Retaining Overpayments Isn't Mickey Mouse Anymore

advertisement

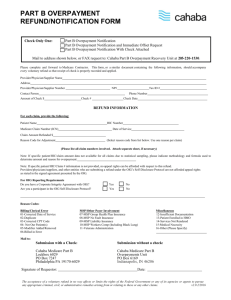

3/15/2011 Retaining Overpayments Isn’t Mickey Mouse Anymore Karen Murray, Yale New Haven Health System Kelly Sauders, Deloitte & Touche James Sheehan, NY Office of Medicaid Inspector General Larry Vernaglia, Foley & Lardner Health Care Compliance Association’s 15th Annual Compliance Institute April 10 – 13, 2011 Outline of Today's Discussion • Background and discussion of PPACA, FERA and current “open” definitions and interpretations • An overview of leading practices for conducting internal investigations and refunding overpayments • Case studies/discussion of scenarios to explore when an overpayment is “identified” and potential actions a compliance officer may take 1 HCCA’s 15th Annual Compliance Institute: Session P8. 1 3/15/2011 Legal/Regulatory Overview Background and Current Interpretations PPACA and FERA • PPACA: Patient Protection and Affordable Care Act (H.R. 3590); signed into law on March 23,2010 • FERA: Fraud Enforcement and Recovery Act; signed into law on May 20, 2009 “We've estimated that most of this [health care reform] plan can be paid for by finding savings within the existing health care system, a system that is currently full of waste and abuse.” – President Obama 3 HCCA’s 15th Annual Compliance Institute: Session P8. 2 3/15/2011 Historical Treatment of Overpayments • The FCA contains a provision for “reduced damages” (reduced to 2X damages) if a court finds that: – the violator furnished the government all information known to such person about the violation within 30 days after the date on which the defendant first obtained the information; – such person fully cooperated with any Government investigation of such violation; and – at the time such person furnished the United States with the information about the violation, no criminal prosecution, civil action, or administrative action had commenced under this title with respect to such violation, and the person did not have actual knowledge of the existence of an investigation into such violation. 4 HCCA’s 15th Annual Compliance Institute: Session P8. FERA & PPACA Changes to the FCA and CMPL • May 20, 2009 FERA changes: – Expressly referenced improper retention of “obligations” – Broadened the definition of a false claim to include the situation where a person “knowingly conceals or knowingly and improperly avoids or decreases an obligation to pay or transmit money or property to the government…” • March 23, 2010 PPACA changes: – Civil Monetary Penalties Law • Failing to report and return known overpayment within 60 days or when cost report due (such failure is also subject to potential FCA liability) • This provision was less noticed…but related… – False Claims Act Provision • PPACA § 6402(a): Express duty to refund and report Medicare and Medicaid overpayments • By the later of 60 days after overpayment “identified” or the date cost report is due • Failure to report and return is an “obligation” for the purpose of FCA 5 HCCA’s 15th Annual Compliance Institute: Session P8. 3 3/15/2011 Considerations for Compliance Officers • Key principles of PPACA: – What is an “overpayment”? – When is it “identified”? – What is the provider’s actual duty? – What is the timeframe for returning and disclosing overpayments? – Who is a “person” receiving or retaining an overpayment? 6 HCCA’s 15th Annual Compliance Institute: Session P8. So what exactly is an “overpayment”? • PPACA Section 6402 Medicare and Medicaid Program Integrity Provisions: – The term ‘‘overpayment’’ means any funds that a person receives or retains under title XVIII (Medicare) or XIX (Medicaid) to which the person, after applicable reconciliation, is not entitled under such title” (“funds” not “benefit”) – Reporting and Returning of Overpayments (paragraph D): • ‘‘(1) IN GENERAL — If a person has received an overpayment, the person shall— – (A) report and return the overpayment to the Secretary, the State, an intermediary, a carrier, or a contractor, as appropriate, at the correct address; and – (B) notify the Secretary, State, intermediary, carrier, or contractor to whom the overpayment was returned in writing of the reason for the overpayment.”” 7 HCCA’s 15th Annual Compliance Institute: Session P8. 4 3/15/2011 Deadlines for reporting and returning “overpayments” • PPACA Section 6402 Medicare and Medicaid Program Integrity Provisions (continued): – An overpayment must be reported and returned under paragraph (1) by the later of: • “(A) the date which is 60 days after the date on which the overpayment was identified; or • (B) the date any corresponding cost report is due, if applicable.” 8 HCCA’s 15th Annual Compliance Institute: Session P8. Enforcement of PPACA overpayment provisions • “(3) ENFORCEMENT – Any overpayment retained by a person after the deadline for reporting and returning the overpayment under paragraph 2 is an obligation (as defined in section 3729(b)(3) of title 31, United States Code) for purposes of section 3729 of such title. • “(4) DEFINITIONS in this subsection: – (A) Knowing and knowingly: The terms ‘knowing’ and ‘knowingly’ have the meaning given those terms in section 3729(b) of title 31, U.S. Code – (C) Person: “(i) In General – the term “person” means a provider of services, supplier, Medicaid managed care organization (as defined in section 1903(m)(1)(A)), Medicare Advantage Organization (as defined in section 1859(a)(1)), or PDP sponsor (as defined in section 1860D41(a)(13)). “(ii) Exclusion – such term does not include a beneficiary.” 9 HCCA’s 15th Annual Compliance Institute: Session P8. 5 3/15/2011 What is not currently defined in PPACA? • No definition of “not entitled” • No definition of “after reconciliation” • No explanation of when the “cost report” deadline applies • No definition of “identified” 10 HCCA’s 15th Annual Compliance Institute: Session P8. What is “not entitled”? • The same analysis of overpayments as providers historically used…condition of payment not met • New York State OMIG definition: – Kickback – Stark – Beneficiary eligibility – Conditions of payment 11 HCCA’s 15th Annual Compliance Institute: Session P8. 6 3/15/2011 What is “after reconciliation”? • Possibilities: – – – – – Calculating co-pay/deductibles Running through cost report Calculating actual reimbursement impact Offsetting underpayments Interim payments vs. final settled payments • New York State OMIG: – Applies to interim payments prior to cost report-based payment determinations – Reconciliations related to Medicaid best price determinations for prescription drugs – CMS 838 quarterly report of Medicare credit balances • Providers may view this principle as contemplating mathematical calculations to arrive at the precise financial impact of the overpayment 12 HCCA’s 15th Annual Compliance Institute: Session P8. When does the “cost report” deadline apply? • Is it only for interim payments that don’t get resolved through the cost report? • Could it apply to all cost-reporting providers, and use the “attachment package” to report and refund overpayments? 13 HCCA’s 15th Annual Compliance Institute: Session P8. 7 3/15/2011 What does it mean to “identify” an overpayment? • Not defined in the Statute • Possibilities could range from: 1. Any “whiff of an overpayment” with no clue of whether it is accurate 2. Awareness that an overpayment has been received, but no knowledge of how much has been overpaid 3. Confidence that an overpayment has been received, and the amount of the overpayment has been determined using commercially reasonable methods and a responsible process 4. To moral certainty that an overpayment has been received, with no possible defenses or counterarguments and an absolute certainty of the amount of the overpayment 14 HCCA’s 15th Annual Compliance Institute: Session P8. What does the NYS OMIG think it means to “identify” an overpayment? • “Identified” for an organization means that the fact of an overpayment, not the amount of the overpayment, has been identified. (e.g., patient was dead at time service was allegedly rendered, Ambulatory Payment Group (APG) claim includes service not rendered, charge master had code crosswalk error) • Compare with language from CMS proposed 42 CFR 401.310 overpayment regulation 67 FR 3665 (1/25/02 draft later withdrawn) – “If a provider, supplier, or individual identifies a Medicare payment received in excess of amounts payable under the Medicare statute and regulations, the provider, supplier, or individual must, within 60 days of identifying or learning of the excess payment, return the overpayment to the appropriate intermediary or carrier.” 15 HCCA’s 15th Annual Compliance Institute: Session P8. 8 3/15/2011 What are some of the NYS OMIG’s examples of “identified” overpayments? • Employee or contractor identifies overpayment in hotline call or email • Patient advises that service not received • RAC advises that dual eligible Medicare overpayment has been found • OMIG sends letter re: deceased patient, unlicensed or excluded employee or ordering physician • Qui tam or government lawsuit allegations • Criminal indictment or information 16 HCCA’s 15th Annual Compliance Institute: Session P8. Implications of NYS OMIG view on when an overpayment is “identified” • The degree of knowledge required to be considered identified • How to address the knowledge of fact of overpayment without knowledge of amount • CMS, state expectations of payment, escrow, inability to pay • Impact of a complaint or indictment on the duty to report and refund • 5th Amendment issues in mandatory reporting 17 HCCA’s 15th Annual Compliance Institute: Session P8. 9 3/15/2011 Challenges facing providers in responding • Difficulty completing certain investigations and fact gathering/data collection within 60 days after the first allegations • Challenges in completing "reconciliation" to make the refund • Level of disclosure required (where to go) • Getting the contractor/payer to accept the money (e.g., complexity of refund forms/processes) 18 HCCA’s 15th Annual Compliance Institute: Session P8. How can providers demonstrate good faith efforts? • Create a record to demonstrate to the government that your organization collected or attempted to address allegations of overpayments – Develop standard form to document employee’s internal disclosure – Document interviews – Document evidence and means to determine credibility – Record employees involved in deliberations and decisions • Keep an ongoing record of overpayment refunds made by your organization (federal, state, private payers) 19 HCCA’s 15th Annual Compliance Institute: Session P8. 10 3/15/2011 How can providers refund overpayments? • Providers must state the reason for overpayment • Notify the State to whom the overpayment was returned in writing and the reason for the overpayment – Use OMIG’s Disclosure Protocol, available on the OMIG web site: www.OMIG.ny.gov – See Pennsylvania’s 2010 Self-Audit Protocol: http://www.dpw.state.pa.us/omap/omapfab.asp – See New Jersey’s Self-Disclosure Process www.nj.state.us/njomig – See the Federal OIG Self-Disclosure Protocol http://oig.hhs.gov/authorities/docs/selfdisclosure.pdf – Also CMS “unsolicited/voluntary refunds” to Medicare contractors (checked July 2, 2010) – See, e.g., http://www.wpsmedicare.com 20 HCCA’s 15th Annual Compliance Institute: Session P8. Conducting Internal Investigations 11 3/15/2011 Internal Investigations • When and how should attorney-client privilege be used? • What are the underlying tensions between mandatory reporting statute and “confidential” disclosures? • Internal or external counsel? • What documents should be marked “privileged”? • Who should be on the investigation team and who should lead? • Do you need external expertise? • What are things to consider when planning the investigation? 22 HCCA’s 15th Annual Compliance Institute: Session P8. Privileged Investigation • The attorney-client privilege – client seeks / receives legal advice from an attorney in confidence • The communications may be protected forever • The underlying facts, on which the communications are based, are not protected • The burden of proving the existence of the privilege rests on the party asserting it 23 HCCA’s 15th Annual Compliance Institute: Session P8. 12 3/15/2011 Tension between mandatory reporting statute & “confidential” disclosures • Privilege does not protect underlying documents and information • Privilege does protect communication of legal advice sought and received • Can client disclose facts of an identified overpayment without waiving the privilege? • What about the role of in-house counsel who “wears two hats”? 24 HCCA’s 15th Annual Compliance Institute: Session P8. Internal / External Counsel Privileged Investigation • Internal, External or Both? Depends on situation – Internal Counsel: privilege does not apply to communications made to obtain “business advice,” only “legal advice” – External Counsel: the retainer should specify the organization is “seeking legal advice” from counsel • Note documents prepared to assist the attorney with “prepared at the request of counsel” or “attorney-client privilege” • Keep all documents confidential • Even privileged documents should be prepared as if they might become public – risk of waiver of the privilege / possibility that the materials will be voluntarily disclosed to the government 25 HCCA’s 15th Annual Compliance Institute: Session P8. 13 3/15/2011 Investigation Team • Selection of investigation team & team leader • Required skill sets of the investigative team – depends on the matter under investigation • Early planning meeting of the investigation team 26 HCCA’s 15th Annual Compliance Institute: Session P8. Internal / External Expertise • Internal Expertise: generally more cost effective; personnel are more knowledgeable about the organization’s own compliance standards • External Consultants: may have more experience with investigations and litigations; the court or government attorney may perceive an outside consultant as more objective than an employee of the organization • When investigation is under privilege, engagement letter should note that the consultant is working at the direction of counsel • Be sure consultant report is sent directly to legal counsel 27 HCCA’s 15th Annual Compliance Institute: Session P8. 14 3/15/2011 Planning the Investigation Investigation Strategy – Create a Road Map • Consider what is known about the matter • Determine possible regulatory issues involved • When to escalate issue to leadership – Criminal Action – Patient Harm – High Dollars – Bad Facts or Timing – OIG Inquiry 28 HCCA’s 15th Annual Compliance Institute: Session P8. Planning the Investigation (Continued) • Set the scope and stick to it – Design auditing procedures around the key issues – keep scope narrow – Use parking lot for other unrelated or new issues that arise and deal with them separately later • Identify witnesses, documents, computer data, etc. • Prepare a written list of documents and data requests • Draft a list of witness interview questions 29 HCCA’s 15th Annual Compliance Institute: Session P8. 15 3/15/2011 Document Management • One person within the organization with overall responsibility for collecting the documents and providing them to counsel – Ensures documents are organized and you have “control” over them – Ensures documents are protected • May need communication from senior management directing employees not to destroy certain types of documents or computer records • Any routine document destruction practices which have the potential for destroying the specified documents must be postponed until further notice – Follow up to ensure the communication reached the right people – ensure directives obeyed 30 HCCA’s 15th Annual Compliance Institute: Session P8. Witness Interviews • Interview the most knowledgeable persons first – this allows the investigation to reveal as much as possible, as soon as possible • Advisable to have more than one person present for an interview – protects against false accusations of improper conduct • If the interview is being undertaken by legal counsel under privilege, ensure protection of the organization’s attorney-client privilege – Employee must know that counsel is representing the company and not the individual employee being interviewed – Employee must understand that the content of the conversation is confidential 31 HCCA’s 15th Annual Compliance Institute: Session P8. 16 3/15/2011 Witness Interview Tips • The ultimate objective of an interview is to get the witness to speak as much as possible and to share everything he or she can remember • Begin with open-ended questions which may open up avenues for follow-up questions • Follow-up questions should be more narrow or focused • More listening and less talking • Silence is a helpful tool in obtaining a response 32 HCCA’s 15th Annual Compliance Institute: Session P8. Witness Interview Tips (Continued) • Ask about time periods – answers may differ depending on the period of time the issue has occurred (e.g., "We did it this way, until 2008 when we changed the process to X”) • Ask witness to identify the names of all other persons knowledgeable about a set of facts – adds to interview list • Create memo summarizing each witness interview as soon as possible – before memories fade – Memo should not be shown to or signed by the interviewee – may significantly weaken claims of protection under attorneyclient privilege and the work product doctrine 33 HCCA’s 15th Annual Compliance Institute: Session P8. 17 3/15/2011 Witness Interview Tips (Continued) • Keep track of the facts of your investigation • Compile relevant facts in a chronology that is continually updated as more facts are learned – This keeps the accumulated learning organized and highlights discrepancies in witness accounts that must be further investigated or evaluated 34 HCCA’s 15th Annual Compliance Institute: Session P8. Investigation Findings Report • Written report for a designated person, identified group in senior management and/or the board • Report will likely take on a number of different forms depending on the complexity and extent of the investigation • Due to the sensitive nature of a final report, dissemination should be limited (e.g., be careful about the creation and dissemination of “draft” copies) • Very sensitive/serious issues – counsel should write the report and keep track of all copies distributed – When possible, copies should be collected from the board or management to avoid dissemination and unauthorized copying 35 HCCA’s 15th Annual Compliance Institute: Session P8. 18 3/15/2011 Case Studies Case Study #1: Hotline report • A hotline call came in on a Sunday night. The caller didn’t leave a name, but said she had worked in the emergency department over the weekend. • The caller was concerned about a case involving an 85-year-old man with chest pain. The hotline report stated that the patient came in on Saturday, was seen in the ED and admitted, but spent the night in the ED due to a bed shortage. On Sunday, it was determined that the patient had improved enough to go home. The caller was concerned because a Case Manager decided to change the patient’s order to “observation status” since the patient had never been in a bed and ended up staying less than 36 hours. The caller was also worried about the patient and didn’t think he was ready for discharge. 37 HCCA’s 15th Annual Compliance Institute: Session P8. 19 3/15/2011 Case Study #1: Hotline report Questions for consideration • As the Compliance Officer, how might you start your follow-up on this call? – Interviews? – Data? • What if, after interviewing the Director of Case Management, it sounds as if the practice of “flipping” patients from inpatient to observation is fairly common (and sometimes done by Case Managers)? • When should you consider attorney-client privilege? • What might your obligation be to “look back”? • What if the hospital changed billing systems two years ago and you can only see billing data for the past two years? • At what point has an overpayment been “identified”? 38 HCCA’s 15th Annual Compliance Institute: Session P8. Case Study #2: Excluded individuals • You are the new Compliance Officer at Very Large Health System. When you took the job, you knew the compliance program needed a little work. Soon after starting, you realized that the System had only been doing OIG exclusion checks for new hires and new medical staff appointments since 2005. However, the System had never screened all existing employees or medical staff members. • You decide to take quick action to address this deficiency in the compliance program and run the entire list of employees and medical staff through the OIG’s List of Excluded Individuals and Entities. • After investigation and removal of “false positives” from the list, you have identified a lab employee who was excluded in 1998 and a radiologist on the medical staff who was excluded in 2008. 39 HCCA’s 15th Annual Compliance Institute: Session P8. 20 3/15/2011 Case Study #2: Excluded individuals Questions for consideration • What are your obligations here? • How might you determine the impact of the excluded lab employee? • How might you determine the impact of the excluded Radiologist? • At what point has an overpayment been “identified”? 40 HCCA’s 15th Annual Compliance Institute: Session P8. Case Study #3: Electronic Medical Record • You are the Compliance Officer at an Academic Medical Center that has recently implemented an electronic medical record (EMR) in all outpatient areas and clinics. As part of your annual compliance work plan, there is a planned documentation, coding and billing review. • You are a little stretched for resources, so you hire a consultant to help you perform this proactive review. The consultant is evaluating a sample of 50 claims on a pre-bill basis. The consultant starts the review on Monday. On Wednesday, the consultant requests a meeting with you. During the meeting, you learn that the consultant has reviewed 30 records so far and, in all 30, the consultant has seen an automatic script used in the EMR 100% of the time for nurse visits indicating that the service was performed incident-to a physician. • This project is not being conducted under attorney-client privilege. 41 HCCA’s 15th Annual Compliance Institute: Session P8. 21 3/15/2011 Case Study #3: Electronic Medical Record Questions for consideration • Since this is being done on a pre-billing basis, has an overpayment concern been identified? • What might your first steps be here? • If this assessment is only being done in one outpatient clinic location, should you look at any others (given what you’ve heard about the system)? • You know you have obligations to Medicare and Medicaid, but what about other payers who have been billed for this service which is not supported by the documentation? 42 HCCA’s 15th Annual Compliance Institute: Session P8. Speaker Contact Information 43 Karen Murray, MBA, FACHE, CHC, CHRC Chief Compliance Officer Yale New Haven Health System Office of Privacy & Corporate Compliance New Haven, CT Phone (203) 688-3369 Email: karen.murray@ynhh.org Kelly J. Sauders, CPA, MBA Partner Deloitte & Touche LLP New York, NY Phone: (212) 436-3180 Email: ksauders@deloitte.com Jim Sheehan New York Office of Medicaid Inspector General 800 North Pearl Street Albany, NY 12204 Phone (518) 473-3782 Email: jgs05@omig.state.ny.us Lawrence W. Vernaglia, JD, MPH Partner & Chair, Health Care Industry Team Foley & Lardner LLP Boston, MA Phone: (617) 342-4079 Email: lvernaglia@foley.com HCCA’s 15th Annual Compliance Institute: Session P8. 22