Econ 503 Stephen L. Parente Macroeconomic Theory Fall 2012

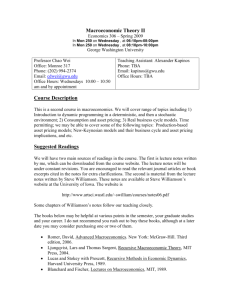

advertisement

Econ 503 Macroeconomic Theory Stephen L. Parente Fall 2012 Syllabus Office: 118 DKH Office Hours: Monday, 9:00-10:30, and by appointment Office Phone: 244-3625 E-mail: parente@illinois.edu Course Homepage: https://netfiles.uiuc.edu/parente/econ503/econ503.html Teaching Assistant: The TA for the course is Joao Bernardo Aurelio-Duarte E-mail: aurelio2@illinois.edu Office Hours: Monday 3-5 PM, and by appointment Recitation: Friday, 10-11:50 AM 215 DKH Course Objective: The goal of this course is twofold. The first goal is technical in nature. More specifically, the course will teach you some standard tools and models that currently dominate macroeconomics. The second goal is more substantive in nature. In particular, the course will demonstrate how macroeconomists apply dynamic general equilibrium methods to derive quantitative answers to questions about which we are currently ignorant. References: The main material for the course consists of lecture notes written by several prominent macroeconomists, such as Per Krusell, Randy Wright, Dirk Krueger and Victor RiosRull. Additionally, there are some supplemental journal articles. Textbooks play a minor role in the course. Nevertheless, I have placed at the bookstore Ljungqvist, L. and T. Sargent. Recursive Macroeconomic Theory. Cambridge: MIT Press (2004). The Ljungqvist and Sargent book is a comprehensive book, and so an excellent resource for a huge number of topics. For lighter reads that will make you into a well-rounded and informed economists, I recommend White, L. The Clash of Ideas, http://mercatus.org/person/working_papers/17178?page=1 Snowden, B. and H. Vane. Conversations with Leading Economists. Northampton, MA: Edgar Elgar Press (1999). 1 Some other useful macro books you might want to add to your professional library are: Stokey, Nancy, Robert E. Lucas, with Edward Prescott. Recursive Methods for Economic Dynamics. Cambridge: Harvard University Press (1989). Cooley, Thomas. Frontiers of Business Cycle Research. Princeton: Princeton University Press, (1995). Farmer, Roger. The Macroeconomics of Self-Fulfilling Prophecies. Cambridge, Ma: MIT Press (1993). Mathematical Preliminaries: Most of the mathematics that you need for the course were covered in the math camp that you took with Pr. Cho. Concepts that I feel are important to the course or that were not covered sufficiently in the camp will be taught either in class or recitation. You may want to review Chapters 12, and 16-21 in Simon and Blume’s book, Mathematics for Economists. Grading: Your grade will be based on a series of problem sets, a midterm and a final exam. The midterm and final will each contribute 45 percent to your grade; the problem sets make up the remaining 10 percent. Problem Sets and Old Exams: Problem sets, and past exams are posted on the course webpage. Academic DishonestyThe University takes serious violations of academic dishonesty. The penalty for Academic dishonesty will be an F for the particular assignment/exam and potentially an F for the course. Students are advised to consult the LAS Student Handbook for definitions of academic dishonesty. Examination Schedule: The midterm will be scheduled around the first part of October. The final examination is scheduled for Wednesday, December 19th 1:30-4:30 PM Some Additional Advice: I encourage you to work with your classmates. My experience, both as a graduate student and as a teacher, is that going over your lecture notes and problem sets with your classmates is an important way by which learning occurs. Note, that whereas you are encouraged to discuss problem sets and their solutions, the work you hand in must be your own! 2 Course Outline/Reading List I. Econ 503 Introduction to Macroeconomics White, Lawrence Clash of Ideas Lucas, R.E. and T. Sargent. 1979. After Keynesian Macroeconomics, Federal Reserve Bank of Mineapolis Review (Spring). Krusell Chapter 1 II. The Solow Model – Krusell 2 III. Dynamic Optimization – Sequence Approach in Robinson Crusoe Economies A. Finite Horizon – Krusell 3.1.1 B. Infinite Horizon – Krusell 3.1.2 IV. Competitive Equilibrium A. Sequential Competitive Equilibrium Krusell 5.1.1, 5.1.2, 5.1.4, Krueger 2.2.5 B. Arrow Debreu Economies and Welfare Theorems Krusell 5.1.3, Krueger 2.2.1-2.2.3, 7; Parente GE Notes C. Negeshi Algorithm Krueger, 2.2.4 Negeshi, T. 1960. “Welfare Economics and Existence of an Equilibrium for a Competitive Economy”. Metroeconometrica 12: 92-97. Kehoe, T.J. 1989. “Intertemporal General Equilibrium Model”s. In F. Hahn, editor, The Economics of Missing Markets, Information, and Games. Clarendon Press, 1989, 363-393. C. Heterogeneity and Aggregation – Parente GE notes Chatterjee, S. 1994. “Transitional Dynamics and the distribution of wealth in a Neoclassical Growth Model”. Journal of Public Economics (54): 97-119. V. Uncertainty Krusell 6, Krueger 6, Ljungqvist and Sargent Chapter 8 3 VI. Deviations from Arrow- Debreu A. Overlapping Generations Model Krusell 7, Wright OLG Notes, Ljungqvist –Sargent 9 Samuelson, P. 1958. “An Exact Consumption Loan Model of Interest with or Without the Social Contrivance of Money”, Journal of Political Economy 66: 467-482. Tirole, J. 1985. “Asset Bubbles and Overlapping Generation”s, Econometrica 53:1071-1100. B. Monopolistic Competition. Krugman, P. 1979. ‘Increasing Returns, Monopolistic Competition”, and International Trade, Journal of International Economics 9:469-79. VII. Dynamic Programming A. Mathematics of Dynamic Programming Wright DP Note; Krueger 4, 5; Ljungqvist and Sargent 1,3,4 B. Social Planner Problem Krusell 3.2, and 3.3, Krueger 3.2.2. VIII. Recursive Competitive Equilibrium Krusell 5.2, Rios-Rull 1-3, Krueger 3.3.4 IX. Economic Policy Krusell 10, Sargent and Ljungqvist 11 and 15 X. Business Cycles Krusell 11 Prescott, Edward C. 1998 “Business Cycle Research: Methods and Problems.” Federal Reserve Bank of Minneapolis Working Paper 590 (October). Prescott. National Income and Product Accounts Notes. Prescott, Edward C. 2004 “Why do Americans Work So Much More than Europeans?” Federal Reserve Bank of Minneapolis Quarterly Review 28: 1 (July). Cooley, Thomas R. and Edward C. Prescott. 1995. “Economic Growth and Business Cycles.” In Frontiers of Business Cycle Research, edited by Thomas Cooley: Princeton: Princeton University Press, 1-39. (Not Downloadable.) 4