Asset management in South Africa

advertisement

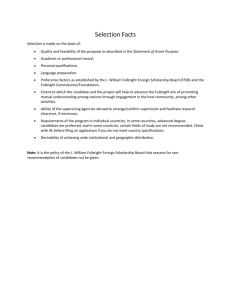

Financial institutions Energy Infrastructure, mining and commodities Transport Technology and innovation Life sciences and healthcare Asset management in South Africa Ten things to know Asset management in South Africa Asset management in South Africa 01 | Licensing of asset managers 04 | Minimum capital for asset managers 02 | Licensing of alternative fund managers 05 | Registration of foreign funds South African asset managers must register as financial service providers (FSPs) with the Financial Services Board (FSB) under the Financial Advisory and Intermediary Services Act (FAIS). Any person carrying on asset management business in South Africa, or from abroad directed at South African clients, whether in a discretionary or non-discretionary capacity, must be licensed as an FSP under FAIS. A category of FSP licence tailored specifically for hedge fund managers (category IIA) was introduced in 2007. Fit and proper requirements under FAIS require different categories of FSPs to maintain specified minimum levels of capital. For example, category I FSPs (essentially, nondiscretionary FSPs) must maintain liquid assets equal to or greater than 4/52 weeks of annual expenditure. An asset manager appointed as a registered manager of a CIS under CISCA is also required to maintain a certain minimum amount of capital, which varies according to the type of CIS. The FSB is now (September 2014) seeking to introduce a category of FSP licence tailored specifically for private equity managers. The preliminary draft of the Code of Conduct for Private Equity Managers borrows a number of concepts from the EU’s Alternative Investment Fund Managers Directive. In particular, significant emphasis is placed on conflicts of interest, as well as remuneration and reward of personnel. There is also a proposed restriction on the leverage that can be employed by private equity funds. It is possible for foreign investment funds to register as “foreign collective investment schemes” under CISCA. A foreign investment fund which is so registered may be marketed publicly in South Africa. In order to qualify for South African registration, a foreign fund must have an investment policy which is consistent with the requirements set out under CISCA. However, CISCA has significantly more restrictive prudential requirements than, for example, the European UCITS regime. In particular, under CISCA a CIS may only use derivatives for limited hedging purposes. Consequently, many UCITS funds do not qualify for registration in South Africa. 03 | Regulation of retail funds 06 | Alternative investment funds South African retail investment funds are known as “collective investment schemes” (CISs) and are regulated under the Collective Investment Schemes Control Act (CISCA). There are different types of collective investment scheme, including a CIS in securities, a CIS in property and a CIS in participation bonds. CISCA places significant restrictions on the asset classes in which a CIS can invest as well as concentration limits on CIS portfolio exposure. The manager of a CIS must be approved and regulated as a CIS manager under CISCA. 02 Norton Rose Fulbright Alternative investment funds, including hedge funds and private equity funds, are currently (September 2014) unregulated in South Africa. Accordingly, such funds need to be carefully structured to ensure that they are not inadvertently regulated by CISCA’s broad provisions. The FSB and the South African Treasury are seeking to introduce a regulated regime for hedge funds in South Africa under the auspices of CISCA and in April 2014 produced a draft set of regulations for public comment. The new regime will introduce two categories of regulated hedge funds, being qualified investor hedge funds, which will be limited in their membership to private arrangements amongst qualified investors, and retail investor hedge funds, which may be marketed to the public but will be subject to a stricter regulatory regime. Asset management in South Africa 07 | Marketing foreign funds Comparatively, South Africa is an extremely restrictive jurisdiction relative to the marketing of foreign investment funds. In essence, fund promoters, both foreign and local and whether or not they are registered as CIS managers under CISCA, are not allowed to solicit investments in funds which are not registered under CISCA from members of the public in South Africa. As a concept, “members of the public” is widely interpreted to include individuals, parastatals and institutions and, unlike many other jurisdictions, South Africa does not have a more permissive private placement regime for sophisticated or high net worth investors. It is permissible for a South African investor to invest in an unregulated foreign fund where the investor makes the initial enquiry (a so called “reverse solicitation”). 08 | Exchange control and investments into Africa Previously, South African private equity funds were required to obtain exchange control approval from the South African reserve Bank (SARB) on a case-by-case basis for investments outside of South Africa. In late 2010, however, following significant lobbying from the industry, the SARB introduced a new exchange control dispensation for private equity funds. Domestic private equity funds mandated to invest into Africa are now able to apply for upfront exchange control approval to invest all of their commitments. The approval is usually issued subject to a number of ongoing reporting requirements and, in some cases, requires renewal every three years. The applicant fund is also required to acquire at least 10% of the equity capital of each foreign target company in which it invests. 09 | Tax residency of foreign investment funds A South African asset manager of an offshore investment fund faces a significant risk of dragging that fund onshore i.e. of that fund being deemed to be resident in South Africa for tax purposes. However, under the Income Tax Act, certain services provided by a South African manager to a foreign investment fund are now disregarded for the purposes of determining whether that fund is tax resident. The carve-out has a number of requirements and, most notably, the offshore fund’s portfolio must comprise solely of cash, government bonds, listed instruments and regularly traded unlisted instruments. As a consequence, private equity funds generally do not qualify for the carve-out. A further requirement of the carve-out is that South African residents may not directly or indirectly own more than 10% of the value of the offshore fund. 10 | Pension fund investment into alternative funds Prudential rules for South African pension funds are set out in Regulation 28 under the South African Pension Funds Act. Regulation 28 was revised in February 2011 to introduce many new investment categories for pension funds, including “private equity fund” and “hedge fund” categories. Under the new Regulation 28 a pension fund can now, subject to certain requirements, invest up to 15% of its assets in hedge funds and private equity funds, whether local or foreign. Norton Rose Fulbright 03 nortonrosefulbright.com Contacts For more information contact: Lance Roderick Director Norton Rose Fulbright South Africa (incorporated as Deneys Reitz Inc) Tel +27 31 582 5654 lance.roderick@nortonrosefulbright.com Gareth Weston Director Norton Rose Fulbright South Africa (incorporated as Deneys Reitz Inc) Tel +27 11 685 8550 gareth.weston@nortonrosefulbright.com Louise Campion Director Norton Rose Fulbright South Africa (incorporated as Deneys Reitz Inc) Tel +27 11 685 8857 louise.campion@nortonrosefulbright.com Norton Rose Fulbright Norton Rose Fulbright is a global legal practice. We provide the world’s pre-eminent corporations and financial institutions with a full business law service. We have more than 3800 lawyers based in over 50 cities across Europe, the United States, Canada, Latin America, Asia, Australia, Africa, the Middle East and Central Asia. Recognized for our industry focus, we are strong across all the key industry sectors: financial institutions; energy; infrastructure, mining and commodities; transport; technology and innovation; and life sciences and healthcare. Wherever we are, we operate in accordance with our global business principles of quality, unity and integrity. We aim to provide the highest possible standard of legal service in each of our offices and to maintain that level of quality at every point of contact. Norton Rose Fulbright LLP, Norton Rose Fulbright Australia, Norton Rose Fulbright Canada LLP, Norton Rose Fulbright South Africa (incorporated as Deneys Reitz Inc) and Fulbright & Jaworski LLP, each of which is a separate legal entity, are members (‘the Norton Rose Fulbright members’) of Norton Rose Fulbright Verein, a Swiss Verein. Norton Rose Fulbright Verein helps coordinate the activities of the Norton Rose Fulbright members but does not itself provide legal services to clients. References to ‘Norton Rose Fulbright’, ‘the law firm’, and ‘legal practice’ are to one or more of the Norton Rose Fulbright members or to one of their respective affiliates (together ‘Norton Rose Fulbright entity/entities’). No individual who is a member, partner, shareholder, director, employee or consultant of, in or to any Norton Rose Fulbright entity (whether or not such individual is described as a ‘partner’) accepts or assumes responsibility, or has any liability, to any person in respect of this communication. Any reference to a partner or director is to a member, employee or consultant with equivalent standing and qualifications of the relevant Norton Rose Fulbright entity. The purpose of this communication is to provide information as to developments in the law. It does not contain a full analysis of the law nor does it constitute an opinion of any Norton Rose Fulbright entity on the points of law discussed. You must take specific legal advice on any particular matter which concerns you. If you require any advice or further information, please speak to your usual contact at Norton Rose Fulbright. © Norton Rose Fulbright South Africa NRF19451 09/14 (UK) Extracts may be copied provided their source is acknowledged.