The Cobb-Douglas Production Function and the Accounting Identity

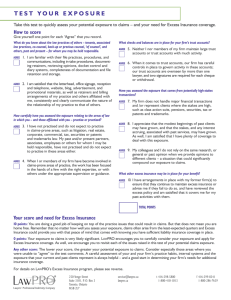

advertisement