Solution Manual

advertisement

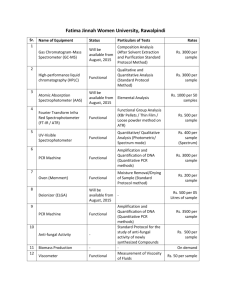

Solution Manual DmaH C. Newnan J ~ e m P. e Lavelle v o 0 a 3 2+ * w= 6 I - . m u l W. - - ( D Y ( D 1 rt09 I r . 1 Y Y(D ' < ( D C ( D 3 z I-. Pi ul ul r 0 1 0 X u t- E m m 09 t- Y P. ul Y ul I-. E 1 (D rt t - r 0 (D ar (D P. ao r u I-. 1 0 0 Y 'd ch Pi :z 0 'd 3 1 ul 0 I-. 5; +- P". 0 ul 0 (D t- u'd I-. I 'd C 0 09 u l 1 ul rt 0 -3 E rt 1 (D I' - ---. % u r ul (D '? 0 0 ch ? Yul I-, (D 3 1 Y I-. I-' (D 09 (D z 2! 3 (D X I YdY, (D 3 Y LZ?+,, +-< 0 "E Y " % E ( D < * (D I-. (D ul (D 1 m u l 2 (Drtm ul % S 2. 2 1 D < c 2 I-' (D ul R Plw I1 C. v k "":92 C wr* 2 9 00 m 0- . P, 0 3 Y m r u ~ W O n w r r CD* Y m r * < . (D Y P 3 < Y P , w,(D V I Y VI Y. 3 (D 0z32 v. 0 0 r 0 0 Y O * r ( D Y (D C ; z.'+J V m o y O O P , r r j r * r . <m o m Y Y O S 'V5 I. SY O3 0 Y m P m m m (D X m C L2. F . Y m O e w r l m e n s n m m m m c a 5 9 (D u a r (D -e [u [u m 1010 m < 3 PI P. R r 3 w (D .w - m r (D r r n x ID ? . o m a 1 3 0 ' 0 9 < 1 m m m 3ID ?. m (D P. o a m D D r- rtE rrP.Pr? 1 3 n 5 0 0 3 m 1 It 3 ID m m P. [u P. [u w a n < IDcmp. r a 3 P. 0 09 3 < m lD [u P. r n z PIC5 a (D c g a [u ID O W n wmr-ID 1 a m o m 5 r n h . ( D P.1 C 3 C m n m 0 7-18 Chapter 7 Rate Of Return Analysis Chapter 7 7-19 Rate Of Return Analysis x r n = q t g ( ? / ~ , ~ , s ) TV~L=B% ? 3500 =. 91% (3,993) = 36bb Tnq i =10% 9'. Skh AmR? MANZ, = 9153(3,791) = 3480 A m &WL~M. 3 q,8% R-A ~ n c u m , i f &s&qf&. -?=--- R W W W W m v I L . W --I d - 0 a m 4 m v I a W N - 0 7-22 Chapter 7 Rate Of Return Analysis Chapter 7 - $30 000(5 516015)=$l65 480 46 $15 000=$165,480 J6(1 T I ) " $15 000(1 + 1)'' $165,400 46 1 + I = [(I65480 46i15000)]1" I = 1071 - I or 7 1002"0> 5"" Unless $15,000 can be ~nvestedw ~ t ha return hlgher than 7 I%, ~tIS better to Walt for 35 years for the retirement fund $15 000 now IS onl) equ~valentto $165,480 46 35 years from non ~fthe Interest rate now is 7 1% ~nsteadof the quoted 5"a - Rate Of Return Analysis 7-54 2000 - 9 1 05 (P/A 1*,30) ( P 4,1*,30)= 2000 91 05 = 2 l 966 from tables %1 (P/A,r,30) 2 22 396 20 930 2 $2 I,, = 2% + 1 29.0((22 396-2 1 966) (22 396-20 930) 2 15'0 mo Nom~nalROR r e ~ e i ~ eb)d tinance compan) - 12(2 15"0) 25 8"0 - 7-52 Using incremental analysis, compute the internal rate of return for the difference between the two alternatives. Alternative B - Alternative A Year (n) 0 + $12000 1 - 3000 2 - 3000 - 3000 3 4 - 3000 - 3000 5 6 - 3000 7 - 3000 8 - 4200 Note: Internal Rate of Return (IROR) equals the interest rate that makes the PW of costs minus the PW of benefits equal to zero 12,000 - 3000(P/A. I', 7) - 4200(P/F, I., 8) = 0 TQ 1' = 18%. 12,000 - 3000(3.812) - 4200(0.2660) = -553 Try I' = 1746 12,000 - 3000(3 922) - 4200(0.2848) = 962 By str line interp.. I' = 17?/0+(1~')(962)1(962 +553)= 17.6% THE CONTRACTOR SkiOU1,D CHOOSE 4L.T. B A N D L.EASE; 17 6 % , 15% MARR 7-53 - $24,000 Total Annual Rekenues $00'12 months * 4 apt Annual Revenues - Expenses = $24,000 - $8,000 = $16.000 To find Internal Rate ol Return the Net Pre5ent Worth must be 0 N P h - $ 16 000(P 4 I * 5)+$160,00O(P/F I* 5 )-$ I40 000 Try 1=12~/0NPW $8464 Tr) I = 15'0 h P W - - % 6 8 1 6 IKOR = 12'0 (3'0)[8 164 (8464+6816]] = 13 7'0 . Part b. At 13 7'0 the apartment building is more attractive than the other options 7-23 3000 = 1 18.90 (P/A,r*,36) (P/A.i*.36) = 300011 12 06 = 26.771 from tables: 1% (P/A,i,36) l % 27.661 1 314 26.543 I,,,,, = I 1/2 96 + (1!4%)(27 661-26 771)1(27 661-26 543) = 1.699% Nominal annual ROR = 12(1.699) = 20.4% NPW = -300,000 + 20,000 (P/F, I * , 10) t (67.000 - 3000) (P/A, I*, 10) - 600 (P;G, I*, 10) looh -300,000 + 20,000 (0.3855) + 64,000 (6.145) - 600 (22 891) = 87,255 NPW greater than zero. The interest rate used is too low. Try r NPW = = Try I = l8"0 NPW = -300.000 = -17,173 + 20,000 (0 191 1 ) + 64,000 (4 494) - 600 (14 352) NPW negative Reduce Try r = 15% NPW = -300.000 t I 20,000 (0 2472) + 64.000 (5 019) - 600 (16 979) = So the rate of return is between 15% and 18%. By linear interpolation: 9130 7-24 Chapter 7 Rate Of Return Analysis Alternotrve B A %300,000 '4-8 $615,000 $3 15,000 Maintenance & operating costs 25,000 10,000 - 1 5,000 Annual benefit 92,000 158,000 66,000 Salvage value -5,000 65.000 70,000 F~rstcost NPW = 0 N P W = -3 15,000 + (66,000 - (-15,000)] ( P / A . I * ,10) + 70,000 (P'F, I * , 10) = 0 Try I = 15% 3 -3 15,000 + 8 1.000 (5.0 19) + 70,000 (0.2472) '0 108,840 :, 0 :.A ROR .- MARR (= 15%). The higher cost alternative ,4 is the more desirable alternative pqyhzmk are ~ $ - h~e a n SUM- ++I) = %a w *rrn e as f j ~ u u - b ~ dq&. - Y ~ 6778