View PDF

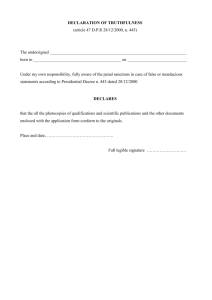

advertisement