Wholesale financial markets factsheet

advertisement

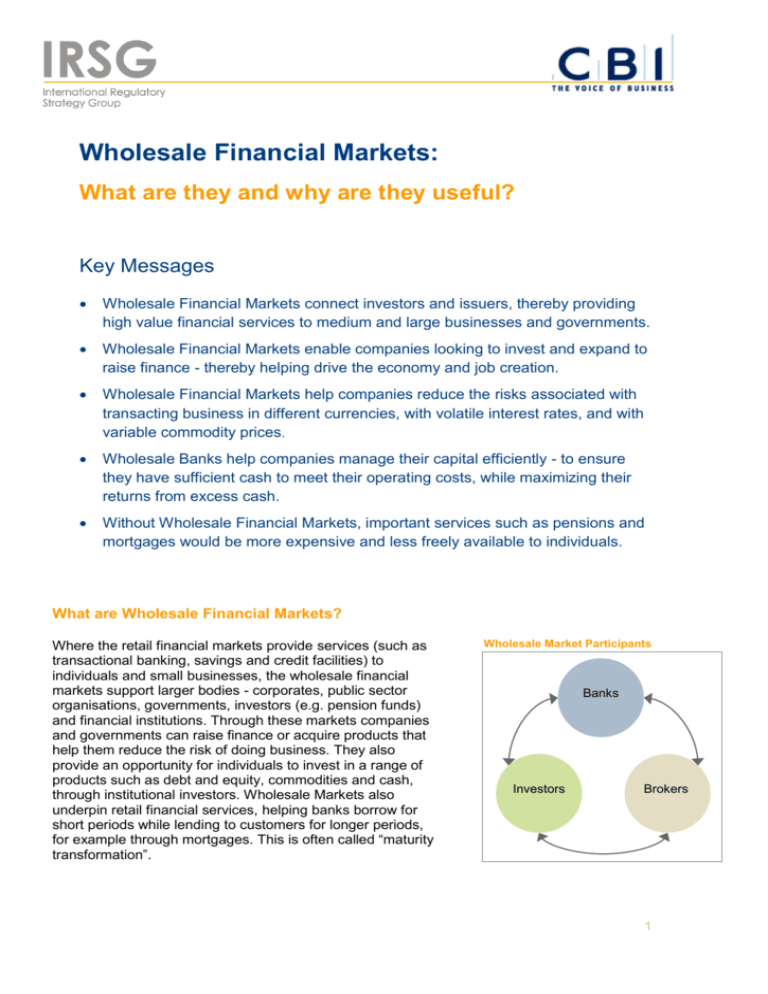

Wholesale Financial Markets: What are they and why are they useful? Key Messages Wholesale Financial Markets connect investors and issuers, thereby providing high value financial services to medium and large businesses and governments. Wholesale Financial Markets enable companies looking to invest and expand to raise finance - thereby helping drive the economy and job creation. Wholesale Financial Markets help companies reduce the risks associated with transacting business in different currencies, with volatile interest rates, and with variable commodity prices. Wholesale Banks help companies manage their capital efficiently - to ensure they have sufficient cash to meet their operating costs, while maximizing their returns from excess cash. Without Wholesale Financial Markets, important services such as pensions and mortgages would be more expensive and less freely available to individuals. What are Wholesale Financial Markets? Where the retail financial markets provide services (such as transactional banking, savings and credit facilities) to individuals and small businesses, the wholesale financial markets support larger bodies - corporates, public sector organisations, governments, investors (e.g. pension funds) and financial institutions. Through these markets companies and governments can raise finance or acquire products that help them reduce the risk of doing business. They also provide an opportunity for individuals to invest in a range of products such as debt and equity, commodities and cash, through institutional investors. Wholesale Markets also underpin retail financial services, helping banks borrow for short periods while lending to customers for longer periods, for example through mortgages. This is often called “maturity transformation”. Wholesale Market Participants Banks Investors Brokers 1 Whilst there is no universally held description of a Wholesale Financial Market, they are most commonly defined by what they do and who they serve. Wholesale Financial Markets support businesses in a number of ways, but the principal of these are: 6,000 Providing Funding: If a company needs money to invest and grow its business, it will often need more than it has readily to hand in the form of retained profits. Such a company needs to find another way to fund its investment. Wholesale Markets can help these companies access finance in a number of ways. 2,000 Firstly, banks help through corporate lending, where they use the money deposited with them by savers to invest in or lend to companies seeking finance. This enables savers to earn a return on their deposits, while at the same time enable organisations of all sizes to access funding. In 2011 over €51bn was lent to non-financial corporations, leading to a total of €4.7tn loans outstanding at the end of December 2011 (see figure 1). Euro Area Loans outstanding to Non–Financial Corporations at the year end (€bn) 5,000 4,000 3,000 1,000 - Source: ECB Figure 1 Value and Number of Initial Public Offerings in the UK 250 350 Value of IPOs $bn (lhs) Number of IPOs (rhs) 200 300 250 150 200 150 100 100 50 50 0 0 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Secondly, they can help organisations and governments raise money directly through issuing debt (bonds) or equity in the capital markets. With an equity issue a company raises money from investors in return for a share in the business. With bond issuance a company raises money from investors, agreeing to pay a specified return until the sum is repaid. In both cases the Wholesale Bank will underwrite the issue that is they will agree to take the responsibility and risk for selling a specific allotment of debt or equity. The Wholesale Bank is better placed to do this, rather than an individual firm, as it has the capital raising ability and capital strength that a typical company does not. Over the last decade companies have raised almost $340bn through initial public offerings (IPO) in the UK (see figure 2). Source: Bloomberg 1000 900 The Wholesale markets help fill the customer funding gap 800 Customer f unding gap £bn (lef t-hand scale) 30 Customer f unding gap as a per cent of loans (right-hand scale) 25 700 20 600 500 15 400 10 300 200 5 100 0 0 2005 2006 2007 2008 2009 2010 H1 2011 Source: Bank of England 30.0 25.0 Assets under Mgt, 2008 $tn Managing Risk: Companies - particularly international ones which transact business in multiple geographies and currencies - are exposed to a number of risks arising from, for example, fluctuations in exchange rates or in the costs of the commodities or raw materials which underpin their business. To be able to plan effectively, companies need to insulate themselves against the risk of movements in commodity prices or interest rates undermining their business - they need to „hedge‟ this risk. Wholesale Banks help companies by structuring hedging products such as Figure 2 Figure 3 The majority of global wealth is managed by insurance, mutual and pension funds. 20.0 15.0 24.0 10.0 18.7 5.0 0.0 19.0 8.1 0.9 1.5 Source: TheCityUK 2.5 3.9 Figure 4 2 derivatives to mitigate the risk volatility can pose to businesses. Wholesale Financial Markets & Customers Inter-Bank Market Short Term The Money Markets Capital Markets Long Term Managing Capital: It is essential that companies manage their working capital as efficiently as Retail Financial Markets & possible. They must understand 1. Access to Capital Market Customers Finance how much cash they need to have 2. Provision of Risk on hand to meet their various Management Banks Products operating costs, while at the same 3. Provision of Saving investment Deposits time maximizing the return of any products excess cash. As part of cash and Retail Customers liquidity management, Wholesale Lending Banks help companies with shortterm investing and borrowing through the money markets or in managed by pension funds worldwide highly liquid products such as government (see figure 4). bonds (i.e. treasury bills or gilts). Funding Asset Purchases: Wholesale Financial Markets also incorporate the interbank market - in which banks borrow from each other to support “maturity transformation” - borrowing for a short period of time to enable long term lending to retail customers, e.g. for mortgages. Without this banks would need to match their lending to their customer deposits, severely limiting the finance available for mortgages and other retail loans. The Wholesale Markets help fill the customer funding gap, which was £274bn in June 2011 (see figure 3). Investing Pensions: The average UK pensioner draws less than half their income from the state pension and other benefits. This means private savings are essential to funding people in their retirement. Private pensions are a core part of these private savings. Institutional investors pool and invest individuals‟ savings in the Wholesale Markets in a range of instruments of various rates of risk and return depending on an individual‟s circumstance, helping them save for retirement. In 2008, $24tn was Financial Institutions Corporations Investors Government Saving Deposits Corporate Customers Lending Case Study Benefit to individuals - Insurance: Risk is inescapable for people, businesses and public bodies, whether it be fire, floods, crime, accidents or other costly threats. Insurance companies paid out £23.4bn in 2010 on claims for general business such as vehicle, property and accident cover, while £151bn was paid out on long-term life assurance and pensions policies. The scale of protection can be seen in the amounts paid out daily: £22m in private motor claims and almost £10m to householders for property damage or the loss of possessions. There were 3.7m private motor claims and 2.1m household claims in 2010. Without the ability to pool and invest premium income, and hedge risks in the Wholesale Markets, insurers would not be able to offer the same levels of coverage to businesses and individuals. 3 Conclusion Authors Wholesale Financial Markets serve corporates, public sector organisations, governments, investors and financial institutions in two broad ways: raising finance and managing risk. The interconnected nature of financial services means this enables activities that directly benefit individuals, for example, access to insurance and mortgages. If the Wholesale Financial Markets were limited, there would be fewer tools to manage risk, and fewer options available to raise finance. The Wholesale Financial Markets Papers have been commissioned by the IRSG & CBI, and compiled by Accenture Research. About IRSG The International Regulatory Strategy Group (IRSG) is a practitioner-led body comprising leading UK-based figures from the financial and professional services industry. It aims to contribute to the shaping of the international regulatory regime at global, regional and national levels, so that it promotes open, competitive and fair capital markets globally and supports sustainable economic growth. Other papers in this series: 1. Wholesale Financial Markets: Why are they valuable to Europe? 2. Wholesale Financial Markets: Why does Europe need International Financial Centres? Its role includes identifying strategic level issues where a cross-sectoral position can add value to existing industry views. It is an advisory body both to the City of London Corporation, and to TheCityUK which is an independent practitioner-led body set up to co-ordinate the promotion of the UK-based financial and professional services industry. About CBI The CBI is the UK's leading business organisation, speaking for some 240,000 businesses that together employ around a third of the private sector workforce. 4 Wholesale Financial Markets: Why are they valuable to Europe? Key Messages Wholesale Financial Markets provide benefits to Europe through the products they provide to business, as well as their contribution to national accounts. European Wholesale Financial Markets helped 340 new companies raise $38bn through equity issuance in 2011. Wholesale Financial Markets helped EU15 corporates raise over $82bn internationally in 2010. Corporates in the EU15 currently have over $1.4tn in international debt outstanding. Wholesale Financial Markets are essential for companies looking to mitigate risks associated with fluctuating commodity prices, exchange rates and interest rates. The notional amount of Euro interest rate swaps outstanding at the end of 2010 was $10.6tn for non-financial institutions. In 2010, the contribution of the wholesale financial sector to EU Gross Value Added was €246bn – and exports were €60bn (€5bn more than USA). Why are wholesale financial markets valuable to Europe? Wholesale Financial Markets are a vital component in achieving the Europe 2020 Growth Strategy, of a smart, sustainable and inclusive economy. A wide array of companies rely on the Wholesale Markets to help them raise the money they need to invest and grow and to help them manage business risks and achieve efficiency in the way they manage their capital. The Europe 2020 Strategy calls specifically for “innovative instruments to finance the necessary investment” for growth. Not only do Wholesale Financial Markets support the European economy, but the financial services sector they underpin makes a substantial contribution to European output in its own right, and is a major employer. From the Europe 2020 Strategy: “Tools for Growth” 1. Deepening the single market - Wholesale markets are perhaps the most interconnected network 2. Investing in Growth - Financial Services provide innovative instruments for investment 3. External Policy Instruments - Wholesale markets enable macroeconomic policy coordination 1 8.0% Wholesale Financial Services as % GDP for selected EU countries 7.4% Enabling Business (Indirect value): 7.0% 6.0% Wholesale Financial Markets make a significant direct contribution to EU job creation and the economy by driving growth in all sectors of the wider economy. The different functions of Wholesale Financial Markets help the EU wider economy in a number of ways through financing businesses and helping them purchase tools to manage risk, as illustrated by the following examples. With a competitive Wholesale Financial Market, these activities enable the wider economy to be competitive itself on the international stage. 4.9% 5.0% 4.0% 3.0% 2.7% 2.0% 2.3% 2.1% 2.0% 2.0% 1.4% 1.3% 1.0% 0.0% Source: London Economics / City of London Corporation Trade in Wholesale Financial Services (€bn) Financing: Invest Securities, a financial services group offering services to small and mid-sized companies, helped to raise €12m in the IPO of Deinove, a company specialising in biofuel technology, on the Paris Stock Exchange (April 2010). Together with €2.35m from Truffle Capital, a French based venture capital firm, the company obtained enough financial resources to cover the needs of its R&D programme for three years, allowing the company‟s 20 employees to continue the development and commercial exploitation of innovative biofuel production. European wholesale markets helped 340 new companies raise $38bn through equity issuance in 2011.1 600 Other services 500 Finanical Services 400 300 432 386 200 100 66 46 38 29 0 Eu27 Total Eu27 Total Service Exports Service Imports Eu27 Total Service Net Imports Source: London Economics / City of London Corporation 300 700 European Equity Raising 625 $260.9 612 Value of IPOs ($bn) 250 600 Number of IPOs 530 500 200 400 150 324 340 $115.7 253 200 $64.1 147 74 50 112 $31.3 2 $38.0 2010 2011 100 $8.2 $7.0 0 0 2002 2003 2004 2005 2006 2007 2008 2009 Source: Bloomberg Net issues of international debt securities by corporates 100 80 60 40 0 -20 -40 Source: BIS 1 $36.1 $22.8 $11.2 20 Managing Input Price Risk with options: A German car manufacturer is required to purchase significant amounts of steel. If steel prices are likely to increase rapidly, the manufacturer may purchase a call option. This would be used 300 269 100 $bn Managing Output Price Risk with forwards: A wheat farmer in the south of France is subject to weather risk impacting on crop prices. During a season of good weather there may be a large volume of wheat grown across France, reducing the final price for the product. However, during a poor season there are low crop yields which drive up the cost as supply struggles to meet demand. In order to mitigate the risk from price variation the farmer will enter into a forward contract which fixes the price at which he will sell his crop. This will reduce the volatility in revenues leading to a more stable operating income. This then feeds through to greater price stability for consumers. The notional amount of commodity forwards and swaps outstanding at the end of 2010 was $2tn.2 Bloomberg (IPO data) Bank for International Settlements 2 if steel prices rose over a certain amount. If the price stayed below that price, then the option would not need to be exercised. This option would provide some certainty to the car manufacturer over the cost of steel, but would not limit the benefit from prices remaining lower. The notional amount of commodity options outstanding at the end of 2010 was $911bn.3 Managing Currency Risk with swaps: An Italian wine company exporting to many countries around the world faces currency risk. Where currencies other than the Euro are used, the wine company would be exposed to variations in the exchange rates between the two countries causing fluctuations in the income received by the Italian firm. To mitigate these fluctuations in export income, the wine company can enter into a „swap‟ which enables it to exchange alternative currencies back into Euros at a preagreed rate. This would ensure that the firm is obtaining a consistent Euro price for each case of wine and receive a more stable income. The notional amount of Euro currency swaps outstanding at the end of 2010 was $1.22tn for nonfinancial institutions. For Dollar currency swaps this was $1.51tn and for Sterling swaps, $379bn4. Managing Interest Rate Risk with swaps: A start-up brewery has a 5 year variable rate bank loan to help with start-up costs and working capital. However this variable rate loan means the company‟s cash flows are unpredictable. In order to fix interest rates for the brewery to provide more certainty over future cash flows, they use an interest rate swap. By paying the counterparty a fixed interest rate, the counterparty pays them a floating interest rate matching that of the brewery‟s bank loan. They can then pay this floating rate back to the bank, and still have the certainty of not being hit by sudden increases in interest rates. Interest rate derivatives are the principal instrument used for risk management, accounting for 78% of global notional value of all over-the-counter derivatives. The notional amount of Euro interest rate swaps outstanding at the end of 2010 was $10.6tn for non-financial institutions. For US Dollar swaps this was $9.7tn and for Sterling swaps it was $3.4tn5. Equity issuance: “The sale of new equity or stock by a firm to investors to raise money, typically to invest in and grow business.” Futures and Forwards: “The buyer of the future or forward contract agrees to buy a product (e.g., a commodity or currency) at a fixed price at a specified period in the future.” Options: “A call option gives the buyer the right to buy a specified asset at a fixed price any time before expiration, and a put option gives the buyer the right to sell a specified asset at a fixed price before expiration.” Interest Rate Swap: “Provides the ability to convert variable interest rate payments on loan to fixed payments.” Currency Swap: “One participant offers to swap a set of cash flows for the other’s set of cash flows of equivalent market value.” 3 Bank for International Settlements Bank for International Settlements 5 Bank for International Settlements 4 3 Direct value to Europe: Gross Value Added (GVA): The direct contribution of the financial services sector is measured in the national accounts by value added. Although official industry statistics do not separately distinguish wholesale and retail, estimates from 2010 suggest that wholesale financial services across the EU27 contribute €246bn GVA. This accounted for almost one third of the global contribution from wholesale financial services, and is a rise from €135bn in 2001. This gives an average year on year growth rate of 7%. This value-added is shared across Europe, with the largest centres being the UK (37%), Germany (16%), Netherlands (11%), Italy (8%) and France (8%)6. The wholesale market is also essential to the broader financial services sector. For example, the ability of banks to engage in maturity transformation through the wholesale markets, by accessing the shortterm interbank and money markets and extending longer-term loans to customers, underpins the retail banking sector. As measured, the EU financial sector contributes around 6% of total EU gross value added. The Euro area accounts for over 70% of this, the UK around 20%. A major European export: The EU wholesale financial services sector is also an important contributor to the EU‟s current account balance. The most recent data shows that in 2007 total exports of wholesale financial services by the EU to the rest of the world stood at €66.4bn (13% of total EU services exports). This represented a substantial current account balance surplus in financial services of 6 €37.7bn, almost 45% of the total surplus in services. Conclusion Whilst the EU wholesale financial services generate significant employment and are a major EU net exporter in their own right, their most important role is that of supporting the wider EU business sector. Whether helping small start-ups through the provision of venture capital, or raising capital through IPOs, the wholesale financial markets help Europe‟s businesses fund growth and investment. Through future or forward contracts, and through swaps and options, the wholesale financial markets help give businesses greater predictability of costs and revenue flows. The wholesale financial markets can provide the degree of certainty which underpins business cases, aids competitiveness, and is essential for the success of organisations in the wider economy. About IRSG The International Regulatory Strategy Group (IRSG) is a practitioner-led body comprising leading UK-based figures from the financial and professional services industry. It aims to contribute to the shaping of the international regulatory regime at global, regional and national levels, so that it promotes open, competitive and fair capital markets globally and supports sustainable economic growth. Its role includes identifying strategic level issues where a cross-sectoral position can add value to existing industry views. It is an advisory body both to the City of London Corporation, and to TheCityUK which is an independent practitioner-led body set up to London Economics 2010 figures 4 co-ordinate the promotion of the UK-based financial and professional services industry. Authors The Wholesale Financial Markets Papers have been commissioned by the IRSG & CBI, and compiled by Accenture Research. Other papers in this series: About CBI The CBI is the UK's leading business organisation, speaking for some 240,000 businesses that together employ around a third of the private sector workforce. 1. Wholesale Financial Markets: What are they and why are they useful? 2. Wholesale Financial Markets: Why does Europe need International Financial Centres? 5 Wholesale Financial Markets: Why does Europe need International Financial Centres? Key Messages International Financial Centres are hubs where cross border financial business can be conducted easily and efficiently. An International Financial Centre plays a major role in attracting new business to cities and countries. International Financial Centres benefit the European economy directly through tax contributions, providing jobs, and investment in local businesses. The whole country, and not just the city in question, benefits from having an International Financial Centre, as support services are often located nationwide. Specialisation has enabled multiple European financial centres to prosper; they are highly interdependent, with London being the largest and most interconnected. What is an International Financial Centre? An IFC is a centre (often based around a city) from which cross border financial business can be conducted easily, efficiently, and profitably within a strong regulatory environment. IFCs may be nationally focused (catering mainly to their local economies), regional, or global, providing a diverse range of financial services to clients from around the world. They need deep and liquid capital markets, leading IT and payments infrastructure, and access to talented, highly educated individuals. IFCs are also not just an area where financial firms congregate: a successful financial centre is a hub of high value business services such as legal services and accountancy. There are a number of significant advantages to hosting an IFC, and in an increasingly global world it is vital for Europe to host a leading one. 1 Employment in Wholesale Financial Services Benefits of an International Financial Centre: London 332.000 Providing jobs: The wholesale financial sector employs around 1.4 million people across Europe, although this underestimates the importance of the sector in direct job creation. The sector’s key role in broader financial services means it is critical in supporting a major EU industry with 6.5 million people working in the broader sector across the EU27. Paris Frankfurt Amsterdam 580.000 Luxumbourg Dublin Rest of Europe 270.000 20.000 48.000 34.000 76.000 Source: London Economics Employment in financial services is particularly significant in major cities in the EU where the majority of wholesale financial market activity takes place. It employs 352,000 people in London, 270,000 in Paris, 76,000 in Frankfurt, 54,000 in Amsterdam, 48,000 in Luxembourg and 20,000 in Dublin (figure 1). Figure 1 Investments by stage focus – evolution (industry statistics - % of number of companies financed) 100% 80% 60% 40% However IFCs are not just a cluster of financial service firms - they are a hub of high value business services, including legal and accounting services which facilitate cross border financial transactions. In London alone an additional 240,000 are employed in associated professional services such as accountancy, legal services and management consultancy. Notably, IFCs create high value jobs not just in their host city but across the country. Firms located in London have a large support infrastructure based elsewhere, including Glasgow (Morgan Stanley), Belfast (Citigroup), and Birmingham (Deutsche Bank), as well as overseas (Barclays in Czech Republic). There are similar national and Europe wide benefits from firms based in Paris and Frankfurt. Raising tax: Thriving International Financial Centres also make a considerable tax contribution. The UK financial services sector contributed £63bn in tax in 2010-11, 12% of total tax receipts. Approximately 40% of this is estimated to have derived from wholesale financial services attracted by the IFC. This was enough to pay for government spending on public order and safety, industry, agriculture and employment. 20% 0% 2006 Buyout Growth capital 2007 2008 Replacement capital Later stage venture 2009 2010 Rescue/Turnaround Start-up Seed Source: EVCA Figure 2 Source: Europe Economics Figure 3 European Financial Centres attracting foreign business – Equity Offering Summary Supporting local business: Many investment firms based in Europe will have a local mandate to invest. Investments into European companies hit £41bn in 2010, of which 97% came from European private equity firms. The financial sector plays a key role in helping the European economy Source: Europe Economics Figure 4 2 grow, particularly in the small and medium size sector: 40% of companies receiving funding from the European Venture Capital Association members in 2010 were early stage companies. Without a global international financial centre creating a hub for these sorts of investors, there would be less funding available to the companies of the future in Europe - which is essential as Europe looks to finance a private sector recovery to generate economic growth (figure 2). Europe’s International Financial Centres are: World leaders: IFCs are competing for business in a global market, as other centres (Moscow, Singapore, Malaysia, Dubai) are investing strongly to gain advantage. For Europe to maintain the levels of employment and tax that accompany successful IFCs, it is essential that they continue to attract a significant volume of business. In an increasingly global world with growth highest in the emerging economies, this means successful IFCs need to be able to attract businesses to engage in financial transactions in a domicile which is not their own. Europe has a number of highly successful International Financial Centres including Amsterdam, Dublin, Frankfurt, Luxembourg, Madrid, Milan, Paris and London. Whilst London is often cited as offering the greatest breadth of capabilities (not just in international banking, securities trading and fund management, but in niche areas such as carbon markets and maritime finance), these centres are all leaders in specific product areas - for example, Amsterdam specialises in pension management, and Dublin in fund administration (figure 3). European IFCs are innovative too. London is the leading Western centre for Islamic finance, with five firms that are fully Sharia compliant and over 20 banks supplying Islamic finance, illustrating how the financial sector can innovate to meet evolving business requirements and market demand. Europe’s International Financial Centres offer a full suite of services to clients. Their breadth and depth means they can successfully compete to attract major international businesses to Europe rather than New York or elsewhere. This is illustrated by the 182 equity offerings by non-domestic corporates on European exchanges in 2010, raising over €65bn (figure 4). Greater than the sum of their parts: Often research looks to rank IFCs against each other, but globalisation has long since meant that businesses no longer look at operating purely within national borders. The financial sector has long understood this, which is illustrated when looking at graduate recruitment into London’s financial sector, 22% of which are from overseas, including a high proportion from France and Germany. This European interconnectedness runs far deeper than personnel. It is rooted in the markets themselves, which have become increasingly interdependent over the past decade. This is illustrated by the amount of bank lending outstanding from banks in the UK to recipients in other European countries, which rose from $1tn in 2000 to $2.7tn in September 2011, a 155% increase. Similarly, of the £3.9tn assets managed in the UK, one third, is managed on behalf of overseas clients, with £617bn managed out of the UK for offshore domiciled funds such as Luxembourg based collective investment schemes. Having the IFC situated in the EU means that the business is conducted under the EU’s legal and regulatory framework. 3 This enables EU authorities to influence the levels of risk and capital taken on. Conversely, offshoring the markets contains risk as the firms would not be subject to the same oversight. This interconnectedness allied to the freedom of movement within Europe, and a strong regulatory environment, enables Europe’s International Financial Centres to compete globally and deliver the most effective and efficient services to clients both within Europe and around the world. Conclusion International Financial Centres are leading business hubs underpinned by talented individuals which provide employment and yield tax. Most importantly, they attract investment which flows into local companies. The greater the breadth and depth of a financial centre, the greater its ability to attract investment and support the growth of surrounding economies. Conversely, if these markets were allowed (or encouraged) to decline, Europe would lose jobs, revenue from tax, investment in business and easy access to facilities for the wider economy. As Europe looks to kick start the economic recovery, it is clear that it needs globally competitive IFCs to support this resurgence. Europe has a number of IFCs which will be at the heart of the effort to recover - including the leading global International Financial Centre, London - but their interdependence is essential to their success. industry. It aims to contribute to the shaping of the international regulatory regime at global, regional and national levels, so that it promotes open, competitive and fair capital markets globally and supports sustainable economic growth. Its role includes identifying strategic level issues where a cross-sectoral position can add value to existing industry views. It is an advisory body both to the City of London Corporation, and to TheCityUK which is an independent practitioner-led body set up to co-ordinate the promotion of the UK-based financial and professional services industry. About CBI The CBI is the UK's leading business organisation, speaking for some 240,000 businesses that together employ around a third of the private sector workforce. Authors The Wholesale Financial Markets Papers have been commissioned by the IRSG & CBI, and compiled by Accenture Research. Other papers in this series: 1. Wholesale Financial Markets: What are they and why are they useful? 2. Wholesale Financial Markets: Why are they valuable to Europe? About IRSG The International Regulatory Strategy Group (IRSG) is a practitioner-led body comprising leading UK-based figures from the financial and professional services 4