a discount rate of 13%. We currently do not model for “IP expiry”-related revenue

erosion for this technology, and instead we think it’s eventually at greater risk of

some other potentially superior technology/approach coming along.

Figure 5: JUNO DCF Sensitivity Analysis

Termina l

Growth

Rate

$65.73

-2%

-1%

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

3.5%

4.0%

8%

$102.60

$110.58

$120.56

$126.54

$133.38

$141.28

$150.49

$161.37

$174.43

$190.39

$210.35

9%

$88.40

$94.41

$101.76

$106.08

$110.94

$116.45

$122.75

$130.01

$138.49

$148.50

$160.52

10%

$76.77

$81.38

$86.92

$90.12

$93.69

$97.67

$102.14

$107.22

$113.02

$119.71

$127.52

Discount Rate

11%

12%

$67.11

$58.98

$70.70

$61.82

$74.96

$65.14

$77.39

$67.02

$80.06

$69.06

$83.01

$71.30

$86.30

$73.77

$89.96

$76.50

$94.09

$79.52

$98.77

$82.91

$104.12

$86.72

13%

$52.07

$54.34

$56.97

$58.44

$60.04

$61.77

$63.66

$65.73

$68.00

$70.52

$73.31

14%

$46.15

$47.99

$50.09

$51.26

$52.52

$53.87

$55.35

$56.95

$58.69

$60.60

$62.71

15%

$41.03

$42.53

$44.23

$45.17

$46.18

$47.26

$48.42

$49.68

$51.04

$52.51

$54.13

Source: J.P. Morgan estimates.

What’s the value of a novel technology platform with potential broad applicability?

In our view, this is currently the key question when considering the investment

merits of JUNO. At this stage in its maturation, we believe most of the value inherent

in JUNO is driven by its novel technology platform as opposed to any individual

product candidate. Although this value is admittedly subjective and difficult to

estimate (and is primarily based upon one’s view of comparable companies), we

believe the broad applicability and game-changing potential of Juno’s technology

needs to be taken into account. Not only has the platform been validated through the

10

Cory Kasimov

(1-212) 622-5266

cory.w.kasimov@jpmorgan.com

North America Equity Research

13 January 2015

generation of very exciting early-stage data and collaborations with multiple worldleading cancer research institutions, but we also believe the number of large

pharma/biotech companies entering the space (e.g., NVS, CELG, PFE, JNJ, and

AMGN) lends further credibility to this groundbreaking approach.

11

Cory Kasimov

(1-212) 622-5266

cory.w.kasimov@jpmorgan.com

North America Equity Research

13 January 2015

Management

Below we highlight key executives at Juno.

Hans Bishop, President and CEO

Hans Bishop is a co-founder of Juno and has served as CEO and a member of the

Board since September 2013. Mr. Bishop has also served as a member of the Board

of Avanir Pharmaceuticals (acquired by Otsuka Pharmaceutical) since May 2012.

Mr. Bishop previously served as Chairman of Genesis Biopharma from January 2012

until November 2012. From February 2012 until October 2012, Mr. Bishop was the

COO of PhotoThera (owned by Warburg Pincus), and he continued working with

Warburg Pincus as an Executive in Residence until October 2013. Mr. Bishop

previously served as EVP and COO at Dendreon from January 2010 to September

2011. Mr. Bishop has also served as the President of the Specialty Medicine Business

at Bayer Healthcare Pharmaceuticals from December 2006 to January 2010.

Mr. Bishop worked at Chiron Corp as SVP of Global Commercial Operations until

its sale to Novartis. Mr. Bishop received a B.Sc. in Chemistry from Brunel

University.

Steve Harr, M.D., CFO and Head of Corporate Development

Steve Harr is CFO and Head of Corporate Development and joined Juno in April

2014. Dr. Harr was Managing Director and Head of Biotechnology Investment

Banking at Morgan Stanley from May 2010 until he joined Juno. Prior to his

investment banking role at Morgan Stanley, Dr. Harr was Morgan Stanley’s lead

biotech research analyst and Co-Head of Global Healthcare Research. Dr. Harr

received a B.A. in Economics from College of the Holy Cross and an M.D. from The

Johns Hopkins University School of Medicine. Dr. Harr was a resident in internal

medicine at the University of California, San Francisco.

Mark Frohlich, M.D., EVP, Research & Development

Mark Frohlich is EVP, Research & Development, and joined Juno in February 2014.

Prior to joining Juno, Dr. Frohlich served as EVP of Research & Development and

CMO at Dendreon, where he served in various capacities beginning in August 2005.

Dr. Frohlich received a B.S. in Electrical Engineering and Economics from Yale

University and an M.D. from Harvard Medical School. Dr. Frohlich was a resident in

internal medicine and a fellow in oncology at the University of California, San

Francisco.

Mark Gilbert, M.D., CMO

Mark Gilbert is CMO and joined Juno in March 2014. Prior to joining Juno,

Dr. Gilbert served as an interim CMO or consultant in strategic drug development

and portfolio management in medical oncology for several US biotech and pharma

companies. Previously, Dr. Gilbert served as VP and Head Global Clinical

Development, Therapeutic Area Oncology, at Bayer Schering. Prior to Bayer

Schering, he held several executive positions with Berlex Pharmaceuticals and its

parent company Schering AG, mostly as VP and Head of Global Medical

Development Group, Oncology. Dr. Gilbert joined Berlex from Immunex.

Dr. Gilbert received a B.S. in Biochemistry from the University of Iowa and his

M.D. from the University of Iowa Medical School and trained in internal medicine,

12

Cory Kasimov

(1-212) 622-5266

cory.w.kasimov@jpmorgan.com

North America Equity Research

13 January 2015

infectious disease, and medical oncology at the University of California, San

Francisco, and the University of Washington, respectively.

Ken Mohler, Ph.D., CSO

Kendall Mohler is CSO and joined Juno in October 2013. Previously, Dr. Mohler

was CSO at ZetaRx Biotherapeutics. In addition, he was a co-founder of Trubion

Pharmaceuticals, and during his tenure served as SVP, R&D and CSO. Prior to

Trubion, Dr. Mohler served as VP of Biological Sciences at Immunex Corp, where

he was employed for 13 years. Dr. Mohler has published more than 35 manuscripts

and has four issued patents and six pending patent applications. Dr. Mohler received

a B.S. from the University of Kansas and a Ph.D. in Immunology from University of

Texas Health Science Center at Dallas, Southwestern Medical School.

Elizabeth Smith, SVP, Regulatory Strategy & Portfolio Management

Elizabeth Smith is SVP, Regulatory Strategy & Portfolio Management, and joined

Juno in November 2013. Ms. Smith has over 20 years of experience in the field of

regulatory affairs, quality, and manufacturing, with an emphasis on biologics and

advanced cellular therapies in oncology. Most recently, Ms. Smith served as the VP

of Regulatory Affairs at Dendreon and led the regulatory efforts resulting in FDA

licensure of Provenge. Prior to Dendreon, Ms. Smith held regulatory and

manufacturing positions at Genentech and Immunex. She holds B.A. in Biology from

Central Washington University.

Barney Cassidy, J.D., General Counsel and Secretary

Barney Cassidy is General Counsel and Secretary and joined Juno in January 2014.

Prior to joining Juno, Mr. Cassidy served in various roles at Tessera Technologies

from November 2008 to July 2013, including as its EVP, General Counsel, and

Secretary, and as President of Tessera Intellectual Property. He served in various

roles at Tumbleweed Communications from May 1999 to September 2008.

Mr. Cassidy practiced law at Wilson Sonsini Goodrich & Rosati from August 1992

to May 1999, and at Skadden, Arps, Slate, Meagher & Flom from September 1989 to

July 1992. Mr. Cassidy received a B.A. in Philosophy from the Jesuit House of

Studies, Loyola University, an M.A. in Philosophy from the University of Toronto,

and a J.D. from Harvard Law School.

Andy Walker, Ph.D., SVP, Manufacturing

Andrew Walker is SVP, Manufacturing, and joined Juno in April 2014. Prior to

joining Juno, Dr. Walker served in senior leadership roles at CMC Biologics. While

at CMC Biologics, Dr. Walker’s roles included serving as the Head of the GMP

Manufacturing Department. Dr. Walker also served as Head of the Process

Development organization where he oversaw all aspects of drug development. Over

the course of his career, Dr. Walker has worked on the development and

manufacturing of approximately 50 different biologic drug candidates. Andy earned

his Ph.D. in Chemical Engineering from the University of California, Berkeley, and a

B.S. in Chemical Engineering from the University of Washington.

Robin Andrulevich, VP, People

Robin Andrulevich is VP of People and joined Juno in October 2014.

Ms. Andrulevich has more than 20 years of experience in HR at high-growth

companies. Most recently, Ms. Andrulevich served as the Talent Director for the

early-stage technology venture capital firm, Madrona Venture Group.

13

Cory Kasimov

(1-212) 622-5266

cory.w.kasimov@jpmorgan.com

North America Equity Research

13 January 2015

Ms. Andrulevich also held several key, senior leadership human resources and talent

roles at Amazon and worked closely with its management team to significantly scale

the company’s growth. A graduate of the University of Connecticut, with a B.A. in

Communications Science, Ms. Andrulevich also attended Barnard College and

Columbia University.

14

North America Equity Research

13 January 2015

Cory Kasimov

(1-212) 622-5266

cory.w.kasimov@jpmorgan.com

Models

Figure 6: JUNO Income Statement

Juno Therapeutics Income Statement

Cory Kasimov

cory.w.kasimov@jpmorgan.com

212.622.5266

Comments:

2013A

JCAR15 (Adult rrALL)

JCAR17 (peds rrALL and NHL)

Total Product Revnue

Other Rvenue

Total Revenues

-

COGS

R&D

SG&A

Litigation

GAAP Total Operating Expenses

Non-GAAP Total Operating Expenses

46.2

4.2

1.2

51.7

GAAP Operating Income

Non-GAAP Operating Income

Other income ( expenses)

GAAP pre-tax Income (loss)

Income Tax (benefit)

GAAP Net Income

GAAP Basic EPS

GAAP Diluted EPS

(51.7)

(0.1)

(51.8)

(51.8)

1Q14A

2Q14A

3Q14A

2014E

2015E

2016E

2017E

2018E

2019E

-

-

41.3

41.3

41.3

107.0

54.8

161.8

161.8

151.1

209.4

360.6

360.6

-

-

-

-

2.9

3.4

2.0

8.3

6.5

4.6

1.6

12.7

13.0

5.4

1.4

19.8

17.0

86.0

6.0

2.0

94.0

27.0

108.4

19.4

7.0

134.8

61.3

217.0

37.0

2.0

256.0

112.0

226.2

43.0

269.3

155.0

12.4

249.4

61.1

322.9

208.4

46.9

234.5

73.5

354.9

265.2

97.3

220.2

74.2

391.7

326.7

(8.3)

-

(12.7)

-

(19.8)

(17.0)

(94.0)

(27.0)

(94.0)

(94.0)

(1.59)

(1.59)

(134.8)

(61.3)

(10.7)

(145.5)

(145.5)

(3.37)

(3.37)

(256.0)

(112.0)

(256.0)

(256.0)

(2.82)

(2.82)

(269.3)

(155.0)

(269.3)

(269.3)

(2.89)

(2.89)

(281.6)

(167.1)

(281.6)

(281.6)

(2.90)

(2.90)

(193.1)

(103.4)

(193.1)

(193.1)

(1.93)

(1.93)

(31.2)

33.9

(31.2)

(31.2)

(0.31)

(0.31)

(27.0)

(27.0)

(0.46)

(0.46)

(72.0)

(72.0)

(1.67)

(1.67)

(112.0)

(112.0)

(1.23)

(1.23)

(155.0)

(155.0)

(1.66)

(1.66)

(167.1)

(167.1)

(1.72)

(1.72)

(103.4)

(103.4)

(1.03)

(1.03)

33.9

33.9

0.34

0.34

27.2

59.2

59.2

43.2

43.2

90.8

90.8

93.1

93.1

97.0

97.0

99.9

99.9

100.3

100.3

-

Non-GAAP pre tax income (loss)

Income Tax (benefit)

Non-GAAP Net Income

Non-GAAP Basic EPS

Non-GAAP Diluted EPS

Basic Shares Outstanding

Diluted Shares Oustanding

Margin Analysis:

Gross margin

Operating margin

Net margin

Tax Rate

Cost Analysis:

COGS as % of tot. prod. sales

R&D as % of tot. revenue

SG&A as % of tot. revenue

Year-over-year growth:

Total revenue

R&D Expense

SG&A Expense

Total operating expenses

Operating income

Net income

EPS

Basic Shares

Diluted Shares

4Q14E

NM

NM

NM

0.0%

NM

NM

NM

0%

NM

NM

NM

0%

NM

NM

NM

0%

NM

NM

NM

0%

NM

NM

NM

0.0%

NM

NM

NM

0.0%

NM

NM

NM

0.0%

70%

NM

NM

0.0%

71%

NM

NM

0.0%

73%

NM

NM

0.0%

NM

NM

NM

NM

NM

NM

NM

NM

NM

NM

NM

NM

NM

NM

NM

0.00%

NM

NM

0%

NM

NM

0%

NM

NM

30%

604.35%

147.94%

29%

144.89%

45.44%

27%

61.07%

20.57%

NM

#REF!

#REF!

#REF!

NM

NM

NM

NM

NM

NM

#REF!

#REF!

#REF!

NM

NM

NM

NM

NM

NM

#REF!

#REF!

#REF!

NM

NM

NM

NM

NM

NM

#REF!

#REF!

#REF!

NM

NM

NM

#REF!

NM

NM

#REF!

#REF!

#REF!

NM

NM

NM

#REF!

#REF!

NM

134.51%

357.36%

160.88%

160.88%

NM

#DIV/0!

#DIV/0!

#DIV/0!

NM

100.10%

90.89%

89.89%

89.89%

NM

-16.31%

110.19%

#DIV/0!

NM

4.25%

16.30%

5.18%

5.18%

NM

2.56%

2.55%

0.88%

NM

10.27%

41.90%

19.92%

4.59%

NM

0.40%

4.18%

4.21%

292.07%

-6.00%

20.44%

9.93%

-31.43%

NM

-33.40%

2.97%

4.15%

122.80%

-6.09%

0.86%

10.36%

-83.86%

NM

-83.93%

0.42%

0.92%

<--- Assume core R&D spend

continues to increase;

outer year decline due to

lower success payment

liability

Source: Company reports and J.P. Morgan estimates.

15

Cory Kasimov

(1-212) 622-5266

cory.w.kasimov@jpmorgan.com

North America Equity Research

13 January 2015

Figure 7: JUNO Balance Sheet

Juno Therapeutics Balance Sheet ($ millions)

Cory W. Kas imov

cory.w.kasimov@jpmchase.com

212.622.5216

2013A

2014E

2015E

2016E

2017E

2018E

2019E

Assets

Cash and cash equivalents

Prepaid Expenses

Total Current Assets

PPE, Net

Fair value of covertible preferred stock

Other

Total Assets

36.0

0.2

36.1

0.0

3.8

0.1

40

459.0

0.2

459.2

0.0

459

135.0

0.2

135.2

15.0

-

122.9

0.2

123.1

30.0

-

153.6

0.2

153.8

40.0

-

37.9

0.3

38.2

40.0

-

29.3

0.3

29.6

40.0

-

150

153

194

78

70

Liabilities & Equity

Accounts Payable

Accrued expenses

Total Current Liabilities

Deferred Rent

Total Liabilities

1.1

10.0

11.1

0.1

11.19

2.5

76.5

79.0

0.1

79.10

2.8

1.5

4.2

0.1

4.35

3.0

51.5

54.5

0.1

54.62

3.3

101.5

104.8

0.1

104.92

3.7

56.5

60.1

0.1

60.26

4.0

56.5

60.5

0.1

60.62

72.6

0.0

8.1

(51.8)

28.9

40

TRUE

387.7

0.0

254.1

(261.7)

380.1

459

TRUE

0.0

254.1

(108.3)

145.9

150

TRUE

0.0

454.1

(355.6)

98.5

153

TRUE

0.0

704.1

(615.2)

88.9

194

TRUE

0.0

804.1

(786.2)

17.9

78

TRUE

0.0

804.1

(795.2)

9.0

70

TRUE

380.2

131.0

(22.0)

(30.9)

Convertible preffered Stock

Common Stock

Additional Paid in capital

Accumulated Deficit

Total Shareholders' Equity

Total Liabilities & Equity

check

Working Capital

Source: Company reports and J.P. Morgan estimates.

16

25.0

68.6

49.0

Cory Kasimov

(1-212) 622-5266

cory.w.kasimov@jpmorgan.com

North America Equity Research

13 January 2015

Figure 8: JUNO Cash Flow Statement

Juno Therapeutics Cash Flow Statement ($ millions)

Cory W. Kasimov

cory.w.kasimov@jpmchase.com

212.622.5216

2013A

Non-GAAP Net Income (loss)

Adjustments to reconcile net loss to net operating cash

Depreciation & Amortization

Stock based compensation expense

Non-cash expense in connection with equity issuance

Loss from remeasurement of fair value of convertible stock ooption

Changes in operating assets and liabilities

Prepaid expenses and other assets

Accounts payable

Accrued lia bilities and deferred rent

Cash Flow from Operations

Purchase of PPE

Other

Cash Flow from Investing

Issuance of common stock, net of costs

Issuance of convertible preferred stock, net

Cash Flow from Financing

Total Change in Cash

Beginning Cash Bala nce

Ending Balance: Cash and Investments

$

2014E

2015E

2016E

(112.0) $

2017E

(72.0) $

0.0

0.1

10.2

0.1

5.0

13.0

10.7

$

(0.3)

1.1

10.0

(30.5) $

(7.0)

1.0

(15.0)

(64.3) $

(7.0)

1.0

(205.0)

(304.0) $

(7.4)

1.0

(50.0)

(192.1) $

(7.7)

1.0

(50.0)

(204.3) $

(8.1)

1.0

(120.0)

(210.7) $

(8.5)

1.0

(50.0)

(3.6)

$

(0.04)

(0.0) $

(5.00)

(5.0) $

(20.00)

(20.0) $

(20.00)

(20.0) $

(15.00)

(15.0) $

(5.00)

(5.0) $

(5.00)

(5.0)

$

0.0

66.5

66.5

$

246.0

246.4

492.4

200.0

200.0

$

250.0

250.0

$

100.0

100.0

$

36.0

36.0

$

423.0

36.0

459.0

(12.1)

135.0

122.9 $

30.7

122.9

153.6

$

(115.7)

153.6

37.9 $

$

$

-

5.0

14.3

-

$

(324.0)

459.0

135.0 $

(167.1) $

2019E

(51.8) $

5.0

14.0

-

(155.0) $

2018E

5.0

14.5

-

(103.4) $

5.0

14.8

-

33.9

5.0

15.0

-

$

(8.6)

37.9

29.3

Source: Company reports and J.P. Morgan estimates.

17

Cory Kasimov

(1-212) 622-5266

cory.w.kasimov@jpmorgan.com

North America Equity Research

13 January 2015

Juno Therapeutics: Summary of Financials

Income Statement - Annual

Revenues

Cost of products sold

Gross profit

SG&A

R&D

Operating income

EBITDA

Net interest (income) / expense

Other income / (expense)

Income taxes

Net income - GAAP

Net income - recurring

Diluted shares outstanding

EPS - excluding non-recurring

EPS - recurring

Balance Sheet and Cash Flow Data

Cash and cash equivalents

Accounts receivable

Inventories

Other current assets

Current assets

PP&E

Total assets

FY13A FY14E FY15E FY16E

0

0

0

0

0

0

(19)

(37)

(43)

- (108)

(217)

(226)

- (135)

(256)

(269)

- (135)

(256)

(269)

0

0

0

0

0

0

- (135)

(256)

(269)

- (135)

(256)

(269)

7

59

91

93

- (2.28) (2.82) (2.89)

- (2.28) (2.82) (2.89)

FY13A FY14E FY15E FY16E

459

135

123

0

0

0

459

135

123

0

15

30

459

150

153

Total debt

Total liabilities

Shareholders' equity

-

79

380

4

146

55

99

Net income (including charges)

D&A

Change in working capital

Other

Cash flow from operations

-

(72)

5

(21)

24

(64)

(112)

5

(211)

14

(304)

(155)

5

(56)

14

(192)

Capex

(5)

Free cash flow

(69)

Cash flow from investing activities

(5)

Cash flow from financing activities

492

Dividends

Dividend yield

Source: Company reports and J.P. Morgan estimates.

Note: $ in millions (except per-share data).Fiscal year ends Dec

(20)

(324)

(20)

0

-

(20)

(212)

(20)

200

-

18

Income Statement - Quarterly

Revenues

Cost of products sold

Gross profit

SG&A

R&D

Operating income

EBITDA

Net interest (income) / expense

Other income / (expense)

Income taxes

Net income - GAAP

Net income - recurring

Diluted shares outstanding

EPS - excluding non-recurring

EPS - recurring

Ratio Analysis

Sales growth

EBIT growth

EPS growth - recurring

1Q14A

0A

0A

(3)A

(3)A

(8)A

(8)A

0A

0A

(8)A

(8)A

0A

FY13A

-

2Q14A

0A

0A

(5)A

(6)A

(13)A

(13)A

0A

0A

(13)A

(13)A

0A

FY14E

-

3Q14A

0A

0A

(5)A

(13)A

(20)A

(20)A

0A

0A

(20)A

(20)A

0A

FY15E

89.9%

23.8%

4Q14E

0

0

(6)

(86)

(94)

(94)

0

0

(94)

(94)

59

(1.59)

(1.59)

FY16E

5.2%

2.6%

Gross margin

EBIT margin

EBITDA margin

Tax rate

Net margin

-

0.0%

-

0.0%

-

0.0%

-

Net Debt / EBITDA

Net Debt / Capital (book)

-

-

-

-

Return on assets (ROA)

Return on equity (ROE)

- (58.7%)

- (70.9%)

(84.0%)

(97.3%)

(177.5%)

(220.3%)

Enterprise value / sales

Enterprise value / EBITDA

Free cash flow yield

-

NM

(5.8%)

NM

(3.7%)

NM

(1.9%)

Cory Kasimov

(1-212) 622-5266

cory.w.kasimov@jpmorgan.com

North America Equity Research

13 January 2015

Analyst Certification: The research analyst(s) denoted by an “AC” on the cover of this report certifies (or, where multiple research

analysts are primarily responsible for this report, the research analyst denoted by an “AC” on the cover or within the document

individually certifies, with respect to each security or issuer that the research analyst covers in this research) that: (1) all of the views

expressed in this report accurately reflect his or her personal views about any and all of the subject securities or issuers; and (2) no part of

any of the research analyst's compensation was, is, or will be directly or indirectly related to the specific recommendations or views

expressed by the research analyst(s) in this report. For all Korea-based research analysts listed on the front cover, they also certify, as per

KOFIA requirements, that their analysis was made in good faith and that the views reflect their own opinion, without undue influence or

intervention.

Important Disclosures

Market Maker: JPMS makes a market in the stock of Juno Therapeutics.

Client: J.P. Morgan currently has, or had within the past 12 months, the following company(ies) as clients: Juno Therapeutics.

Lead or Co-manager: J.P. Morgan acted as lead or co-manager in a public offering of equity and/or debt securities for Juno

Therapeutics within the past 12 months.

Client/Investment Banking: J.P. Morgan currently has, or had within the past 12 months, the following company(ies) as investment

banking clients: Juno Therapeutics.

Investment Banking (past 12 months): J.P. Morgan received in the past 12 months compensation from investment banking Juno

Therapeutics.

Investment Banking (next 3 months): J.P. Morgan expects to receive, or intends to seek, compensation for investment banking

services in the next three months from Juno Therapeutics.

Company-Specific Disclosures: Important disclosures, including price charts and credit opinion history tables, are available for

compendium reports and all J.P. Morgan–covered companies by visiting https://jpmm.com/research/disclosures, calling 1-800-477-0406,

or e-mailing research.disclosure.inquiries@jpmorgan.com with your request. J.P. Morgan’s Strategy, Technical, and Quantitative

Research teams may screen companies not covered by J.P. Morgan. For important disclosures for these companies, please call 1-800-4770406 or e-mail research.disclosure.inquiries@jpmorgan.com.

Juno Therapeutics (JUNO, JUNO US) Price Chart

102

85

68

Price($)

51

34

17

0

Dec

14

Dec

14

Dec

14

Jan

15

Jan

15

Jan

15

Source: Bloomberg and J.P. Morgan; price data adjusted for stock splits and dividends.

The chart(s) show J.P. Morgan's continuing coverage of the stocks; the current analysts may or may not have covered it over the entire

period.

J.P. Morgan ratings or designations: OW = Overweight, N= Neutral, UW = Underweight, NR = Not Rated

Explanation of Equity Research Ratings, Designations and Analyst(s) Coverage Universe:

J.P. Morgan uses the following rating system: Overweight [Over the next six to twelve months, we expect this stock will outperform the

average total return of the stocks in the analyst’s (or the analyst’s team’s) coverage universe.] Neutral [Over the next six to twelve

months, we expect this stock will perform in line with the average total return of the stocks in the analyst’s (or the analyst’s team’s)

19

Cory Kasimov

(1-212) 622-5266

cory.w.kasimov@jpmorgan.com

North America Equity Research

13 January 2015

coverage universe.] Underweight [Over the next six to twelve months, we expect this stock will underperform the average total return of

the stocks in the analyst’s (or the analyst’s team’s) coverage universe.] Not Rated (NR): J.P. Morgan has removed the rating and, if

applicable, the price target, for this stock because of either a lack of a sufficient fundamental basis or for legal, regulatory or policy

reasons. The previous rating and, if applicable, the price target, no longer should be relied upon. An NR designation is not a

recommendation or a rating. In our Asia (ex-Australia) and U.K. small- and mid-cap equity research, each stock’s expected total return is

compared to the expected total return of a benchmark country market index, not to those analysts’ coverage universe. If it does not appear

in the Important Disclosures section of this report, the certifying analyst’s coverage universe can be found on J.P. Morgan’s research

website, www.jpmorganmarkets.com.

Coverage Universe: Kasimov, Cory W: ACADIA Pharmaceuticals (ACAD), Acorda Therapeutics Inc. (ACOR), Aegerion

Pharmaceuticals (AEGR), Alkermes, Inc. (ALKS), Amgen Inc (AMGN), Ariad Pharmaceuticals (ARIA), BioMarin Pharmaceuticals

(BMRN), Biogen Idec (BIIB), Celgene (CELG), Clovis Oncology (CLVS), Gilead Sciences (GILD), Incyte Corporation (INCY), Keryx

Biopharmaceuticals (KERX), MannKind Corporation (MNKD), Novavax (NVAX), Otonomy (OTIC), Pharmacyclics, Inc. (PCYC),

Regeneron Pharmaceuticals (REGN), Sage Therapeutics (SAGE), Sangamo BioSciences (SGMO), Seattle Genetics (SGEN), Ultragenyx

(RARE), Vertex Pharmaceuticals (VRTX), ZIOPHARM Oncology (ZIOP), ZS Pharma (ZSPH), bluebird bio (BLUE)

J.P. Morgan Equity Research Ratings Distribution, as of January 1, 2015

J.P. Morgan Global Equity Research Coverage

IB clients*

JPMS Equity Research Coverage

IB clients*

Overweight

(buy)

45%

56%

45%

75%

Neutral

(hold)

43%

49%

48%

67%

Underweight

(sell)

12%

33%

7%

52%

*Percentage of investment banking clients in each rating category.

For purposes only of FINRA/NYSE ratings distribution rules, our Overweight rating falls into a buy rating category; our Neutral rating falls into a hold

rating category; and our Underweight rating falls into a sell rating category. Please note that stocks with an NR designation are not included in the table

above.

Equity Valuation and Risks: For valuation methodology and risks associated with covered companies or price targets for covered

companies, please see the most recent company-specific research report at http://www.jpmorganmarkets.com, contact the primary analyst

or your J.P. Morgan representative, or email research.disclosure.inquiries@jpmorgan.com.

Equity Analysts' Compensation: The equity research analysts responsible for the preparation of this report receive compensation based

upon various factors, including the quality and accuracy of research, client feedback, competitive factors, and overall firm revenues.

Other Disclosures

J.P. Morgan ("JPM") is the global brand name for J.P. Morgan Securities LLC ("JPMS") and its affiliates worldwide. J.P. Morgan Cazenove is a marketing

name for the U.K. investment banking businesses and EMEA cash equities and equity research businesses of JPMorgan Chase & Co. and its subsidiaries.

All research reports made available to clients are simultaneously available on our client website, J.P. Morgan Markets. Not all research content is

redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your sales

representative.

Options related research: If the information contained herein regards options related research, such information is available only to persons who have

received the proper option risk disclosure documents. For a copy of the Option Clearing Corporation's Characteristics and Risks of Standardized Options,

please contact your J.P. Morgan Representative or visit the OCC's website at http://www.optionsclearing.com/publications/risks/riskstoc.pdf

Legal Entities Disclosures

U.S.: JPMS is a member of NYSE, FINRA, SIPC and the NFA. JPMorgan Chase Bank, N.A. is a member of FDIC. U.K.: JPMorgan Chase N.A., London

Branch, is authorised by the Prudential Regulation Authority and is subject to regulation by the Financial Conduct Authority and to limited regulation by

the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from J.P. Morgan on

request. J.P. Morgan Securities plc (JPMS plc) is a member of the London Stock Exchange and is authorised by the Prudential Regulation Authority and

regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Registered in England & Wales No. 2711006. Registered Office 25

Bank Street, London, E14 5JP. South Africa: J.P. Morgan Equities South Africa Proprietary Limited is a member of the Johannesburg Securities

Exchange and is regulated by the Financial Services Board. Hong Kong: J.P. Morgan Securities (Asia Pacific) Limited (CE number AAJ321) is regulated

by the Hong Kong Monetary Authority and the Securities and Futures Commission in Hong Kong and/or J.P. Morgan Broking (Hong Kong) Limited (CE

number AAB027) is regulated by the Securities and Futures Commission in Hong Kong. Korea: J.P. Morgan Securities (Far East) Ltd, Seoul Branch, is

regulated by the Korea Financial Supervisory Service. Australia: J.P. Morgan Australia Limited (JPMAL) (ABN 52 002 888 011/AFS Licence No:

238188) is regulated by ASIC and J.P. Morgan Securities Australia Limited (JPMSAL) (ABN 61 003 245 234/AFS Licence No: 238066) is regulated by

ASIC and is a Market, Clearing and Settlement Participant of ASX Limited and CHI-X. Taiwan: J.P.Morgan Securities (Taiwan) Limited is a participant

of the Taiwan Stock Exchange (company-type) and regulated by the Taiwan Securities and Futures Bureau. India: J.P. Morgan India Private Limited

(Corporate Identity Number - U67120MH1992FTC068724), having its registered office at J.P. Morgan Tower, Off. C.S.T. Road, Kalina, Santacruz - East,

Mumbai – 400098, is a member of the National Stock Exchange of India Limited (SEBI Registration Number - INB 230675231/INF 230675231/INE

20

Cory Kasimov

(1-212) 622-5266

cory.w.kasimov@jpmorgan.com

North America Equity Research

13 January 2015

230675231) and Bombay Stock Exchange Limited (SEBI Registration Number - INB 010675237/INF 010675237) and is regulated by Securities and

Exchange Board of India. Telephone: 91-22-6157 3000, Facsimile: 91-22-6157 3990 and Website: www.jpmipl.com. For non local research reports, this

material is not distributed in India by J.P. Morgan India Private Limited. Thailand: This material is issued and distributed in Thailand by JPMorgan

Securities (Thailand) Ltd., which is a member of the Stock Exchange of Thailand and is regulated by the Ministry of Finance and the Securities and

Exchange Commission and its registered address is 3rd Floor, 20 North Sathorn Road, Silom, Bangrak, Bangkok 10500. Indonesia: PT J.P. Morgan

Securities Indonesia is a member of the Indonesia Stock Exchange and is regulated by the OJK a.k.a. BAPEPAM LK. Philippines: J.P. Morgan Securities

Philippines Inc. is a Trading Participant of the Philippine Stock Exchange and a member of the Securities Clearing Corporation of the Philippines and the

Securities Investor Protection Fund. It is regulated by the Securities and Exchange Commission. Brazil: Banco J.P. Morgan S.A. is regulated by the

Comissao de Valores Mobiliarios (CVM) and by the Central Bank of Brazil. Mexico: J.P. Morgan Casa de Bolsa, S.A. de C.V., J.P. Morgan Grupo

Financiero is a member of the Mexican Stock Exchange and authorized to act as a broker dealer by the National Banking and Securities Exchange

Commission. Singapore: This material is issued and distributed in Singapore by or through J.P. Morgan Securities Singapore Private Limited (JPMSS)

[MCI (P) 199/03/2014 and Co. Reg. No.: 199405335R] which is a member of the Singapore Exchange Securities Trading Limited and is regulated by the

Monetary Authority of Singapore (MAS) and/or JPMorgan Chase Bank, N.A., Singapore branch (JPMCB Singapore) which is regulated by the MAS. This

material is provided in Singapore only to accredited investors, expert investors and institutional investors, as defined in Section 4A of the Securities and

Futures Act, Cap. 289. Recipients of this document are to contact JPMSS or JPMCB Singapore in respect of any matters arising from, or in connection

with, the document. Japan: JPMorgan Securities Japan Co., Ltd. is regulated by the Financial Services Agency in Japan. Malaysia: This material is issued

and distributed in Malaysia by JPMorgan Securities (Malaysia) Sdn Bhd (18146-X) which is a Participating Organization of Bursa Malaysia Berhad and a

holder of Capital Markets Services License issued by the Securities Commission in Malaysia. Pakistan: J. P. Morgan Pakistan Broking (Pvt.) Ltd is a

member of the Karachi Stock Exchange and regulated by the Securities and Exchange Commission of Pakistan. Saudi Arabia: J.P. Morgan Saudi Arabia

Ltd. is authorized by the Capital Market Authority of the Kingdom of Saudi Arabia (CMA) to carry out dealing as an agent, arranging, advising and

custody, with respect to securities business under licence number 35-07079 and its registered address is at 8th Floor, Al-Faisaliyah Tower, King Fahad

Road, P.O. Box 51907, Riyadh 11553, Kingdom of Saudi Arabia. Dubai: JPMorgan Chase Bank, N.A., Dubai Branch is regulated by the Dubai Financial

Services Authority (DFSA) and its registered address is Dubai International Financial Centre - Building 3, Level 7, PO Box 506551, Dubai, UAE.

Country and Region Specific Disclosures

U.K. and European Economic Area (EEA): Unless specified to the contrary, issued and approved for distribution in the U.K. and the EEA by JPMS plc.

Investment research issued by JPMS plc has been prepared in accordance with JPMS plc's policies for managing conflicts of interest arising as a result of

publication and distribution of investment research. Many European regulators require a firm to establish, implement and maintain such a policy. This

report has been issued in the U.K. only to persons of a kind described in Article 19 (5), 38, 47 and 49 of the Financial Services and Markets Act 2000

(Financial Promotion) Order 2005 (all such persons being referred to as "relevant persons"). This document must not be acted on or relied on by persons

who are not relevant persons. Any investment or investment activity to which this document relates is only available to relevant persons and will be

engaged in only with relevant persons. In other EEA countries, the report has been issued to persons regarded as professional investors (or equivalent) in

their home jurisdiction. Australia: This material is issued and distributed by JPMSAL in Australia to "wholesale clients" only. This material does not take

into account the specific investment objectives, financial situation or particular needs of the recipient. The recipient of this material must not distribute it to

any third party or outside Australia without the prior written consent of JPMSAL. For the purposes of this paragraph the term "wholesale client" has the

meaning given in section 761G of the Corporations Act 2001. Germany: This material is distributed in Germany by J.P. Morgan Securities plc, Frankfurt

Branch and J.P.Morgan Chase Bank, N.A., Frankfurt Branch which are regulated by the Bundesanstalt für Finanzdienstleistungsaufsicht. Hong Kong: The

1% ownership disclosure as of the previous month end satisfies the requirements under Paragraph 16.5(a) of the Hong Kong Code of Conduct for Persons

Licensed by or Registered with the Securities and Futures Commission. (For research published within the first ten days of the month, the disclosure may

be based on the month end data from two months prior.) J.P. Morgan Broking (Hong Kong) Limited is the liquidity provider/market maker for derivative

warrants, callable bull bear contracts and stock options listed on the Stock Exchange of Hong Kong Limited. An updated list can be found on HKEx

website: http://www.hkex.com.hk. Japan: There is a risk that a loss may occur due to a change in the price of the shares in the case of share trading, and

that a loss may occur due to the exchange rate in the case of foreign share trading. In the case of share trading, JPMorgan Securities Japan Co., Ltd., will be

receiving a brokerage fee and consumption tax (shouhizei) calculated by multiplying the executed price by the commission rate which was individually

agreed between JPMorgan Securities Japan Co., Ltd., and the customer in advance. Financial Instruments Firms: JPMorgan Securities Japan Co., Ltd.,

Kanto Local Finance Bureau (kinsho) No. 82 Participating Association / Japan Securities Dealers Association, The Financial Futures Association of Japan,

Type II Financial Instruments Firms Association and Japan Investment Advisers Association. Korea: This report may have been edited or contributed to

from time to time by affiliates of J.P. Morgan Securities (Far East) Ltd, Seoul Branch. Singapore: JPMSS and/or its affiliates may have a holding in any of

the securities discussed in this report; for securities where the holding is 1% or greater, the specific holding is disclosed in the Important Disclosures

section above. Taiwan: This material is issued and distributed in Taiwan by J.P. Morgan Securities (Taiwan Limited). India: For private circulation only,

not for sale. Pakistan: For private circulation only, not for sale. New Zealand: This material is issued and distributed by JPMSAL in New Zealand only to

persons whose principal business is the investment of money or who, in the course of and for the purposes of their business, habitually invest money.

JPMSAL does not issue or distribute this material to members of "the public" as determined in accordance with section 3 of the Securities Act 1978. The

recipient of this material must not distribute it to any third party or outside New Zealand without the prior written consent of JPMSAL. Canada: The

information contained herein is not, and under no circumstances is to be construed as, a prospectus, an advertisement, a public offering, an offer to sell

securities described herein, or solicitation of an offer to buy securities described herein, in Canada or any province or territory thereof. Any offer or sale of

the securities described herein in Canada will be made only under an exemption from the requirements to file a prospectus with the relevant Canadian

securities regulators and only by a dealer properly registered under applicable securities laws or, alternatively, pursuant to an exemption from the dealer

registration requirement in the relevant province or territory of Canada in which such offer or sale is made. The information contained herein is under no

circumstances to be construed as investment advice in any province or territory of Canada and is not tailored to the needs of the recipient. To the extent that

the information contained herein references securities of an issuer incorporated, formed or created under the laws of Canada or a province or territory of

Canada, any trades in such securities must be conducted through a dealer registered in Canada. No securities commission or similar regulatory authority in

Canada has reviewed or in any way passed judgment upon these materials, the information contained herein or the merits of the securities described herein,

and any representation to the contrary is an offence. Dubai: This report has been issued to persons regarded as professional clients as defined under the

DFSA rules. Brazil: Ombudsman J.P. Morgan: 0800-7700847 / ouvidoria.jp.morgan@jpmorgan.com.

General: Additional information is available upon request. Information has been obtained from sources believed to be reliable but JPMorgan Chase & Co.

or its affiliates and/or subsidiaries (collectively J.P. Morgan) do not warrant its completeness or accuracy except with respect to any disclosures relative to

21

Cory Kasimov

(1-212) 622-5266

cory.w.kasimov@jpmorgan.com

North America Equity Research

13 January 2015

JPMS and/or its affiliates and the analyst's involvement with the issuer that is the subject of the research. All pricing is as of the close of market for the

securities discussed, unless otherwise stated. Opinions and estimates constitute our judgment as of the date of this material and are subject to change

without notice. Past performance is not indicative of future results. This material is not intended as an offer or solicitation for the purchase or sale of any

financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not

intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipient of this report must make its own

independent decisions regarding any securities or financial instruments mentioned herein. JPMS distributes in the U.S. research published by non-U.S.

affiliates and accepts responsibility for its contents. Periodic updates may be provided on companies/industries based on company specific developments or

announcements, market conditions or any other publicly available information. Clients should contact analysts and execute transactions through a J.P.

Morgan subsidiary or affiliate in their home jurisdiction unless governing law permits otherwise.

"Other Disclosures" last revised November 29, 2014.

Copyright 2015 JPMorgan Chase & Co. All rights reserved. This report or any portion hereof may not be reprinted, sold or

redistributed without the written consent of J.P. Morgan. #$J&098$#*P

22