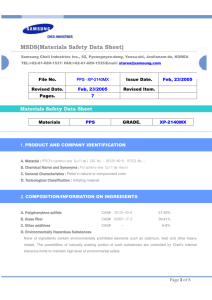

2011

advertisement