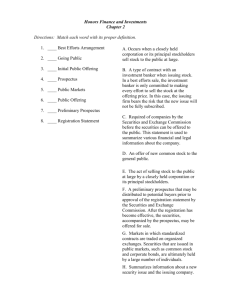

Chapter 11 Financing and Listing Securities

advertisement