SECURITY AND PORTFOLIO MANAGEMENT

advertisement

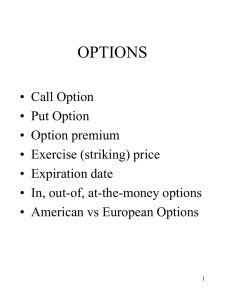

UNIVERSITY OF WAH Department of Management Sciences MBA-539: SECURITY AND PORTFOLIO MANAGEMENT COURSE DESCRIPTION/OBJECTIVES The objective of the course is to study theory and empirical evidence relevant for portfolio management. An emphasis is placed on understanding how an investment professional would allocate funds in a hypothetical portfolio. Major topics include estimation of capital market parameters, tradeoff between risk and return, optimal portfolio selection, equilibrium asset pricing models, and delegated portfolio management. Emphasis will be put on development of techniques that should be part of the tool kit of those interested in becoming professional investors and/or researchers in finance. The course material is tilted heavily towards equity markets since there are separate courses that cover fixed income markets and derivative securities. This course is designed to primarily address the needs of advanced students in an MBA program. LEARNING OUTCOMES By the end of this course it is expected that the student will be able to: 1. Understand the operations of financial markets; 2. To analyze the various types of assets including equities, fixed income securities, and derivatives; 3. To perform risk analysis. 4. Enhance the skills are required for corporate finance, trading, and investment banking positions. COURSE CONTENT WEEK Week 1 TOPICS Investment Settings Week 2 Organization And Functioning Of Securities Market Week 3 Security market indicator series Week 4 Introduction to efficient market hypothesis Week 5 An introduction to portfolio management Week 6 An introduction to asset pricing models Week 7 Analysis of financial statements Week 8 Security valuation Week 9 Stock market analysis Week 10 Industry analysis Week11 Company analysis and stock valuation Week 12 Technical analysis Week 13 Introduction to behavioral finance Week 14 Introduction to financial derivatives UNIVERSITY OF WAH Department of Management Sciences Week15 Week 16 Forwards, Futures, Options & Swaps Project/Revision TEXT/REFERENCE BOOK 1. Jones. P. Charles; Investment: Analysis & Management, John Wiley & Sons. 2. Sharpe, Alenander and Bailey; Investments, Prentice Hall. 3. Bodie, Kanne & Marcus; Investment, McGraw Hill. 4. Radcliff; Investment: Concepts Analysis Strategy, Addison Wesley.