48 Note 9. Income Taxes

advertisement

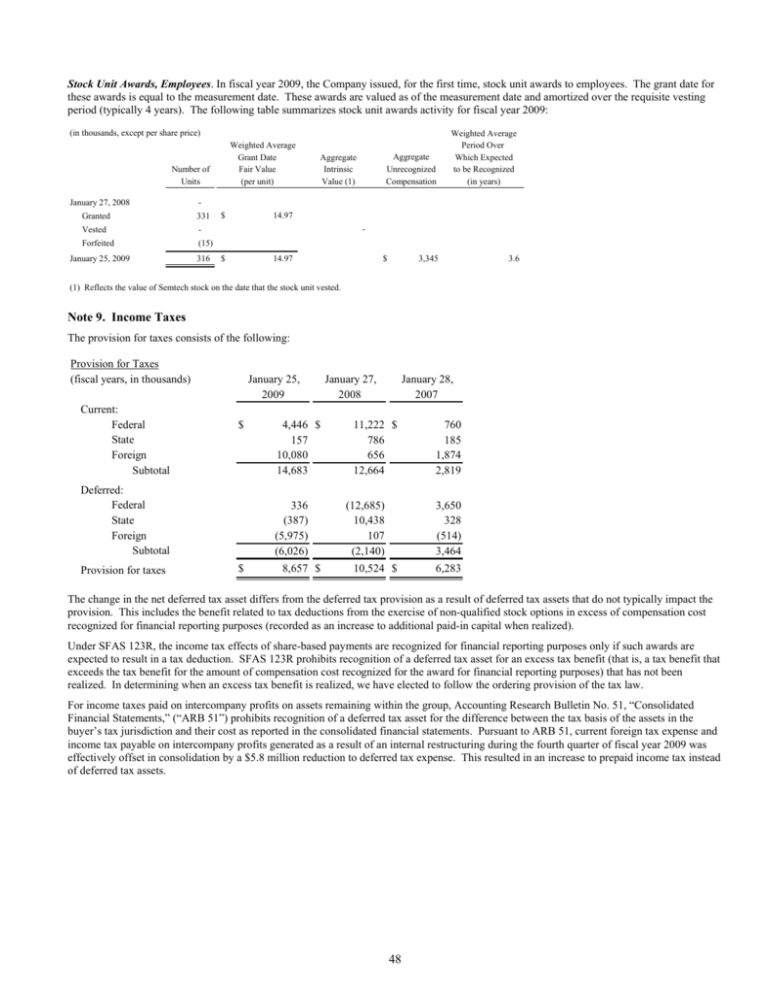

Stock Unit Awards, Employees. In fiscal year 2009, the Company issued, for the first time, stock unit awards to employees. The grant date for these awards is equal to the measurement date. These awards are valued as of the measurement date and amortized over the requisite vesting period (typically 4 years). The following table summarizes stock unit awards activity for fiscal year 2009: (in thousands, except per share price) Weighted Average Grant Date Fair Value (per unit) Number of Units January 27, 2008 Aggregate Unrecognized Compensation Aggregate Intrinsic Value (1) Weighted Average Period Over Which Expected to be Recognized (in years) - Granted 331 Vested - Forfeited (15) January 25, 2009 316 $ 14.97 - $ 14.97 $ 3,345 3.6 (1) Reflects the value of Semtech stock on the date that the stock unit vested. Note 9. Income Taxes The provision for taxes consists of the following: Provision for Taxes (fiscal years, in thousands) Current: Federal State Foreign Subtotal January 25, 2009 $ Deferred: Federal State Foreign Subtotal Provision for taxes 4,446 $ 157 10,080 14,683 336 (387) (5,975) (6,026) $ 8,657 $ January 27, 2008 January 28, 2007 11,222 $ 786 656 12,664 (12,685) 10,438 107 (2,140) 760 185 1,874 2,819 3,650 328 (514) 3,464 10,524 $ 6,283 The change in the net deferred tax asset differs from the deferred tax provision as a result of deferred tax assets that do not typically impact the provision. This includes the benefit related to tax deductions from the exercise of non-qualified stock options in excess of compensation cost recognized for financial reporting purposes (recorded as an increase to additional paid-in capital when realized). Under SFAS 123R, the income tax effects of share-based payments are recognized for financial reporting purposes only if such awards are expected to result in a tax deduction. SFAS 123R prohibits recognition of a deferred tax asset for an excess tax benefit (that is, a tax benefit that exceeds the tax benefit for the amount of compensation cost recognized for the award for financial reporting purposes) that has not been realized. In determining when an excess tax benefit is realized, we have elected to follow the ordering provision of the tax law. For income taxes paid on intercompany profits on assets remaining within the group, Accounting Research Bulletin No. 51, “Consolidated Financial Statements,” (“ARB 51”) prohibits recognition of a deferred tax asset for the difference between the tax basis of the assets in the buyer’s tax jurisdiction and their cost as reported in the consolidated financial statements. Pursuant to ARB 51, current foreign tax expense and income tax payable on intercompany profits generated as a result of an internal restructuring during the fourth quarter of fiscal year 2009 was effectively offset in consolidation by a $5.8 million reduction to deferred tax expense. This resulted in an increase to prepaid income tax instead of deferred tax assets. 48