Liberal Welfare Reforms Notes

advertisement

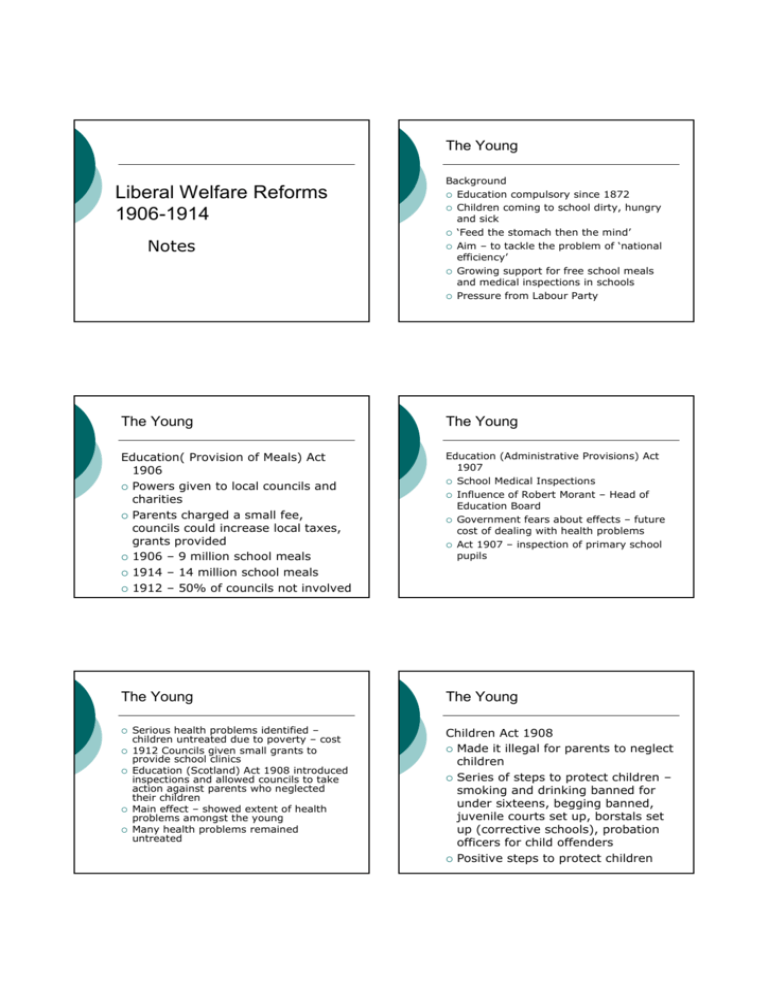

The Young Liberal Welfare Reforms 1906-1914 Notes Background Education compulsory since 1872 Children coming to school dirty, hungry and sick ‘Feed the stomach then the mind’ Aim – to tackle the problem of ‘national efficiency’ Growing support for free school meals and medical inspections in schools Pressure from Labour Party The Young The Young Education( Provision of Meals) Act 1906 Powers given to local councils and charities Parents charged a small fee, councils could increase local taxes, grants provided 1906 – 9 million school meals 1914 – 14 million school meals 1912 – 50% of councils not involved Education (Administrative Provisions) Act 1907 School Medical Inspections Influence of Robert Morant – Head of Education Board Government fears about effects – future cost of dealing with health problems Act 1907 – inspection of primary school pupils The Young The Young Serious health problems identified – children untreated due to poverty – cost 1912 Councils given small grants to provide school clinics Education (Scotland) Act 1908 introduced inspections and allowed councils to take action against parents who neglected their children Main effect – showed extent of health problems amongst the young Many health problems remained untreated Children Act 1908 Made it illegal for parents to neglect children Series of steps to protect children – smoking and drinking banned for under sixteens, begging banned, juvenile courts set up, borstals set up (corrective schools), probation officers for child offenders Positive steps to protect children The Old The Old Background Influence of Lloyd George, Churchill after 1908 – ‘New Liberals’ Need to tackle poverty Concerns about ‘national efficiency’ Concerns about economic and military strength of Germany – introduced pensions in 1889 The Old The Sick Old Age Pensions Act 1908 People over 70 with an annual income of £21 £31 per year given 5p – 25p per week Had to be UK residents for 25 years – no ex prisoners, no work shy, no drunks Maximum pension of 25p per week still left people below the poverty line (Rowntree) Huge demand – 1million pensioners by 1914 Liberals underestimated extent of problem Background Plans for a unified system National insurance scheme to be set up Taxes raised – income tax, super tax on rich, capital gains tax (tax on sale of property) Opposition of Friendly Societies – loss of business Opposition of doctors – fears about having to provide cheap treatment to the poor The Sick The Sick National Insurance Act 1911 (Part 1) Health insurance Workers/Employers/Government contributions each week Entitlements – sickness benefit of 50p per week for 13 weeks then 25p for 13 weeks Disablement Benefit of 25p after 26 weeks Maternity benefit introduced Treatment by government approved doctors Fears about cost – increased taxation – government aimed to keep costs down Opposition of Friendly Societies – made profits providing private pensions to working people Public in favour of Old Age Pensions Support of Trade Unions Support of Labour Party – won two byelections from Liberals in 1907 Basic provision of health care for the poor in Britain Some relief from fear of illness and its impact on families Workers families not covered by the scheme Hospital treatment not covered by health insurance The Unemployed/Low Paid The Unemployed/Low Paid Background Changing attitudes to unemployment Unemployment often outwith the control of workers – cyclical, seasonal Unemployment demonstrations 1903 – 1905 Trade unions supported better unemployed rights Unemployed could vote – appeal of Labour Party Unemployed Workmen’s Act 1905 Distress Committees set up to help unemployed – public works schemes, payments to unemployed, help to emigrate Money raised through local taxes and public appeals Lack of money – many schemes were temporary Raised awareness of problem of unemployment The Unemployed/Low Paid The Unemployed/Low Paid Labour Exchanges 1909 Employment arrangements inefficient – men hanging around factories looking for work Solution – Labour Exchanges – employers registered jobs – information passed to unemployed 1910 – 83 Labour Exchanges 1913 – 430 Labour Exchanges Success – 3,000 found jobs every day by 1914 National Insurance Act 1911 (Part 2 Unemployment insurance Workers/Employers/Government made weekly contributions Trades involved – shipbuilding, engineering, building, iron making, sawmilling Payments when unemployed 35p a week for 15 weeks each year The Unemployed/Low Paid The Unemployed/Low Paid Insured worker had to register at a Labour Exchange Workers who were dismissed did not receive benefits 2.3 million workers insured by 1913 Small proportion of the working population but was the beginning of a comprehensive system for helping the unemployed Help for the Employed Workmen’s Compensation Act 1906 – compensation for injuries received at work to be paid by employers Coal Mines Act 1908 – shorter hours for coal miners Trade Boards Act 1909 – minimum wages for women in low paid work Shops Act 1911 – half day off each week for shop workers Acts helped vulnerable workers