69 The primary sources of liquidity for the Holding Company are

advertisement

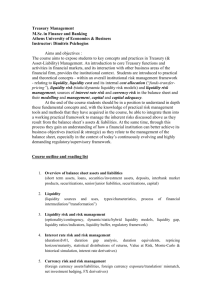

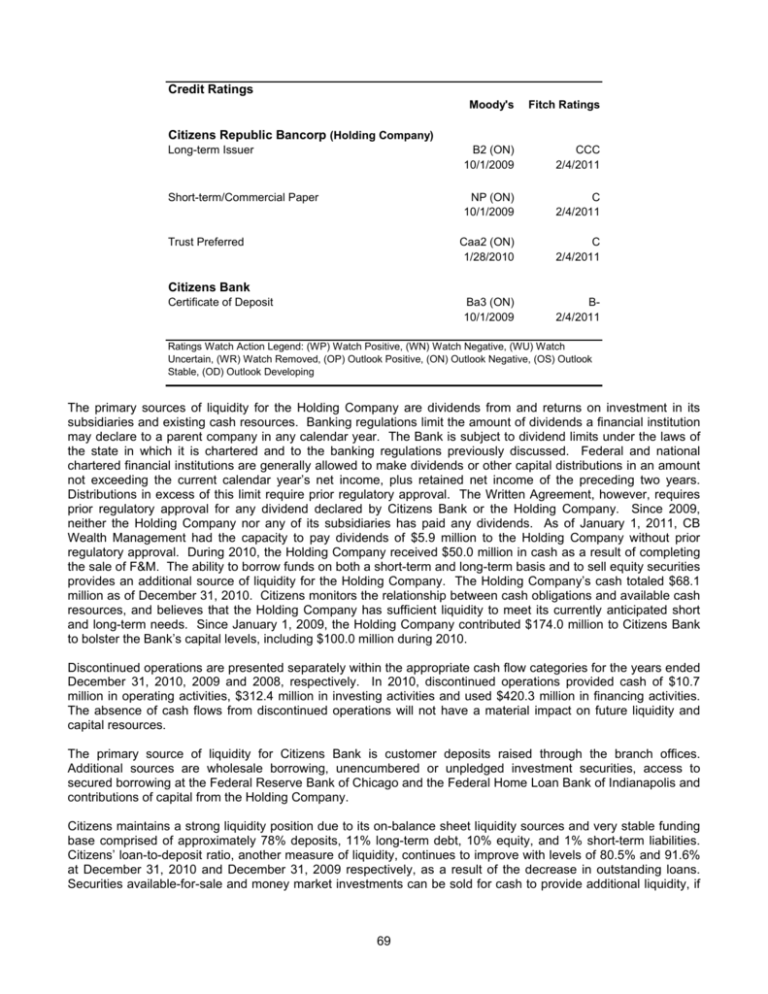

Credit Ratings Moody's Fitch Ratings Long-term Issuer B2 (ON) 10/1/2009 CCC 2/4/2011 Short-term/Commercial Paper NP (ON) 10/1/2009 C 2/4/2011 Caa2 (ON) 1/28/2010 C 2/4/2011 Ba3 (ON) 10/1/2009 B2/4/2011 Citizens Republic Bancorp (Holding Company) Trust Preferred Citizens Bank Certificate of Deposit Ratings Watch Action Legend: (WP) Watch Positive, (WN) Watch Negative, (WU) Watch Uncertain, (WR) Watch Removed, (OP) Outlook Positive, (ON) Outlook Negative, (OS) Outlook Stable, (OD) Outlook Developing The primary sources of liquidity for the Holding Company are dividends from and returns on investment in its subsidiaries and existing cash resources. Banking regulations limit the amount of dividends a financial institution may declare to a parent company in any calendar year. The Bank is subject to dividend limits under the laws of the state in which it is chartered and to the banking regulations previously discussed. Federal and national chartered financial institutions are generally allowed to make dividends or other capital distributions in an amount not exceeding the current calendar year’s net income, plus retained net income of the preceding two years. Distributions in excess of this limit require prior regulatory approval. The Written Agreement, however, requires prior regulatory approval for any dividend declared by Citizens Bank or the Holding Company. Since 2009, neither the Holding Company nor any of its subsidiaries has paid any dividends. As of January 1, 2011, CB Wealth Management had the capacity to pay dividends of $5.9 million to the Holding Company without prior regulatory approval. During 2010, the Holding Company received $50.0 million in cash as a result of completing the sale of F&M. The ability to borrow funds on both a short-term and long-term basis and to sell equity securities provides an additional source of liquidity for the Holding Company. The Holding Company’s cash totaled $68.1 million as of December 31, 2010. Citizens monitors the relationship between cash obligations and available cash resources, and believes that the Holding Company has sufficient liquidity to meet its currently anticipated short and long-term needs. Since January 1, 2009, the Holding Company contributed $174.0 million to Citizens Bank to bolster the Bank’s capital levels, including $100.0 million during 2010. Discontinued operations are presented separately within the appropriate cash flow categories for the years ended December 31, 2010, 2009 and 2008, respectively. In 2010, discontinued operations provided cash of $10.7 million in operating activities, $312.4 million in investing activities and used $420.3 million in financing activities. The absence of cash flows from discontinued operations will not have a material impact on future liquidity and capital resources. The primary source of liquidity for Citizens Bank is customer deposits raised through the branch offices. Additional sources are wholesale borrowing, unencumbered or unpledged investment securities, access to secured borrowing at the Federal Reserve Bank of Chicago and the Federal Home Loan Bank of Indianapolis and contributions of capital from the Holding Company. Citizens maintains a strong liquidity position due to its on-balance sheet liquidity sources and very stable funding base comprised of approximately 78% deposits, 11% long-term debt, 10% equity, and 1% short-term liabilities. Citizens’ loan-to-deposit ratio, another measure of liquidity, continues to improve with levels of 80.5% and 91.6% at December 31, 2010 and December 31, 2009 respectively, as a result of the decrease in outstanding loans. Securities available-for-sale and money market investments can be sold for cash to provide additional liquidity, if 69