1 Question E07.2 - Konstantin Vasilev's page!

advertisement

Department of Economics

University of Essex

Dr Gordon Kemp

Session 2012/2013

Spring Term

EC352 – Econometric Methods

Solutions for Exercises from Week 09

1

Question E07.2

Suppose that you are interested in the relationship between the number of letters of application

sent by a job seeker and the probability of being employed. You have data about a cohort of

Essex students in 2005 and know their job status (employed or unemployed) and the number of

letters of application they have sent in the last year of study. Let Ei denote a binary variable

that takes the value 1 if person i is employed and 0, otherwise; and let Li denote the number

of letters sent by person i.

1. Suppose that one student in the sample has sent 50 applications and is employed. Write

down the probability of that particular event as a function of (unknown) parameters.

Answer:

• The probability of this particular event would be:

exp(β0 + 50β1 )

1 + exp(β0 + 50β1 )

2. Derive formally the marginal effect on the probability of being employed of sending an

additional letter.

Answer:

• Treating number of letters as continuous:

d Pr {Ei = 1|Li }

dLi

dΛ (β0 + β1 Li )

= β1 λ (β0 + β1 Li )

dLi

)

(

exp (β0 + β1 Li )

= β1

[1 + exp (β0 + β1 Li )]2

= β1 Λ (β0 + β1 Li ) [1 − Λ (β0 + β1 Li )]

=

• Note that for a full answer you would need to derive this formally: it helps to use

property that d exp(z)/dz = exp(z). The formula is more complicated if you treat

Li as discrete.

3. Within the context of a logit model, is the marginal effect of an application letter on the

probability of being employed identical for all individuals? Explain.

Answer:

1

• In general no – the marginal effects would only be the same here when either β1 = 0

or when Li is the same for all individuals. This is because Λ(β0 + β1 Li ) varies with

Li provided that β1 6= 0.

• For a more complete answer, it is useful to graph λ(z) = dΛ(z)/dz = exp(z)/[1 +

exp(z)]2 = Λ(z)[1 − Λ(z)] against z.

2

Exercise C17.1

This question is about efficiency in spread betting markets. The data consists of 553 observations on games taken during the 1994-95 men’s college basketball season in the US and is

contained in the file pntsprd.dta (this data is also used in computing Exercise C8.5 crom

Wooldridge). The variable spread is the Las Vegas points spread for the day before the game

was played. In spread betting, the gambler usually wagers that the difference between the scores

of two teams will be less than or greater than the value specified by the bookmaker. The offered

bet consists of specifying one of the teams as the “favorite”, the other as the “underdog”, and

a points spread which is always positive. If the gambler bets $100 on the favorite and the favorite’s score minus the the underdog’s score is greater than the spread then the gambler wins

$100; if it less than the spread than the gambler loses $100; while if it is equal to spread no

money is won or lost. Often spreads are often offered in half-point fractions to aovid the last

outcome (in which case bookmaker would still have to cover the transactions costs of the bet).

2

1. The variable favwin is a binary variable if the team favored by the Las Vegas points spread

wins. A linear probability model (LPM) to estimate the probability that the favored team

wins is:

Pr(favwin = 1|spread) = β0 + β1 spread

Explain why, if the spread incorporates all relevant information, we expect β0 = 0.5.

Answer:

• Suppose that there are no overheads to betting, bookmakers are risk neutral, the

betting market is perfectly competitive, and pushes never occur. Then the bookmaker will offer a bet with an expected payout to the gambler of $0 which means

that the probability of the gambler winning should equal the probability of the

gambler losing and hence should equal 0.5. If the LPM is correct and the spread

was equal to zero that should mean that the probability of the favorite winning

should equal 0.5 which corresponds in the LPM to β0 = 0.5.

• In practice, there are overheads and pushes do occur. Furthermore, the LPM may

not be appropriate and in the data set bookmakers never offer zero spreads. All of

these factors put some doubt on the conclusion that β0 should equal 0.5.

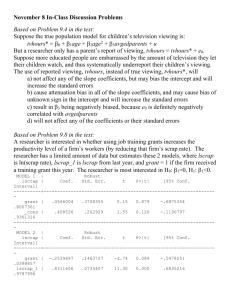

2. Estimate the model from Part (1) by OLS. Test H0 : β0 = 0.5 against a two-sided

alternative. Use both the usual and heteroskedasticity-robust standard errors.

Answer:

• An standard OLS regression of f avwin on spread gives the results:

. regress favwin spread

Source |

SS

df

MS

-------------+-----------------------------Model | 11.0636261

1 11.0636261

Residual | 88.9038241

551 .161349953

-------------+-----------------------------Total | 99.9674503

552 .181100453

Number of obs

F( 1,

551)

Prob > F

R-squared

Adj R-squared

Root MSE

=

=

=

=

=

=

553

68.57

0.0000

0.1107

0.1091

.40168

-----------------------------------------------------------------------------favwin |

Coef.

Std. Err.

t

P>|t|

[95% Conf. Interval]

-------------+---------------------------------------------------------------spread |

.0193655

.0023386

8.28

0.000

.0147718

.0239593

_cons |

.5769492

.0282345

20.43

0.000

.5214888

.6324097

------------------------------------------------------------------------------

Then we can perform a test of H0 : β0 = 0.5 against a two-sided alternative based

on the usual standard errors generating the results:

. test _cons=0.5

( 1)

_cons = .5

F(

1,

551) =

Prob > F =

7.43

0.0066

so this would lead us to reject the null hypothesis at all conventional significance

levels.

3

• However, we know that binary response models (including the LPM) exhibit heteroskedasticity. Redoing the regression with robust standard errors generates the

output:

. regress favwin spread, vce(robust)

Linear regression

Number of obs

F( 1,

551)

Prob > F

R-squared

Root MSE

=

=

=

=

=

553

101.54

0.0000

0.1107

.40168

-----------------------------------------------------------------------------|

Robust

favwin |

Coef.

Std. Err.

t

P>|t|

[95% Conf. Interval]

-------------+---------------------------------------------------------------spread |

.0193655

.0019218

10.08

0.000

.0155905

.0231405

_cons |

.5769492

.0316568

18.23

0.000

.5147664

.6391321

------------------------------------------------------------------------------

and then the test of H0 : β0 = 0.5 against a two-sided alternative based on

heteroskedasticity-robust standard errors generates the results:

. test _cons=0.5

( 1)

_cons = .5

F(

1,

551) =

Prob > F =

5.91

0.0154

This still rejects the null hypothesis although.

3. Is spread statistically significant? What is the estimated probability that the favored team

wins when spread = 10?

Answer:

• With the usual standard errors the t-stat on the spread is 8.28 with a p-value of 0

to 3s.f. while with the heteroskedasticity-robust standard errors the t-stat is 10.08

with a p-value of 0 to 3s.f. Clearly the spread is highly significant for the LPM

regardless of which standard errors are used.

• The estimated probability that the favored team wins when spread = 10 is:sma

0.5769 + (0.0193 × 10) = 0.7699

i.e. about 77%.

4. Now estimate a probit model for Pr(favwin = 1|spread). Interpret and test the null

hypothesis that the intercept is 0.

[Hint: Remember that Φ(0) = 0.5.]

Answer:

• Fitting a probit model gives:

4

. probit favwin spread

Iteration

Iteration

Iteration

Iteration

Iteration

0:

1:

2:

3:

4:

log

log

log

log

log

likelihood

likelihood

likelihood

likelihood

likelihood

=

=

=

=

=

-302.74988

-266.49244

-263.62542

-263.56223

-263.56219

Probit regression

Number of obs

LR chi2(1)

Prob > chi2

Pseudo R2

Log likelihood = -263.56219

=

=

=

=

553

78.38

0.0000

0.1294

-----------------------------------------------------------------------------favwin |

Coef.

Std. Err.

z

P>|z|

[95% Conf. Interval]

-------------+---------------------------------------------------------------spread |

.092463

.0121811

7.59

0.000

.0685885

.1163374

_cons | -.0105926

.1037469

-0.10

0.919

-.2139328

.1927476

------------------------------------------------------------------------------

When the spread is zero then the predicted probability that the favorite wins is

Φ(βb0 ). Since βb0 = −0.0105926 this gives:

. disp normal(-0.0105926)

.49577424

i.e. almost a 50% chance of winning (very slightly under). The z-stat on the

intercept is -0.10 with a p-value of 0.919 so we do not reject the null hypothesis

that the intercept is 0.

5. Use the probit model to estimate the probability that the favored team wins when spread =

10. Compare this with the LPM estimate from Part (3).

Answer:

• Plugging this in we get:

. disp normal(-.0105926 + (.092463 * 10))

.8196514

i.e. a predicted probability of winning of 82% (rather higher than with the LPM

estimates)

6. Add the variables f avhome, f av25 and und25 to the probit model and test the joint

significance of these variables using the Likelihood Ratio test. (How many df are in the

chi-square distribution?) Interpret this result focusing on the question of whether the

spread incorporates all observable information prior to a game.

Answer:

• Running this probit regression gives:

. probit favwin spread favhome fav25 und25

Iteration 0:

Iteration 1:

log likelihood = -302.74988

log likelihood = -265.47417

5

Iteration 2:

Iteration 3:

Iteration 4:

log likelihood = -262.70317

log likelihood = -262.64181

log likelihood = -262.64177

Probit regression

Number of obs

LR chi2(4)

Prob > chi2

Pseudo R2

Log likelihood = -262.64177

=

=

=

=

553

80.22

0.0000

0.1325

-----------------------------------------------------------------------------favwin |

Coef.

Std. Err.

z

P>|z|

[95% Conf. Interval]

-------------+---------------------------------------------------------------spread |

.0878845

.0129491

6.79

0.000

.0625047

.1132642

favhome |

.1485753

.1370571

1.08

0.278

-.1200517

.4172024

fav25 |

.003068

.15869

0.02

0.985

-.3079587

.3140946

und25 | -.2198082

.2505842

-0.88

0.380

-.7109443

.2713278

_cons | -.0551801

.128763

-0.43

0.668

-.3075509

.1971907

------------------------------------------------------------------------------

• To test the joint significance of these added variables using the Likelihood Ratio

test we compare:

h

i

bU R − L

bR

LR = 2 L

with a χ2 (q), i.e. a chi-square with q d.f. where q is the number of restrictions we

are testing.

• Here we want to test that three coefficients are equal to zero so q = 3. Then:

h

i

bU R − L

b R = 2 × [(−262.64177) − (−263.56219)]

LR = 2 L

= 1.84084

Now the 10% significance level critical value from a χ2 (3) test is 6.25139.4 so we

clearly do not reject the null. Thus adding these additional variables does not

seem to provide any significant additional information relevant to predicting the

probability of a favored team win that was not already accounted for by the spread.

3

Computing Exercise C17.2

This question is about discrimination in approval of loan applications. The data consists

of 1989 observations on loan applications in Boston in 1990 and are contained in the file

loanapp.dta (this data is also used in Computer Exercises C7.8, C8.7 and C9.7 from Wooldridge).

1. Estimate a probit model of approve on white. Find the estimated probability of loan

approval for both whites and non-whites. How do these compare with the linear probability

estimates?

Answer:

• Running the probit estimation gives:

. probit approve white

Iteration 0:

Iteration 1:

log likelihood = -740.34659

log likelihood = -701.33221

6

Iteration 2:

Iteration 3:

log likelihood = -700.87747

log likelihood = -700.87744

Probit regression

Number of obs

LR chi2(1)

Prob > chi2

Pseudo R2

Log likelihood = -700.87744

=

=

=

=

1989

78.94

0.0000

0.0533

-----------------------------------------------------------------------------approve |

Coef.

Std. Err.

z

P>|z|

[95% Conf. Interval]

-------------+---------------------------------------------------------------white |

.7839465

.0867118

9.04

0.000

.6139946

.9538985

_cons |

.5469463

.075435

7.25

0.000

.3990964

.6947962

------------------------------------------------------------------------------

Running the LPM gives:

. regress approve white

Source |

SS

df

MS

-------------+-----------------------------Model | 10.4743407

1 10.4743407

Residual |

203.59303 1987 .102462521

-------------+-----------------------------Total | 214.067371 1988 .107679764

Number of obs

F( 1, 1987)

Prob > F

R-squared

Adj R-squared

Root MSE

=

=

=

=

=

=

1989

102.23

0.0000

0.0489

0.0485

.3201

-----------------------------------------------------------------------------approve |

Coef.

Std. Err.

t

P>|t|

[95% Conf. Interval]

-------------+---------------------------------------------------------------white |

.2005957

.01984

10.11

0.000

.1616864

.239505

_cons |

.7077922

.0182393

38.81

0.000

.6720221

.7435623

------------------------------------------------------------------------------

The coefficient estimates are quite different; however, they are not directly comparable. The estimate from the LPM suggests that the probability of approval in

a loan application for a white applciant is about 20 perecntage points higher than

for a non-white applicant.

• In both models the coefficient on white is positive and very strongly statistically

significant.

2. Now, add the variables hrat, obrat, loanprc, unem, male, married, dep, sch, cosign,

chist, pubrec, mortlat1, mortlat2, and vr to the probit model. Is there statistically

significant evidence of discrimination against non-whites?

Answer:

• Adding these variables to the probit generates the following results:

. probit approve white hrat obrat loanprc unem male married dep sch cosign

chist pubrec mortlat1 mortlat2 vr

Iteration

Iteration

Iteration

Iteration

Iteration

0:

1:

2:

3:

4:

log

log

log

log

log

likelihood

likelihood

likelihood

likelihood

likelihood

=

=

=

=

=

-737.97933

-603.5925

-600.27774

-600.27099

-600.27099

Probit regression

Number of obs

7

=

1971

LR chi2(15)

Prob > chi2

Pseudo R2

Log likelihood = -600.27099

=

=

=

275.42

0.0000

0.1866

-----------------------------------------------------------------------------approve |

Coef.

Std. Err.

z

P>|z|

[95% Conf. Interval]

-------------+---------------------------------------------------------------white |

.5202525

.0969588

5.37

0.000

.3302168

.7102883

hrat |

.0078763

.0069616

1.13

0.258

-.0057682

.0215209

(remaining output suppressed)

The estimated coefficient on white is smaller than in the earlier probit regression:

here the estimate is 0.520 while the earlier estimate was 0.784. However, again the

coefficients are not entirely comparable. We still seee that the coefficient is positive

and highly statistically significnat (though not as significant as previously).

• Note that the maximized log-likelihood has gone up by about 100 so that all this

additional stuff in the probit is jointly highly statistically significant.

3. Estimate the model from Part (2) by logit. Compare the coefficient on white to the probit

estimate.

Answer:

• Running the logit estimation of the model from Part (2) gives:

. logit approve white hrat obrat loanprc unem male married dep sch cosign chist

pubrec mortlat1 mortlat2 vr

Iteration

Iteration

Iteration

Iteration

Iteration

Iteration

0:

1:

2:

3:

4:

5:

log

log

log

log

log

log

likelihood

likelihood

likelihood

likelihood

likelihood

likelihood

=

=

=

=

=

=

-737.97933

-634.97536

-601.41194

-600.49724

-600.49616

-600.49616

Logistic regression

Number of obs

LR chi2(15)

Prob > chi2

Pseudo R2

Log likelihood = -600.49616

=

=

=

=

1971

274.97

0.0000

0.1863

-----------------------------------------------------------------------------approve |

Coef.

Std. Err.

z

P>|z|

[95% Conf. Interval]

-------------+---------------------------------------------------------------white |

.9377643

.1729043

5.42

0.000

.598878

1.27665

hrat |

.0132631

.0128802

1.03

0.303

-.0119816

.0385078

(remaining output suppressed)

The coefficient estimate on white is now 0.938 but again this is not directly comparable with the earlier estimates. It is both positive and highly statistically significant.

• Note that the maximized log-likelihood from this logit estimation is −600.49616

while that from th earlier probit estimation was −600.27099 so these are not very

different.

4. Use Equation (17.17) from Wooldridge to estimate the sizes of the discrimination effects

for probit and logit.

8

Answer:

• Equation (17.17) from Wooldridge outline a way of calculating the average partial

effect (APE) of a discrete explanatory variable in a binary response model. This

can be done in Stata by using the margins command with the at option and

then combining the results. To do this for the probit model we re-run the probit

estimation and then we run the margins command at white=0 and at white=1 :

. probit approve white hrat obrat loanprc unem male married dep sch cosign chist

pubrec mortlat1 mortlat2 vr

(output suppressed)

. margins, at(white=0 white=1)

Predictive margins

Model VCE

: OIM

Number of obs

Expression

: Pr(approve), predict()

1._at

: white

=

0

2._at

: white

=

1

=

1971

-----------------------------------------------------------------------------|

Delta-method

|

Margin

Std. Err.

z

P>|z|

[95% Conf. Interval]

-------------+---------------------------------------------------------------_at |

1 |

.7923174

.0210981

37.55

0.000

.7509659

.8336689

2 |

.8965419

.0072597

123.49

0.000

.8823131

.9107707

-----------------------------------------------------------------------------. disp (.8965419 - .7923174)

.1042245

From this we see that for the probit model, the estimated APE on loan approval of

being white as compared to non-white is an increase of 0.104, i.e. 10.4 percentage

points. We can do the same for the logit model which gives:

. logit approve white hrat obrat loanprc unem male married dep sch cosign chist

pubrec mortlat1 mortlat2 vr

(output suppressed)

. margins, at(white=0 white=1)

Predictive margins

Model VCE

: OIM

Number of obs

Expression

: Pr(approve), predict()

1._at

: white

=

0

2._at

: white

=

1

=

1971

-----------------------------------------------------------------------------|

Delta-method

|

Margin

Std. Err.

z

P>|z|

[95% Conf. Interval]

-------------+----------------------------------------------------------------

9

_at |

1 |

.7955101

.0203441

39.10

0.000

.7556364

.8353838

2 |

.8963808

.0072951

122.87

0.000

.8820826

.9106789

-----------------------------------------------------------------------------. disp (.8963808-.7955101)

.1008707

From this we see that for the logit model, the estimated APE on loan approval of

being white as compared to non-white is an increase of 0.101, i.e. 10.1 percentage

points. We can see that these answers are fairly similar and are both noticeably

positive, suggesting tht there is discrimination in loan approval even after controlling for this additional collection of factors. Note that the corresponding estimated

APE from the LPM is simply the coefficient on white in the regression with the

other factors included:

. regress approve white hrat obrat loanprc unem male married dep sch cosign

chist pubrec mortlat1 mortlat2 vr

Source |

SS

df

MS

-------------+-----------------------------Model | 35.4004787

15 2.36003192

Residual | 178.393534 1955

.09124989

-------------+-----------------------------Total | 213.794013 1970

.10852488

Number of obs

F( 15, 1955)

Prob > F

R-squared

Adj R-squared

Root MSE

=

=

=

=

=

=

1971

25.86

0.0000

0.1656

0.1592

.30208

-----------------------------------------------------------------------------approve |

Coef.

Std. Err.

t

P>|t|

[95% Conf. Interval]

-------------+---------------------------------------------------------------white |

.1288196

.0197317

6.53

0.000

.0901223

.1675169

hrat |

.001833

.0012632

1.45

0.147

-.0006444

.0043104

(remaining output suppressed)

This gives an estimated APE of 0.129, i.e. about 12.9 percentage points which is

rather above the estimated APE’s from the probit and logit estimations.

10