Food Beverage_A Natural Growth Industry

advertisement

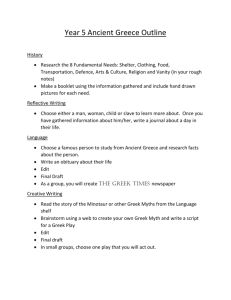

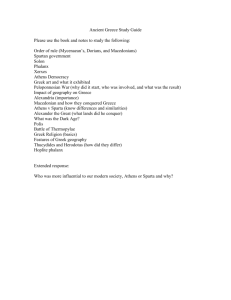

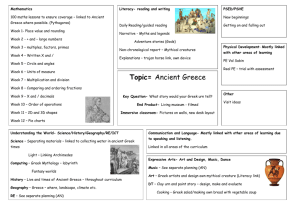

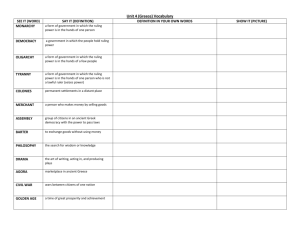

Food & Beverage A Natural Growth Industry January 2011 Table of Contents Food & Beverage in Greece: A growth industry sector Advantages and key business drivers Areas of potential growth and business expansion Success stories in trade and investment Food & Beverage in Greece: A growth industry sector F&B is the most dynamic and high-growth sector of Greek manufacturing… F&B enterprises represent 17.1% of total manufacturing enterprises Number of companies in the Greek F&B sector 16,500 16,000 Key Figures 15,715 15,500 15,000 1,270 are industrial companies with prominent domestic and international presence. The rest are SMEs 16.255 15,195 14,490 14,500 14,000 13,500 2004 2005 2006 2007 Almost 16,300 enterprises at industrial and artisanship level Sales account for 12 billion Euro covering 21% of total manufacturing Employs 120,000 people covering 22% of total employment in manufacturing Pastries, snacks, confectionery and pasta represent 2/3 of the enterprises, 1/3 of the total turnover and absorb half of total employment Source: Foundation for Economic and Industrial Research (IOBE) - F&B Sector Annual Report 2009, Eurostat …contributing decisively and steadily to the country’s exports and EU diet Share of the F&B industry exports in Greece’s total foreign trade 13.00% EU is the major export destination for the Greek F&B products (2008) 26% 12.80% 12.60% 12.40% 12.30% EU-27 12.30% Rest of the world 12.20% 12.10% 12.20% 12.00% 74% 2005 2006 2007 2008 Source: Foundation for Economic and Industrial Research (IOBE) - F&B Sector Annual Report 2009, Eurostat Outward looking by nature… High rating of Greek F&B investments abroad and prominent presence in international markets Greek investments in developed regions by sector (2007) Greek investments in developing regions by sector (2007) Financial Services Food & Beverage 2% Financial Services 2% 3% 2% 10% 28% 4% 4% Information & Communications Technology Retail & Wholesale Trade Construction & Real Estate 5% 2% 2% 1% Information & Communications Technology Food & Beverage 4% 4% Construction & Real Estate 9% Building Materials Pacaging Materials & Machinery Energy & Environment 55% Mining 8% Building Materials 8% 28% Tourism, Travel, Leisure & Entertainment Other Retail & Wholesale Trade 19% Basic Metals Machinery & Equipment Other Source: Invest in Greece, Policy & Planning Unit: Latest version survey entitled “Greek Investors in Foreign Markets 2001-2007” Strong receiver of FDI… Second strongest sector in Greek manufacturing after chemicals Foreign Direct Investments in the Greek manufacturing sector (2003-2009) – Gross figures 13% 2% 17% Food & beverage Refineries 8% 16% Chemicals Metals Machinery Transport means Rest 15% Source: Bank of Greece, 2010 29% …resistant and adaptive to the current financial crisis Employment • 5.5% increase in workforce in the first half of 2009 contributing to the alleviation of the crisis’s consequences Industry Production • Despite the decrease in 2009 production (2.6% in food and 6.7% in drinks), F&B experienced milder losses than those of the total manufacturing sector (10.6%) Source: Foundation for Economic and Industrial Research (IOBE) - F&B Sector Annual Report 2009 Bakery, snacks, confectionery and pasta is the largest subsector in terms of turnover and employment Employment by subsector (% classification) Turnover by subsector (% classification) 1.60% Meat Production & Processing 1.70% Fishery products 7.00% 11.80% 16.50% Fishery products 6.90% Vegetable & Fruit Processing Vegetable & Fruit Processing 10.40% 10.00% Vegetable & Animal Oils & Fats 8.60% Vegetable & Animal Oils & Fats 6.40% Dairy Products Flour Products 32.10% 16.80% Prepared Animal Feed Bakery, Snack, Confectionery & Pasta Products Drinks 2.70% 4.30% Meat Production & Processing 12.10% 46.30% Dairy Products Flour Products Prepared Animal Feed 3.00% 1.60% Source: Foundation for Economic and Industrial Research (IOBE) - F&B Sector Annual Report 2009, Eurostat Bakery, Snack, Confectionery & Pasta Products Drinks Advantages and key business drivers A privileged sector environment… • Low operating costs • Abundant raw materials of high quality • Access to the emerging growth markets of Southeast Europe and Eastern Mediterranean through the established production and sales network of Greek enterprises • Shift towards a low calorie, cholesterol free and vitamin-rich diet throughout the western world favoring the Greek Mediterranean diet • Highly experienced and well-educated labor force …offering plenty of benefits to international entrepreneurs… • A well-developed domestic retail / supermarket network that guarantees timely distribution and has already attracted key foreign players (Carrefour, Delhaize, Lidl) • Strong focus on R&D. Innovative manufacturers and highly specialized research centers develop new up-market and high quality products. Leaders in R&D, innovation and food technology are: The Food Industrial Research & Technological Development Company (ETAT) The Institute of Agrobiotechnology The Institute of Aquaculture The University of Thessaly …and a promising future as will continue to be the steam-engine of Greek manufacturing • Further development of small local production and reinforcement of competitiveness • Further reinforcement of R&D and innovation at industry level to cover new consumer needs and preferences (i.e. demand for convenience and specialized products based on safe, healthy and high quality ingredients) • Increasing demand and new consumer habits lead the way for branded products • Strategic alliances and further human resource exploitation are key industry priorities in the immediate future Source: Foundation for Economic and Industrial Research (IOBE) - F&B Sector Annual Report 2009, The Greek Economy in 2008 – Taseis Journal The Greek F&B industry is supported by a potent agricultural sector • Agriculture accounts for 5-6% of GDP in Greece as compared to 1.5% of EU-15. Although the share of agriculture in total economy diminished in the previous decade, continues to be at much higher levels in comparison with other EU members • Greek agriculture continues to provide jobs to a considerable amount of people in Greece. Its share in total employment (17%) is much higher than that of EU-15 (4.3%) • 35 to 40% of the total agricultural land is cultivated with arable crops, 20% with olive trees, 11% with cotton, 8% with fruits and vegetables, 3.5% with vines and 1.5% with tobacco Source: “A Brief Overview of Agriculture in Greece”, Pavlos D. Pezaros, Director of Agricultural Policy, Ministry of Rural Development & Food The Greek F&B industry is supported by a potent agricultural sector (2)… • Fertile semi-mountainous and mountainous areas: 50-55% of the cereals, 60-65% of olive trees, 70% of sheep and goat herds and 40-50% of bovine animals are cultivated or raised in these areas • A big size of holdings: Statistically, about 800,000 of family-type holdings appear to still be active in Greece Source: “A Brief Overview of Agriculture in Greece”, Pavlos D. Pezaros, Director of Agricultural Policy, Ministry of Rural Development & Food … characterized by a developing and very promising organic segment Reliance on organic food imports offers space for business expansion to cultivators, producers and processors 35% 65% Production of organic foodstuffs Imports of organic foodstuffs • The sector of organic products mainly consists of small, family-owned businesses • Producers and processors of organic products in Greece account approximately for 7,810 • Latest available figures suggest that cereals come first (38.3%) in organic cultivation followed by olive trees (38.2%) and vines (3.8%) Source: ICAP Organic Farming & Products sector study (April 2009), ΔΗΩ (Organization for the Inspection and Certification of Organic Products) Fish farming holds a discrete position in Greece’s F&B industry • Greece is the largest producer of sea bream and sea bass in the Mediterranean (370,000,000 fry & 150,000 tons of fish) and a key supplier of European markets (85% of the produced fish is exported • Greek farmed sea bream & sea bass constitute one of the four most important agriculture products of Greece (together with olive oil, tobacco and cotton), occupying the second place in the Greek agricultural exports • Approximately 100 companies, are engaged in the Mediterranean Aquaculture in Greece, the vast majority of which are small family businesses Source: Sector data and statistics presented by Dias, Nireus and Selonda Aquaculture Groups Fish farming holds a discrete position in Greece’s F&B industry (2) • 5 listed groups in the Athens Stock Exchange control over 70% of domestic production • Strong consolidation through mergers and acquisitions into larger groups opting to become more powerful in the market Key European Producers (2009) 3.20% 1.80% 4.40% Greece Consolidation Over Time 350 6.30% Turkey Spain 12.40% 48% 300 Italy France 23.80% Egypt, Morocco, Tunis Other 260 229 250 200 330 318 315 302 193 175 167 150 Companies 125 98 100 70 50 0 1997 2000 2003 2006 2008 2010* * Estimate Source: Sector data and statistics presented by Dias, Nireus and Selonda Aquaculture Groups Licenses Areas of potential growth and business expansion Abundant niche markets… There is abundant opportunity to create value added in many product categories in the Greek F&B sector, especially as the global interest in healthful foods continues to expand: Honey and nut based snacks Macaroni products Marmalades and pickled goods Ready made meals and frozen food Seafood …offer great potential… Meat and delicatessen products based on olive oil and other healthy Mediterranean ingredients Boutique and niche market goods including: sprirulina and saffron, both widely known for their therapeutic attributes mastiha and other herb products unique sauces baby foods …for investment and business expansion chocolates and confectionery cheeses specialty herb mixes traditional spoon sweets Liqueurs and fruit juices herbal beverage products organic products Simple steps to Establish a F&B manufacturing activity in Greece Decide on geographical area, focusing on target market, availability of raw materials, transportation and infrastructure Explore space availability within Industrial Areas where set-up is easier and faster Issue licenses if the investment is to be located outside an Industrial Area Use our free support services for guidance and assistance, saving valuable time Success stories in trade and investment Greece is the base of famous F&B brands Your Investment Partner in the region 3 Mitropoleos St. 105 57 Athens, Greece t. +30 210 3355700 f. +30 210 3242079 e. info@investingreece.gov.gr