ADVANCED FINANCIAL ACCOUNTING & REPORTING QUESTION

advertisement

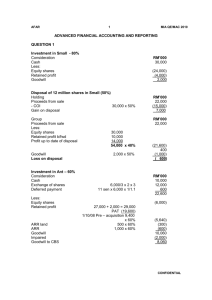

AFAR 1 MIA QE/SEPT 2009 ADVANCED FINANCIAL ACCOUNTING & REPORTING QUESTION 1 COI 60,000/ 3 x 2 x 3 COI COI - pre acquisation dividends COI Cost of control – Thyme (30%) 1st acquisition RM’000 RM’000 120,000 Ordinary share capital 60,000 Retained profit 6,000 Goodwill 54,000 Cost of control – Thyme (30%) 2nd acquisition RM’000 RM’000 70,000 Ordinary share capital 60,000 Retained profit 7,530 Goodwill 2,470 Cost of control – Mint (80%) RM’000 320,000 Ordinary share capital ( 6,000) Retained profits ITA Goodwill 27,280 32,000 134,720 Cost of control – Basil (1/3) RM’000 600 Ordinary share capital Retained profit Goodwill RM’000 200 33 367 COC – Ist acquisition 2nd acquisition URP – inventory Debenture interest MI To CPL Profit and loss account – Thyme RM’000 Bal b/d 6,000 7,530 4,000 300 14,480 8,190 COC MI To CPL Profit and loss account –Mint RM’000 33,280 Bal b/d 10,060 6,960 RM’000 120,000 RM’000 40,500 RM’000 50,300 CONFIDENTIAL AFAR 2 Consolidated profit and loss account RM’000 Pre acquisition dividends 6,000 Debenture interest 4,000 To CBS 172,284 MIA QE/SEPT 2009 RM’000 161,000 134 8,190 12,960 Bal b/d Profit from JV From Thyme From Mint CBS Minority interest –Thyme (40%) RM’000 Ordinary share capital 94,480 Retained profit RM’000 80,000 14,480 CBS Minority interest – Mint (20%) RM’000 Ordinary share capital Retained profit 48,060 ITA RM’000 30,000 10,060 8,000 Alternative presentation (schedule format) Analysis of equity/goodwill - Thyme Thyme Ist 2nd acquisition acquisition Share capital 60,000 60,000 200,000 Ret profit b/d 40,500 6,000 Ist acquisition 7,530 20,000 2nd acquisition 40,500-15,400 x 30% URP Debenture interest MI( 40,500 - 4,000 300 x 40%) 66,000 67,530 COI 120,000 70,000 Goodwill 54,000 2,470 Analysis of equity/goodwill – Mint Mint Equity Share capital 120,000 150,000 Ret profit b/d 50,300 33,280 At date of acquisition 38,700 + (11,600 x 3/12) =41,600 ITA 40,000 32,000 PrePostMI(40%) acquisition acquisition 80,000 (6,000) (7,530) Preacquisition (4,000) ( 300) 14,480 14,480 8,190 94,480 Post acquisition MI (20%) 30,000 (33,280) 8,000 CONFIDENTIAL AFAR 3 MI 50,300 x 20% COI Goodwill MIA QE/SEPT 2009 10,060 10,060 6,960 48,060 185,280 320,000 134,720 Consolidated retained profit RM’000 Balance b/d 161,000 From Thyme 8,190 From Mint 6,960 From Joint Venture 134 Debenture interest ( 4,000) ----------172,284 ====== Consolidated income statement of Herb group for the year ended 31 December 2008 RM’000 Revenue 85,000 + 54,000 + (40,000 x 9/12) + (15,000 134,000 x 1/3) – 40,000 COS 35,000 + 21,000 + (14,000 x 9/12) + (6,000 x ( 32,500) 1/3) – 40,000 + URP 4,000 GP 101,500 Distribution cost 8,900 + 5,400 + (4,500 x 9/12) + (3,400 x ( 18,808) 1/3) Administrative 9,000 + 8,700 + (6,500 x 9/12) + (5,000 x ( 24,142) expenses 1/3) – 100 Finance cost 1,000 + 500 + 4,000 + 300 ( 5,800) Profit before tax 52,750 Tax 9,900 + 3,000 + (3,400 x 9/12) + 200 x 1/3 ( 15,518) Profit after tax 37,234 Profit attributable to : RM’000 MI : Thyme 15,400 – URP 4,000 -300 x 40% 4,440 Mint 11,600 x 9/12 x 20% 1,740 Parent + equity holders 31,054 -----------37,234 ======= Statement of changes in equity of Herbs group Retained profit b/fwd Herbs Thyme 25,100 – 20,000 x 30% Profit for the year Retained profit c/fwd RM’000 139,700 1,530 31,054 172,284 CONFIDENTIAL AFAR 4 MIA QE/SEPT 2009 Consolidated balance sheet of Herb group as at 31 December 2008 RM’000 Non current assets PPE 100,000 + 210,000 + 175,000 + (23,700 x 1/3) Investments 570,000 – 120,000 – 70,000 – 320,000 – 600 Intangible asset Goodwill 54,000 +134,720 + 367 + 2,470 Current assets Inventories 46,000 + 40,000 + 25,000 + 400/3 – URP 4,000 107,133 Accounts receivable 25,000 + 20,000 + 10,000 + 1,000/3 – 300 Bank 5,000 + 2,000 + 1,000 + 500/3 Cash in transit Equity and reserves Share capital CPL MI 94,480 + 48,060 Non current liabilities Loans 50,000 + 8,000 Current liabilities Accounts payable 30,000 + 19,000 + 7,700 + 12,500/3 – 170 Accrued interest Tax 5,000 + 4,500 + 3,000 + 12,000/3 492,900 59,400 40,000 191,557 55,033 8,167 130 -----------954,320 ======= 500,000 172,284 142,540 58,000 60,696 4,300 16,500 -----------954,320 ======== Alternative solution using the equity method of consolidation for Joint Venture Consolidated income statement of Herb group for the year ended 31 December 2008 RM’000 Revenue 85,000 + 54,000 + (40,000 x 9/12) – 40,000 129,000 COS 35,000 + 21,000 + (14,000 x 9/12) – 40,000 ( 30,500) + URP 4,000 GP 98,500 Distribution cost 8,900 + 5,400 + (4,500 x 9/12) ( 17,675) Administrative 9,000 + 8,700 + (6,500 x 9/12) – 100 ( 22,475) expenses Finance cost 1,000 + 500 + 4,000 + 300 ( 5,800) Profit before tax 52,550 Share of profit of JV 400 x 1/3 134 Tax 9,900 + 3,000 + (3,400 x 9/12) ( 15,450) Profit after tax 37,234 CONFIDENTIAL AFAR 5 MIA QE/SEPT 2009 Consolidated balance sheet of Herb group as at 31 December 2008 RM’000 Non current assets PPE 100,000 + 210,000 + 175,000 Investments 570,000 – 120,000 – 70,000 – 320,000 – 600 Intangible asset Goodwill 54,000 + 134,720 + 2,470 Investment in joint venture Current assets Inventories 46,000 + 40,000 + 25,000– URP 4,000 Accounts receivable 25,000 + 20,000 + 10,000 – 300 Bank 5,000 + 2,000 + 1,000 Cash in transit Equity and reserves Share capital CPL MI 94,480 + 48,060 Non current liabilities Loans 50,000 + 8,000 Current liabilities Accounts payable 30,000 + 19,000 + 7,700– 170 Accrued interest Tax 5,000 + 4,500 + 3,000 485,000 59,400 40,000 191,190 734 107,000 54,700 8,000 130 -----------946,154 ======= 500,000 172,284 142,540 58,000 56,530 4,300 12,500 -----------946,154 ======== (Total:25 marks) QUESTION 2 Income statement for the year ended 31 March 2009 RM’000 Revenue 5,000 Cost of sales (2,716) -------2,284 Administrative expenses (240) Distribution expenses (90) Finance cost (86) Loss on investment property (50) ---------Profit before tax 1,819 Income tax (376) ---------Profit after tax 1,442 ====== CONFIDENTIAL AFAR 6 MIA QE/SEPT 2009 Statement of changes in equity of Comel Bhd for the year ended 31 March 2009 Equity Balance 1/4/08 RM’000 1,200 Option Equity Retained component earnings RM’000 RM’000 1,760 40 Profit for the year Dividend paid Balance 31/3/09 1,200 40 Total RM’000 2,960 40 1,442 ( 400) 1,442 (400) 2,802 4,042 Balance sheet of Comel Bhd as at 31 March 2009 RM’000 Non current assets PPE (6,260 – 400) Leased asset (320 -64) Investment property Current assets Inventory Cash Bank Accounts receivable 5,860 256 350 740 100 560 400 _____ 8,266 ===== Equity Ordinary shares Equity component 1,200 40 Retained profits 2,802 Long term liabilities Convertible loan stock Deferred taxation Lease creditors Current liabilities Accounts payable Lease creditors 568 156 190 3,230 80 --------8,266 ===== CONFIDENTIAL AFAR 7 Workings 1. Cost of sales as per TB - finance charge + depreciation on Leased asset 2. Finance costs Interest (48 +8) Interest on lease MIA QE/SEPT 2009 RM’000 2,700 ( 48) 64 ---------2,716 ====== RM’000 56 30 --------86 ====== 3. Convertible loan stock Years 1 2 3 4 Cash flow RM’000 48 48 48 648 Total value of debt component Proceeds of the issue Equity component Discount factor@10% 0.91 0.83 0.75 0.68 Present value RM’000 43.6 39.8 36.0 440.6 560 600 40 Interest for year ended 31/3/09 : ( 10% x 560) – (8% x 600) = 8 4. Tax base RM600,000 x 26% = 156,000 deferred tax provision decrease from RM180,000 to RM156,000 (Total:25 marks) QUESTION 3 a) At the balance sheet date, no retraining of staff has taken place. The company has only finalized the retraining programme plan, therefore, there is no obligation because no obligating event (retraining) has taken place. No provision is therefore, to be recognized in the 31 March 2009 financial statements. (4 marks) b) MegaPlant is of the opinion that the loss from the fire may be covered by an insurance claim. However, the insurance company is disputing the claim. This appears to be a contingent asset. If a contingent asset is probable, it should be noted in the financial statements. However, if it is only possible, it should be ignored. As this claim is at an early stage and the company has not yet sought a legal opinion, it would be premature to consider the claim probable. In these circumstances, the contingent asset should be ignored and the financial statements will be unaffected. (5 marks) CONFIDENTIAL AFAR 8 MIA QE/SEPT 2009 c) The contamination would result in clean up costs only when the company is required to do so under the laws of the particular country or the company has a widely published environmental policy in which it undertakes to clean up all contamination that it causes. Should there be a legislation requiring a clean up, the obligating event is the contamination of the land because of the virtual certainty of legislation requiring cleaning up. An outflow of resources is probable in this case and therefore, a provision is recognized for the best estimate of the costs of the clean-up. An entity can operate in a country where there is no environmental legislation however, the entity has a widely published environmental legislation and the entity has a record of honouring this published policy. In this case, the obligating event is the contamination of the land, which gives rise to a constructive obligation because the conduct of the entity has created a valid expectation on the part of those affected by it that the entity will clean up the contamination. An outflow of resources is probable in this case and therefore, a provision is recognized for the best estimate of the costs of the clean-up. Where there is no legislation and the company also does not have a widely published environmental legislation, there is no legal or constructive obligation, and thus no provision is required. (6 marks) d) Although the company is under no legal obligation to refund purchases by dissatisfied customers, this refund policy would generally be made known to its customers. The obligating event is the sale of the product, which gives rise to a constructive obligation because the conduct of the store has created a valid expectation on the part of its customers that the store will refund purchases. The directors should expect that it would be probable that a proportion of goods are returned for refund. A provision is recognized for the best estimate of the costs of refunds. (5 marks) e) The contract is non-cancellable and cannot be returned or re-let to another user. The obligating event is the signing of the lease contract, which gives rise to a legal obligation. An outflow of resources embodying economic benefits is probable. The entity accounts for the lease under FRS 117 Leases. The overhaul cost will only be incurred when and if the air travel industry improves as well as when Flightbus decides to operate the two planes again. As such, there is no obligating event yet. No provision is to be recognised for overhaul cost. (5 marks) (Total:25 marks) QUESTION 4 A. i. The building has been successfully tenanted to various tenants, and it is therefore held by Shipyard Authority to earn rentals and/or capital CONFIDENTIAL AFAR 9 MIA QE/SEPT 2009 appreciation rather than for use in the production or supply of goods or services or for administrative purposes, or sale in the ordinary course of business. FRS 140 therefore permits such a property interest held under an operating lease to be classified as an investment property provided it is accounted for as if it were a finance lease in accordance with FRS 117. Shipyard Authority has complied with this requirement and it may, therefore, opt to account for the warehouse as an investment property. But if it chooses to do so, it must adopt the fair value model set out in FRS 140 for asset recognition. However, once Shipyard Authority decides to account for the warehouse as an investment property, it must consistently account for its entire investment property portfolio at fair value. (4 marks) ii. The first question that needs to be addressed is whether the building owned by Company B qualifies to be classified as an investment property. 75% of the building is held to earn rentals and the balance of 25% is held for use as a sales and administrative office, i.e. 25% is owner-occupied. In these circumstances, the property is an investment property only if either of the following conditions are met: a) The portion tenanted could be sold separately (or leased out separately under a finance lease), in which case Company B accounts for this portion separately as an investment property under FRS 140 and the owner-occupied portion as property, plant and equipment under FRS 116. b) If (a) is not met, but only an insignificant portion is owner-occupied, then the building is an investment property. If condition (a) is not met, the 25% portion which is owner-occupied cannot be considered to be insignificant, and as a result, the building cannot be classified as an investment property. On the assumption that condition (a) is met and the 75% portion accounted as an investment property, the change from the cost model to the valuation model for the investment property is accounted for as a change in accounting policy. Under the valuation model, or the fair value model, Company B will measure its investment property at fair value. The transitional provisions of FRS 140 require that the difference between the previous carrying amount and the fair value to be adjusted against the opening balance of retained profits. In addition, if Company B has disclosed fair value information in its previous financial statements (determined in accordance with FRS 140), it is encouraged to adjust the opening balance of retained profits for the earliest period presented for which such fair value was disclosed publicly and to restate comparative information for those periods. The 25% continues to be accounted for under the cost basis, i.e. at cost less accumulated depreciation and impairment losses. (6 marks) B. Impairment i. Impairment loss CONFIDENTIAL AFAR 10 MIA QE/SEPT 2009 RM Cost of factory building Depreciable amount Cost of factory building Residual value (10% of cost) RM 2,600,000 2,600,000 (260,000) 2,340,000 Annual Depreciation over useful life Depreciation over 10 years Carrying amount of factory building 78,000 (780,000) 1,820,000 Recoverable amount 1,500,000 Impairment loss ii. 320,000 Fair value of the building RM2,250,000 RM RM Carrying amount of factory building 1,820,000 Recoverable amount higher of Fair value less cost to sell 2,250,000 (350,000) 1,900,000 And value-in-use Recoverable amount 1,500,000 1,900,000 Impairment loss C. Nil (6 marks) Borrowing Costs FRS 123 defines a qualifying asset as an asset that necessarily takes a substantial period of time to get ready for its intended use or sale. The construction of the ship will take approximately 3 years to complete, thus is a qualifying asset. Capitalisation rate Types of financing 8% Redeemable preference shares 10% Loan Stock 7% Term Loan Principal RM Weighted Average (a) Interest Rate (b) (a) x (b) 60,000,000 30% 8% 2.4% 40,000,000 100,000,000 200,000,000 20% 50% 100% 10% 7% 2.0% 3.5% 7.9% Total interest Types of financing 8% Redeemable preference Principal RM Interest Rate 60,000,000 8% Total Interest RM 4,800,000 CONFIDENTIAL AFAR 11 shares 10% Loan Stock 7% Term Loan 40,000,000 100,000,000 MIA QE/SEPT 2009 10% 7% 4,000,000 7,000,000 15,800,000 RM Interest qualifying for capitalization RM120,000,000 x 7.9% Interest to be charged as expense Total Interest 9,480,000 6,320,000 15,800,000 (6 marks) D. There must be facts and circumstances to support ComAir’s ability to continue providing air service indefinitely between the two cities and this can be supported by analysis of demand for air travel between the two cities as well as cash flow supports. If based on an analysis of all the relevant factors, there is no foreseeable limit to the period over which the asset is expected to generate net cash inflows for ComAir, an intangible asset shall be regarded by ComAir as having an indefinite useful life. In which case, the intangible asset related to route authority can then be treated as intangible assets with indefinite useful life. No amortization is required until useful life is determined to be finite. The asset is tested for impairment annually and when there’s an indication of impairment. (3 marks) (Total: 25 marks) CONFIDENTIAL