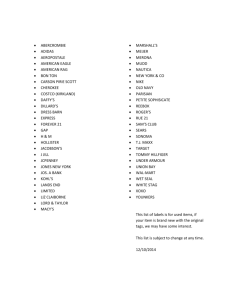

Liz Claiborne Inc. - Corporate-ir

advertisement