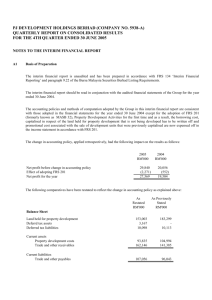

Morgan Stanley Dean Witter & Co.

advertisement