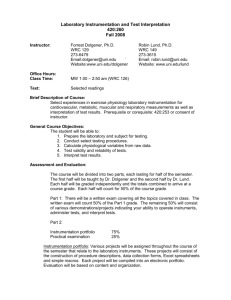

Mean-variance portfolio choice

advertisement

SK460 Finance Theory, Diderik Lund, 24 January 2001

Mean-variance portfolio choice

One individual, mean-var preferences.

Has a given wealth W0 to invest at t = 0.

Regards probability distribution of future (t = 1) values as

exogenous. (Values at t = 1 include payouts like dividends,

interest.)

Today also: Regards security prices at t = 0 as exogenous.

Later: Include this individual in equilibrium model of competitive security market at t = 0.

Notation

Investment of W0 in n securities:

n

X

W0 = pj0Xj

j =1

n

X

= Wj 0 :

j =1

Value of this one period later:

n

n

p~

X

X

~

= Wj = pj 0 j 1 Xj

j =1

j =1 pj 0

n

n

X

X

= pj 0 (1 + R~ j )Xj = Wj 0(1 + R~ j )

j =1

j =1

n Wj 0

n

X

X

= W0

(1 + R~ j ) = W0 wj (1 + R~ j ) = W0 (1 + R~ p ):

j =1 W0

j =1

W~ =

n

X

p~j1Xj

j =1

Stochastic variables have a tilde, thus no subscript for state s.

1

SK460 Finance Theory, Diderik Lund, 24 January 2001

Mean-var preferences for rates of return

W~

0

1

n

n

X

X

= W0 wj (1 + R~ j ) = W0 B@1 + wj R~ j CA = W0 (1 + R~ p ):

j =1

j =1

R~ p is rate of return for investor's portfolio.

This and next week: Each investor's W0 xed.

Then preferences well de ned over R~p, may forget about W0

for now.

Let p E (R~p ) and p var(R~p). Then

E (W~ ) = W0(1 + E (R~p )) = W0(1 + p);

var W~ = W02 var(R~ p );

r

r

~

var(W ) = W0 var(R~ p ) = W0 p:

r

Increasing, convex indi erence curves in ( var(W~ ); E (W~ )) diagram

imply increasing, convex indi erence curves in (p ; p ) diagram.

But: A change in W0 will in general change the shape of the latter

kind of curves (\wealth e ect").

2

SK460 Finance Theory, Diderik Lund, 24 January 2001

Mean-var opportunity set, two risky assets

Investor may construct (any) portfolio of (only) two risky assets.

What is opportunity set in (p; p ) diagram?

W0 = W10 + W20

3

2

W

W

W~ = W10(1+R~ 1)+W20(1+R~ 2) = W0 4 W10 (1 + R~ 1) + W20 (1 + R~ 2)5

0

0

= W0 [a(1 + R~ 1) + (1 , a)(1 + R~ 2 )] W0 (1 + R~ p ):

For j = 1; 2, let j E (R~j ), j2 = var(R~ j ), and let ij cov(R~ 1 ; R~ 2 ). Then:

1

0

,

p

2

p = a1 + (1 , a)2 @) a = , A ;

1

2

p2 = a212 + (1 , a)222 + 2a(1 , a)12:

Taken together:

where

r

p = A2p + Bp + C;

2 + 2 , 2

1

A ( ,2 )2 12 ;

1

2

,

22 12 , 2122 + 212(1 + 2 )

B

;

(1 , 2 )2

2 2 + 2 2 , 2 C 2 1 (1 ,2 )2 1 2 12 :

1

3

2

SK460 Finance Theory, Diderik Lund, 24 January 2001

Opportunity set, two risky assets, contd.

p

The function () = A2 + B + C is called an hyperbola, the

square root of a parabola. Both have minimum points at = ,2AB .

4

SK460 Finance Theory, Diderik Lund, 24 January 2001

Opportunity set, two risky assets, contd.

Asymptotes for hyperbola:

p

! 1 ) ! A + pB ;

2 A

p

! ,1 ) ! , A , pB :

2 A

Proof (of rst part only):

p

p

p

( () , A)(p() + A)

lim

[

(

)

,

A

]

=

lim

!1

!1

() + A

B + C p

( ())2 ,pA2

p

=

lim

= lim

!1 A2 + B + C + A

!1 () + A

B

+ C

B ;

s

p

=

= lim

p

!1

A + B + C2 + A 2 A

and the result follows.

5

SK460 Finance Theory, Diderik Lund, 24 January 2001

Opportunity set, two risky assets, contd.

When a varies, the hyperbola is traced out.

a = 1 gives the point (1; 1).

a = 0 gives the point (2; 2).

Value of a at minimum point, f.o.c.:

0=

gives

d = 2a2 , 2(1 , a)2 + (2 , 4a)

12

1

2

da

2,

2

a = 2 + 2 ,122 amin:

12

1

2

6

SK460 Finance Theory, Diderik Lund, 24 January 2001

Minimum point of hyperbola

Is always amin 2 [0; 1]? No, will prove amin 2 [0; 1).

Proof: Choose notation 1 < 2 (so a is share of portfolio in the less

risky asset). De ne the correlation coecient 12 = 1122 . Then:

amin > 1 () 22 , 12 > 12 + 22 , 212

() 12 > 12 () 12 > 1=2;

which may or may not be true. (Only restriction on 12 is ,1 12 1.)

Similarly:

amin < 0 () 12 > 2 > 1;

1

which is impossible.

7

SK460 Finance Theory, Diderik Lund, 24 January 2001

Hyperbola's dependence on correlation

Five constants determine shape of hyperbola:

1; 2; 1; 2; 12:

Assets' coordinates, (1; 1) and (2; 2), are not sucient.

For xed values of these four, let 12 vary.

This is not something the investor may choose to do, only a

way to illustrate possible situations.

Easier to discuss in terms of 12 12=12.

Consider rst what hyperbola looks like for a 2 [0; 1].

Consider rst the extremes, 12 = 1.

For 12 = 1 and a 2 [0; 1], nd p = a1 + (1 , a)2.

Linear in a, thus also in p.

In interval between the two points: Straight line.

Line reaches vertical axis somewhere outside interval. Kink.

8

SK460 Finance Theory, Diderik Lund, 24 January 2001

Hyperbola's dependence on correlation, contd.

Opposite extreme, 12 = ,1, gives p = [a1 + (1 , a)2].

Also broken line, but now, kink for some a 2 [0; 1].

Speci cally, at amin = + .

Summing up:

{ For 2 (,1; 1), a true (strictly convex) hyperbola.

{ For extreme cases, a broken line.

{ Only for those extreme cases is p = 0 possible.

Opportunity set consists of the hyperbola or broken line, only.

When only two risky assets, impossible to obtain point outside

2

1

2

(or \inside") hyperbola.

De nition Copeland and Weston p. 165 misleading for n = 2.

9

SK460 Finance Theory, Diderik Lund, 24 January 2001

Mean-var portfolio choice, two risky assets

Increasing, convex indi erence curves.

Increasing, concave opportunity set (upper half).

Tangency point will maximize (expected) utility.

Everyone will choose from upper half of hyperbola.

Called ecient set.

Choice within ecient set depends on preferences.

More risk averse: Lower .

10

SK460 Finance Theory, Diderik Lund, 24 January 2001

Mean-var opport. set: One risky, one risk free asset

Let 1 = 12 = 0 in formulae.

Get linear relation between p and a.

Thus linear relation between p and p.

Simpli es. Good reason for working with (; ), not (2; ).

Opportunity set broken line.

Again, upper half is ecient.

11

SK460 Finance Theory, Diderik Lund, 24 January 2001

Mean-var opportunity set: n risky assets, n > 2

Let variance-covariance matrix of (R~ 1 ; : : :; R~ n) be

V

2

66 11

= 6664 ..

n1

3

1n 77

..

nn

77 :

75

Symmetric, n1 = cov(R~ n ; R~ 1) = cov(R~ 1 ; R~ n) = 1n :

Diagonal elements were previously called i2 = var(R~ i).

If V has full rank, then impossible to construct portfolio of these

assets with p = 0. (No proof now.) Will concentrate on this case.

(If V has less than full rank, then p = 0 can be chosen. For n = 2,

these were the cases 12 = 1.)

Assume now V has full rank. Can be shown: Opportunity set now

consists of an hyperbola and the points inside it. (Proof in Roll,

later.) Hyperbola called frontier portfolio set. Upper half of it is

ecient set.

12

SK460 Finance Theory, Diderik Lund, 24 January 2001

Mean-var oppo. set: One risk free, n risky assets, n > 2

Let Rf be rate of return on risk free asset.

Risk free asset can be combined with any portfolio of risky.

Everyone will want max p for any given p.

Assume Rf less than at min point.

(Will return to opposite possibility later.)

Then: Combination of risk free asset with tangency portfolio is

ecient. Ecient set is linear.

13