RECYCLING PROBLEM 3-1 Journalizing transactions and proving

advertisement

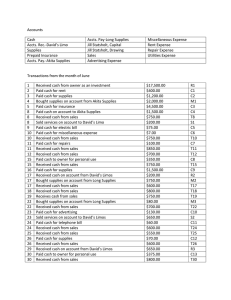

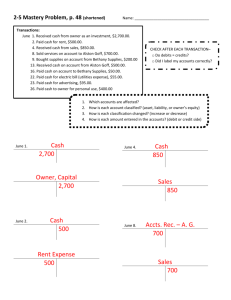

R E C Y C L IN G PR O B L E M 3-1 Journalizing transactions and proving and ruling a journal Adeline Stein owns a service business called Stein Express, which uses the following accounts: Cash Supplies Prepaid Insurance Accts. Rec. - M. Bien Accts. Pay.-Rim Supply Accts. Pay.-Parks Co. Adeline Stein, Capital Adeline Stein, Drawing Sales Advertising Expense Miscellaneous Expense Rent Expense Repair Expense Utilities Expense Transactions: Aug. 1. Received cash from owner as an investment, $8,750.00. Rl. 2. Paid cash for supplies, $500.00. Cl. 3. Paid cash for rent. $300.00. C2. 4. Bought supplies on account from Rim Supply, $1,200.00. Ml. 5. Paid cash for electric bill, $250.00. C3. 8. Paid cash on account to Rim Supply, $700.00. C4. 8. Received cash from sales. $425.00. T8. 8. Sold services on account to M. Bien, $125.00. Sl. 9. Paid cash for insurance, $l,900.00. C5. 10. Paid cash for miscellaneous expense, $27.00. C6. 10. Received cash from sales, $297.00. Tl0. I l. Paid cash for supplies, $770.00. C7. I l. Received cash from sales, $493.00. Tl I. 12. Received cash from saies. $294.00. Tl2. 15. Paid cash to owner for personal use, $125.00. C8. 15. Received cash from sales. $275.00. TI5 16. Paid cash for repairs, $88.00. C9. 17. Received cash on account from M. Bien, $125.00. R2. 17. Bought supplies on account from Parks Co., $345.00. M2. 17. Received cash from sales, $200,00 T l7. 18. Received cash from sales, $600.00. Tl8. 19. Received cash from sales, $175.00. Tl9 22. Bought supplies on account from Parks Co., $80.00. M3. 22. Received cash from sales. $450.00. T22 23. Paid cash for telephone bill, $50.00. C l0. 23. Sold services on account to M. Bien. $425.00. 52. 24. Paid cash for advertising, $80.00. C1I. 24. Received cash from sales. $250.00. T24. 25. Received cash from sales, $325.00. T25. 26. Paid cash for supplies, $45.00. C12. 26. Received cash from sales. $3I0.00. T26. 29. Received cash on account from M. Bien. $425.00. R3. 30. Paid cash to owner for personal use, $I50.00. 31. Received cash from sales, $450.00. T30. Instructions: 1. Use page 1 of the journal given in the Recycling Problem Working Papers. Journalize the transactions for August 1 through August 19 of the current year. Source documents are abbreviated as follows: check, C; memorandum, M: receipt, R; sales invoice, S; calculator tape, T. 2. Prove and rule page 1 of the journal. Carry the column totals forward to page 2 of the journal. 3. Use page 2 of the journal to journalize the transactions for the remainder of August. 4. Prove page 2 of the journal. 5. Prove cash. The beginning cash balance on August 1 is zero. The balance on the next unused check stub is $8,859.00. 6. Rule page 2 of the journal.