THE NATION'S SICK ECONOMY

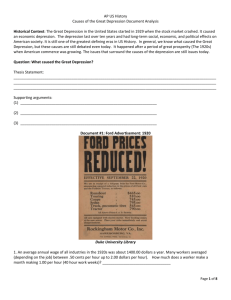

advertisement

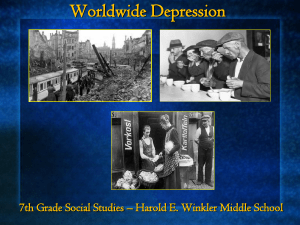

STANDARD: ECON 3.1 MARKET ECONOMY 3.6 CHANGES IN ECONOMIC ACTIVIT Y Opening: The Nation’s Sick Economy Work Period: Great Depression Notes and video Closing: Hardship and Suf fering During the Depression THE NATION’S SICK ECONOMY As the 1920s advanced, serious problems threatened the economy while Important industries struggled, including: A griculture Railroads Textiles Steel Mining Lumber Automobiles Housing Consumer goods CONSUMER SPENDING DOWN By the late 1920s, American consumers were buying less (demand declined) Rising prices, stagnant wages and overbuying on credit were to blame Most people did not have the money to buy the flood of goods factories produced (overproduction) A SUPERFICIAL PROSPERIT Y Many during the 1920s believed the prosperity would go on forever Wages for most workers fell while productivity increased GAP BETWEEN RICH & POOR WIDENED Photo by Dorothea Lange The gap between rich and poor widened The wealthiest 1% saw their income rise 75% The rest of the population saw an increase of only 9% More than 70% of American families earned less than $2500 per year THE UNFORTUNATE CYCLE Companies did not pass on their prosperity to their employees by paying them more, so workers couldn’t afford to buy the products they made. When consumers reached their limit of installments, they had to stop spending. No spending means lay offs for workers. FARMERS STRUGGLE Photo by Dorothea Lange During World War I European demand for American crops soared After the war, they faced international competition, depressed prices, debt and taxes Farmers defaulted on bank loans causing banks to fail BEFORE the crash in 1929. Fewer banks= limited number of loans for everyone else. REPUBLICAN ADMINISTRATIONS Gov’t abandoned policy of progressivism and limited regulation of Big Business (unlike Sherman Anti-Trust and trust-busing of TR) Return to laissez-faire meant corporations became increasingly powerful The tariff was raised and the Supreme Court overturned child labor and minimum wage laws for women Income taxes for wealthy slashed, and they invested in luxury goods and the stock market instead of new factories THE STOCK MARKET By 1929, many Americans were invested in the Stock Market The Stock Market had become the most visible symbol of a prosperous American economy (“get rich quick”) SEEDS OF TROUBLE By the late 1920s, problems with the economy emerged Speculation: Too many Americans were engaged in speculation – buying stocks & bonds hoping for a quick profit Margin: Americans were buying “on margin” – paying a small percentage of a stock’s price as a down payment and borrowing the rest The Stock Market’s bubble was about to break THE 1929 CRASH In September the Stock Market had some unusual up & down movements On October 24, the market took a plunge . . .the worst was yet to come On October 29, now known as Black Tuesday, the bottom fell out 16.4 million shares were sold that day – prices plummeted People who had bought on margin (credit) were stuck with huge debts By mid-November, investors had lost about $30 billion THE GREAT DEPRESSION The Stock Market crash signaled the beginning of the Great Depression The Great Depression is generally defined as the period from 1929 – 1940 in which the economy plummeted and unemployment skyrocketed The crash alone did not cause the Great Depression, but it hastened its arrival FINANCIAL COLLAPSE After the crash, many Americans panicked and withdrew their money from banks Banks had invested in the Stock Market and lost money In 1929- 600 banks fail By 1933 – 11,000 of the 25,000 banks nationwide had collapsed Bank run 1929, Los Angeles THE FEDERAL RESERVE The Federal Reserve (1913), the nation’s central bank, has the capacity to regulate the money supply by making loans to banks, which then make loans to businesses, which hire workers, who buy products. Early in the 1920s, the Fed pursued easy credit policies. Charged low interest rates which helped fuel stock market speculation mania. In the late 1920s, the Fed tried to tighten money in order to curb stock market speculation, ultimately discouraging lending. GNP DROPS, UNEMPLOYMENT SOARS Between 1928-1932, the U.S. Gross National Product (GNP) – the total output of a nation’s goods & services – fell nearly 50% from $104 billion to $59 billion 90,000 businesses went bankrupt Unemployment leaped from 3% in 1929 to 25% in 1933 HAWLEY-SMOOT TARIFF To protect American industry from foreign competition, Congress passed the toughest tariff in U.S. history called the Hawley- Smoot Tariff It was meant to protect U.S. industry yet had the opposite effect-limited international trade. Foreigners were unable to sell their goods in US markets and did not have dollars to buy American goods. Other countries enacted their own tariffs and soon world trade fell 40% PRESIDENT HOOVER Went farther than any other president and urged companies to voluntarily maintain wages and hours. Lower consumer demand made this impossible and companies laid off workers and cut hours. Advocating “rugged individualism”, Hoover urged that prosperity was “just around the corner” “Hoovervilles” “Hooverflags” “Hooverblankets” HARDSHIPS DURING DEPRESSION The Great Depression brought hardship, homelessness, and hunger to millions Across the country, people lost their jobs, and their homes (25% unemployed) Many wandered from town to town selling apples and pencils door to door. No system of unemployment insurance Wages and hours were cut and people bought only essential goods. “Runs” on the banks (people tried to withdraw all of their money) caused banks to collapse EFFECTS OF DEPRESSION Families undernourished Schools closed (couldn’t pay teachers) Marriages delayed Birthrate fell Men abandoned families Some families worked together Women/children forced to work States and charities couldn’t fix the problem Needed the gov’t to step up.