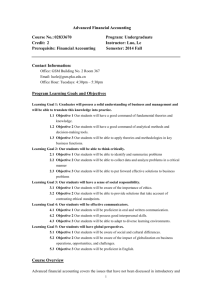

2014 Audited Financial Statements

advertisement