Patents as Collateral and the Market for Venture Lending*,†

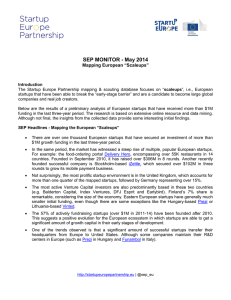

advertisement