Managerial Economics & Business Strategy Chapter 3 Overview

advertisement

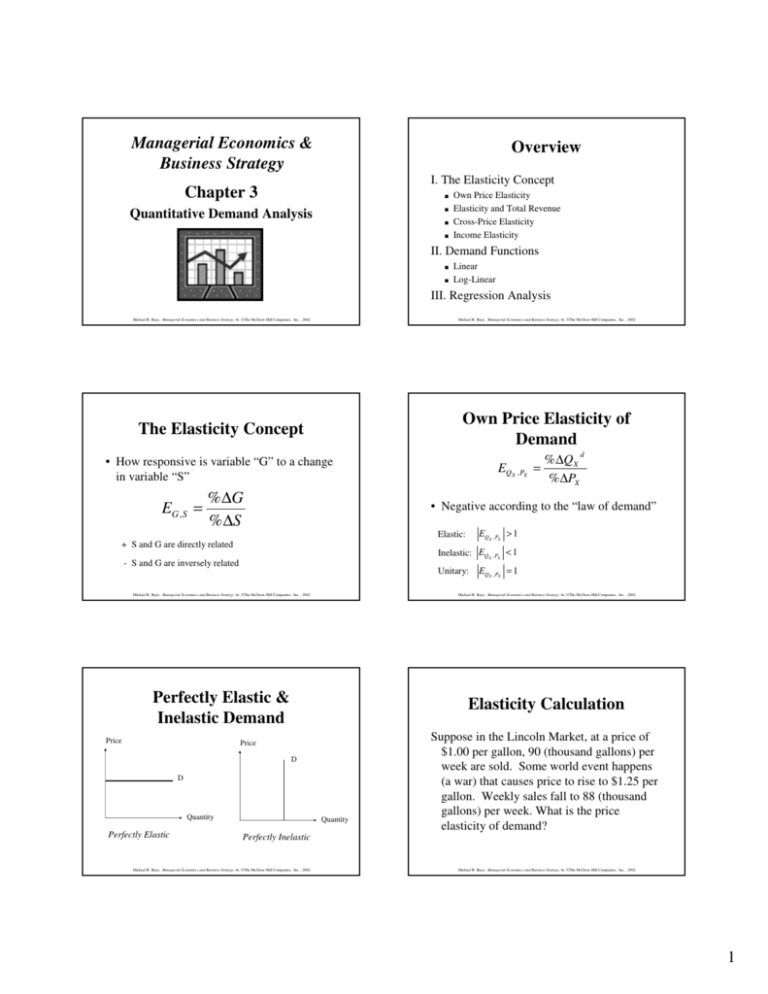

Managerial Economics & Business Strategy Overview I. The Elasticity Concept Chapter 3 ■ ■ Quantitative Demand Analysis ■ ■ Own Price Elasticity Elasticity and Total Revenue Cross-Price Elasticity Income Elasticity II. Demand Functions ■ ■ Linear Log-Linear III. Regression Analysis Michael R. Baye, Managerial Economics and Business Strategy, 4e. ©The McGraw-Hill Companies, Inc. , 2002 Michael R. Baye, Managerial Economics and Business Strategy, 4e. ©The McGraw-Hill Companies, Inc. , 2002 The Elasticity Concept Own Price Elasticity of Demand • How responsive is variable “G” to a change in variable “S” EG ,S = % ∆G % ∆S EQX , PX = EQ X , PX > 1 Elastic: Inelastic: EQ X , PX < 1 - S and G are inversely related Unitary: Michael R. Baye, Managerial Economics and Business Strategy, 4e. ©The McGraw-Hill Companies, Inc. , 2002 EQX , PX = 1 Michael R. Baye, Managerial Economics and Business Strategy, 4e. ©The McGraw-Hill Companies, Inc. , 2002 Perfectly Elastic & Inelastic Demand Elasticity Calculation Price D D Quantity Perfectly Elastic d • Negative according to the “law of demand” + S and G are directly related Price %∆QX %∆PX Quantity Suppose in the Lincoln Market, at a price of $1.00 per gallon, 90 (thousand gallons) per week are sold. Some world event happens (a war) that causes price to rise to $1.25 per gallon. Weekly sales fall to 88 (thousand gallons) per week. What is the price elasticity of demand? Perfectly Inelastic Michael R. Baye, Managerial Economics and Business Strategy, 4e. ©The McGraw-Hill Companies, Inc. , 2002 Michael R. Baye, Managerial Economics and Business Strategy, 4e. ©The McGraw-Hill Companies, Inc. , 2002 1 Own-Price Elasticity and Total Revenue Elasticity Calculation From the definition of own price elasticity : % change in P/ % change in Q, we can operationalize this as by finding the average arc price elasticity: E =( Q2-Q1/ P2-P1) x ( P2+P1/ Q2+Q1) so E = (88-90/1.25-1) x (1.25+1/88+90) E = -2/.25 x 2.25/178 = - 0.102 which is relatively inelastic. • Elastic ■ • Inelastic ■ Michael R. Baye, Managerial Economics and Business Strategy, 4e. ©The McGraw-Hill Companies, Inc. , 2002 Factors Affecting Own Price Elasticity ■ 8 ■ Inelastic 4 ■ 2 D 3 4 5 Quantity Time • Demand tends to be more inelastic in the short term than in the long term. • Time allows consumers to seek out available substitutes. 6 2 Available Substitutes • The more substitutes available for the good, the more elastic the demand. Elastic 1 Total revenue is maximized at the point where demand is unitary elastic. Michael R. Baye, Managerial Economics and Business Strategy, 4e. ©The McGraw-Hill Companies, Inc. , 2002 Elasticity, TR, and Linear Demand 10 Increase (a decrease) in price leads to an increase (a decrease) in total revenue. • Unitary ■ Price Increase (a decrease) in price leads to a decrease (an increase) in total revenue. Expenditure Share • Goods that comprise a small share of consumer’s budgets tend to be more inelastic than goods for which consumers spend a large portion of their incomes. Michael R. Baye, Managerial Economics and Business Strategy, 4e. ©The McGraw-Hill Companies, Inc. , 2002 Michael R. Baye, Managerial Economics and Business Strategy, 4e. ©The McGraw-Hill Companies, Inc. , 2002 Cross Price Elasticity of Demand Income Elasticity EQX , PY = % ∆QX % ∆PY d + Substitutes - Complements Michael R. Baye, Managerial Economics and Business Strategy, 4e. ©The McGraw-Hill Companies, Inc. , 2002 EQ X , M = % ∆QX % ∆M d + Normal Good - Inferior Good Michael R. Baye, Managerial Economics and Business Strategy, 4e. ©The McGraw-Hill Companies, Inc. , 2002 2 Example 1: Pricing and Cash Flows • According to an FTC Report by Michael Ward, AT&T’s own price elasticity of demand for long distance services is -8.64. • AT&T needs to boost revenues in order to meet it’s marketing goals. • To accomplish this goal, should AT&T raise or lower it’s price? Michael R. Baye, Managerial Economics and Business Strategy, 4e. ©The McGraw-Hill Companies, Inc. , 2002 Example 2: Quantifying the Change • If AT&T lowered price by 3 percent, what would happen to the volume of long distance telephone calls routed through AT&T? Answer: Lower price! • Since demand is elastic, a reduction in price will increase quantity demanded by a greater percentage than the price decline, resulting in more revenues for AT&T. Michael R. Baye, Managerial Economics and Business Strategy, 4e. ©The McGraw-Hill Companies, Inc. , 2002 Answer • Calls would increase by 25.92 percent! EQX , PX = −8.64 = % ∆QX % ∆PX d d % ∆QX − 3% d − 3% × (− 8.64 ) = %∆QX − 8.64 = d %∆QX = 25.92% Michael R. Baye, Managerial Economics and Business Strategy, 4e. ©The McGraw-Hill Companies, Inc. , 2002 Michael R. Baye, Managerial Economics and Business Strategy, 4e. ©The McGraw-Hill Companies, Inc. , 2002 Example 3: Impact of a change in a competitor’s price Answer • According to an FTC Report by Michael Ward, AT&T’s cross price elasticity of demand for long distance services is 9.06. • If competitors reduced their prices by 4 percent, what would happen to the demand for AT&T services? • AT&T’s demand would fall by 36.24 percent! EQ X , PY = 9.06 = % ∆Q X %∆PY d d % ∆Q X − 4% d − 4% × 9.06 = %∆Q X 9.06 = d %∆Q X = −36.24% Michael R. Baye, Managerial Economics and Business Strategy, 4e. ©The McGraw-Hill Companies, Inc. , 2002 Michael R. Baye, Managerial Economics and Business Strategy, 4e. ©The McGraw-Hill Companies, Inc. , 2002 3 Demand Functions • Mathematical representations of demand curves • Example: Specific Demand Functions • Linear Demand d Q X = 10 − 2 PX + 3PY − 2 M • X and Y are substitutes (coefficient of PY is positive) • X is an inferior good (coefficient of M is negative) • • • • d Q X = α 0 + α X PX + α Y PY + α M M + α H H PX QX Own Price Elasticity EQ X , PX = α X EQX , PY = α Y PY QX EQX ,M = α M Income Elasticity Cross Price Elasticity Michael R. Baye, Managerial Economics and Business Strategy, 4e. ©The McGraw-Hill Companies, Inc. , 2002 Michael R. Baye, Managerial Economics and Business Strategy, 4e. ©The McGraw-Hill Companies, Inc. , 2002 Example of Linear Demand Log-Linear Demand ln Q X d = β 0 + β X ln PX + βY ln PY + β M ln M + β H ln H Qd = 10 - 2P Own-Price Elasticity: (-2)P/Q If P=1, Q=8 (since 10 - 2 = 8) Own price elasticity at P=1, Q=8: (-2)(1)/8= - 0.25 Own Price Elasticity : Cross Price Elasticity : Income Elasticity : Michael R. Baye, Managerial Economics and Business Strategy, 4e. ©The McGraw-Hill Companies, Inc. , 2002 Example of Log-Linear Demand M QX βX βY βM Michael R. Baye, Managerial Economics and Business Strategy, 4e. ©The McGraw-Hill Companies, Inc. , 2002 P P • ln Qd = 10 - 2 ln P • Own Price Elasticity: -2 D D Q Linear Michael R. Baye, Managerial Economics and Business Strategy, 4e. ©The McGraw-Hill Companies, Inc. , 2002 Q Log Linear Michael R. Baye, Managerial Economics and Business Strategy, 4e. ©The McGraw-Hill Companies, Inc. , 2002 4 Regression Analysis • Used to estimate demand functions • Important terminology ■ ■ ■ ■ ■ Least Squares Regression: Y = a + bX + e Confidence Intervals t-statistic R-square or Coefficient of Determination F-statistic An Example • Use a spreadsheet to estimate log-linear demand ln Qx = β 0 + β x ln Px + e Michael R. Baye, Managerial Economics and Business Strategy, 4e. ©The McGraw-Hill Companies, Inc. , 2002 Michael R. Baye, Managerial Economics and Business Strategy, 4e. ©The McGraw-Hill Companies, Inc. , 2002 Summary Output Interpreting the Output • Estimated demand function: Regression Statistics Multiple R 0.41 R Square 0.17 Adjusted R Square 0.15 Standard Error 0.68 Observations 41.00 ■ ■ ANOVA df Regression Residual Total SS 1.00 39.00 40.00 MS Coefficients Standard Error 7.58 1.43 -0.84 0.30 Intercept ln(P) F 3.65 18.13 21.78 3.65 0.46 t Stat 5.29 -2.80 7.85 P-value 0.000005 0.007868 Significance F 0.01 Lower 95% Upper 95% 4.68 10.48 -1.44 -0.23 • How good is our estimate? ■ ■ ■ Michael R. Baye, Managerial Economics and Business Strategy, 4e. ©The McGraw-Hill Companies, Inc. , 2002 Summary ■ ■ Elasticities are tools you can use to quantify the impact of changes in prices, income, and advertising on sales and revenues. Given market or survey data, regression analysis can be used to estimate: • Demand functions • Elasticities • A host of other things, including cost functions ■ Managers can quantify the impact of changes in prices, income, advertising, etc. Michael R. Baye, Managerial Economics and Business Strategy, 4e. ©The McGraw-Hill Companies, Inc. , 2002 ln Qx = 7.58 - 0.84 lnPx Own price elasticity: -0.84 (inelastic) t-statistics of 5.29 and -2.80 indicate that the estimated coefficients are statistically different from zero R-square of .17 indicates we explained only 17 percent of the variation F-statistic significant at the 1 percent level. Michael R. Baye, Managerial Economics and Business Strategy, 4e. ©The McGraw-Hill Companies, Inc. , 2002 Sample Exam Problem Variable Coefficient S. Error Constant 100 5.00 P -2.50 ? PY -1.20 0.5 M 0.10 ? t-stat ? 4.0 ? 2.5 R2 = .75 # of Observations = 200 Michael R. Baye, Managerial Economics and Business Strategy, 4e. ©The McGraw-Hill Companies, Inc. , 2002 5 Sample Exam Problem Fill in the table and assuming the null hypothesis is that the coefficient is zero in each case. Find the price elasticity of demand assuming average income is $2000, P=$100 and PY is $5. Will revenue fall or rise is price is lowered? Sample Exam Problem Variable Coefficient S. Error Constant 100 5.00 P -2.50 0.625 -1.20 0.5 PY M 0.10 0.04 t-stat 20.0 -4.0 -2.4 2.5 R2 = .75 # of Observations = 200 Michael R. Baye, Managerial Economics and Business Strategy, 4e. ©The McGraw-Hill Companies, Inc. , 2002 Michael R. Baye, Managerial Economics and Business Strategy, 4e. ©The McGraw-Hill Companies, Inc. , 2002 Sample Exam Problem Sample Exam Problem Q = 100 – 2.5P – 1.2 PY +.1M demand fn. Q = 100 – 2.5P – 1.2*5 + .1*2000 Q = 294 – 2.5P demand curve E = -2.5*P/Q so P = 100 implies Q = 44 E = -250/44 = -5.68 so highly elastic Lower price and revenue will rise. Given the demand curve we just calculated, what price maximizes total revenue? What is elasticity at that price? We have Q = 294 – 2.5P and TR = Q*P so TR = (294 – 2.5P)P = 294P –P2 dTR/dP = 294-5P = 0 or P = $58.8 and Q = 147 so E = -2.5* (58.8/147) = -1 Michael R. Baye, Managerial Economics and Business Strategy, 4e. ©The McGraw-Hill Companies, Inc. , 2002 Michael R. Baye, Managerial Economics and Business Strategy, 4e. ©The McGraw-Hill Companies, Inc. , 2002 Sample Exam Problem Sample Exam Problem Marginal revenue by definition is dTR/dQ. MR >0 implies elastic demand MR< 0 implies inelastic demand MR=0 implies unitary elastic demand The demand cure is Q = f(P) but we need P = g(Q) or inverse demand curve to obtain the MR curve (to find dTR/dQ) Michael R. Baye, Managerial Economics and Business Strategy, 4e. ©The McGraw-Hill Companies, Inc. , 2002 From previous slide: Q = 294 – 2.5P Solve for P in terms of Q: 2.5P = 294 – Q or P = 117.6 – 0.4Q . TR(Q) = P*Q = (117.6-0.4Q)Q MR = dTR/dQ = 117.6 – 0.8Q Michael R. Baye, Managerial Economics and Business Strategy, 4e. ©The McGraw-Hill Companies, Inc. , 2002 6 Sample Exam Problem By definition, MR = 0 implies we have maximized total revenue. Solving: 117.6 – 0.8Q = 0 implies Q = 147 Substitute into inverse demand curve: P = 117.6 – 0.4*147 so P = $58.8 Just like a couple of slides back. Note, we checked that E=1 at that price. Michael R. Baye, Managerial Economics and Business Strategy, 4e. ©The McGraw-Hill Companies, Inc. , 2002 7