Form IT-214 - AARP Tax-Aide

advertisement

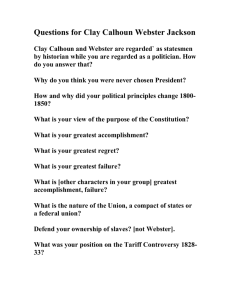

NY Return County/School District (IT-201 p1) • School District Name & Number Webster=679, Brighton=063, Fairport=188, Penfield=488, Pittsford=500, Wayne=678, Williamson=705, Rochester=538 To find other: Select in the Menu Bar Click on “State Help” Click on “NY” Click on “NY Codes” “County and School District Codes” Select “M” for Monroe or “W” for Wayne County Scroll to the appropriate county name and school district OR refer to list in Publication IT-201 Webster, NY – TaxHelper 2015 -1- NY Return Additions to Income (IT-201 p2) • Check transfers from federal return Interest on non-NY state and local bonds transfer to Line 20 W-2 Box 14 “414HSUB” amounts (public employee retirement contributions) transfer to Line 21 New York 529 college savings non-qualified withdrawals are entered manually on Line 22 Some Form W-2, Box 14 entries are subject to NY tax even though not subject to Federal Tax Webster, NY – TaxHelper 2015 -2- NY Return Subtractions from Income (IT-201 p2) NY does not tax these items carried from the federal return NY state tax refunds transfer to Line 25 NY, local and federal government pensions transfer to Line 26 Social Security benefits transfer to Line 27 US bond interest transfers to Line 28 Non-government pensions up to a maximum of $20K per person transfer to Line 29 Adjustments may need to be manually entered on line 29. See slides on Pensions and Annuities Transfers to Line 31 Railroad pensions (code S-122) from Federal 1099-R Disability Income Exclusion (code S-124) from NY IT-221 Long Term Care Residential Care Deduction (code S-105) from NY IT-225 Webster, NY – TaxHelper 2015 -3- NY Return Household Credit (IT-201 p3) • Line 40 – Household Credit (nonrefundable) Taxwise calculates this automatically If filing status is MFS and the spouse’s AGI / dependent info is not available, enter 999999 and 99, respectively, to eliminate the credit Webster, NY – TaxHelper 2015 -4- NY Return Long Term Care Insurance Premiums (IT-249) • Long Term Care premiums must be entered separately for taxpayer and spouse on the Federal Schedule A Detail Worksheet, even if taxpayer is not itemizing on his Federal return. Taxwise calculates the NY Credit and carries forward the result to NY IT-249 Line 42. Webster, NY – TaxHelper 2015 -5- NY Return Long Term Care Insurance Premiums (IT-249) • The credit is 20% of the premiums paid • The credit is nonrefundable, but unused credit can be carried over to next year • Be sure to check for any carryover from the previous year’s IT-249 Schedule H, line 24 and enter it on the current year’s IT-249 Schedule F, line 13. TaxWise does not do this for you. Webster, NY – TaxHelper 2015 -6- NY Return Long Term Care Insurance Premiums (IT-249) • Since this is a non-refundable credit, it is limited to the tax due • Line 24 is the amount to be carried forward to the next tax year • Add a note to the Main Information Sheet to remind the Counselor next year to not forget to make a manual entry of the carryover. Webster, NY – TaxHelper 2015 -7- NY Return Sales or Use Tax (IT-201 p3) • Line 59: Record sales tax that the taxpayer wishes to pay for internet / catalog / QVC purchases • The table above is from the 2015 Form IT-201 Instructions Webster, NY – TaxHelper 2015 -8- NY Return Refundable Credits (IT-201 p4) • Refundable Credits Nursing Home Assessment Child Tax Credit Credit Child and Dependent Care Credit College Tuition Credit Earned Income Credit Family Tax Relief Credit Real Property Tax Credit Volunteer Firefighters and Ambulance Workers Credit Webster, NY – TaxHelper 2015 -9- NY Return Empire Child Tax Credit (Form IT-213) • Child Tax Credit (refundable) NY Form IT-213 is placed in the forms tree if there is a federal child tax credit Same income limitations as federal Credit is 33% of federal credit BUT, a child under 4 years of age does not qualify Must have social security number of child(ren) Taxwise automatically determines eligibility and credit amount Webster, NY – TaxHelper 2015 -10- NY Return Child & Dependent Care Credit (Form IT-216) • Child and Dependent Care Credit (refundable) NY Form IT-216 is placed in the forms tree if there is a federal child and dependent care tax credit Credit ranges from 20% to 110% of federal credit depending on income Taxwise automatically calculates the credit Taxpayers should be advised that if they don’t keep records or if the records do not prove what they claimed, the credit will be disallowed. Form DTF-216 provides recordkeeping suggestions for child care expenses and how to keep good records. Webster, NY – TaxHelper 2015 -11- NY Return Earned Income Credit (form IT-215) • Earned Income Credit (refundable) NY Form IT-215 is placed in the forms tree if there is a federal earned income credit The NY credit is 30% of the federal credit This credit is reduced by the household credit Taxwise automatically determines eligibility and credit amount Webster, NY – TaxHelper 2015 -12- NY Return Real Property Tax Credit (Form IT-214) • Real Property Tax Credit (refundable) – Qualifications Household gross income is $18,000 or less In the same NY residence for at least 6 months NY State resident for the entire year Cannot be a dependent on another taxpayer’s federal return Your residence was not completely exempted from property tax and the taxpayer paid rent or property taxes Market value of all real property owned is $85,000 or less If a renter: Average total monthly rent paid by household members is $450 or less, excluding heat, gas, electricity, furnishings and board Did not live in housing exempt from property taxes If qualified, link to NY Form IT-214 from Form IT-201, Line 67, and complete the form Webster, NY – TaxHelper 2015 -13- NY Return College Tuition Credit/Deduction (Form IT-272) • College Tuition Credit or Itemized Deduction (refundable) The taxpayer, spouse or dependent (for whom they are taking an exemption) was an undergraduate student enrolled at institution of higher education Taxpayer must not be claimed as a dependent on another taxpayer’s NY return Taxpayer must be a full-year resident of NY to claim the credit Only tuition expenses are eligible NY Form IT-272 is placed in the forms tree if an education credit is claimed on the federal return. You must have the federal ID# of the college/university The credit is a maximum of $400 per student If education expenses are reported as an adjustment to income on the federal return you will have to link to IT-272 p1 from IT-201, Line 68 Webster, NY – TaxHelper 2015 -14- NY Return College Tuition Credit/Deduction (Form IT-272) • College Tuition Credit or Itemized Deduction Note the red highlighted instructions for selecting the best alternative for the taxpayer Check each box to determine which option provides the largest refund or smallest amount due When “itemized deduction” is selected, the credit amount is highlighted as being overridden - ignore it Webster, NY – TaxHelper 2015 -15- NY Return Nursing Home Assessment (Form IT-258) • Nursing Home Assessment Credit (refundable) The assessment imposed on a NY residential health care facility and paid directly by the taxpayer can be claimed as a credit The assessment must be separately stated on the billing statements and must be paid directly by the individual taxpayer claiming the credit If an individual other than the resident is actually paying the assessment, the individual who paid the assessment, not the resident, is entitled to claim the credit Add Form “NY IT-258” in the Forms Tree Complete NY IT-258; the credit will be transferred to IT-201, Line 71 Note: If the assessment amount reduced the tax liability in the prior tax year because it was included in Federal Schedule A Medical Deductions, then some or all of this credit may be taxable in the current tax year (see next page) NOTE: There is a temporary rate increase, however, the NYS credit is still limited to the 6% allowed pursuant to Public Health Law section 2807-d(2)(b). The 6% base rate eligible for the credit should be explicitly identified on the Nursing Home billing statement. Webster, NY – TaxHelper 2015 -16- Federal Return Nursing Home Assessment Credit Recovery • If all of the following conditions are met, then some or all of the tax year 2014 Nursing Home Assessment credit may be federally taxable in 2015: In 2014 the taxpayer itemized deductions In 2014 the Schedule A Medical Expense Deduction included a NY Nursing Home Assessment 2014 Medical Expense Deduction (Schedule A line 4) was > $0 • Then you must do the following in TaxWise On the current year 1040 page 1, answer “yes” to the question below line 9b “Did you itemize deductions last year and receive state or local tax refunds…” Open the State Tax Refund Worksheet Enter on Line 4 the smaller of: The Nursing Home Assessment included as a medical deduction on 2014 Schedule A or The allowed medical expense deduction from 2014 Schedule A, line 4 State Tax Refund Worksheet 2014 2014 2014 2014 Complete all other entries on the worksheet (continue on next page) 2014 Webster, NY – TaxHelper 2015 -17- Federal Return Nursing Home Assessment Credit Recovery The total from the St Tax Refund Wkt line 14 (taxable amount of state income tax refund) is automatically transferred to Form 1040 line 10 The total from the St Tax Refund Wkt line 15 (taxable amount of the Nursing Home Assessment Credit recovery) is automatically transferred to Form 1040 Wkt7 line 4 (Recovery of itemized deductions) which further transfers to Form 1040 line 21 State Tax Refund Worksheet 2014 2014 2014 2015 1040 p1 ! Note that for very high AGIs (see worksheet at bottom of Schedule A) itemized deductions may be subject to limitations, in which case you must refer to Publication 525 (see section on “Miscellaneous Income/Recoveries”) to determine the amount of the State Income Tax refund and Nursing Home Assessment credit that are taxable in the current year. 1040 Wkt7 Webster, NY – TaxHelper 2015 -18- NY Return Volunteer Firefighters/Ambulance Workers (Form IT-245) • Volunteer Firefighters and Ambulance Workers Credit (refundable) Must be a full-year NY State resident and must have been an active volunteer for the full tax year The credit is $200 for each qualified volunteer (taxpayer and/or spouse) Maximum credit per return is $400 Search for “NY 245” in the TW “Find a form” window Complete NY IT-245 and TW will carry the credit to Form 201, Line 71 Webster, NY – TaxHelper 2015 -19- NY Return Disability Income Exclusion (Form IT-221) • Taxpayers may exclude either their actual weekly disability pay or $100 a week, whichever is less if they meet ALL of the following: They received disability pay They were not yet 65 when the tax year ended They cannot be engaged in gainful employment They retired on disability and were permanently and totally disabled when they retired (Physician’s statement required) On January 1 of the tax year, they had not yet reached the age when their employer’s retirement program would have required them to retire If they filed “Married Filing Separately” on their Federal and New York State returns, they must have lived apart during the entire tax year. Note: the total of the disability income exclusion and any pension and annuity income exclusion cannot exceed $20,000. • Must Create a PDF of Physician’s Statement and attach to e-file Add form “NY PDFs” to the forms tree Select IT-221 in order to attach file that has been scanned • Link from IT-201, line 31 to “NY 225 Wkt 2”, enter exclusion amount on line 124 Webster, NY – TaxHelper 2015 -20- NY Return New York Resident Credit (Form IT-112-R) • Credit is for full-year or part-year residents of NYS if any part of your income was taxed by another state, a local government within another state, or the district of Columbia. • Credit is allowable only for the part of the tax that applies to income received in the other taxing authority while you were a New York resident. • Credit is not refundable. • Note: If any taxes were paid to a Canadian province, please use form IT-112-C, New York State Resident Credit for Taxes Paid to a Province of Canada. Webster, NY – TaxHelper 2015 -21- NY Return New York Resident Credit (Form IT-112-R) • Enter in column B of Form IT-112-R the gross income from column A that was taxed by the other taxing authority. Webster, NY – TaxHelper 2015 -22- NY Return Estimated Tax – Form IT-2105 • Taxpayers are not required to file estimated taxes if they expect to owe less than $300 of New York State, city of New York, or city of Yonkers income tax after deducting tax withheld and credits that you are entitled to claim. • Payment - April 18, June 15, Sept 15 and Jan 17 • Estimated taxes can also be paid using Form IT-2105 Add to the Forms Tree “NY 2105 Wkt” Enter estimated tax you wish to pay for the next tax year directly below line 28 You can apply any current year overpayment towards next year’s estimated payment Taxwise will place Forms IT-2105 Payment Vouchers into the Forms Tree for printing Webster, NY – TaxHelper 2015 -23- NY Return Underpayment of Estimated Tax (Form IT-2105.9) • Underpayment of Estimated Tax No penalty if total payments is at least equal to 100% of prior year’s tax (110% if prior year’s AGI was more than $150,000) A penalty may be assessed if the amount owed is $300 or more and is more than 10% of the tax due NY Form IT-2105.9 is used to calculate the penalty and will show up (NY 05.9) in the Forms Tree with a red flag Volunteer income tax preparers should not calculate interest and penalties. If there is a potential penalty, then Form IT-2105.9 will appear in the forms tree (see next slide for instructions to deal with penalty) Webster, NY – TaxHelper 2015 -24- NY Return Underpayment of Estimated Tax (Form IT-2105.9) See next slide showing Form IT-2105.9 and follow these instructions • Be sure that the Box in Part 2 is checked to indicate that the Short method will be used to figure penalty • Un-override line 17 (F8, if necessary) • If there is no penalty indicated on Line 24, then you are done • If there is a penalty indicated on Line 24, enter the 2014 tax on line 16, if not carried over, and check the box if appropriate • If now there is no penalty on Line 24, then you are done • If there is a penalty on Line 24, explain to taxpayer that they may receive a bill from the NYS Dept. of Taxation and • Override line 17 to zero to eliminate the penalty on line 24 before filing Webster, NY – TaxHelper 2015 -25- NY Return Underpayment of Estimated Tax (Form IT-2105.9) Override (F8) to 0 check box, if appropriate check box Webster, NY – TaxHelper 2015 -26- NY Return e-File, Refund and Amount Due Options (IT-201 p4 ) Selections for efile, tax refunds or amounts due are made independently from the federal return Webster, NY – TaxHelper 2015 -27- NY Return Refund Options (IT-201 p4) 1. 2. 3. 4. • Note that if there was no federal refund and the taxpayer wants a state refund direct deposited, option 2 should be checked • See next slide for how to complete the entries for direct deposit of the state refund if there was no federal refund or if they want to deposit the state refund into a different account than one specified for the federal refund • Mention that direct deposit is the most secure and quickest method. However, don’t try to persuade Webster, NY – TaxHelper 2015 -28- NY Return Refund Options (IT-201 p4) • For direct deposit of state refund when there is no federal refund or the taxpayer wants to specify a different account Supply account information in two places on the NY form If there is no federal refund, make sure there is no direct deposit info on Main Info Sheet Webster, NY – TaxHelper 2015 -29- NY Return Amount Due Options (IT-201 p4) • Situations when tax is owed: Pay via Electronic Funds Transfer with withdrawal date specified Remit via a check in the mail Credit card Taxpayer must make arrangements online via http://www.tax.ny.gov/ Not user friendly for infrequent computer user Typical convenience charge is 2.5% of amount to be remitted with a minimum convenience charge of about $4 Unable to pay File tax return and pay as much as possible NY will bill for remaining tax due plus interest Pay bill immediately when received or call the number provided on the bill to make arrangements Webster, NY – TaxHelper 2015 -30- NY Return Amount Due Options (IT-201 p4) • If taxpayer is unable to pay, F3 the red from the two payment options • The return is ready for filing after any diagnostics are resolved and no forms are flagged Webster, NY – TaxHelper 2015 -31-