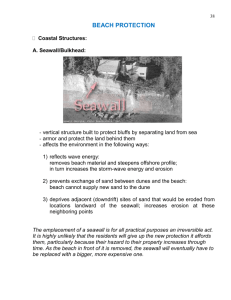

Cost-benefit analysis of options to protect Old Bar from coastal erosion

advertisement