March 2007 – Paper Towels and Napkins: fastest growing tissue

advertisement

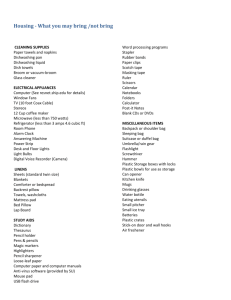

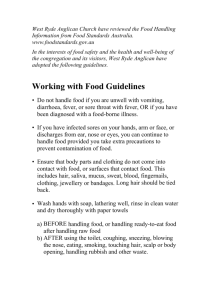

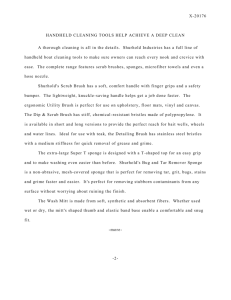

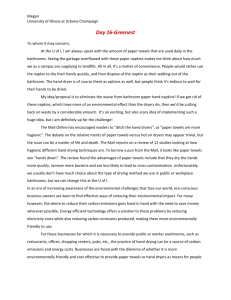

The European Tissue Paper Industry Association Administrative office: Kunstlaan 44 Avenue des Arts, B-1040 Brussels T : +32.2.549 5230 – F : +32.2.5021598 – E : info@europeantissue.com. Press Information March 2007 Paper Towels and Napkins: fastest growing tissue category in Europe There has been strong growth in the consumer sector of the European market for paper towels and napkins, with the potential1 for a further market growth of 270% for towels and 350% for napkins compared with the current US market. Household towels: new usages steer market performance Superior product technology, improved quality and higher absorbance capacities provide a versatility that has so far been unprecedented in West-European markets. When comparing US towel consumption with Europe, dramatic growth areas are revealed. Not only are they used in the kitchen but also in the broader household environment. In the United States, in addition to kitchen use, paper towels are used for a wide variety of household tasks, resulting in wider use for crafts, hobbies, painting or drying working surfaces than in Europe. Household usages are the main purchasing reason of this product in the US, unlike in Europe, to the extent that the category previously known as “kitchen towels” could be re-named “household towels”. In Eastern Europe, where penetration levels are still low, paper towels are the fastest growing category, with enormous potential for further growth. Here, the growth opportunity resides in increasing product penetration into more households. Largest increase in market volume in the last decade In Europe, consumer kitchen towels accounted for the largest increases in market volume between 1996 - 2004. Increasing use of premium quality products and multi-ply product structures supported this growth. The introduction of new brands based on TAD1 technology, bringing softer more absorbent products, supported by extensive marketing campaigns, made a significant contribution to the buying trends in this end user segment. The evolution of markets such as the UK, Germany and Italy proves the superior quality and performance of TAD (Through Air Dry) towels. The versatility of TAD towels for a multitude of uses appeals to the consumer and encourages brand loyalty. Consumers are also willing to pay more for a high 1 ETS, European Tissue Symposium – market 2005 (see forecast of potential consumption of the market per capita for Napkins & Towels as attached) Wave 3 T&N - EN - 28022007- 1 performing product. For example, products such as Lotus Maestro (Georgia Pacific) extend use and re-utilisation possibilities beyond those of any other paper towel. There is a huge market potential for kitchen rolls. Two crucial factors foster value growth for towels: some countries still have ample room for further penetration, and new at-home uses will continue to grow in line with improved technology. These aspects combined cause the value per towel-sheet to increase and will continue to do so in the coming years. Something similar, if slightly less pronounced, is happening with napkins: consumption of napkins also continues to develop, reaching surprisingly high growth rates in several countries, including those with traditionally weak napkin penetration levels, such as Germany and the UK. Northern/Central Europe and Southern Europe have traditionally been quite different markets for napkins: white one ply napkins dominate the South while in the North coloured and printed ones are the preferred option. Overall, recent trends show a preference for attractive printed design napkins. However, it is predicted that white napkins will gradually see more colour and printing, including in the Southern European market. With a lot of development potential left, even in countries with the highest per capita consumption of tissue - such as the Nordic countries and the UK - and the increasing popularity of attractively designed products, a rapid expansion of the napkins business can be Europe-wide. The impact of new technologies TAD towels (kitchen rolls) have been on the market since the late 1990s. A series of initiatives such as Scottex Casa Ultra (Kimberly-Clark) in Italy 1992, followed by the launch of Bounty towel (1997 – Procter & Gamble) - supported huge marketing campaigns in the UK and Switzerland - followed by the German launch of Zewa (SCA) in 1999, created a new high growth premium segment. More recently, in France and Belgium, Lotus-Okay (Georgia Pacific) has been re-launched as a TAD product. As a consequence, the average quality requirements for ‘kitchen’ towels has risen, evolving into a new segment of ‘household’ towels, suitable for new, heavy duty usages outside the kitchen area. This is why in some markets - such as Germany and to a lower extent Italy - producers have developed part of their traditional 2 ply Wave 3 T&N - EN - 28022007- 2 product to 3 ply towels, steering this new, higher quality category to more profitable levels in Western Europe. Consumption per Capita Europe & USA NAPKINS UK 1,2 Finland 0,3 4,5 USA Netherlands 0,5 Ireland 0,6 Austria 0,8 Norway & Iceland 1,1 West Europe 1,5 Germany 0,6 Sweden 1,3 France 0,6 Greece 3,9 Denmark 1,9 Spain 3,0 Italy 2,6 Switzerland Current Market Increase +350% Potential Market 5,7 Belgium 1,7 Czech Rep. 0,3 Hungary 0,9 Portugal 0,5 b€ 1,6 b€ 2,1 b€ 2,4 Croatia / Slovenia 1,1 Slovakia 1,2 Europe 1,0 Units: € per head, RSV billion € Bulgaria 1,7 0,2 Poland Romania/Moldavia 0,6 Baltic States source: ETS estimates of consumption per capita in Europe and USA 0,9 East Europe 0,5 Russia 0,3 Ukraine / Beelarus 0,2 0 1 2 3 4 5 TOWELS UK 4,9 Finland 6,5 9,3 USA Netherlands 3,2 Ireland 4,3 Austria 4,2 Norway & Iceland 6 West Europe 4,6 Germany 5,2 Sweden 6,6 France 5 Greece 4,6 Denmark 7,9 Spain 5,7 Italy 4,6 Switzerland 3,8 Belgium Current Market Increase +270% Potential Market 4,3 Czech Rep. 0,6 Hungary 2,2 Portugal 2,6 Croatia / Slovenia 2,9 b€ 5,4 b€ 7,4 b€ 2,7 Slovakia 0,5 Units: € per head, RSV billion € 2,5 Europe 0,3 Bulgaria 0,7 Poland Romania/Moldavia source: ETS estimates of consumption per capita in Europe and USA 0,5 Baltic States 1,1 East Europe 0,4 0 2 4 6 8 10 ETS estimates of the consumption per capita in Europe and US, 2005. In no other tissue segment is there a higher rate of growth in Europe than for Towels and Napkins. Source: ETS. Wave 3 T&N - EN - 28022007- 3 About ETS The European Tissue Symposium (ETS) is a trade organisation. Its members represent the majority of tissue paper producers throughout Europe and about 90% of the total European tissue production. Information provided by the ETS / European Tissue Symposium Roberto Berardi - tel. + 39 011 8128810 - roberto.berardi@europeantissue.com Wave 3 T&N - EN - 28022007- 4 Attachment: Market information on Towels & Napkins In no other tissue segment is there a higher rate of growth in Europe than for Towels and Napkins. The industry2 predicts a continued potential market growth of respectively 270% for Towels and 350% for Napkins for Europe compared with the current US market situation. The introduction of innovative high performance and differentiated products, leading to a broader variety of usage in the household area, will increase the overall value of the market. The heavy duty effect in the UK: Bounty and Lotus kick the market value upwards Without doubt, Bounty (Procter & Gamble) simply and drastically changed the paper towel category in the UK. Since Bounty’s introduction seven years ago, the market has grown by +55%: category value jumped from £191 to £297 million by 2006. Bounty’s own value in this period went from zero to £58 million, making it the UK’s top product in this category. How did this happen? Two key areas of success were identified: the introduction of a superior product technology (TAD), and a creative high impact TV campaign, fully supported in the distribution channels. Simultaneously, Georgia Pacific continued to support its Lotus Thirst Pockets Towels, with significant marketing efforts contributing to important growth. Driven by both brands and their marketing efforts, the trade registered an additional turnover of £106 million. Market research confirms that the use of paper towels for specific tasks increased between 60% and 900% from launch till today. 2 ETS, European Tissue Symposium – market 2005 (see forecast of potential consumption of the market per capita for Napkins & Towels as attached) Wave 3 T&N - EN - 28022007- 5 Italy towel market value trend increases by +215% in one decade During 1998 the Italian market saw an unprecedented increase in the previously steady value level of its paper towel segment: a remarkable and sudden jump in growth of 26%! Why? In this period, the Italian market saw its biggest increase in over 5 years: products with high quality print, 3-ply products, TAD-products, high performance (resistance and absorbency), and new embossing all featured. Both domestic and international producers were involved, and their products retain a significant market share and sustained growth rate thanks due to the innovative nature of what has become a multipurpose product. 300.000 (€ 000) 250.000 200.000 150.000 100.000 50.000 0 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 Source: AcNielsen. Tot Italy Italian HHT Market Value Trend in 000 € - Source: AC Nielsen Wave 3 T&N - EN - 28022007- 6 Embossed 2-ply napkins generate substantial market growth Almost a year earlier, the Italian napkins market underwent a similar change. Scottex (Kimberly-Clark) launched a micro-embossed 2-ply napkin to support category performance. In a flat and stagnant 1-ply market, this new technology afforded value growth of the category and the 2-ply branded segment. Today, this product type is responsible for half of the Italian market’s value. 1,9 1,7 1,5 1,3 1,1 0,9 0,7 0,5 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 Average RSP per 100 Napkins driven by launch of micro-embossed 2 ply – source: AC Nielsen Dutch kitchen towel adds value to the category The last decade has seen a +32% increase in the Netherlands’ kitchen towel market. Lotus Maestro (Georgia Pacific) entered the Dutch kitchen towel market in 1995, surprising with the first premium product in this segment. Georgia Pacific has been the first Use/Rinse/Re-use high wetstrength product in Europe. The product quickly developed good distribution support, contributing to category growth. In fact, growth in this category was due solely to Lotus Maestro, demonstrating that the more a product is differentiated, the less it needs large-scale promotional support and the more it drives loyalty, both trade and consumer. Today, despite being double the price of regular tissue towel, it is the second most common product in many Dutch households. Research also demonstrates that repeat buyers represent more than 80% of the Maestro sales. Wave 3 T&N - EN - 28022007- 7 70,000 60,000 Euro x 1,000 50,000 40,000 30,000 20,000 10,000 1990 1991 1992 1993 1994 1995 1996 1997 1998 KT EXCL LOTUS MAESTRO 1999 2000 2001 2002 2003 2004 2005 LOTUS MAESTRO Dutch HHT Market Value Trend in 000 € Its all about creating economic opportunities and value As European consumers discover the enormous variety of uses for tissue towels, opportunities are created for the introduction of innovations and for growing the value of the category. At the end of 2001, Renova introduced the Double-Face concept: a new range of two-ply towels, one interior blank sheet for safe contact with, for example, food, covered by an exterior coloured ply. This exciting concept, with new fashionable and seasonable print art designs, not only helped Renova to open new markets for its brand in Northern European countries, but was a great contributory factor in the 10% growth of Renova’s value market share in Portugal over the last four years. 35% 30% 25% RNV 20% B1 15% B2 10% 5% 0% 2001 2002 2003 2004 2005 Value Market share in PORTUGAL - Source Ac Nielsen Wave 3 T&N - EN - 28022007- 8 Exceptional absorbency is good for business What’s the difference between a sponge and kitchen towel rolls? Not a lot since KimberlyClark introduced Scottex with a new level of absorbency, reversed the price and promotional pressure of the difficult competitive Italian market with Scottex Cartaspugna, creating the revolutionary giant segment. Based on the TAD technology, Scottex Cartaspugna (the ‘paper sponge’) features exceptional strength (+66%) and absorbance (+51%) in larger sheets if compared to previous standards. Consumer acceptance is impressive. Competitive brands achieve between 1% to 22 % consumer bonding, Scottex now achieves 54%. If every kitchen roll in Italy were sold at the same price as Scottex Cartaspugna, total market value would grow by 24%. Two leading brands, Scottex (Kimberly-Clark) and Regina (Sofidel), also launched extra-long kitchen towels which were sold at prices clearly above the average price of standardlength rolls. These products stimulated the overall growth of the market by bringing the average value per roll to a higher level. Whereas the traditional Italian market in the past was characterised by standard products with price as the driving force, these two brands established what is effectively a new category, generating such brand awareness that their names joined the hall of fame alongside major household brands such as Bic, Gillette, Lego and Coca Cola in this market. Market Value per Segment 350.000.000 300.000.000 250.000.000 +61% vs. previous year, driven by the new Scottex Cartaspugna 200.000.000 150.000.000 100.000.000 50.000.000 TOTAL KITCHEN ROLLS Source: AcNielsen. Tot Italy GIANT+MAXI 2.005 MEGA REGULAR 2.006 Market Value by Segment – Source AC Nielsen Wave 3 T&N - EN - 28022007- 9