ANZ - FSI terms of reference

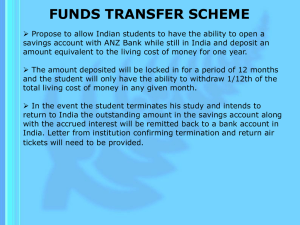

advertisement